S&P +36.75

USB -0.16

S&P -60.75

USB -0.01

S&P -35.50

USB -0.02

S&P -85.50

USB +0.27

S&P +132.00

USB +0.04

S&P +30.50

USB +0.02

S&P -21.75

USB +0.29

S&P -1.00

USB -0.12

S&P -109.50

USB +1.06

S&P -0.50

USB +0.16

S&P +10.00

USB +0.07

Feb

15

6950, from Ani Sachdev [Updated]

February 15, 2026 | 1 Comment

I counted the number of crossings of the ES future past 6950. I counted the using the nearest expiry future. I counted using 30 min increments. Since October 29, 2025:

ES crossed from close to close across 6950, 78 times. 39 times up, 39 times down - true Logbola.

ES traded through and touched 6950 at any time at least 154 times (counted when there was low < 6950 < high).

Curious if any specs have used data like this to predict future prices.

Zubin Al writes:

14 hourly crosses night and open [Friday, 13 Feb.].

Cagdas Tuna comments:

I find the fact that whether call it NY Fed or Blackrock or other main street banks whoever single handedly controls and manage to keep VIX below 20 that is ultimate power controls the US stock market.

Larry Williams responds:

No one is holding anything down—or up—my vix fix is essentially same as $vix it cannot be controlled.

Cagdas Tuna is skeptical:

Yes, nothing is controlled!

Zubin Al Genubi prefers market dynamics:

Vix suppression is caused by: 1) heavy ODTE trade, while VIX is calculated on options 23-37 days out; 2) dispersion in SP index (dispersion meaning Mag 7 vs other 493; see RTY almost up 2%); 3) Big fund/ETF imbalances balancing deltas; 4) mean reversion of VIX/and buy the dip, which can break down at some point.

Larry Williams gets cosmic:

The universe is always expanding, Hawking proved. Stocks are part of that.

Feb

11

New Fed Chair Not So Bearish, from Jeffrey Hirsch

February 11, 2026 | Leave a Comment

…we present the S&P 500’s performance following a change in leadership at the Fed. Historically, performance is not all that bearish. Aside from the 3 months later interval, all other interval’s frequency of advance (% Higher) are above our standard 60% bullish threshold and average performance is positive.

Going one additional step, let’s say Eugene Meyer was not responsible for the Great Depression and Alan Greenspan probably did not cause the market’s crash in 1987. Bad timing, perhaps? Removing them from the data essentially removes the most bearish data. Average performance across all intervals goes up and is positive while frequency of gains also improves noticeably and performance 1-year later jumps to an average gain of 12.7%, with the S&P 500 higher 90% of the time.

Feb

10

Stops, from Zubin Al Genubi

February 10, 2026 | Leave a Comment

![]()

We should never get stopped out of a trade just because we have lost money. We exit trades if we no longer like them—losing money, while deeply unpleasant, should never be the sole criterion for exiting.

Peter Penha responds:

The last stop I left was a stop loss in Platinum futures sub $800 and the market took the contract down $65 and stopped me out, made one lower print $5 below me, and then came back up. Probably was the low print post March 2020.

I have had horrific experience with Schwab/thinkorswim…they once sold me out (partially) of calls on Sugar that were deep in the money at a make believe bid price way off market and below intrinsic value. When I challenged them noting that equity markets were open and they could easily have raised cash in many liquid ways - they told me they reserve the right to do what they want. I have multiple snapshots of them marking positions below intrinsic value, and lately while I was long silver futures they would mark my long Sugar contract to zero (I would see a negative futures cash position equivalent to the notional value of my long position).

I have been thinking of Marty Zweig and how he did very well leaving trailing stops on individual stocks and need to find my copy and revisit Winning on Wall Street and see how he did it (successfully).

Rich Bubb writes:

I AI'd trailing stops info thru Gemini.

The rule-of-thumb I currently/usually use is 8%-15% TSL% (trailing stop loss %). And typically use a lower-is-better TSL%. The volatility and economic tea leaves divination determine the TSL%. If I have less conviction in a position, I'll reduce TSL% to (sometimes) let the Market tell me how wrong I initially was.

And I got burned at the start of Great Recession, where I had TSL%s way-too relaxed; upper teens TSL%. The TSL%s all worked, but by then I'd lost about 15%+. Painful lesson.

Feb

8

CIO predicts 2026, too

February 8, 2026 | Leave a Comment

Expect Equity Markets to Broaden in 2026, Led by Small Caps, International

Both fiscal and monetary stimulus should boost earnings in the U.S. and abroad, with dollar weakness continuing to underpin international stocks.

Nils Poertner comments:

Back in High School, they gave a 1 pager of Latin and we had 1 hour to translate it (since it is an ancient language I was spending a lot of time to see what this all meant.) We all know English more or less. These days, I read a 1 pager in English (like this page) in 1 minute. My modern brain actually agrees with the whole article. Yummy. In reality there are probably a lot of cliches in it….

Zubin Al Genubi writes:

AI is about training data otherwise it gets stale and cliched. Like a person reading the same newspaper every day. Google has lots of data. Musk is merging SpaceX with AI because as internet provider he will have access to unlimited global data. I wonder what their contract disclosures say about data privacy.

Steve Ellison responds:

"Expect"? I have seen the broadening occurring since November. There was an extended non-confirmation of Dow Theory last summer into fall as the Industrials were making new highs, but the Transports remained below their November 2024 high. Not only did the Transports finally make an all time high, now they are making new highs before the Industrials do. Similarly, the equal-weighted S&P 500 ETF RSP, which was badly lagging the cap-weighted SPY in the 2025 rally off the "Liberation Day" tariff lows, made a new high yesterday while the cap-weighted index only partially regained some of its losses from earlier in the week.

I said on X [6 Feb.], "Lots of strength in the broader market. While technology stocks were selling off the last few days, the Industrial, Materials, Consumer Staples, and Energy sector ETFs all made new highs".

Feb

7

Filming Electrons at 1 Quadrillion FPS, from Jeff Watson

February 7, 2026 | Leave a Comment

Veritasium: Filming Electrons at 1 Quadrillion FPS

Explore slow motion like never before, from century-old strobe techniques to a quadrillion FPS camera. Witness light's journey through objects and the movement of electrons within molecules. Discover how scientists use sound and incredibly short laser pulses to capture these breathtaking moments.

Feb

5

6 new lows, from Zubin Al Genubi

February 5, 2026 | Leave a Comment

The last few down swings each had 6 new lows before a bottom. Today, marking a new low for this swing after hours will end up a new low number 5 by the end of tomorrow.

Steve Ellison writes:

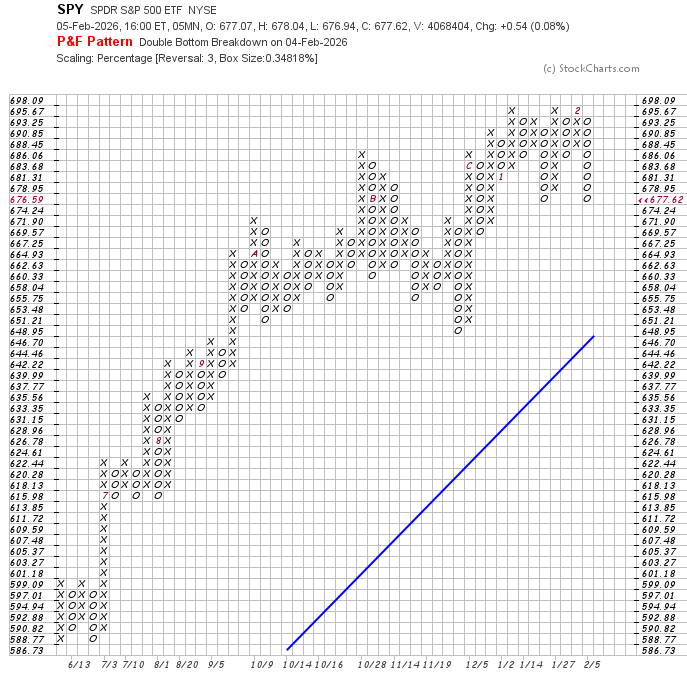

Interesting. I have been experimenting with multi-level point and figure charts. Using a box size of 1.4% (a long-term average true daily range) and a 3-box reversal, SPY is still within 4.2% of its all-time high and hence in an uptrend. Drill down with smaller box sizes and shorter time intervals, and interesting price structures appear. At a 1/4 ATR box size, today's close was at a similar level to the Jan. 20 low.

Lots of sector rotation under the surface. If 2025 was the year of the magnificent 7 and the flatlining 493, this year may be the opposite. While technology was getting beaten down this week, the Industrial, Materials, Consumer Staples, and Energy sector ETFs all made new highs.

Zubin Al Genubi adds:

Lots of late night shenanigans going on. Asian markets trading open in late thin US futures creating imbalances. Price action appears algo driven.

Nils Poertner comments:

I like the pattern with 6 new lows. Well spotted. Otoh, if the pattern does not repeat the surprise for mkts is bigger. nature offers "patterns" and "break of patterns" and both are relevant - else it would be a museum.

Cagdas Tuna predicts:

Then it is going to be a rough year for market cap weighted indices in US.

Peter Ringel writes:

While I would always give a study, like Big Al‘s more weight to remove opinion. I wonder, if there is a January effect regarding regime type or sector or general trading type. Not necessary % performance. Will the rest if the year trade like January? Would give a 2015 type year.

