S&P +8.00

USB -0.17

S&P +43.25

USB +0.08

S&P +44.00

USB -0.05

S&P -24.50

USB +0.24

S&P -1.25

USB -0.17

S&P +43.00

USB +0.13

Nov

21

Poker player’s brain, from Jeff Watson

November 21, 2024 | Leave a Comment

The Incredible Brain of a Poker Player

A true social phenomenon, poker is not just a game of chance and money. From a scientific perspective, we can think of it as a sporting discipline, requiring numerous biological and mental resources. Winning, losing, thinking, bluffing, resisting stress…each of these events results in specific brain activity. By combining testimonials from some of the best players in the world with insights from scientific experts and unique experiences, this documentary will allow each of us to understand the internal processes that govern our risk-taking, and each of our decisions.

Nov

20

Howard Hammer

November 20, 2024 | Leave a Comment

Vic and Howie Hammer being inducted into paddlable hall of fame. Howie at 88 the founder.

Howard Hammer – PFA Paddleball Legend of the Game Profile

Howard Hammer is the first inductee into the PFA Hall of Fame, and rightfully so. He was not only one of the greatest players the game has ever seen, but he also contributed more to the game than anyone I know. No one else is more associated with paddleball than Howie. Therefore, the title “Mr. Paddleball” is really appropriate.

Video: Paddleball Shots: Fundamentals, by Howard Hammer

Book: Paddleball: how to play the game, by Howard Hammer, 1979.

Nov

18

The wisdom of Sancho

November 18, 2024 | Leave a Comment

while Don quixote is voted the best novel of all time, and its humour and anecdotes are considered sui generis, not many have commented on the wisdom of this book as great as its wit. I have found the proverbs contained within - all very short, salty and sententious - the perfect companion to the book itself. the companion by Ulick Ralph Burke, Sancho Panza's Proverbs, is the perfect partner to the duo and is a work of masterly scholarship. In addition to the saltiness of all proverbs, there is an underlying Spanish diffidence and pregnancy to all the proverbs that enhances the novel.

Nov

17

New study by Dimson, et. al.

November 17, 2024 | Leave a Comment

the authors of this study should receive a Nobel Prize. the study is magnificent and the conclusions are useful and surprising. I would add that the studies do not take into account the theory of ever changing cycles. current conditions differ from the 19th century.

Long-run Asset Returns

Annual Review of Financial Economics, volume 16, issue 1,

2024[10.1146/annurev-financial-082123-105515]

David Chambers, University of Cambridge - Judge Business School; CEPR

Elroy Dimson, University of Cambridge - Judge Business School; European Corporate Governance Institute (ECGI)

Antti Ilmanen, AQR Capital Management

Paul Rintamäki, Aalto University

Date Written: October 10, 2024

The literature on long-run asset returns has continued to grow steadily, particularly since the start of the new millennium. We survey this expanding body of evidence on historical return premia across the major asset classes-stocks, bonds, and real assets-over the very long run. In addition, we discuss the benefits and pitfalls of these long-run data sets and make suggestions on best practice in compiling and using such data. We report the magnitude of these risk premia over the current and previous two centuries, and we compare estimates from alternative data compilers. We conclude by proposing some promising directions for future research.

Nov

16

Favorite piano

November 16, 2024 | Leave a Comment

my favorite piano work at my favorite venue by my favorite non-family woman who I've known for 50 years:

Pianist Rorianne Schrade plays Eduard Schütt's Paraphrase of J. Strauss Tales from the Vienna Woods

Rorianne Schrade YouTube channel

Rorianne's website.

Nov

15

A case for BTC

November 15, 2024 | Leave a Comment

a very resonant and helpful piece highly recommended:

Get Rich While Saving the World! Baby Tristan's Case for Bitcoin

one wouldn't be surprised if Tristan's middle name was Victor.

Nov

14

Crypto and the money supply, from Bill Rafter

November 14, 2024 | Leave a Comment

Should the market cap of crypto currencies be included in money supply for macroeconomic purposes?

William Huggins replies:

I'd you cant use it to pay taxes it doesn't count (just another asset, like a stamp).

Kim Zussman asks:

Why not? They add because if you pay taxes with fiat you can buy merch with crypto.

William Huggins responds:

you can barter wine or chocolate for a ton of things online too but we don't count those either. if money is "anything taken as payment" then we have to get very serious about "degrees of moneyness" (hence m0,m1,etc). in that spectrum, its pretty clear that the only things on the list are legal tender so unless you live in the land of bukele, it doesn't count (also, whose money supply does crypto count as exactly?)

Peter Penha:

I will volunteer that there is no moneyness to crypto as it was determined a 100% haircut asset by the DTC.

I think this leaves Blackrock and other crypto ETF managers in the interesting position that they cannot include crypto ETFs in one of their asset allocation funds or a target date fund, etc - inclusion would pollute.

Crypto in the USA appears to be a walled garden - the only contagion I can see to the financial world would be to holders of Micro Strategy Convertible Debt.

Stefan Jovanovich writes:

The question you all are raising here has a history - how far can "the law" go to monetize promises to pay? Originally, the answer was not one step. The Constitution says that legal tender can only be Coin. Article I, Section 8.

The lawyers have been working around that limitation ever since. Their greatest difficulty has been getting around the literalist non-lawyer Presidents who keep following the actual instructions the People established by vote as "the law".

Success came with the Aldrich-Vreeland Act which authorized banks with Federal charters to form "currency associations". Those were given authority to issue emergency currency could be backed by securities other than U.S. bonds, including commercial paper, state and local bonds, and other miscellaneous securities.

Section 18 of the Act: "The Secretary of the Treasury may, in his discretion, extend from time to time the benefits of this Act to all qualified State banks and trust companies, which have joined the Federal reserve system, or which may contract to join within fifteen days after the passage of this Act: Provided, That such State banks and trust companies shall be subject to the same regulations and restrictions as are national banks under this Act: And provided further, That the circulating notes issued under this Act shall be lawful money and a legal tender in payment of all debts, public and private, within the United States."

Everything since 1908 has been a variation on that theme - "lawful money" can be whatever Congress says it is.

Bill Rafter comments:

I started this question because I am working on a slight variation of digitally quantifying inflation. With the loose definition of inflation being “too much money chasing too few goods”, then the “money” part should include all that can conceivably buy the “goods”. Since one can increasingly buy a whole lot of stuff with crypto, then crypto deserves inclusion. If one were to fast-forward to a time of massive currency instability (this is just a thought experiment), having included the cryptocurrency might have facilitated greater forecasting.

Stefan Jovanovich adds:

For me the paradox of Bitcoin is that it has been a spectacularly successful asset - like a share of Berkshire Hathaway stock bought in the days before Buffett even went public - but it has never been a money. If I had Bill's brain and cleverness, I would try to include in the calculations the sum of personal and corporate credit that the lenders cannot easily pull away from the table (the potential moneyness supply) and the amount of credit actually used; and then seek the correlations to the fluctuations in that spread. In the days before central banking, speculators watched the net supply of commercial paper as such an indicator.

Nov

12

Sporting anecdotes

November 12, 2024 | Leave a Comment

Sporting Anecdotes (1923) shows us what the state of sports was like in England in 1800's. much betting on walking races, boxing, horse racing. and here is the greatest fives player of all time: john cavanaugh, much fighting of badgers, etc; great match of walking 1000 miles in 1000 hours; gouging match in america; fidelity of a dog; curious wager - walking against eating; throwing cricket ball 100 miles to deliver a post and win a bet; wisdom of Pliny who lived 100+ years.

Nov

10

The Old Right was a principled band of intellectuals and activists, many of them libertarians, who fought the “industrial regimentation” of the New Deal, and were the first to note that, in America, statism and corporatism are inseparable.

Despite some current claims, however, these writers ardently defended capitalism, including big business and corporations, celebrated the profit motive, and took a strict laissez-faire attitude towards international trade. They loathed tariffs, and saw protectionism as a species of socialist planning.

Humbert H. writes:

Current restrictionist trade theories in the conservative movement, therefore, are not those of the Old Right. Their intellectual legacy is more likely British mercantilism.

The British did pretty well under mercantilism. I have always supported free (meaning from both sides) trade with equally situated countries, like US and Canada, but I love restrictionism and tariffs imposed on countries like China. It's crazy, in my opinion, to have "free trade" with a country that can and routinely does restrict imports, has slave labor, no "social safety net", steals intellectual property in a variety of ways, and can chose to focus on any trade area to bankrupt it's counterparts in a "free" country. The ability to produce a variety of goods is fundamental to the strength of the country. In wars, pandemics, and trade wars the other country starts having domestic capabilities is crucial. When this debate was first discussed in France, restricting the imports of oranges from Spain and Portugal into France was used as an example of what not to do, and that's a poor example compared to importing steel and semiconductors.

Larry Williams comments:

Hamilton's use of tariffs made America great.

Stefan Jovanovich writes:

Hamilton made his living as a private attorney in New York representing the marine insurance companies whose policies required shippers to be "woke" - i.e. perfect observers of their policies' neutrality warranties.

Pamela Van Giessen adds:

Silent Cal Coolidge the Vermonter was also good with tariffs and preferred them to income taxes.

Along with Secretary of the Treasury Andrew Mellon, Coolidge won the passage of three major tax cuts. Using powers delegated to him by the 1922 Fordney–McCumber Tariff, Coolidge kept tariff rates high in order to protect American manufacturing profits and high wages. He blocked passage of the McNary–Haugen Farm Relief Bill, which would have involved the federal government in the persistent farm crisis by raising prices paid to farmers for five crops. The strong economy combined with restrained government spending produced consistent government surpluses, and total federal debt shrank by one quarter during Coolidge's presidency.

Michael Brush responds:

Smoot-Hawley worsened the Great Depression.

Humbert H. cautions:

That's not really a fact, it's a debatable point. There's a range of opinions there from "it caused it" to "it did nothing to worsen it". It's one of those things like "what caused the fall of Rome" that can't be decisively proven.

Stefan Jovanovich offers:

Effective date of Smoot-Hawley Tariff: June 17, 1930

Tariff collections:

Fiscal Year 1931: $378,354,005.05

Fiscal Year 1932: $327,754,969.45

Fiscal Year 1933: $250,750,251.27

Total tax collections by Treasury:

Fiscal Year 1931: $2,118,092,899.01

Fiscal Year 1932: $2,118,092,899.01

Fiscal Year 1933: $2,576,530,202.00

Pamela Van Giessen writes:

Amity Shlaes goes into detail about how the depression was extended (or recovery didn’t come) in The Forgotten Man. She attributes the worsening of the depression, especially in the late ‘30s, to a combination of government interventions that included the Smoot-Hawley tariff, government (and union) demands to keep wages high, banking regulation, over-regulation, and FDR’s new deal, among other government interventions. In short, there doesn’t seem to be just one cause though it seems reasonable to blame each of the interventions.

Art Cooper adds:

I also found Murray Rothbard's America's Great Depression to have worthwhile insights.

Nov

7

Gouging, controls, and heroism

November 7, 2024 | Leave a Comment

Price Controls: Still A Bad Idea, by David R. Henderson.

When University of Chicago economist Harold Demsetz gave a talk in the winter of 1970 at the University of Winnipeg, where I was an undergrad, he used an analogy that many critics of price controls still use. Demsetz told his audience that using price controls to reduce inflation is like responding to cold weather in Winnipeg by breaking the thermometer. His point was that just as thermometers respond to temperature, prices are an indicator of underlying economic phenomena, namely supply and demand. Breaking a thermometer doesn’t cause the temperature to rise; controlling prices doesn’t cause inflation to fall.

The Edict of Diocletian: A Case Study in Price Controls and Inflation, by Murray N. Rothbard.

Citizens of the old Roman Empire distrusted paper currency and refused to accept anything but gold or silver coin as money. So the rulers found themselves barred from inflating the money supply by the unobtrusive method of printing additional currency.

But the Roman emperors soon discovered an ingenious device. They proceeded to call in the coins of the realm, ostensibly for repairs. Then, by various means, such as filing off small parts of the coins, or introducing cheaper alloys, they reduced the silver content of the money without changing its original face value. This devaluation enabled them to add many more silver coins to the Roman money supply. The practice was started by Nero, and accelerated by his successors. By Diocletian’s time, the denarius (standard silver coin) had been reduced to one-tenth of its former value.

The Speculator As Hero, by Victor Niederhoffer.

Some speculators are discoverers like Christopher Columbus, creators like Henry Ford, or inventors like Thomas Edison. Their job is easy to place on a high plane. My role in the grander order is indirect, relatively invisible and unplanned. The only discoveries I make are the routes that prices will travel. Like hundreds of thousands of other traders, I try to predict the prices of common goods a day or two in the future. If I think the price of an item will go up, I buy today and sell later. If I think that the price is going down, I’ll sell at today’s higher price. The miracle is that in taking care of ourselves, we speculators somehow ensure that producers all over the world will provide the right quantity and quality of goods at the proper time, without undue waste, and that this meshes with what people want and the money they have available.

Nov

6

From the research archives: Predictive and Statistical Properties of Insider Trading

November 6, 2024 | Leave a Comment

Predictive and Statistical Properties of Insider Trading

Author(s): James H. Lorie and Victor Niederhoffer

Source: Journal of Law and Economics, Vol. 11, No. 1, (Apr., 1968), pp. 35-53

Published by: The University of Chicago Press

The subject has been studied before in many ways, but none of the preceding studies has been definitive and the additional methods of analysis seemed promising. Opinions are somewhat polarized. Academic studies have found virtually no evidence of profitable exploitation by insiders of their special knowledge and no value to outsiders in data on trading by insiders. Others believe that insiders often make extraordinary profits and that knowledge of their trading is valuable. Both the SEC and investors should be interested in which opinion is correct. The methods and coverage of this study differ from those of earlier work, as do our conclusions. We show that proper and prompt analysis of data on insider trading can be profitable, although almost all earlier academic work has reached the contrary conclusion.

Nov

4

Poker again - for those times when you need something to study, from Humbert X.

November 4, 2024 | Leave a Comment

Poker Theory and Analytics

MIT OpenCourseWare

Topics:

Basic Strategy

Analysis Techniques and Applications

Preflop Analysis

Tournament Play

Poker Economics

Game Theory

Decision Making

Article about the instructor (for the 2015 class)

Nov

2

And the law won

November 2, 2024 | Leave a Comment

From Big Al:

The more any quantitative social indicator is used for social decision-making, the more subject it will be to corruption pressures and the more apt it will be to distort and corrupt the social processes it is intended to monitor.

Variation:

When a measure becomes a target, it ceases to be a good measure.

Nils Poertner writes:

if one could find a way to increase the odds of Sod's law happening to oneself (trading or otherwise, outside trading). one could find a way to be less exposed to that law. don't have an exact formula here it is just a question.

This book The Improbability Principle: Why Coincidences, Miracles, and Rare Events Happen Every Day, by David Hand, did flip a lever in my brain many yrs back. in this book he described that we have an inadequate idea of probabilities and nature is far more dynamic than we think and that perhaps our own actions and belief systems play a much larger role…(btw, am not saying fate never plays a role)

Rich Bubb writes:

Having witnessed (pre-retirement in 2020) multiple project, engineering & quality failures related to Murphy and/or SOD variants, the engineering & technicians [and often-times myself] that had to deal with the 'Magic Wand' mgmt insane dreams-up are/is best avoided by 'stepping away from the problem, asap'. In some areas, this 'stepping-away' is also known as the "Do NOTHING Rule". Corollary: "Ain't My Job Rule."