Nils Poertner responds:

yes. for practical purpose, it may be easier to trade mkts which receive less attention by the wider financial community /media.

Feb

5

Gaming tournament going on between AI versions, from Big Al

February 5, 2026 | Leave a Comment

Liv Boree, poker pro, interviews Deep Mind guy:

Why Google Made ChatGPT, Gemini & Claude Play 900,000 hands of Poker…

…before going on to earn a First Class Honours degree in Physics with Astrophysics at the University of Manchester. During this time she played lead guitar in heavy metal bands Dissonance and Nemhaim and modelled for a number of alternative clothing brands such as Alchemy Gothic.

Victor Niederhoffer comments:

especially if you live in denmark

Feb

4

2026 Bullish Confirmation, from Larry Williams

February 4, 2026 | Leave a Comment

Yale Hirsch and his son Jeff have shown that a positive change, from the last trading day of the year to the 5th trading day of the new year, portends a bullish year (positive first 5-day percent change).*

Consider this … in the last 76 years of trading, the S&P 500 has declined for the year 20 times or 26% of the time. In other words, 74% of the time, there has been a yearly gain.

Jeff’s numbers show that in those last 76 years, 49 years showed a positive first 5-day percent change. Only 8 of those years went on to close down for the year. That’s an 84% bias for the year to close higher when we have a positive first 5-day percent change.

My add-on to Yale’s and Jeff’s work was to look at the years that gained 1.2% or more in the first 5 days of trading. There were 28 such years. Of those years, only 2 were down for the year. That’s a 93% bias for the year to close higher. What an improvement from the average 74%!

In 2026, the first 5-day** change for the Dow Jones 30 was +3%.

In 2026, the first 5-day** change for the S&P 500 was +1.6%.

Those 28 years had an average annual return of 14%. The remaining years had an annual gain of 5.3%. I see this as excellent confirmation of the bullishness of my Forecast 2026 Report.

Cagdas Tuna writes:

There is no need for a statistical analysis to assume any given year will be positive for US indices. It is almost guaranteed to be positive every year. No offense to any list member.

Larry Williams responds:

Wrong 24% of time we close down for the year.

Michael Brush is surprised:

Wow did not know it was that high.

Larry Williams agrees:

I was taken back by it as well.

Asindu Drileba asks:

2026 is bullish? But Senator, you said you expect a recession in 2026 with 100% certainty. Is this a contradiction? Or maybe its possible for the market to be bullish even during a recession?

Larry Williams answers:

Yes, there was a projection made a year ago for a 2026 sell off —in the last 12 months data changed—large improvements in fundamentals and hopefully I got a little better understanding of long term cycles. New Data matters.

Nils Poertner writes:

Asindu- there would be simply too many variables out to make that statement with such a certainty in advance. Just impossible. It remains a probability game. Used to subscribe to some cycle research that claimed to have things figured out yrs in advance. quite pricey subscription. it was HOOK, LINE and SINKER (for me).

Denise Shull comments:

New Data matters.

Indeed it does. Wonder why it’s challenging for many to incorporate?

Nils Poertner responds:

Good question. On this note… (Pure) data analysts believe pattern matching on large datasets will solve our problems. But what if the really vital information isn't being collected? What if it's invisible to our trained systems?

Feb

3

The Autobiography of Mark Twain

February 3, 2026 | Leave a Comment

The Autobiography of Mark Twain contains a litany of people who cheated him and losses on his investments near the end of his life.

Nothing ever happened to Mark Twain in a small way. His adventures were invariably fraught with drama. Success and failure for him were equally spectacular. And so he roared down the years, feuding with publishers, being a sucker for inventors, always learning wisdom at the point of ruin, and always relishing the absurd spectacle of humankind, which he regarded with a blend of vitriol and affection.

Feb

2

Dollar Weakens as Markets Reprice US Political Risk, from Peter C. Earle

February 2, 2026 | Leave a Comment

For decades, US dollar dominance rested on a simple but profound foundation. Predictable institutions made the dollar stable, on the belief — sometimes overstated — that the United States would not deliberately undermine its own currency. That belief is now visibly eroding.

The dollar has fallen to its weakest level in nearly four years, not because of a recession or crisis at home, but because investors are increasingly uneasy about the direction of American policy. Against a basket of other currencies, the US dollar is approaching the lows seen during the COVID pandemic as markets are beginning to price in something more corrosive than cyclical weakness. Political and institutional risk is emanating from Washington itself.

Dollar Weakens as Markets Reprice US Political Risk

Feb

1

Does January predict the next 11 months?, from Big Al

February 1, 2026 | Leave a Comment

In this quick study the answer is no.

Jeffrey Hirsch has a different take:

From my newsletter issue published last night:

Jan

31

A strange glut of silver, from Laurel Kenner

January 31, 2026 | Leave a Comment

With silver at $110 an ounce, it seemed like a good idea to raid the family heirlooms.

But my friendly coin dealer wasn’t having any. He’s buying nothing but Eagle coins. The usual buyers — industry, mints, and jewelers — don’t have the capacity to handle the inflow.

Read the full post on Laurel's Substack: Nobody Asked Me, But…A strange glut of silver

Jan

30

Another volatility measure, from Zubin Al Genubi

January 30, 2026 | 1 Comment

Take a price corridor by forming a double barrier (rounds might be nice) delta up and delta down from the initial spot price. When the barrier is touched, we note the exit time, t1, and reset the barrier around the current price. This generates a sequence of exit times t1, t2,…,tn from which we want to estimate volatility. This shows how fast price moved.

Peter Ringel writes:

TY, this looks like a clever approach. I do something similar with zigzag vol and time. It is computational heavier. Yours sounds lighter. Will try it.

Jan

29

Tycoons, artisans, and interchangeable parts

January 29, 2026 | Leave a Comment

The Tycoons: How Andrew Carnegie, John D. Rockefeller, Jay Gould, and J. P. Morgan Invented the American Supereconomy has unusually informative chapter on machine tools, but the rest of the book is the standard hateful stuff about carnegie and gould.

The Industrial Revolution in the Connecticut River Valley

The Connecticut River valley played an important role in the formation of the Industrial Revolution as artisans and mechanics, often spurred on by resourcefulness and isolation, created new tools and new patterns of work in the many mills and shops along the Connecticut’s tributaries.

The American Precision Museum is located in the renovated 1846 Robbins & Lawrence factory on South Main Street in Windsor, Vermont. The building is said to be the first U.S. factory at which precision interchangeable parts were made, giving birth to the precision machine tool industry.

Jan

28

Triage in medicine, from Nils Poertner

January 28, 2026 | Leave a Comment

process of rapidly sorting and prioritizing patients based on the severity of their condition and the urgency of their need for care, especially during emergencies

Amateur /untrained person coming to a traffic accident (w multiple casualties) would rush to help those who cry the loudest (eg maybe just a broken arm) whilst neglecting those who need urgent attention (eg unconscious - about to pass out).

Analogy to speculation? Ordinary investors (ie untrained) getting hooked to "loud" and in your face "stories" in mass fin media - but perhaps neglecting the vital, more silent trends in mkts - which would help them make money over time.

Jan

27

Ralph Vince’s latest, from Larry Williams

January 27, 2026 | Leave a Comment

Ralph Vince's newest book. Not about the markets.

The Theology of Lust follows Ricky “Pork Chop” White — a wounded, self-mythologizing erotic savant — as he stumbles through desire, regret, and violent entanglements, trying to turn raw masculinity into something redemptive. It’s a darkly funny, psychologically unfiltered journey where erotic obsession, betrayal, and a lurking murder plot converge on one man’s desperate attempt to find some sort of salvation out of the mess he calls a life.

Asindu Drileba writes:

Nice! I remember Ralph Vince mentioned that one of his favourite books was The Bible. There is a strange relationship between speculation, theology & computers(artificial intelligence) that no one has comprehensively talk about. Hopefully, I will learn more about theology from this book.

Peter Ringel comments:

When I read the senator writing "the greatest project of his life", I immediately feared, that he fell victim to French, Spanish or Portuguese girls. The title seems to confirm this.

Larry Williams responds:

Good guess but not quite Ralph has a new steal proof coin coming out the book is a year old but was just translated to English from French.

Steve Ellison recalls:

We had a long-ago list member who would frequently draw parallels between never-ending market arguments such as fundamental vs. technical analysis and the European religious wars of the 1600s or theological debates such as predestination vs. free will.

Jan

26

Americana: A 400-Year History of American Capitalism

January 26, 2026 | Leave a Comment

the best history of business and America with new takes on founding and inventions.

Americana: A 400-Year History of American Capitalism

Bhu Srinivasan boldly takes on four centuries of American enterprise, revealing the unexpected connections that link them. We learn how Andrew Carnegie's early job as a telegraph messenger boy paved the way for his leadership of the steel empire that would make him one of the nation's richest men; how the gunmaker Remington reinvented itself in the postwar years to sell typewriters; how the inner workings of the Mafia mirrored the trend of consolidation and regulation in more traditional business; and how a 1950s infrastructure bill triggered a series of events that produced one of America's most enduring brands: KFC. Reliving the heady early days of Silicon Valley, we are reminded that the start-up is an idea as old as America itself.

Jan

25

The Chair’s quest, from Peter Ringel

January 25, 2026 | Leave a Comment

Vic gives out a quest (a research quest).

I swear, I did see Vic's X post only afterwards. I too was thinking about the levels / rounds and how to test them today during my drive. Probably everybody is tired of starring at the same levels and so the mind wonders and wanders.

I am thinking of this approach:

utilize volume profile / volume per price level

(here a buffer bin can be applied / granularity from tick to x points)

(this will become important)

slice / bin the time series in segments of x

x needs to be defined,

I am thinking simple price ranges right now

normalize the segments

create a summary volume profile of all the segments ( an average or total sum )

plot it and hope something stands out

then a deeper statistical analysis of the volume profile, which is a frequency distribution

another approach could be to look at the "rejection power" of a price level after a crossing / touching event.

the crossing / touching events are often fuzzy in time

maybe remove time here a la range bars

after the event qualify the price range traveled for a fix time interval

so price-no-time vs price-time

Zubin Al Genubi writes:

The sample generally is biased bullish. Maybe take a look at bear regimes to see how hypothesis hold up. Also need to use unadjusted prices to retain rounds.

Peter Ringel responds:

TY. I am also thinking cash and virgin levels (around ATHs). the question of prices vs percentages will come up here too again.

If one sticks to prices and assumes an underlying behavioural cause of rounds, there probably are regimes with more or less black and white borders (fast transition) from 50 with weight to 100 with weight to maybe back to 50 in low volatility environments. Also the question, what difference does it make, if the index is 7000 vs 700.

William Huggins suggests:

it may be worth seeing if there are "liquidity cliffs" at rounds rather than sticky prices (order clustering as opposed to price clustering)

Peter Ringel adds:

The open interest at rounds at the option chain is usually noticeable higher vs all other steps.

Now I am thinking to look at the waning of these. Are they getting eaten up. Would explain the multiple crossings of a round needed till we get new ATHs.

Jan

24

Rise and fall of Charles Schwab

January 24, 2026 | Leave a Comment

Steel Titan: The Life of Charles M. Schwab

How did Schwab progress from day laborer to titan of industry? Why did Andrew Carnegie and J.P. Morgan select him to manage their multimillion-dollar enterprises? And how did he forfeit their confidence and lose the presidency of U.S. Steel? Drawing upon previously undiscovered sources, Robert Hessen answers these questions in the first biography of Schwab.

4.4 out of 5 stars

Charles Schwab made made ingenious contributions to Carnegie Steel and shortly after at the age of 35 became pres of US Steel. he was subject to such criticism during his tenure and eventually bought Bethlehem Steel.

Jan

23

Alternative to value at risk

January 23, 2026 | Leave a Comment

alternative to value at risk invented by the Japanese quality of control scholar Taguchi.

Loss functions and constraints improve sea surface height prediction

In order to understand currents, tides and other ocean dynamics, scientists need to accurately capture sea surface height, or a snapshot of the ocean's surface, including peaks and valleys due to changes in wind, currents and temperature, at any given moment. In order to more accurately forecast ocean circulation and other processes, climate variability, air-sea interactions and extreme weather events, researchers need to be able to accurately predict sea surface height into the future.

The Taguchi loss function is graphical depiction of loss developed by the Japanese business statistician Genichi Taguchi to describe a phenomenon affecting the value of products produced by a company. Praised by Dr. W. Edwards Deming (the business guru of the 1980s American quality movement), it made clear the concept that quality does not suddenly plummet when, for instance, a machinist exceeds a rigid blueprint tolerance. Instead 'loss' in value progressively increases as variation increases from the intended condition. This was considered a breakthrough in describing quality, and helped fuel the continuous improvement movement.

Jan

22

The Engineering Rules that Trade, Stefan Jovanovich

January 22, 2026 | Leave a Comment

If a design takes too long to execute, it fails.

Never fall for sunk costs; the current tally does not know what you paid.

Avoid the Optimizing trap: do not develop system for a market that does not actually trade

Leave school early. In classes you come in first by getting the correct answer to every question on the test. In markets the winners ask the right questions and accept the risks that come from being wrong.

Carder Dimitroff writes:

Never fall for sunk costs; the current tally does not know what you paid.

The real story behind commercial nuclear power.

Vic approves:

a sparkling and useful post

Jan

21

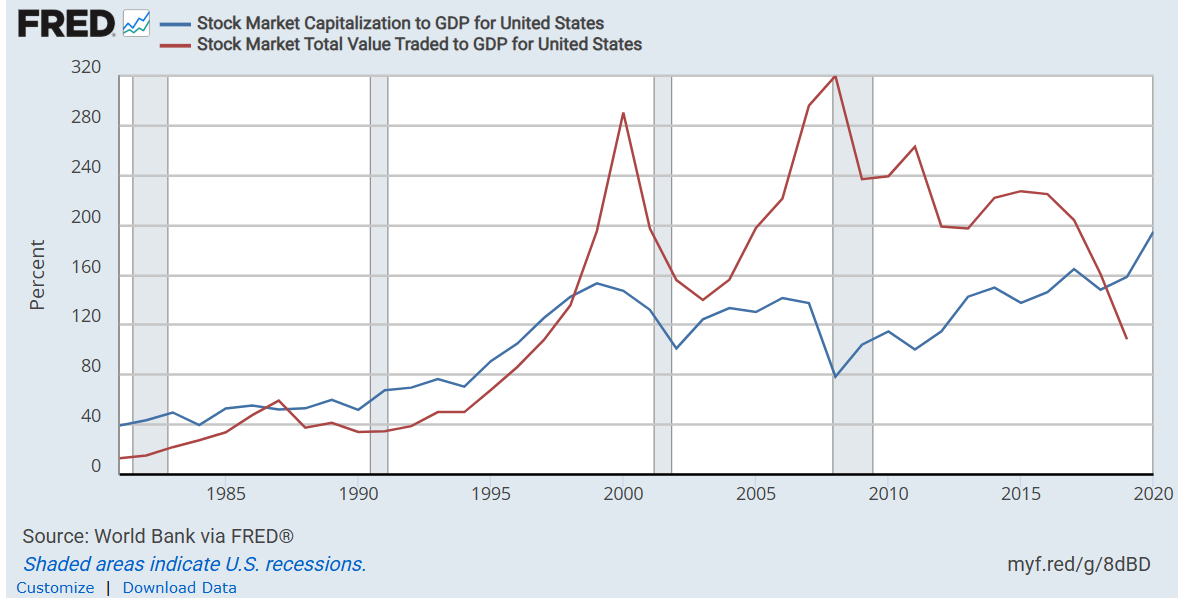

US Stock Mkt Value as pc of GDP (US), from Humbert X.

January 21, 2026 | Leave a Comment

Used to be like sub 50pc in the 1990 and now well over 200pc. Not meant to be of any value for speculation (would have been rubbish in the past and don't think any value for future). but one wonders what it does in terms of tension (internal/ external) as we as shareholders would not like to give back gains so easily (and there is the drift etc). Tricks to be used to keep it up - see v recent events- not judging here.

Larry Williams offers a chart:

Big Al wonders:

I wonder to what extent the decline in "Stock Market Total Value Traded to GDP" reflects a shift to dark-pool/off-exchange trading.

Peter Ringel writes:

TY Larry, great data! looks like we are severely undervalued. A 90s style party is coming.

@BigAl this too is a valid point. If founders don't go the exchanges anymore. Is there data on this off-exchange size? At least for their exit they will most likely show up in equities. Why should early backers not do this in the end? Its too juicy.

related: If off-exchange sector really gets dominant, then FED policy becomes even more toothless.

They have no tools to influence this.

Big Al asks Gemini:

In the US, how much stock trading occurs in dark pools or otherwise off exchanges?

Over 50% of all U.S. stock trading volume now occurs off-exchange, in venues such as dark pools and through internalizers at major firms, exceeding the volume on public exchanges for the first time in early 2025.

Overall Off-Exchange Volume: While dark pools specifically account for a smaller portion of the off-exchange activity (around 13% of consolidated turnover), the overall off-exchange market, including internalizers and bilateral trades, accounts for the majority of U.S. equity trading volume.

Purpose of Dark Pools: Dark pools and other off-exchange venues are primarily used by large institutional investors to execute big orders anonymously, which helps them avoid significant market impact and predatory high-frequency trading (HFT) strategies that can occur on public "lit" exchanges.

Regulatory Oversight: Despite their name, dark pools are regulated as Alternative Trading Systems (ATS) by the SEC and must report executed trades to regulators like the FINRA on a delayed basis.

Market Share Trends: Off-exchange trading share has been on a general upward trend for years, driven by the desire for better execution quality and anonymity. This shift has implications for traditional price discovery on public exchanges.