Or, knowing that everything rarely goes according to plan (Unknown Unknowns), & expect something-to-hit-the-proverbial-fan. One method I used (more often than I should admit), is a Reverse Fishbone/Ishikawa Diagram. The method has the "Result" of anything going wrong replacing the assumed desired effect , aka the 'Fish-head', then working backwards trying to determine Man, Method, Environment, Measurement, Machine, etc., possible snafu's, & mitigate or pre-fix problems.

Sometimes the Reverse Fishbone is done after the problem is revealed. And the $$$ Cost of mitigation are sometimes 'argued-away' by the cost-benefit folks controlling the situation's budget. This is one reason many engineers fear &/or loathe accountants (but not out loud).

Asindu Drileba adds:

Sods law seems related to a set of precepts used in computer science called the Fallacies of distributed computing.

When building a trading system assume that;

- The market's returns will arrive at the worst possible sequence.

- Your orders will not get filled exactly the way you want.

- Transaction fees are going to eat all your gains

- Your broker is going to scam you (a là FTX)

- You trading system might go offline for arbitrary reasons

- Regulations might change against your favour. (up tick rule, no shorting stocks)

Building a trading system based on such pessimistic assumptions will actually result it a system that will go through alot of muck and still be reliable.

Nov

1

The beauty of prices

November 1, 2024 | Leave a Comment

From Prices, by Warren and Pearson (1933):

Prices are the major criterion by which the producer can know what society wants. The only way the farmer can tell whether to produce cabbages or wheat is on the basis of price. The only way that his son can determine whether society wants him to be a farmer or a coal miner or doctor is on the basis of price. The woman with the market basket, the retailer who must sell to live, the farmer who must have fence wire to keep his cattle in, the steel producer who must sell in order to operate his mill — all combine to make prices. The algebraic sum of all the millions of transactions between all the buyers and sellers of the world makes prices. The system does not always work perfectly, but no committee could guide the millions of producers to meet human needs so well as prices guide them — provided the medium of exchange functions properly. When it functions badly, the people turn to dictators and social control.

Only through prices can consumption be wisely guided. We would all like porterhouse steak and Packard cars, but these require so much human effort to produce that it is not possible to produce enough for all. Hens do not lay many eggs in winter. Consumers would like them in winter as well as or better than in summer. By raising prices in winter, the supply is made to last.

Oct

31

US National Debt possible consequences & hedges, from Asindu Drileba

October 31, 2024 | Leave a Comment

There is a lot of talk about how precarious US Debt situation is. Two questions:

1. What possible disaster may come out of this? I am thinking Zimbabwe type hyper inflation. What other kind of disaster can happen?

2. What can retail level people do to protect themselves from this? Buy Swiss Francs? Gold & Silver? Bitcoin? What?

Larry Williams responds:

Gloom and doomers here is the chart to look at:

Bud Conrad writes:

Gold 1 year is up 24%. Silver 1 year is up 50%. The circumstances today are still very bad for the dollar. (Which is what is actually declining.)

The BRICS+ are meeting in Russia tomorrow Putin, Xi, Modi, Iran, Saudi Arabia (observer only), UAE etc.) to continue de-dollarization with non-dollar-denominated trade through non-SWIFT transactions for international Central Bank settlement. NO body is talking about this, being focused on how much the candidates will print up to bribe us for votes. The $1.1 T for interest on the $35 T of official Government Debt could rise, as the 10 year Treasury rate hit 4.2% while the Fed CUT short-term rate. Including unfunded liabilities for Social Security and Medicare would say the debt obligations are more like $200 T.

This is 10 year Treasury. Red pointer is when Fed Cut short term rate:

There is no way around avoiding the money printing required. Inflation and price rises are inevitable, as foreigners divest their $8 T of Treasury holdings, to avoid US asserting sanctions or seizing assets like the $300B of Russia holdings. They want out of US Hegemony fast, because of 14 rounds of sanctions on Russia.

Oct

30

For Those of Us Who Are Chronically Late to the Party, from Stefan Jovanovich

October 30, 2024 | Leave a Comment

Larry Williams interview with Jason Shapiro:

Masterclass with Larry Williams: COT, Market Cycles & Trading Secrets Revealed

Join Jason Shapiro, a renowned contrarian trader, as he unravels the complexities of the COT Report with legendary trader Larry Williams in this must-watch deep dive. Discover the market insights and trading strategy secrets that have led to their success, as they discuss everything from the impact of macroeconomics on trading decisions to the nuances of technical and sentiment analysis.

Oct

28

A few favorite people

October 28, 2024 | Leave a Comment

a daughter and a wife

Two of the favorite people of my long life - Robert Schrade and Susan N

Oct

27

For the life-advice thread: Letter to a newborn son

October 27, 2024 | Leave a Comment

Vic to Aubrey, 2006:

The occasion of a birth is always a good time to take stock of the important things in life that a father would like to share. In your case, it's even more important, because at 62, I am the oldest father that the big Pennsylvania hospital that you were born in had ever discharged, and I am going to have to compress much of my hopes and knowledge and love for you into a few short years. Here are some of the main lessons for you that I hope to set in motion so clearly and firmly by my own example and also with practical direct applications for you while I'm alive that it will become second nature to you, and these guidelines will be useful merely for a review, but it's too late to lock the stable after the horse has been stolen, so here goes.

You were named after two characters, Jack Aubrey, a very worthy character Patrick O'Brian and C.S. Forester wrote about in their series of books about the adventures of the greatest British naval captain in history, who traveled the world with great skill and overcame great danger to make the world safe for freedom; and Charles Darwin, the greatest biologist, who after a trip around the world discovered the nature of life and change. While both showed extraordinary abilities, mental and physical strength, study, science, and character — friendship, loyalty, persistence — in their quests for success, the heroic quality of Jack Aubrey is what inspired your first name.

Oct

26

Insights from Elmer Kelton

October 26, 2024 | Leave a Comment

some insights of Elmer Kelton about markets. (1) When you sell something at an auction, auctioneer will always tell you that you should have been here yesterday at the market was great then but it crashed. today. (2) if futures are up "there's no relation of cash to futures".

S&P had gone 9 days without a 20 day high. explanation is surge in odds. now at a high.

my favorite Elmer Kelton besides The Time It Never Rained:

Here are four of this famous author's speeches, recorded live. Known for his award-winning fiction, Elmer Kelton is highly sought after as a keynote speaker. His vast knowledge of, and passion for, the subjects he uses as backdrops for his novels is evident in these finely-crafted, humorous talks.

Oct

25

Any system gets gamed, from H. Humbert

October 25, 2024 | Leave a Comment

Sports Betting Apps Are Even More Toxic Than You Thought

Pro bettors have taken to disguising themselves as gambling addicts so sportsbooks keep the free money flowing.

Among the main challenges for a pro bettor is finding places that will take your money. If you show signs of being good, or even just highly methodical, most sportsbooks will drastically limit how much you can wager. But there are ways around this. Sharps, as pros are known, often employ surrogates to place bets on their behalf in exchange for a share of the winnings. Or they “prime” their accounts by making wagers that a casual bettor, or square, typically would.

“If I open an account in New York, maybe for a few weeks I just bet the Yankees right before the game begins,” says Rufus Peabody, a pro bettor and co-host of the Bet the Process podcast. If this trick works, the book sees these normie, hometown bets as a sign that it’s safe to raise his limits. That gives Peabody a bigger purse to work with when he switches to making bets he thinks will pay out—and that the book will likely recognize as coming from a skilled player. The idea is to win as much as you can before the house catches on.

Pro bettors have recently added a wrinkle to their priming routines: They’re acting like gambling addicts. Isaac Rose-Berman recently described the practice in his How Gambling Works newsletter:

“One pro bettor I know set up a bot which logs in to his accounts every day between 2 and 4 a.m., to make it seem like he can’t get through the night without checking his bets. Another withdraws money and then reverses those withdrawals so it looks like he can’t resist gambling.”

Oct

24

Spec variety pack

October 24, 2024 | Leave a Comment

Hernan Avella provides a quick book review:

The Biggest Bluff is a decent book, light enough to enjoy in audiobook format. The book follows a simple narrative, weaving decision theory and cognitive biases into the context of the author’s journey learning poker while being mentored by one of the best ever. There are many useful nuggets for the discretionary trader throughout. In today’s markets, where speed and computational power are abundant—much like the solver and GTO approach in poker—the wisdom of the great Eric Seidel can be distilled as follows:

• Focus and pay attention

• Emphasize the decision-making process, iterate, and improve upon it—don’t obsess over results.

• Don’t complain about bad beats; take randomness stoically.

• There’s always something to learn, and always be humble.

David Lillienfeld on GLP-1s and Alzheimer's:

It's rare that one can say much that's definitive about Alzheimer's–other than that we don't know much. However, it seems there's some reason for hope coming from the GLP-1:

Ozempic predecessor suggests potential for GLP-1 drugs in Alzheimer’s in early trial

A small clinical trial suggests that drugs like Ozempic could potentially be used not just for diabetes and weight loss but to protect the brain, slowing the rate at which people with Alzheimer’s disease lose their ability to think clearly, remember things and perform daily activities. The results need to be borne out in larger trials, which are already underway, before the medicines could receive approval for the disease.

Kim Zussman on happiness, money, and "olfactory enrichment":

The Price of Happiness

What is the shape of the relationship between money and happiness, and what are its implications?

People typically think about money in raw units such as dollars. Yet research on money and happiness typically examines the association between happiness and the logarithm of income, or Log(income). This logarithmic association between income and happiness is frequently either overlooked or misunderstood. To help address this, the present report examines this association and makes five key points….

Conclusion: Minimal olfactory enrichment administered at night produces improvements in both cognitive and neural functioning. Thus, olfactory enrichment may provide an effective and low-effort pathway to improved brain health.

Oct

23

Early Voting, from Laurel Kenner

October 23, 2024 | 1 Comment

I am against early voting and other unbounded residuals from Covid. Election day should be a civic event where people actually show up.

Nevertheless, I voted early because it’s now part of the political game. Forecasts based on the ratio of early-voting party members make headlines.

Full post: Nobody Asked Me, But…

Oct

22

I made a fake AI podcast about The Chair, from Asindu Drileba

October 22, 2024 | Leave a Comment

There is this new tool from Google called Notebook LM. It converts text into an audio of podcast format, two people conversing about the topic (a man & a woman). It's so good, I would say it's impossible for me to differentiate between a fake Notebook LM podcast and a real one. The AI's call him a "Renaissance Finance Man" and honestly speaking, I really enjoyed the fake podcast.

It's just 10 minutes long, if you want to listen to it, here it is. (You need to be signed into Gmail or a Google account to listen.)

Laurence Glazier responds:

Extraordinary. Will take a look at this. We need to be circumspect about everything we thought was real. Certainly any photos or new articles we see in the media.

Gyve Bones asks:

Very well done. What sources did you supply the LM?

Asindu Drileba explains:

The text was simply the About page of Daily Speculations. That's all I used. But I suspect it also added content else where from the internet and they mention stuff that isn't present in the about page.

Oct

21

Nuclear: Back to the Future, from Carder Dimitroff

October 21, 2024 | Leave a Comment

The media is buzzing about nuclear power as the silver bullet. Two commercial nuclear power plants are in the process of coming out of retirement.

The odds of the two retired nuclear plants successfully navigating their way out of retirement are high. The Michigan unit (Palisades) won a $1.52 billion federal loan guarantee, $300 million from the state, [significant] tax benefits, and bipartisan support from state lawmakers. In addition, Palisades has already signed long-term Power Purchase Agreements for the full power output with rural electric co-ops Wolverine Power Cooperative and Hoosier Energy, which serve rural communities in Michigan, Illinois, and Indiana. DOE will also provide $1.3 billion in funding to two Michigan area power cooperatives to boost power purchases from the Palisades plant.

The Pennsylvania unit (Three Mile Island) is about two years behind Palisades. Their 20-year offtake agreement is with Microsoft. They may decline federal loan guarantees but take advantage of aggressive tax advantages (federal loans have feisty terms).

Both plants will require extensive and high-paying workforces. They will generate significant state and local property taxes and create economic multipliers for local, state, and regional areas.

While each plant may appear old, its components are relatively new. Over the years, each plant has undergone preventive maintenance that required replacing components and maintaining federal safety standards. While each plant is relatively small (under 900 MW), they can safely run for an additional 20 years with routine maintenance.

The validity of the proposed restart schedules is a question. I wonder if they can access new fuel in time because of a rigid queue to support the nation's nuclear fleet. I also question whether there is enough time to overcome the hurdles of the federal regulator (NRC). These are external activities that developers can manage but cannot control.

The natural question is about other nuclear plants. Specifically, how many more retired nuclear plants can be restarted? The answer is that it depends. It depends on how far a plant has been decommissioned, who owns the title, the degree to which the state supports continued operations, whether government incentives can overcome costs, and how desperate consumers are for power.

David Lillienfeld comments:

I find it hard to believe that the community around TMI is going to accept a restart all that easily.

Carder Dimitroff replies:

Thank you. This is an important point. TMI has two nuclear power plants (two reactors and two generators). Only one unit was involved in the TMI incident. Until it retired in late 2019, the other had operated reliably for 40 years after the incident. It retired for financial reasons, and local property taxes jumped when it did.

Not all, but most communities hosting nuclear power plants appreciated the employment, economic, and tax benefits the facility provided. When plants approached retirement age, community leaders sought opportunities to extend or replace the facility.

With one operating unit, TMI was the biggest employer in the county, with nearly 700 high-paying workers. Local businesses depended on the plant for their economic success. In addition, schools and other government departments enjoyed robust budgets while average homeowners' property taxes remained relatively low.

For these reasons, most communities would likely support continued operations. As always, some will want to see the asset permanently decommissioned. While there are no public safety issues that differ from those of any other nuclear plant, those most concerned about TMI would have moved years ago.

David Lillienfeld responds:

There was a documentary about TMI made in the last decade (I think). There were a lot of local residents who registered anger that the reactors had been built there in the first place. I'm not so confident that they would have moved by now. That said, your comments about the economics make a strong case for moving forward with a restart. I guess the big winners are Microsoft shareholders.

Oct

20

Nuclear restart: Murphy strikes, from Carder Dimitroff

October 20, 2024 | Leave a Comment

Whenever there's a home project, it usually requires three visits to the hardware store. Murphy's Law prevails as "anything that can go wrong will go wrong." The same is true in the nuclear world. But in this case, Murphy was an optimist:

Corrosion exceeds estimates at Michigan nuclear plant US wants to restart.

Steam generators are radiators. They transfer heat from inside the reactor building to outside the building without mixing fluids that move the heat. They have a simple job but rely on complex metallurgy. It's common practice to replace steam generators from time to time. So, this news is not a surprise, but it will delay the expected restart and increase costs.

In general, nuclear power plants come in two flavors. One uses steam generators that isolate the reactor's primary loop from the turbine's secondary loop. The other has only one loop directly connecting the reactor to the turbine without steam generators.

The first is a Pressurized Water Reactor (PWR) manufactured mainly by Westinghouse and its technology partners (France, China, and Korea). The second is a Boiling Water Reactor (BWR) manufactured by General Electric and its technology partners.

Both Michigan and Pennsylvania restarts rely on PWR technology.

Oct

19

Basic counting, applied to the healthcare system, from Big Al

October 19, 2024 | Leave a Comment

In 1973, when John Wennberg published his first journal article on unwarranted variations in the delivery of healthcare, he was largely ignored. But over the past 40 years, Wennberg—the founder of the Dartmouth Atlas Project and the Peggy Y. Thomson Professor Emeritus in the Evaluative Clinical Sciences at Geisel—has helped to change the way physicians and patients approach medical decision making and shaped efforts to reform the nation's health-care system.