Steve Ellison does some analysis:

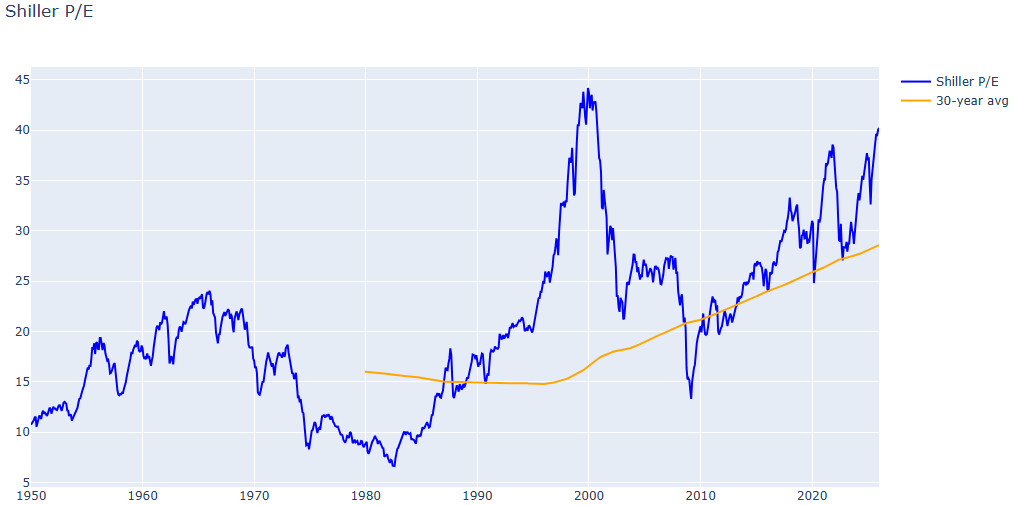

The Shiller Cyclically Adjusted Price Earnings (CAPE) ratio is at its second highest level in history, exceeded only in 1999-2000. What I find interesting is that the 30-year moving average of this ratio has nearly doubled since 1990. My theory is that permanently lower interest rates in an aging population support generally higher stock valuations than in past eras when large families were the norm.

And in the spirit of the old Spec List, here is the Python code I used (.text file) to generate this graph.

Big Al adds:

Another issue is the effect of Mag7 stocks which are global in a new way, beyond US GDP.

Jan

20

Books read over the weekend

January 20, 2026 | Leave a Comment

books read over the weekend of jan 17 - Autobiography of Mark Twain, Following the Equator, How the West Was Won, Little Boss, Abraham Lincoln, The Time It Never Rained, Sherlock Holmes. all recommended.

The Little Boss was a great philanthropist, donated for 2811 libraries, still left 1 billion to carnegie foundation, started carnegie institute, carnegie university, carnegie hero fund among many others.

List of Carnegie libraries in the United States

Jan

19

Memorializing revered persons

January 19, 2026 | Leave a Comment

at 82 years old, not being mobile at all, subject to frequent falls and having fallen on my head last nite, i thought that I mite memorialize those that I have revered at first.

the best no longer with us: : Arthur Niederhoffer, Robert Schrade, Iving Redel, Jack Barnaby, Tom Wiswell, Fred Mosteller, Jules Leopold, Arnold Fish (music teacher), Moe Orenstein, Marty Riesman.

Continuing with those who have influenced me and I revere: James Lorie, Milton Bond, Harvey Sellers, Joan Schreiber, Michelle Siteman.

two more greats who I revere and love: MFM Osborne, Harold Weaver.

Jan

19

Audiobooks, 2025

January 19, 2026 | Leave a Comment

out of the clear blue i received a summary of my audible listening the past year: "logged 4043 hours among 276 titles." feel compelled to listen because reading hurts my eyes and causes extra hours of sleep the next morning.

my favorite audibles are those of Elmer Kelton, Sherlock Holmes, Hampton Sides, Music of Verdi as well as Gilbert and Sullivan, Patrick O Brian (the 22 Aubrey-Maturin series), Bernd Heinrich (The Trees in My Forest and Why We Run), Trojan Wars.

Jan

18

Whenever I listen to Gilbert and Sullivan

January 18, 2026 | Leave a Comment

Whenever I listen to Gilbert and Sulvivan, with their love of satirizing the old person in love with a much younger, and the cranky old man who is oblivious to his faults, I am drawn to remember and reflect on the similarities of those who preceded to the current and former pres and vp.

Jan

18

Traders and Art/Music, from N. Humbert

January 18, 2026 | Leave a Comment

Noticed many of my trading friends have an affinity for either ART or MUSIC or both (active or passive) It occurred to me the other day, that both offer ways to somewhat stay sane, it allows the adult to play and have some fun /relax.

Because society as a whole has something matrix like (going to school, learn about consensus reality, fill out the forms, get a BS job, keep up with the JONES, feel empty..) and this is a nice way to see beyond it and feel a bit at ease. That is all.

Here is a lovely Schubert piece. enjoy

Schubert, Trio No. 2, Op. 100, Andante con moto | Ambroise Aubrun, Maëlle Vilbert, Julien Hanck

Asindu Drileba responds:

Narrator: "Fate had already determined that he will die childless and penniless."

Epilogue: "It was in the reign of George III that the aforesaid personages lived and quarreled; good or bad, handsome or ugly, rich or poor, they are all equal now."

Whenever I hear that piece, I think of those words from Barry Lyndon. It was such a good "slice of life" type film.

Jeffrey Hirsch recalls:

Yale was quite a composer. I tried to produce the musical he wrote about the Elephant Man called Merrick & Melissa. But he was a better composer than I was a producer.

Jan

16

Tacit knowledge, life lessons, and roast beef

January 16, 2026 | Leave a Comment

Nils Poertner suggests:

there is a wonderful book by Michael Polanyi - on tacit knowledge (unlike explicit knowledge one has to develop that skill oneself). not trying to proselytize here that is quite good of a book) and worth many gold nuggets

Jeff Watson offers:

There are some great nuggets in this video - 100 quotes, 100 meals for a lifetime:

100 Harsh Life Lessons That Made My Life So Much Better

Larry Williams knows where the beef is:

America's Top Roast Beef Sandwiches, According to Food Critics

Peter Ringel follows up:

Classical Music for When You're in a Food Coma

Jan

15

Boids, from Asindu Drileba

January 15, 2026 | Leave a Comment

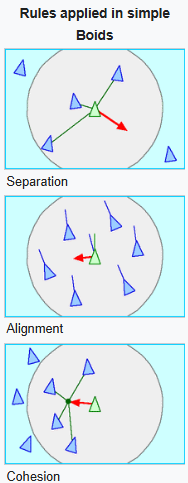

Their is a more interesting school of Artificial Intelligence branded as "Artificial Life" (AL). Their goal is mostly on how to simulate living things in nature, in contrast to Artificial Intelligence where the goal is to solve day to day human problems (it doesn't matter to AI people if the solutions are not consistent with how nature actually does it, but for AL people it does).

An Artificial Life researcher at Nvidia in the 1980s came up with the idea of Boids. It was a very simple algorithm for the simulation of collective intelligence i.e schools of fish, flocks of birds, herds of herbivores. If you have watched The Lord of the Rings, the battle scenes are generated using boids.

One of the parameters of boids is "cohesion". Cohesion is the tendency of "boids" (individual entities in a flock) to move towards their "center of mass". Cohesion is computed by listing the individual coordinates of each "boid" and then finding their average.

In markets, the "current price" can be thought of as the "center of mass" or "cohesion", an "average" of offerings on the order books. Traders may prefer to place orders close to current prices to get filled faster.

When I trade manually and get filled, I am often tempted to close my position in event of small loss (away from the average). Or take profit in event of a small win (still away from the average). I feel like a "boid", and It seems like my need to undergo "cohesion" or chase the "center of mass".

Jan

14

Manipulation, from Humbert X.

January 14, 2026 | Leave a Comment

The allegation of “manipulation” is inevitably just code for “I just badly hosed a trade that seemed so good on paper.” Whereas the proper response to a bad trade is introspection and examination of one’s system. In the markets as elsewhere, there can be a general tendency towards the rejection of personal responsibility. This regularly surfaces in the “manipulation” allegation.

William Huggins responds:

not an opinion on anyone's trading but there is a "fun" bit of psych referred to as the fundamental attribution error in which my successes are the result of hard work and skill while the success of others boils down to luck. similarly, when things go wrong for me, its bad luck (or nefarious forces, "them") but when things go wrong for others, its their bad choices or immorality. pretty much every single person falls into this trap unless they spend a great deal of effort fighting back against the heroic narrative.

Humbert X. comments:

I find it does me little good to think about others, other than to identify when they are travelling in a herd and at an extreme level of emotion, for contrarian purposes. Though sometimes it is possible to learn from their successes and failures assuming they are being transparent about what went right or wrong, which is rare.

Nils Poertner writes:

Good to read Hannah Arendt on this note (free floating anxiety within any society have to go somewhere and sinister groups will use it for their advantage - if not a virus, then some other "Country-" Phobia, then climate change etc… So it would not be enough to change politicians , the anxiety is within the masses (and mostly unconscious).

The key for a speculator is to travel light in life and take things with a bit of distance (2 inches are often enough) - and focus on the process of making money!

Jan

13

An attempt by the disbelievers

January 13, 2026 | Leave a Comment

An attempt by the disbelievers to take the S&P below 7000 that fails in spite of the cheering squad on the bearish side.

Jan

13

The love of royalty

January 13, 2026 | Leave a Comment

the love of royalty and the slave-like tendency is exemplified by the initially negative reaction to the queries about chance gardener expense in the rebuilding at the Fed.

i have not been able to find a study that takes account of the slave-like tendency and the love of royalty and its impact on investments.

Jefferson would not have sold stocks and bonds when the chair of the fed was in trouble. Nor would he have followed the Palindrome in his investments nor the sage of Nebraska.