Over the course of two days at Dartmouth, Jack and his colleagues laid out the content of their work—leaving me to sort out its revolutionary implications. Elliott Fisher, David Goodman, and H. Gilbert Welch, all physicians, showed me data suggesting that in regions of the country and at individual hospitals that delivered the most medical services—as measured by days in the hospital, tests, procedures, and visits from multiple specialists—patients did not, on average, live longer. It also did not appear that regions whose patients were the sickest on average—and therefore potentially most in need of more treatment—were the ones where the most care was delivered. Jack and the others went on to show me that many patients were unwittingly getting elective surgeries (including cardiac bypass, mastectomy, and prostate surgery) that could cause side effects that patients did not know about or fully understand, raising the question of whether they would have wanted the surgeries had the pros and cons been explained to them in a way they could grasp.

Tracking Medicine: A Researcher's Quest to Understand Health Care, by John E. Wennberg.

Kim Zussman adds:

There are financial incentives to do procedures (both for drs and hospitals), creating moral hazard. I.e., it is more likely for an interventional cardiologist to recommend an angiogram than it is for a non-interventional to do so. Note the income difference in the table. Click on the image for full view or go to the article:

Cardiology salaries on the rise, how does yours compare?

According to Modern Healthcare’s 2017-2018 By the Numbers report, most physician specialties have seen an increase in average salary since 2015-2016. Interventional and non-invasive cardiology are no exception.

Oct

18

The Price series, and a nice day in the park

October 18, 2024 | Leave a Comment

Prices, by Warren and Pearson (1933), has first exegesis as to why prices are the key to orderly satisfactions of producers and consumers. a beautiful book with many tables of prices from 1786 to 1933.

World prices and the building industry

Index numbers of prices of 40 basic commodities for 14 countries in currency and in gold, and material on the building industry. (The Price series)

how service cuts supposedly increase interest rates. LIZ Truss compare this to quantity of money theory - anything to increase 3 letter siblings.

Oct

17

A reader recommends

October 17, 2024 | Leave a Comment

Advanced Portfolio Management: A Quant's Guide for Fundamental Investors, by Giuseppe Paleologo

Advanced Portfolio Management: A Quant’s Guide for Fundamental Investors is for fundamental equity analysts and portfolio managers, present, and future. Whatever stage you are at in your career, you have valuable investment ideas but always need knowledge to turn them into money. This book will introduce you to a framework for portfolio construction and risk management that is grounded in sound theory and tested by successful fundamental portfolio managers. The emphasis is on theory relevant to fundamental portfolio managers that works in practice, enabling you to convert ideas into a strategy portfolio that is both profitable and resilient. Intuition always comes first, and this book helps to lay out simple but effective "rules of thumb" that require little effort to implement and understand. At the same time, the book shows how to implement sophisticated techniques in order to meet the challenges a successful investor faces as his or her strategy grows in size and complexity. Advanced Portfolio Management also contains more advanced material and a quantitative appendix, which benefit quantitative researchers who are members of fundamental teams.

Oct

16

Professor Bejan interview, from Steve Ellison

October 16, 2024 | Leave a Comment

75-minute interview with Professor Bejan on the occasion of his winning the 2024 Association of Mechanical Engineers Medal: The professor discusses, among other things, how his experience playing basketball gave him insights into how systems of flow evolve.

J.A. Jones Distinguished Professor of Mechanical Engineering

Professor Bejan was awarded the Benjamin Franklin Medal 2018 and the Humboldt Research Award 2019. His research covers engineering science and applied physics: thermodynamics, heat transfer, convection, design, and evolution in nature.

He is ranked among the top 0.01% of the most cited and impactful world scientists (and top 10 in Engineering world wide) in the 2019 citations impact database created by Stanford University’s John Ioannidis, in PLoS Biology. He is the author of 30 books and 700 peer-referred articles. His h-index is 111 with 92,000 citations on Google Scholar. He received 18 honorary doctorates from universities in 11 countries.

Oct

15

Jensen’s inequality, from Big Al

October 15, 2024 | Leave a Comment

Nicely-done video on Jensen's inequality.

And some interesting reads:

Jensen’s Inequality As An Intuition Tool

Jensen’s Inequality guides our predictions by forcing us to deliberately consider how the average input maps to the average output. When the function that maps the input to the output is non-linear, Jensen’s Inequality tells us in which direction our predictions will be biased. Stated another way: Jensen’s Inequality informs us when an average occurance is a poor predictor of the average result.

Jensen’s Inequality (2): Unlocking Optimization and Decision-Making Power

Jensen’s inequality is a simple yet powerful concept. In short, it states that for a convex function, the function’s value at the average of some points is less than or equal to the average of the function’s values at those points. At first glance, this may seem rather abstract. But its implications are profound. Jensen’s inequality allows us to derive bounds and build intuition about complex systems.

Oct

14

1924 Immigration Act, from Stefan Jovanovich

October 14, 2024 | Leave a Comment

This year is the 100th anniversary of the Johnson-Reed Immigration Act signed into law in 1924 by President Coolidge. It was a modification of the 1917 Immigration Act which was the first law to establish quotas for entry into the United States.

Before 1917 the only numerical restrictions on entry to the United States was the Chinese Exclusion Act of 1882, which excluded EVERYONE Chinese. Immigration acts had placed restrictions on individuals (1882 - no convicts, indigents, prostitutes, lunatics, idiots; 1903 - no anarchists, epileptics, crazies; 1907 - no infected, mentally or physically handicapped who could not work), but there had been no quotas. The 1917 Immigration Act continued the exclusion of the Chinese but extended it to everyone else in East Asia except the Japanese and the Filipinos. The law also imposed a literacy test for anyone over 16, but the test was for the person's own language, not just English.

The 1924 Act extended the outright exclusion to the Japanese and can reasonably be identified as the triggering event that allowed Fascists to take control over the government of Japan and spend the next decade and a half convincing the people who had embraced representative democracy, American jazz and baseball that they should choose their own race as the one to come first.

Humbert H. comments:

It’s interesting how some reasons for excluding specific groups from being able to immigrate have changed over time. “Strong economic competitor” has completely disappeared, whereas it was one of two main reasons for excluding the Japanese. There must be some sort of widespread recognition that importing groups that demonstrate great achievement in some economic areas is good for the country even though there is certainly some collateral damage to the established population.

Stefan Jovanovich rejoins:

GR and I have different readings about the exclusion for the Japanese. It was not economic competition; the U.S. had a healthy positive trade balance with Japan between the two world wars. We sent them oil and wheat; they sent us toys and trinkets.

The political pressures for exclusion came from

(1) Teddy Roosevelt's complete hatred of the Japanese AND the Russians (Give a President the Nobel Peace prize and bad things always happen). That made disdain for the Nips into a bedrock belief of all progressive Republicans (Thank you Earl Warren)

(2) The continuing negotiations after the signing of the Washington Naval Treaty of 1922

Humbert H. clarifies:

I didn’t mean economic competition with Japan, but with Japanese immigrants, mainly in California

Asindu Drileba writes:

I heard from somewhere, that before World War 1, passports & visas where not enforced that seriously. You could just show up to any place you wanted to go to without many formal requirements. I just imagine if the world was like that? Anyone can show up anywhere anytime without any legal hurdles?

Noam Chomsky (MIT linguist) says that there are two kinds of globalization.

Globalization 1: Is the free movement of people (labour) around the world with less restrictions.

Globalization 2: Is the free movement of capital & goods (products) with little legal restrictions.

He says that as we we're entering the 21st century, there has been a sharp decrease in Globalization 1 and a sharp increase in Globalization 2. It has been described that Globalization 2 has benefited corporations a lot (some even claim it has benefited the economy as a whole).

Can a country benefit economically (can corporations & markets see gains?) by making immigration as easy as it is to send money around the world? That is, people (labour) moving around with very little restrictions?

Jeff Watson offers:

It would be better this way:

A world of free movement would be $78 trillion richer

Yes, it would be disruptive. But the potential gains are so vast that objectors could be bribed to let it happen.