AI comments:

Jefferson's political philosophy was fundamentally opposed to the concepts of royalty and hereditary power. His personal seal even bore the motto, "Rebellion to tyrants is obedience to God". He dedicated his life to establishing a government in the United States that was a stark contrast to the monarchies of Europe. Jefferson's views on the matter included:

Aversion to European Systems: While serving as the U.S. minister to France, Jefferson observed European courts and societies and grew to detest their systems, viewing them as corrupt and oppressive. He once wrote of his hope that America would forever remain free from "kings, nobles, and priests".

Advocacy for Equality: The core of his political writing, most notably the Declaration of Independence, is based on the principle that "all men are created equal" with inherent rights to "life, liberty, and the pursuit of happiness," a concept directly at odds with a hierarchical system of royalty.

Opposition to Aristocracy: He actively worked to dismantle any potential for a permanent aristocracy in America, advocating for policies such as the abolition of primogeniture and entail (laws that kept large estates within a single family line).

It is possible that the user's query stems from a misunderstanding of his complex personal life and correspondence, which included deep affection for individuals who were part of European high society, such as the married Italian-English artist Maria Cosway. However, these were personal relationships, not an endorsement of the political system of royalty itself.

Jan

12

Contest for the best study of rounds

January 12, 2026 | 1 Comment

i have for the last 62 years wanted a definitive study of what happens when a stock breaks a round number from below. related to this is an answer to the question of whether buying the stock that has gone up the most is a good system.

i took a crack at this while i started at the univ of Chicago. studying what happened when a stock went from below 10 to above 10. the results were so favorable that i stopped the research. it is specially relevant now that the S&P broke 7000.

AND GOLD ABOUT TO BREAK 5000. ITS A GOOD THING TO KNOW. OUT OF FAIRNESS I WILL GIVE AN AWARD OF 3000 FOR THE BEAT ANSWER TO THIS QUERY.

Jan

12

Zugzwang, from Zubin Al Genubi

January 12, 2026 | 1 Comment

In chess, zugzwang refers to a situation where a player has to move, but every move worsens the player's position. When a portfolio manager's risk limits are hit or losses are thought to be unacceptable, the situation is quite the same. - Hari Krishnan

The Immortal Zugzwang Game is a chess game between Friedrich Sämisch and Aron Nimzowitsch, played in Copenhagen in March 1923. It gained its name because the final position is sometimes considered a rare instance of zugzwang occurring in the middlegame. According to Nimzowitsch, writing in the Wiener Schachzeitung in 1925, this term originated in "Danish chess circles".

Nils Poertner writes:

on this note (lack of imagination), see David Hand's probability lever concept:

The Law of the Probability Lever essentially states that slight changes in the circumstances or assumptions of a statistical model can dramatically change the calculated probabilities of events.

Larry Williams states:

ZUGZWANG The life of a trader in one word—always in too early or out too late, also out too early or too late.

Jan

11

Movie Recommendations for Specs, from Asindu Drileba

January 11, 2026 | Leave a Comment

In case you're looking for some movies for the holiday season that may be of interest to a "spec persona", I have a few I recommend:

1. Uncut Gems: Perfect depiction of the of the life of a speculator with no risk management or "system".

2. The Count of Monte Cristo: Perfect illustration of Howard Mark's second level thinking, deception & poker in the markets.

3. The Game: Good movie on self reflection.

4. The Conversation : Deception in the context of corporate board members. To lure his prey, an apex predator (played by Harrison Ford) baits his victims with a "weak target". The Godfather is Francis Coppola's most popular film, but this one is definitely my favourite of his movie's. Also, if you like Jazz music you will love this!

5. The International: Evil specs (arms dealing & nation state money lending). The movie has a very serious tone. No unnecessary jokes or unrealistic fight scenes. Based off the real BCCI scandal.

Jan

11

Counting, on the expressway

January 11, 2026 | Leave a Comment

one in six trucks i passed on trip from Manhattan to Connecticut were Amazon's trucks. about 200 passed.

Jan

10

Original music from Duncan Coker

January 10, 2026 | Leave a Comment

Duncan Coker - Roadside Attractions

Duncan Coker likes to leave a little distance between himself and the characters that narrate his songs. That way he’s free to imagine himself as a long haul trucker, a cowboy or a young singer with dreams of a Nashville music career. He can put himself back a decade, feign an accent or wind up on a different side of the continent. Whatever it takes to move the story forward. What else is songwriting but real feelings channeled through fiction? Every character a sideways version of its author but in another multiverse.

Still, Coker’s songs are true-to-life. He keeps his antenna up, always looking for the signals in the noise. He is a stenographer of the human condition. You might even catch him in the dairy aisle, thumb-typing a phrase he overheard into his phone, destined for a spot in his next verse. Coker’s songs also grapple with the realness of life—the loss of his father or his love for his wife Julie. He enjoys the puzzle of conveying big emotions with a few choice words that rhyme.

Jan

9

Verdi on markets

January 9, 2026 | Leave a Comment

Verdi - The Force of Destiny (La forza del destino) - Overture

La forza del destino (The Power of Fate, often translated as The Force of Destiny) is an Italian opera by Giuseppe Verdi. The libretto was written by Francesco Maria Piave based on a Spanish drama, Don Álvaro o la fuerza del sino (1835), by Ángel de Saavedra, 3rd Duke of Rivas, with a scene adapted from Friedrich Schiller's Wallensteins Lager (Wallenstein's Camp). It was first performed in the Bolshoi Kamenny Theatre of Saint Petersburg, Russia, on 29 October 1862 O.S. (N.S. 10 November).

La forza del destino is frequently performed, and there have been a number of complete recordings. In addition, the overture (to the revised version of the opera) is part of the standard repertoire for orchestras, often played as the opening piece at concerts.

Jan

8

Relevant animal behavior study, from Big Al

January 8, 2026 | Leave a Comment

Self-control is definitely an issue in trading! I kept thinking of the crayfish pov. They probably shined him up by telling him he was "preferable".

Can this Cuttlefish Pass an Intelligence Test Designed for Children?

Nils Poertner responds:

Very good. For specs / traders the self-control is tested now with media trying to steal our energy (emotional vampires) with high amygdala stories - whereas the mkts does whatever it does. "get the joke"

Jan

7

News, from Duncan Coker

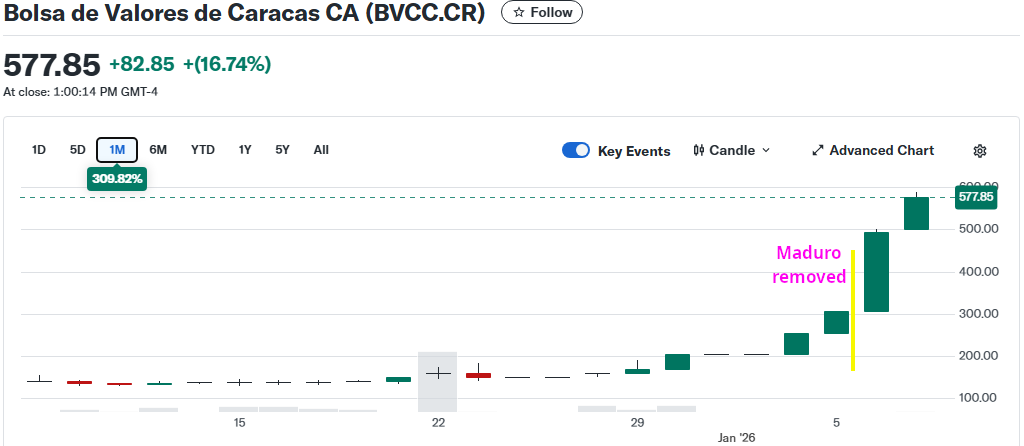

January 7, 2026 | Leave a Comment

Interesting 40% move in Caracas stocks the days Before the capture. It is as if someone knew about the plans and acted on that information. News follows the markets as Larry has taught us.

Jan

6

Leather jacket indicator, from Cagdas Tuna

January 6, 2026 | Leave a Comment

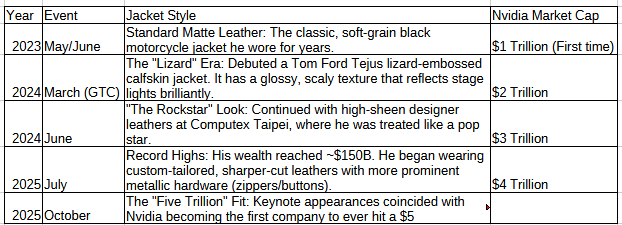

I asked Gemini if the Nvdia stock price milestone dates associated with Jensen Huang's famous leather jackets. Here is the timeline of Jensen's jacket evolution alongside Nvidia’s stock milestones:

The one that caught my attention is Lizard Era in March 2024. At that time Nvdia price was around $100 and after Jensen's Lizard Jacket appearance Nvdia stock fell 20-25%. And here is Jensen while debuting new chips last night. We will learn soon if the Lizard Jacket is a helpful tool for front running Nvdia stock!

Steve Ellison likes the idea:

Very unique and insightful analysis. My wife read a biography of Mr. Huang. When he was growing up in Oregon, his immigrant relatives wanted to put him in a private school, but the school they enrolled him in was a reformatory. After that life experience, I am pretty sure that Mr. Huang can't be intimidated by Donald Trump or Xi Jinping.