Humbert H. responds:

Of course anyone with a minimal economic education would realize that free movement of “labor” or entrepreneurs would result in creation of enormous wealth. In the real world though, new immigrants going on the dole has become a feature and not a bug in many wealthy countries. You read anything from England, and that seems like an accepted fact there. The list of various culture-clash and crime issues is long and only irritates people who are for unrestricted immigration. So this not a pure economics problem but more multifaceted. My point was that something, perhaps better knowledge of economics or personal experience, or maybe less dog-eats-dog competition for survival, taught the populace that importing highly capable people usually leads to good outcomes.

Jordan Low adds:

Do you enjoy Bing Cherries? He lost his farm in the act.

Ah Bing was a 19th century horticulturalist and credited as the cultivator and namesake of the popular Bing cherry. Bing migrated to the U.S. around 1855 and worked as foreman in the Lewelling family fruit orchards in Milwaukie, Oregon.

Oct

13

FL insurance markets, from David Lillienfeld

October 13, 2024 | 1 Comment

Milton's travel through Florida had the eye wall intact straight through until it got to the Atlantic. Strong storm. Among the 4 strongest in the history of the Atlantic. One thing is clear though: There's a lot of destruction from this storm.

Hence, I have to wonder if there are going to be any insurers left in the Florida market, and if there are any left, which ones? I'm not sure that those insurers still there will make for good investment, but maybe they'll be able to survive in that market. It just seems unlikely.

Art Cooper responds:

There will certainly be private P&C insurers (in addition to state-created Citizens Property Insurance Company) continuing to do business in FL after Milton, but I strongly suspect they will continue to increase their restrictions on coverage. I understand that many victims of Hurricane Helene who thought they had coverage for its damage are being shocked to find out they either didn't, or did not to the extent to which they'd believed.

Historically, the aftermath of an event causing massive insurance claims is an opportune time to invest in carriers doing a lot of business in the affected area, because marginal carriers cease writing policies, thereby minimizing competition, and the event provides cover for dramatic rate increases. (Buy when there's "blood in the streets".) If you're bullish on the P&C sector, wait till after billions of dollars of claims are made, then try to buy at support levels.

I don't have any numbers on net migration out of FL, but I can attest anecdotally that the pandemic-induced flood into the state has ended. Bear in mind, however, that migration to FL has been characterized by wild swings for the past 100 years, and I'm confident it will continue to be volatile. Weather events such as Helene and Milton, and more importantly the greatly increased cost of homeowner's insurance, will of course be inhibiting factors going forward.

Carder Dimitroff writes:

I understand why some would consider NEE for short positions. I can see why the market might ping them. If the price sinks and the value is right for you, consider buying NEE as others sell.

Why? NEE Florida's assets are regulated. Within the state, they operate on a cost-plus-a-margin basis. They have a good relationship with the state's regulators (the state needs them). Their power plants and wires may be damaged, but the state's ratepayers will likely cover all their losses. There may be a temporary cash flow issue, but even those costs will be covered. For traders, it might take a year for NEE to recover financially.

Oct

13

What Modern Medicine Gets Wrong

October 13, 2024 | 1 Comment

EconTalk podcast: What Modern Medicine Gets Wrong (with Marty Makary)

Johns Hopkins surgeon Dr. Marty Makary talks about his book Blind Spots with EconTalk's Russ Roberts. Makary argues that the medical establishment too often makes unsupported recommendations for treatment while condemning treatments and approaches that can make us healthier. This is a sobering and informative exploration of a number of key findings in medicine that turned out to be wrong and based on insufficient evidence.

Oct

12

The ideal PPI

October 12, 2024 | Leave a Comment

what was the ideal ppi for the BLS to report yesterday? under the circumstances the 0.30 rise in S&P was fairly good. but the gentlemen didn't like it at the close again. yet an all time hi with a weak close. can't be too wrong.

Oct

12

Asking for recommendations, from Steve Ellison

October 12, 2024 | Leave a Comment

Recommendations for an intro to multivariate statistics?

Bill Egan replies:

Here are four excellent multivariate statistics books I have used for many years. I suggest tackling them in this order.

1. Jerrold Zar - Biostatistical Analysis, 5th ed. (this is half univariate and half multivariate)

2. Neter, Kutner, Wasserman, Nachtsheim - Applied Linear Statistical Models, 4th ed (there is now a 5th ed and you can find the pdf by googling)

3. Alvin Rencher - Methods of Multivariate Analysis (there is now a 3rd ed.)

4. Mardia, Kent, Bibby - Multivariate Analysis (there is now a 2nd ed.)

You need to understand linear algebra to do this, e.g., at the level of Strang's Introduction to Linear Algebra, 6th ed. (his lectures are on MIT's opencourse website). Rencher, Neter, and Mardia all use that notation extensively. You also need to understand and be able to do univariate stats at the level of:

• Snedecor and Cochran - Statistical Methods, 8th ed.

• Riffenburgh and Gillen - Statistics in Medicine, 4th ed.

You will really learn multivariate methods only if you code them. Matlab is the best (Matlab Home is cheap), and yes, I coded everything in these books and a lot more work of my own invention in Matlab.

David Lillienfeld adds:

Snedecor and Cochran is the grand old lady of texts. Neter et al is still pretty popular on campuses.

Asindu Drileba asks:

Concerning statistical packages. I often hear some data science communities complain about how there are simply too many bugs & wrong implementations in the Python space. Maybe this is why you are recommending MATLAB? What do think of R or Julia?

Bill Egan responds:

I have used Matlab since 1993 for many things - research, papers, patents, commercial scientific software products. Matlab stands for matrix laboratory. The original data structure was scalar, vector, matrix. If you like to work in matrix/linear algebra notation, or need to, Matlab is the program to use. Other data structures have been added on, such as tables for mixed data types, but like al ladd-ons, this does not always work well. Quality control of the software is great. Very widely used by engineers. Very high level language, so you can see the algorithm without getting lost in the details like you do in C++.

R is not so good for linear algebra because the original data structure is a table for mixed data types. Matrix work is more difficult. Quality control of core R and major packages is good despite R being open source (although it has license restrictions) because it is used by many academic statisticians. I used R for analysis for a couple of years. Fairly high level language. Better for classical stats work where you make a table out of the data and have mixed data types.

Python is completely open source and the people who created and use it most have no knowledge of statistics and that shows. We used it primarily as a scripting/control language inside one of my software products. Available packages do have bugs/errors or are missing methods for stats. We tested them and could not use them; I had my guys code any stats related stuff from scratch. It is not as high level a language as R or Matlab, so you have to do more work. Do not recommend it.

I have no experience with Julia.

Oct

11

The similarities

October 11, 2024 | Leave a Comment

Catastrophe 1914. the similarities between the start of w.w.1. and the current situation before the first attempted assassination are very great.

From the acclaimed military historian, a new history of the outbreak of World War I: the dramatic stretch from the breakdown of diplomacy to the battles - the Marne, Ypres, Tannenberg - that marked the frenzied first year before the war bogged down in the trenches.

In Catastrophe 1914, Max Hastings gives us a conflict different from the familiar one of barbed wire, mud, and futility. He traces the path to war, making clear why Germany and Austria-Hungary were primarily to blame, and describes the gripping first clashes in the West, where the French army marched into action in uniforms of red and blue with flags flying and bands playing. In August, four days after the French suffered 27,000 men dead in a single day, the British fought an extraordinary holding action against oncoming Germans, one of the last of its kind in history. In October, at terrible cost the British held the allied line against massive German assaults in the first battle of Ypres. Hastings also recreates the lesser-known battles on the Eastern Front, brutal struggles in Serbia, East Prussia, and Galicia, where the Germans, Austrians, Russians, and Serbs inflicted three million casualties upon one another by Christmas.

Oct

10

Red state:blue state / In state:out state, from Kim Zussman

October 10, 2024 | Leave a Comment

Discussions on Florida prompted another look at domestic migration (one state to another, from 2020-2023) by presidential vote in the 2020 election. Using Wiki data on net migration and 2020 results*, here is a table of the top and bottom 10 in-migration states, on a per-capita basis, with voting colors**.