Peter Ringel adds:

agree. probably useful insights can come from seemingly absurd corners. Like the weather of sports teams in NYC.

Jan

6

Markets from networks

January 6, 2026 | Leave a Comment

Markets from Networks: Socioeconomic Models of Production, by Harrison C. White, is one of the most realistic and profound understandings of the the entire industrial structure. highly recommended.

White argues that the key to economic action is that producers seek market niches to maximize profit and minimize competition. As they do so, they base production decisions not only on anticipated costs from suppliers and anticipated demand from buyers, but also by looking at their competitors. In fact, White asserts, producers act less in response to actual demand than by anticipating it: they gauge where competitors have found demand and thus determine what they can do that is similar and yet different enough to give themselves a special niche.

Jan

5

Markets approve

January 5, 2026 | Leave a Comment

today every major us market is up substantially showing the approval of the Maduro capture and its impact on wealth.

Jan

5

Oil, from Cagdas Tuna

January 5, 2026 | Leave a Comment

So where lies the thin line between liberating Venezuela and putting world into oil supply based recession?

Larry Williams comments:

The quality of their crude is a different issue we use to refine it here; sour, full of gravel etc.

Stefan Jovanovich writes:

Historically, before full sanctions in 2019, the US imported over 600,000 barrels per day (bpd) of Venezuelan crude, with refiners like Citgo (PDVSA-owned), Valero, Chevron, and Phillips 66 as top recipients.

More recently (post-2023 relief), Valero accounted for 44% of imports, Chevron 32%, and Phillips 66 10%.

Carder Dimitroff writes:

IMO, it's not about oil. The US is a net exporter. They're doing just fine without Venezuela. If heavy oil is desired for refining optimization, as some claim, there's a direct pipeline from Canada.

Stefan Jovanovich responds:

It would help if Carder focused on the use of heavy oil for marine diesel and bunker oil for steam turbines. Those are the essential propulsion fuels for China's Navy; hence, Hegseth's comment today assuring China that it would continue to receive its share of Venezuela's output.

Carder Dimitroff expands:

Globally, three major regions produce heavy crude: Russia, Canada, and Venezuela. Downstream, “heavy oil” or “heavy fuel oil” usually means the residual, high-boiling product left after lighter fractions (gasoline, diesel, kerosene, etc.) are distilled from crude. As Stefan suggests, heavy oil and bunker oil are growing markets, not only in China but also elsewhere.

In my opinion, the administration's interests in Venezuela reflect several interests. High on my list are Venezuela's untapped rare-earth elements (about 300,000 metric tons).

Pamela Van Giessen offers:

Interesting analysis here:

The Real Reason the Pentagon Approved Venezuela: Critical Minerals and Adversary Expulsion

The Department of War has allocated $7.5 billion under the One Big Beautiful Bill Act specifically for critical minerals, with $1 billion already deployed to stockpile antimony, bismuth, cobalt, indium, scandium, and tantalum. This is not economic policy. This is national security infrastructure. The United States is 100% import reliant for 12 critical minerals and over 50% reliant for 28 of the 50 minerals classified as essential to national security. These materials are not interchangeable. They cannot be substituted. They form the irreducible foundation of modern weapons systems.

Boris Simonder questions the thesis:

What rare earth does Venezuela hold that is proven and confirmed? Based on USGS Mineral Commodity Summaries 2025 and other sources like CSIS reports, Venezuela has no significant cobalt production or reserves listed. Antimony deposits exist but are small and underdeveloped, with declining output due to infrastructure issues.

Jan

4

Natural Gas, from Nils Poertner [Update]

January 4, 2026 | Leave a Comment

European Natural gas - not that far to test 2024 lows, and perhaps even pre-Ukraine-war levels eventually? Peace coming (?) Or general decline in Gas prices (US natty has gone the other direction for a while).

"Price move first - fundamentals later." When something moves (even though I don't trade it - or have expertise in it yet), I often look at it and wonder what it could mean. Mass financial media hasn't picked up on this theme either (much) - another reason to consider what it means…

Carder Dimitroff comments:

For me, this is an important observation. EU-US fundamentals have changed. The current US administration "encouraged" the EU to accept US LNG imports. At the same time, US LNG export capacity has increased. For Europe, the supply-demand dynamics changed. In the next several months, it will continue to change:

• 14.49 Bcfd US LNG export capacity - current.

• 21.81 Bcfd US LNG export capacity - under construction.

• 13.24 Bcfd US LNG export capacity - approved but not under construction.

• 12.49 Bcfd US LNG export capacity - proposed and seeking approval.

Most of this LNG use capacity uses, and will use, Texas/Louisiana natural gas as its feedstock. Feedstock and LNG prices will likely be correlated with Henry Hub prices. If most of this capacity is built, the following trends are likely to emerge:

• US citygate (NG) average prices will float higher.

• US LMP (electric) average prices will float higher.

• US NGL average prices will sink.

• EU NG average NG and LMP prices will stabilize.

More importantly, global LNG markets are changing and will continue to change. Keep in mind:

• Global LNG capacity is expanding

• The US is not the LNG cost leader and never can be.

• As the US dominates EU imports, global markets adjusted accordingly.

Of course, traders should be indifferent about these long-term fundamentals. But long-term investors might consider options.

Stefan Jovanovich asks:

Follow-up question for Carder and others: "What do you think about the Doombird thesis that the Permian drillers and the mid-stream connectors will shift to have natural gas be the hydrocarbon asset that they look to make money from and oil will be the secondary source of income?"

Carder Dimitroff replies:

If the question concerns long-term prospects, global demand for diesel, jet fuel, plastics, and related products is expected to grow. Gasoline consumption may be slowing, but it is not crashing. But who knows where the economy is headed?

For the US, natural gas as a bridging fuel makes sense if it can reach consumers. In the US, domestic delivery is a problem. Globally, LNG delivery is also a problem, but for different reasons. Because they deliver to Henry Hub, producers should be indifferent between the two markets. Beyond Henry, LNG is becoming increasingly accessible, whereas citygates will continue to struggle.

The US is also a net exporter of oil and oil products. Again, the product supports two separate markets.

Most Permian wells produce oil and associated gas (and they are getting gassier). It's not a choice. They get both.

For me, the short-term challenge is global overproduction. Geopolitical considerations rather than economic factors drive the decision to overproduce and erode margins. It will end, and the markets will revert. Until then, it will be difficult for American producers to finance new wells.

Jan

3

Fund manager’s bizarre apology video, from Jeff Watson

January 3, 2026 | Leave a Comment

From 2018: Investment boss in tearful video apology over losses

And a recent take on it: Fund Manager's Bizarre Apology Video

J. Humbert responds:

Reminds me of this one from a few years ago…

Fleeing investment manager offers victims teary bon voyage – Chicago Tribune

Charles Harris wiped tears from his eyes, looked straight at one of his friends and apologized for lying about the value of the commodity pool he oversaw.

This scene was recorded on one of three DVDs made aboard Harris’ boat as it was apparently heading away from the U.S. and the federal authorities who are looking for Harris.

Jan

1

A great book to start the New Year

January 1, 2026 | 1 Comment

From the archives:

Elroy Dimson, Paul Marsh and Mike Staunton, Triumph of the Optimists. We cannot say too often that if you read one investment book, this should be it. Ever since its publication in early 2000, it has informed our approach to the market and served as a source of trading ideas. The first comprehensive international market database, this book by three distinguished London Business School professors belongs on the shelf of every investor, trader, policy-maker and economist. In all the sciences, great strides in seeing things how they are came about after the compilation and classification of data. At last we have something that builds on the University of Chicago’s Center for Research in Securities Prices, the U.S. database that led to an explosion in market knowledge and testing a generation ago.

Elroy Dimson, Paul Marsh and Mike Staunton of the University of London Business School worked together on this massive project. Within Triumph's pages, an investor may find definitive information on inflation adjusted returns for stocks, bonds and treasury bills, real dividends, correlation between markets worldwide, and the relative performance of value and growth stocks.

Unlike most books written by academics, Triumph avoids hasty generalizations and biased sampling procedures. The authors rightly fault earlier investment studies for arbitrary selection of starting and stopping points, the tendency to include the good and exclude the bad, and a parochial focusing on a small slice of the global picture. Their work epitomizes outstanding investment research.

Great works can be created in humble circumstances. Shakespeare was an actor and entrepreneur who reworked old plots so that his theatre company could make a buck. Cervantes wrote a parody of the fashionable knight errantry books to repay his debts. Dimson told us that he and his colleagues thought of Triumph as "a labor of love, just a small contribution that could lead to a paperback meant for light reading on planes". He added, "Our families would be less kind about our fixation." Staunton, who collected the data, prefers to gather statistics by himself from original sources at specialized libraries instead of delegating the work.

The main conclusion of Triumph is that a random selection of US stocks returned 1,500,000 percent in the twentieth century. Yes, big losses occurred at times, such as the back-to-back losses of -28 percent and -44 percent in 1930 and 1931, or the 10 years from 1970 to 1979 when stocks hardly budged while the dollar lost 28 percent of its purchasing power.

But overall, adjusted for inflation, the return on US stocks amounted to 6.3% a year, better than any other class of securities.

Dec

31

Great recent webinars, from Peter Ringel

December 31, 2025 | Leave a Comment

Reviews of 2025 and previews of 2026:

Mr Hirsch:

- Got many new ideas for research and helpful context

- also learned that I use the term Santa wrong!

Adam Grimes:

Trading the Changes: Structure, Regimes, and the Path to 2026

- always brilliant

- lots of actionable stuff and gems

Larry Williams:

Larry Williams’ 2026 Market Forecast: Cycles, Risks, and Opportunities

Dec

31

There is market manipulation, from Larry Williams

December 31, 2025 | Leave a Comment

Every time I take a position the market manipulates my emotions. Every damn time.

Humbert Y. agrees:

Ha! As always, Larry nails it. This is the only relevant manipulation to be on guard for, and it is not an easy task…

W. Humbert comments:

My entrances are typically during what I perceive as a manipulation, I look for them.

Dec

30

Only the strong

December 30, 2025 | Leave a Comment

making you hold for the rounds at 6950 and 7000. only the strong.

Dec

30

Jobs: Rebirth, from Bill Rafter

December 30, 2025 | Leave a Comment

Monitoring the U.S. economy through job growth has been unusually difficult in recent months. Under normal circumstances, the labor data would offer a clean read on economic momentum. Instead, a politically driven government shutdown temporarily removed millions of workers from payrolls, distorting every major employment indicator. The strategy failed to achieve its political aims, but it forced millions of Americans to forgo paychecks until the shutdown ended—leaving analysts with a statistical mess to untangle.

The central question now is straightforward but critical: How much of the current job growth reflects genuine economic expansion, and how much is simply the reinstatement of furloughed workers—or seasonal part-time hiring for the holidays?

The next Non-Farm Payroll Report arrives Friday, January 2, 2026, and for the first time in months we may get a clearer signal. Our estimate points to a substantial increase in jobs, driven entirely by the behavior of Payroll Tax Receipts, which have long been our most reliable real-time indicator of labor market strength.

After a period of negative growth, Payroll Tax Receipts have turned sharply upward. As shown in the accompanying chart, the leading indicator (red line) has lagged the actual receipts (blue line) during the shutdown distortions, but is now crossing above and beginning to lead the series higher. This is not a temporary blip. It marks the beginning of a multi-year positive trend—one we forecasted months ago and which is now unfolding exactly as expected.

Our estimate for the January 2nd NFP Report: +162,000 jobs

If this projection holds, it will confirm that the underlying economy has regained its footing and that the Payroll Tax Receipt signal is once again pointing the way forward.

Sorry — 4.3% GDP Growth Isn’t Real

Several major outlets (Bloomberg, CNBC, Axios) recently reported that the U.S. economy grew at an annualized 4.3% pace in Q3 2025. The number comes from a delayed BEA release (12/23) that extrapolated partial quarterly data into an annual rate. But that headline figure simply doesn’t match real-time economic activity.

Payroll Tax Receipts Tell the Truth

Our most reliable indicator of economic momentum has always been Payroll Tax Receipts. They reflect actual wages and actual jobs — not model-based projections.

Here’s what the tax data shows:

During Q3 2025, Payroll Tax Receipt growth was never positive.

Annualized growth for the quarter averaged 1.42%, and that’s looking back over a full year.

Current annualized growth through Christmas 2025 is under 0.5%.

Those numbers are nowhere near 4.3%.

Why the BEA Estimate Misleads

The BEA’s figure is:

Annualized — multiplying a partial quarter by four

Distorted by the government shutdown, which delayed data collection

Contradicted by real-time tax flows that never showed a surge

Even the BEA notes this is an initial estimate, replacing two missed releases. It is unusually fragile and backward-looking.

Interpretations Will Vary — But the Data Doesn’t

Some may speculate that an unexpectedly high GDP print could influence monetary policy by suggesting renewed inflation pressure. Whether or not one believes that, the conclusion is straightforward:

The 4.3% GDP claim cannot be supported by real economic data.

Payroll Tax Receipts — the cleanest, least-manipulable indicator we have — show growth well under 1%, not 4%.

Larry Williams adds:

One of the best predictors of jobs is the stock market, which is also forecasting more people back to work.

Dec

29

A curious case of silver, from Anatoly Veltman

December 29, 2025 | Leave a Comment

So as Silver trades yet another stratospheric (psychological) target, there are a few questions. On commercial side, both Demand and Supply are price-inelastic. Whatever industrial uses are, Silver is hardly substitutable, especially at the time when other metals are just as pricey. And on new Supply side, much Silver gets out of the ground as a by-product from mines not primarily operating as "a Silver mine". So, again, Silver production can't be easily jacked up during Silver's rise.

On non-commercial side, however, it's the opposite. Supply/Demand balance works as it should. $77 (or $100 lol) market would cause Buyers to be abandoning bids; while grandmas might start dusting silverware off and storming pawnshops. Any other considerations?

Peter Penha responds:

Exactly - if you look at the Silver Institute Supply / Demand models it shows we have been in several years of deficits (still in deficit of course this year and next) - Mine supply peaked a decade ago

If you add up all the non industrial uses of silver (Jewelry, Photography+film (Chris Nolan & IMAX), and all silverware) they do not make up the deficit.

So in the Silver Institute model and I am talking 2023 $28 silver price we have some 20% of total ounces that need to be divested every year to maintain supply/demand.

60% of uses are industrial - solar is the future everywhere now….for those missing the US battery trade —> the Biden era tax credits for solar are now Trump credits for solar+batteries & the AI data centers are now going to be Bring Your Own Capacity and storage & connect to the grid.

Read the full post with additional comments.

Dec

28

Letters From A Self-Made Merchant To His Son

December 28, 2025 | Leave a Comment

The book Letters From A Self-Made Merchant To His Son was a bestseller in 1901 and is still one that every kid and businessman should read. it's advice from a meatpacker for his son and goes thru Harvard and is based on the founders of Armour and co and Swift.

it's filled with advice on a proper way to choose a girl and how to be successful in business. Highly recommended.

Here is a good summary of the letters from the best book on business and life wisdom that there is. The timeless advice is more relevant for today than any new work could be. Just buy it. Read it. Implement it.

Dec

26

Fantastic Veritasium video on power laws, from Asindu Drileba

December 26, 2025 | Leave a Comment

With direct application to speculation (featuring VC's):

You've (Likely) Been Playing The Game of Life Wrong

The world is not Normal.

Dec

24

Stubby Pringle’s Christmas, from Dailyspeculations

December 24, 2025 | 8 Comments

This is one of my favorite stories. I hope you enjoy it, and I wish you a Merry Christmas. — Victor Niederhoffer

This is one of my favorite stories. I hope you enjoy it, and I wish you a Merry Christmas. — Victor Niederhoffer

High on the mountainside by the little line cabin in the crisp clean dusk of evening Stubby Pringle swings into saddle. He has shape of bear in the dimness, bundled thick against cold. Double stocks crowd scarred boots. Leather chaps with hair out cover patched corduroy pants. Fleece-lined jacket with wear of winters on it bulges body and heavy gloves blunt fingers. Two gay red bandannas folded together fatten throat under chin. Battered hat is pulled down to sit on ears and in side pocket of jacket are rabbit-skin earmuffs he can put to use if he needs them.

Stubby Pringle swings up into saddle. He looks out and down over worlds of snow and ice and tree and rock. He spreads arms wide and they embrace whole ranges of hills. He stretches tall and hat brushes stars in sky. He is Stubby Pringle, cowhand of the Triple X, and this is his night to howl. He is Stubby Pringle, son of the wild jackass, and he is heading for the Christmas dance at the schoolhouse in the valley.

[For the entire text of the story, please follow this link].

Dec

23

Force of destiny

December 23, 2025 | Leave a Comment

force of destiny sp at 7000 now at 6900.

Dec

23

Low status jobs becoming high status, from Nils Poertner

December 23, 2025 | Leave a Comment

Fascinating to watch how former low status jobs, like cybersecurity, have become high status now. Same is true the other way around as well (eg (male) technician at the London tube system who makes a quarter of his wife who is in real estate - although that is changing now). Wondering what low type jobs / or ppl are on the fringes today will be in high demand in coming years.

Carder Dimitroff responds:

Try these:

Any of the crafts. Specifically, licensed electricians, plumbers, and HVAC techs. Many make more than engineers.

Public response teams. Specifically, firefighters, EMTs, and law enforcement. Many make more than lawyers, particularly when pensions are considered.

Career military. Specifically, for those with 20 years of service. Lifetime benefits are incredible (free college, unlimited grad schools, pensions w/colas, lifetime medical insurance, VA benefits, hiring preferences).

Pamela Van Giessen suggests:

Car mechanics

Henry Gifford writes:

My friend who fixed boilers said to his sophisticated, suit-and-tie, well educated in-laws “I’m not the smartest guy around. I’ve only read two or three books in my life. I don’t think I’m smart enough to come up with a sophisticated investment plan (nods all around the room at this point). So I just buy one piece of New York City real estate each year and hope for the best”. No more nodding at that point.

Guess what blue collar people who don’t have vices do with their money? They buy property. Who is better suited to own real estate? People who fix things and have friends who fix things, or lawyers?

And what nobody mentions is that some people are much better at those sorts of work than others. Simply finding someone to show up and try to do those things is hard. Someone who is good at one of those trades is in even higher demand.

Those fantastic benefits for former military people are not limited to the military – all federal employees get all those benefits after twenty years of work. If someone joins the military at 18, and gets out at 38, or gets out sooner and then works in the post office or etc. until they “get their twenty”, they get full salary with increases for life. Income that will survive any lawsuit, even the IRS can’t take it all. They maybe collect a total of three years of salary for every year worked.

Nils Poertner responds:

Certainly good to encourage young men (or women) to follow a path that interests them - and not just follow a path that is currently "high status". This "Yousef" guy who was my IT guy at Bankers Trust decades ago (low status in my eyes back then) became a cyberpunk in 2008…you get the idea. That said, it is a power game outside. young men need wives etc.

Henry Gifford adds:

I judge the level of a single woman’s interest in me by counting the seconds until she says “what do you do?”.

No woman has ever asked me if I like what I do, or am good at what I do – not important.

Many men have a choice between coming home miserable to a wife, or coming home happy to an empty house. Age old dilemma, no known fix, as all our DNA has evolved to enhance survival, which for a woman over the millennia has meant marrying the chief’s son, or someone else with high status.

Larry Williams recalls:

When I was dating all women ever asked me is your place or mine. Must have been doing something wrong.

Michael Brush is curious:

Do you have a cycle chart for that?

Larry Williams clarifies:

Yes but there are not enough examples to draw a conclusion.

Dec

22

Bitcoin Historical Drawdowns, from Cagdas Tuna

December 22, 2025 | 1 Comment

It will be the first time mainstream institutions, such as ETFs, banks etc. are so heavily involved with this asset class if it is repeating the historical pattern.

Cycle 1 (2010 - 2013)

• Peak: December 2013

• Drawdown: 93% from ATH

Cycle 2 (2014 to 2017)

• Peak: December 2017

• Drawdown: ~86-87% from ATH

Cycle 3 (2018 to 2021)

• Peak: November 2021

• Drawdown: ~75-77% from ATH

Cycle 4 (2025 to ???)

• Peak: October

• Drawdown: 30% from ATH for now

If 70-80% drawdown repeats, Bitcoin will be below 40000 and Crypto Treasury geniuses will be meeting with Trump for a bailout! But Who will bailout Trump?

Dec

22

Tales from the pit, from Jeff Watson

December 22, 2025 | Leave a Comment

Chuck Proctor (video interview)

In this episode of In The Harbor, we sit down with Chuck Proctor, a seasoned spread trader specializing in 30-year Treasury bond futures. Chuck takes us through his remarkable rise on the trading floor—from starting as a runner, to becoming a clerk, and ultimately earning his place as a local trader.

Together, we revisit the golden era of open-outcry pit trading: the chaos, the camaraderie, the competition, and the moments that shaped a generation of traders. Chuck shares firsthand stories of what it was like to survive—and thrive—in an environment built on instinct, speed, and human connection.

We then shift to the present day to examine the “death of the pits” and the takeover of markets by computers and algorithms. Chuck offers candid insights on how the culture of trading has evolved, what was lost, and where opportunity still exists for those willing to adapt.

Dec

21

Study of ancient languages. from Nils Poertner

December 21, 2025 | Leave a Comment

Idea for younger Specs: In School, some of us studied old languages, Latin, ancient Greek, one had to sit 1 hour to figure out what individual words could mean. And then put it all together. One could have the same approach for reading modern newspaper articles now. like this WSJ article here (I know that ppl can read "English" - I meant in a more reflective way. "Get the joke")

Five Reasons Investors Are Feeling Good About Stocks Again

and then check /study with "expected" vs "actual" in 1 week, 1 month, 1 quarter etc,

on a rolling basis to hone intuition /train memory.

Stefan Jovanovich recalls:

Arthur Sullivan - "no, I am not a descendant of the composer, whom none of you dunces will have heard of. He was English; I am Irish." - remains my favorite of all teachers. He lasted 1 year at Hackley - then a borstal boarding school for children who had to be warehoused, now a respectable Westchester County day school. He taught 9th grade Latin and turned it into a lesson in military tactics and strategy. The little Latin and less Greek are long gone, but I can still see his face and those of my classmates the day he explained to us how Caesar used a company of archers to conduct reconnaissance by fire.

Dec

20

Low range of S&P

December 20, 2025 | Leave a Comment

amazingly low range of sp last 2 months with half of all prices in 6800 handle and sd of 9.

Dec

20

Another amazing measurement: LIGO, from Alston Mabry

December 20, 2025 | Leave a Comment

The Absurdity of Detecting Gravitational Waves

The LIGO site.

Dec

19

Request for “off topic” books on speculation, from Asindu Drileba

December 19, 2025 | Leave a Comment

Often when I listen to specs I hear "off-topic" book recommendations. Examples:

"The most important book to do with trading is Secrets of Professional Turf Betting by Robert Bacon" — The Chair. A book about parimutuel horse betting.

"The most important book to do with the stock market is Horse Trading by Ben Green" — A game theorist & friend of The Chair. A book about selling horses

"I can find new trading strategies on almost every new page (Thinking Fast and Slow by Daniel Khaneman)" — The Chair's Brother (Mr. Roy Niederhoffer). A psychology book

"Our entire investment philosophy is based off this book (Snow Crash by Neal Stephenson) — Fred Wilson of Union Square Ventures, a Tier 1 VC firm. Its a sci-fi book.

"One of the most important things you can learn todo with investing is creative writing" — Jeffrey Hirsch. Not a book but still an off-topic research recommendation.

I have never regretted reading an "off-topic" book. Any more of such recommendations?

Nils Poertner responds:

Coaching Plain & Simple, by P. Szabo, D. Meier (book about learning - how to coach oneself in a way)

Asindu - what books to get rid off, to burn, what is an obstacle in your life is also relevant. Early 2008, I visited a French friend on Lehman trading floor in London. V nice guy, senior analyst for their credit models, high IQ 130 plus, bit gullible though. He was surrounded by over 20 books of advanced math on either side of his desk. I had the urge to get a huge sledgehammer and whack down the books…you know.

Larry Williams suggests:

Zurich axioms. A must read.

Peter Ringel agrees with Larry:

I have them on my wall. Besides some of the lists by Vic, Larry, Adam Grimes and some other. Valuable.

And did you find the Daily Speculations booklist?

Asindu Drileba writes:

Yes. I forgot about Zurich Axioms. Thanks. This Daily Speculations list is good, I actually wasn't aware of it.

Dec

18

Clustering, from Nils Poertner

December 18, 2025 | 2 Comments

There is this known phenomenon that coffee chains (Starbucks, Costa Coffee) in a city are often next to each other. Same for gas (petrol) Stations. Makes no sense for the customer but applying game theory it certainly does.

Perhaps the same could be said for analysts forecasts by major broker dealers?

Early 2010 (pre Eurocrisis) I recall speaking to a Deutsche Banker covering Italian regional banks. She said she would have loved to write a more bearish story but was afraid of internal repercussions (as they were trying to win other business from those Italian banks).

Dec

17

John Freeborn, from Stefan Jovanovich

December 17, 2025 | Leave a Comment

His book Tiger Cub: The Story of John Freeborn DFC* is the best writing about the RAF in WW 2.

The facts are from Grok; the comments are mine.

John Connell Freeborn, DFC & Bar (1 December 1919 – 28 August 2010), was a distinguished British fighter pilot and flying ace in the Royal Air Force (RAF) during the Second World War. He was kicked out of Leeds Grammar School at 16 for fighting and found his calling when he joined the RAF 3 years later under a short service commission. After 4 hours and 20 minutes of flight time, he was allowed to solo. In 3 months he went from trainee to pilot officer.

During the Battle of Britain (July–October 1940) Freeborn flew more operational hours than any other RAF pilot—over 300 sorties. He is credit with 5 confirmed kills (Messerschmitt Bf 109s) and 3 shared kills.

Freeborn served as RAF liaison and test pilot in the United States (January–December 1942), commanded No. 118 Squadron (June 1943–January 1944), was wing commander of 286 Wing in Italy (1944–1945). He quit the RAF in 1946; it was, he said, "run by nincompoops".

Dec

16

Oil at $55

December 16, 2025 | Leave a Comment

oil at $55 a barrel. all inflation numbers very bull for S&P and USD. definitely deserving of a rate reduction. except for chance gardner posturing.

Dec

16

Only the paranoid survive, from Nils Poertner

December 16, 2025 | Leave a Comment

written by another smart Hungarian (who came to the US). Andy Grove (late Intel CEO), real name is Gróf, András István. Jewish Hungarian middle class. András Gróf was born to a middle-class Jewish family in Budapest in 1936.

typically it does not pay to be surrounded by paranoid ppl in business or speculating (one reason I don't like preppers in my vicinity as they irritate me too much) -OTOH, perhaps there is some value to adding here and there a friend who is a bit paranoid at times.

Dec

15

McDonald’s Admits It’s Too Expensive for Customers, from Art Cooper

December 15, 2025 | Leave a Comment

[Re the DailySpec Thanksgiving story.]

McDonald's Admits It's Too Expensive for Customers

In no way does this contradict the point of the story — customers looking for a low-price meal can (and have) go to other fast-food chains, such as Taco Bell. Free enterprise and competition are necessary for a happy society.

Dec

15