6/10 top in-migration states were Red, but only 2/10 top out-migration states were Red. Also of note is the out-migration raw numbers for CA and NY.

* List of U.S. states and territories by net migration

** Red = Trump, Blue = Biden, lighter colors were close to tied.

Oct

9

Programming Collective Intelligence, from Asindu Drileba

October 9, 2024 | Leave a Comment

I feel so lucky to have come across this book. And I think it's so relevant to the market. The book is titled Programming Collective Intelligence and markets can be thought of as a form of collective intelligence. Like some people may suggest, a market can be described as a single brain made up of other brains.

The book is very practical and gives examples on how to make predictions amongst collective entities participating in E-commerce sites, Dating websites, Social Networks, Real Estate and so on. It has no mathematics (that I have seen so far). Everything is written is very clean readable Python code (no use of obscure Python features or keywords).

Here is the book's own description of Chapter 8:

Introduces decision trees as a method not only of making predictions, but also of modeling the way the decisions are made. The first decision tree is built with hypothetical data from server logs and

is used to predict whether or not a user is likely to become a premium subscriber. The other examples use data from real web sites to model real estate prices and "hotness."

And Chapter 11:

Introduces genetic programming, a very sophisticated set of techniques that goes beyond optimization and actually builds algorithms using evolutionary ideas to solve a particular problem. This is demonstrated by a simple game in which the computer is initially a poor player that improves its skill by improving its own code the more the game is played.

Table of contents & book description

Oct

8

Government planning and efficiency, from Big Al

October 8, 2024 | Leave a Comment

Originally, 32 ships were planned, with $9.6 billion research and development costs spread across the class. As costs overran estimates, the number was reduced to 24, then to 7; finally, in July 2008, the Navy requested that Congress stop procuring Zumwalts and revert to building more Arleigh Burke destroyers. Only three Zumwalts were ultimately built. The average costs of construction accordingly increased, to $4.24 billion, well exceeding the per-unit cost of a nuclear-powered Virginia-class submarine ($2.688 billion), and with the program's large development costs now attributable to only three ships, rather than the 32 originally planned, the total program cost per ship jumped. In April 2016 the total program cost was $22.5 billion, $7.5 billion per ship.

Henry Gifford disagrees with the implication:

I am no fan of runaway government spending, and waste, and stealing, but I applaud the decision to stop construction of the Zumwalt ships when it became apparent they were not what the navy wanted. It would have been better for the egos and careers of senior Navy officers to make believe the Zumwalt ships were desirable and keep making them, then quietly retiring.

The "peacetime" military has a huge challenge predicting what weapons will work well in the next war. At the same time, the military needs to maintain some shipbuilding capacity in the US, so that ships can be made in the US in the future. Maintaining shipbuilding capacity requires continuously building navy ships, needed or not needed, as the capacity to build ships in the future is critical. I haven't heard about anyone putting numbers on the value of this capacity.

Before WW2 the US has a robust shipbuilding industry that shifted to building navy ships, and ramped up for increased production. In the years since, that industry has gone away, except for a few pleasure boats and for military craft. One version I heard was that the last time ships were manufactured in the US installing a porthole required work by members of thirteen different unions, a problem presumably not faced in the places where the shipbuilding industry is robust today. With no significant shipbuilding industry in the US now, outside of military ships, the navy needs to keep building ships. (I think navy ships don't have many portholes, which probably avoids on of the challenges formerly faced by the commercial shipbuilding industry in the US).

One version of the Zumwalt story I heard is that much of the Zumwalt superstructure was made of Aluminum, to save weight, especially high up where saving weight increases stability and/or frees up capacity for mounting weapons high up, while the lower parts of the structure and hull were made of steel, and the dissimilar metals reacted with each other (happens quickly in the presence of salt water), resulting in terrible corrosion and structural damage. The Aluminum superstructure idea has been tried on naval ships before, but as Aluminum burns in a fire, it is not without risk to crew and ship in battle.

Another version of the story I heard is that the ship was designed for weapons which never materialized, thus the ships were cancelled. It all sounds logical, but somehow doesn't have the ring of truth that the version above has.

I also note that the Zumwalt ships were significantly larger than the Burke class ships made before and after it, and it seems quite believable (to me) that the navy simply wanted a larger number of smaller ships. Once upon a time the larger a battleship was the larger the guns it could carry and thus it had the firepower to shoot further than opponents, which meant it had the capability to maneuver to where an enemy was within range of its guns, while staying out of range of the enemy's guns. This battle-winning capability was worth the cost of huge ships. Now in the age of missiles and radar, the size of a ship is not nearly as relevant. During WW2 German soldiers reportedly said "one of our panzer tanks is worth ten of those American Sherman tanks, but every time we build one panzer they build eleven Shermans". As tank-on-tank battles were not the main, or main intended use of tanks, eleven OK tanks had many, many advantages over one superior tank. The US Navy might have decided that for similar reasons they are much better off with a larger number of smaller ships than a smaller number of Zumwalt ships. I would be surprised if the actual truth about the decision is ever made public, and more surprised if I was ever convinced that I was convinced the real reason(s) was made public.

The math about per-unit cost when development cost is amortized over the number of units produced is, I think, useful, but implies that development cost for something that never saw production or only went into limited production was somehow wasted.

The US navy now has hard data on the seakeeping ability of a full-scale tumblehome hull ship design, which I think nobody had before the Zumwalt actually went to sea. No, testing a scale model is not a robust test because much in fluid dynamics does not scale (google "Reynolds Number"). And if computer modeling alone was good enough nobody would have wind tunnels. The history of airplane development is full of planes that were built and flown in very small numbers, with the data helping to inform future designs. As the Zumwalt was such a radical design, departing so far from normal shipbuilding experience and formulas (google "metacentric height", "center of buoyancy", and "center of gravity"), it, I think, deserves to be thought of in much the same way as plane designs that saw very limited production and saw testing, and informed future designs in a useful way.

The US navy also has hard data on the radar signature of a tumblehome hull design, which nobody else has unless they pointed their radar sets at a Zumwalt class ship while configured for battle. I somehow doubt the US Navy sailed the Zumwalts close to the coast of Russia unless they added radar reflectors to them to mask their actual wartime radar signatures.

Maybe someone on the list developed and tested a trading strategy and found it lacking, then used the insights gained to test another strategy that turned out to be useful. Was the cost of developing and testing the first strategy wasted? I think not.

Carder Dimitroff writes:

Henry, your comment about aluminum reminded me of nuclear power plant design. For the reasons you state, aluminum is not allowed inside the containment (reactor building). Copper and stainless steel are used in place of aluminum. Outside the containment, aluminum is everywhere. I assume the US Navy requires similar standards for their nuclear submarines and aircraft carriers. Many design features in commercial nuclear plants originate from the nuclear navy.

Oct

7

What some Specs are keeping an eye on

October 7, 2024 | Leave a Comment

From Carder Dimitroff:

Note: 1 GW = about 1 nuclear power plant.

US DOE/EIA: Batteries are a fast-growing secondary electricity source for the grid.

Utility-scale battery energy storage systems have been growing quickly as a source of electric power capacity in the United States in recent years. In the first seven months of 2024, operators added 5 gigawatts (GW) of capacity to the U.S. electric power grid, according to data in our July 2024 electric generator inventory. In 2010, only 4 megawatts (MW) of utility-scale battery energy storage was added in the United States. In July 2024, more than 20.7 GW of battery energy storage capacity was available in the United States.

From Kim Zussman:

Argentina Scrapped Its Rent Controls. Now the Market Is Thriving.

For years, Argentina imposed one of the world’s strictest rent-control laws. It was meant to keep homes such as the stately belle epoque apartments of Buenos Aires affordable, but instead, officials here say, rents soared.

Now, the country’s new president, Javier Milei, has scrapped the rental law, along with most government price controls, in a fiscal experiment that he is conducting to revive South America’s second-biggest economy.

The result: The Argentine capital is undergoing a rental-market boom. Landlords are rushing to put their properties back on the market, with Buenos Aires rental supplies increasing by over 170%. While rents are still up in nominal terms, many renters are getting better deals than ever, with a 40% decline in the real price of rental properties when adjusted for inflation since last October, said Federico González Rouco, an economist at Buenos Aires-based Empiria Consultores.

From Asindu Drileba:

Charles Piller and the team here at Science dropped a big story yesterday morning, and if you haven't read it yet, you should. It's about Eliezer Masliah, who since 2016 has been the head of the Division of Neuroscience in the National Institute on Aging (NIA), and whose scientific publication record over at least the past 25 years shows multiple, widespread, blatant instances of fraud. There it is in about as few words as possible.

It turns out that alot of FDA drug approvals where based on this guy's research (a few listed in the article). I wonder what effect it may have on pharmaceutical businesses based off his research. Imagine spending decades & billions on a drug whose prior research turn's out to be completely forged (photoshopped images). This looks really bad for the Alzheimer's drug focused pharmaceutical industry.

From David Lillienfeld:

This is a comparison of international drug prices. U.S. gross prices are higher than those in comparison countries for all drugs and for brand-name originator drugs but lower for unbranded generic drugs.

Oct

5

Larry Williams comments:

Yield curve is very bullish at this time - it is so misunderstood.

Peter Ringel does some counting:

I found a FED Cut gives some bear pressure on SPY 5, 10 days after. Then it goes into meaningless regarding SPY.

only T+5 , T+10 are probably significant. We just crossed the end of that bearish pressure.

T+1 10000 reshuffled - Observed difference: -0.03, Bootstrap p-value: 0.8573

T+5 10000 reshuffled - Observed difference: -0.96, Bootstrap p-value: 0.0206

T+10 10000 reshuffled - Observed difference: -1.13, Bootstrap p-value: 0.0514

T+20 10000 reshuffled - Observed difference: -0.88, Bootstrap p-value: 0.2829

(a work in progress)

Oct

4

The multiple comparisons problem, from Big Al

October 4, 2024 | Leave a Comment

A paper co-authored by Andrew Gelman who is a high-profile writer on statistics at Columbia:

Why we (usually) don’t have to worry about multiple comparisons*

Andrew Gelman, Jennifer Hill, Masanao Yajima

July 13, 2009

Abstract

Applied researchers often find themselves making statistical inferences in settings that would seem to require multiple comparisons adjustments. We challenge the Type I error paradigm that underlies these corrections. Moreover we posit that the problem of multiple comparisons can disappear entirely when viewed from a hierarchical Bayesian perspective. We propose building multilevel models in the settings where multiple comparisons arise.

Multilevel models perform partial pooling (shifting estimates toward each other), whereas classical procedures typically keep the centers of intervals stationary, adjusting for multiple comparisons by making the intervals wider (or, equivalently, adjusting the p-values corresponding to intervals of fixed width). Thus, multilevel models address the multiple comparisons problem and also yield more efficient estimates, especially in settings with low group-level variation, which is where multiple comparisons are a particular concern.

[ … ]

The Bonferroni correction directly targets the Type 1 error problem, but it does so at the expense of Type 2 error. By changing the p-value needed to reject the null (or equivalently widening the uncertainty intervals) the number of claims of rejected null hypotheses will indeed decrease on average. While this reduces the number of false rejections, it also increases the number of instances that the null is not rejected when in fact it should have been. Thus, the Bonferroni correction can severely reduce our power to detect an important effect.

Here is a widely-read blog Gelman co-authors.

Oct

2

Dissonance and disbelief

October 2, 2024 | Leave a Comment

Cognitive dissonance 2: "i think the former president did a 'hades of a job'", but prob of winning fell from 60% to 45% from 1 day before to 1 day after.

one is reading again don quixote where his household throws away his books on chivalry because they believe it contribute to his supposed madness. along comes this article and headline from charles schwab "how to identify head and shoulders patterns."

my goodness - at this stage in our education 70 years after magee on technical analysis and 120 years after it was first recommended in The Magazine of Wall Street. even sancho would throw up his hands in disbelief.

Oct

2

Maybe G*d plays dice after all, from Kim Zussman

October 2, 2024 | Leave a Comment

Anyone else sick of the idea that gamblers are best at financial markets? Why aren't the champion players the richest in the world? Would you hire a gambler to manage your life savings? Don't gamblers (Livermore, etc) die broke?

Why This Wall Street Firm Wants Its Traders to Play Poker

Young traders who join the trading giant Susquehanna International spend at least 100 hours playing cards during a 10-week training program. When the stock market closes at 4 p.m., they often head straight from the trading floor to a dedicated poker room at the firm’s headquarters in the Philadelphia suburbs.

Jeff Yass, Susquehanna’s co-founder, sometimes joins in, scrutinizing hands new hires play and gauging how effectively they bluff. Thousands of employees, from traders to technologists, participate in the firm’s annual poker tournament. At least three have notched wins at the World Series of Poker in Las Vegas.

Big Al offers:

Peter Ringel writes:

I agree to all the points from the trading side. I know the basics of poker, but not a skilled player. Not even a novice. It makes sense to use the filter "skilled poker player" for manager selection. But how to become a skilled player ? Is it easier to become skilled in poker vs a skilled trader? I suspect it is a similar hard battle.

Asindu Drileba comments:

The problem with "skill level" is that they kind of translate differently. Warren Buffet for example is a Bridge addict. (Bridge is also a game of chance like poker) He (Buffet) is definitely an "above average skill player", but nit amongst the top 20 in the world. In investing however, Buffet may be regarded as part of the top 5.

The same goes for other financiers. Sam Altman (top VC in Silicon Valley), Jason Calcanis (Top VC in Silicon Valley), Charlie Munger were probably above average poker players but their edges were stronger in the finance & investing world — but all these attribute poker to their success.

Big Al writes:

1. Poker is very different from other casino games. There is a lot of skill involved, a lot of math (at the higher levels), a deep understanding of game theory (at the very high levels), and there are many more decisions to be made in poker compared to, say, roulette. Most poker pros probably wouldn't call poker "gambling", though some are degen gamblers when they walk away from the poker table.

2. Poker is a lot like the other casino games in that, for most people, the best decision is not to play. Like in markets, where the best decision for most is not to trade but just buy a diversified portfolio and hold it for a long time.

3. But firms like Susquehanna are not advising "most people" and they're not buying and holding SPY. For them, poker is a good way to assess and develop various skills that are relevant to hacking the market and making big bets. Poker is a great laboratory for testing "risk tolerance".

4. The poker "ecosystem" is a lot like the trading market in that there is a need to keep getting new suckers to enter at the bottom level and convince them they can win.

Oct

1

Book rec, from Carder Dimitroff

October 1, 2024 | Leave a Comment

Empire, Incorporated: The Corporations That Built British Colonialism

Across four centuries, from Ireland to India, the Americas to Africa and Australia, British colonialism was above all the business of corporations. Corporations conceived, promoted, financed, and governed overseas expansion, making claims over territory and peoples while ensuring that British and colonial society were invested, quite literally, in their ventures. Colonial companies were also relentlessly controversial, frequently in debt, and prone to failure. The corporation was well-suited to overseas expansion not because it was an inevitable juggernaut but because, like empire itself, it was an elusive contradiction: public and private; person and society; subordinate and autonomous; centralized and diffuse; immortal and precarious; national and cosmopolitan-a legal fiction with very real power.

Sep

30

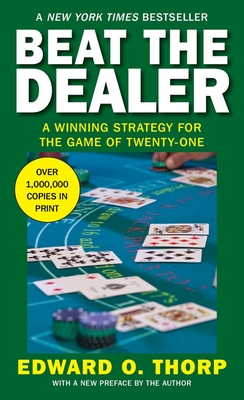

Ed Thorp hosts Joseph Granville at UC Irvine (1981), from Big Al

September 30, 2024 | Leave a Comment

Interesting, for the history of market prognostication: