Aug

31

Chess and markets, from Nils Poertner

August 31, 2021 | Leave a Comment

I don't believe in psychology, I believe in good moves!

- Bobby Fischer

Met top player in chess (IM level), who started trading in 2014 and has done very well for himself. Loved his attitude re learning.

Chess is wonderful training ground as ppl tend to look at things more objectively.

Think about it - to be good at chess player- one has to become very honest with regards to oneself. Self-deception is not going to work for long.

And empathy means real empathy (understanding moves of others, not projecting own fantasies which modern world is all about). Kids got to learn chess more.

Michael Cook agrees:

Couldn’t agree more!

I think there are a good few other parallels. If we take a game in a series as a trade, eg sometimes you can see your position degrading over time and sometimes something you never saw coming, in a move or two, completely destroys you. If it’s obvious to you, it is highly likely it is obvious to your opponent (the lack of value of first order thinking) etc etc.

Nils Poertner seconds:

agree. modern psychology is overrated and chess (and other board games) under-rated for the human mind.

so many ppl have strong views about this and that (eg academic world). and that is fine for me, but in chess one is getting more or less direct feedback within a few minutes or hours.

An enjoyable few minutes with one of the best:

Magnus Carlsen's Mind-Blowing Memory! World Chess Champion tested

Aug

29

More of Wiswell’s Wisdom

August 29, 2021 | Leave a Comment

advice of Tom Wiswell to all (especially teenagers): "look and listen and learn — the secret of success lies in using your eyes and ears."

Wiswell's favorite and most important proverb for games and markets and life: "moves that disturb your position the least, disturb your opponent the most."

Aug

28

Sennett & Aiken: Is this market as good as it gets? Cardano vs Ethereum?

August 28, 2021 | Leave a Comment

Is this market as good as it gets? Cardano vs Ethereum? 2021/08/27

Yelena Sennett and Andy Aiken: The less freedom, the more the market rallies, but it can continue longer than anybody expects, like during the great financial crisis in 2007. ADA Cardano Coin outperformance.

Aug

28

Self-cancellation, Deplatforming, and Censorship

August 28, 2021 | Leave a Comment

recommended article of the month "self cancellation, deplatforming, and censorship", nick gilespie Reason Magazine current issue (calls for a reality and extremism expert)

(Ed. note: Currently available only to digital subscribers of Reason Magazine.)

Self-cancellation, Deplatforming, and Censorship: A taxonomy of cancel culture.

Aug

27

Ghost Soldiers

August 27, 2021 | Leave a Comment

what a difference between the planning and the courage and the direction and the execution and the bravery of this mission in 1944 with world war 2 technology and ww2 spirit and direction. how these rescuers would look at the current situation. well worth reading, listen.

Ghost Soldiers, by Hampton Sides

Aug

24

Hidden persuaders

August 24, 2021 | Leave a Comment

one notes the use of the word progressive in many advertisements. what other hidden persuaders do you see in marketing?

The Hidden Persuaders, by Vance Packard

free associations of the day: loss of identity, masks, kamala harris proximity, changing of guard around holidays, infrastructure.

Aug

24

Wondering why the FTSE has lagged, from James Lackey

August 24, 2021 | Leave a Comment

One of the things that make me a poor manager but perhaps a leader mindset is to me pointing out problems with out a proper solution seems, well, silly.

At the trading desk here in Weston with Mr Vic, the one thing that caught my eye quickly was the FTSE and it's low prices. I have no clue so google landed the link below. any ideas?

Has the FTSE 100 really performed as badly this century as it appears?

Nils Poertner muses:

good spot - many other indices are rich (and firms, too, eg. Apple)?

long FTSE is probably the next big thing for Cathy Woods - am mentioning her name since she gets a lot of bad press in Europe but her calls have been quite good in last few yrs.

Paul O'Leary is skeptical:

FTSE an unlikely place for Cathie Wood to find the hyper growth she looks for.

A reader offers a critique:

The author shoots himself in the foot when he says if you bought all the companies in FTSE 100 in 2001 this is what you would have got…the constituents have changed. I skimmed the rest because it was clear the author didn't really know what was going on.

James Lackey clarifies:

Thank you paul, my apologies to all. My better question is what is wrong with English stocks or is that a bad question, i.e., nothing is wrong? I've lost so much money buying laggards and value, specs forgive me.

Big Al theorizes:

Here's a theory: The Digital Revolution has been one of the greatest expansions of human activity/productivity/wealth in history and it has been centered in the US, as have the stocks of the companies surviving the competition for doing the revolutionizing. The winners have been added to indices, and the losers dropped. This equity/index mechanism has far outperformed all others.

James Lackey responds:

Big, that is what I needed! I was lost (did not get the joke) and as usual was the last to know.

Stefan Jovanovich provides an historical perspective:

Big Al nails it, once again. The British invention of industrial production achieved the same startling results; within a third of a century, the center of the world's low-cost production of fabrics shifted from the hand-looms of India to the "infernal machinery" of the Midlands.

Aug

21

Sennett & Aiken: While 4500 is still a possibility, large correction is likely.

August 21, 2021 | Leave a Comment

While 4500 is still a possibility, large correction is likely. 2020/08/20

Yelena Sennett and Andy Aiken: Odds of a 10-15% correction in S&P 500 & Nasdaq are increasing with the continued loss of confidence in the US military and government.

Aug

21

My favorite places for visitors to NYC to go see, from Henry Gifford

August 21, 2021 | Leave a Comment

Uptown:

My favorite art museum in NYC is The Frick Collection. Large enough to get overwhelmed with the beauty of both the art and the building, not so big you get exhausted and feel small like in The Metropolitan Museum, not so crowded you get jostled in the crowds and can’t see anything, like at MOMA or The Guggenheim. For the Frick at 70th St. and 5th Ave, take the 6 Train to 68th St.-Hunter College. (Editor's note: As of this posting the Frick Collection at 70th St. and 5th Ave is closed for renovations, but the Frick Madison is open at 945 Madison Avenue at 75th Street. Take the 6 Train to 77th St.)

Don’t forget The Cloisters (A train to 190th Street, then a 5 minute walk through an amazing garden). It is a building built partly from parts of cathedrals and monasteries wrecked during WW1, and saved from being re-used to build stone walls, instead reassembled and made into a museum on a bluff overlooking the Hudson River. It houses one of the world’s best tapestry collections.

The largest church in the US (as per floor area) is The Cathedral of St. John The Divine at 112th Street and Amsterdam Ave. A few blocks North, at Amsterdam Avenue and 116th Street, is the Columbia University campus, which is interesting to walk through. Riverside Church, also breathtaking, is a few blocks away at 120th Street and Riverside Drive. Across the street at 121st Street and Riverside Drive is Grant’s Tomb, which was the most popular tourist attraction in the country in 1900. #1 train to 110th or 116th Street, or B or C train to 110th Street.

Midtown:

But the real cathedral, the Cathedral of Commerce, is B & H Photo on 9th Avenue at 34th Street. Don’t walk in and get overwhelmed and neglect to go upstairs, where the real action is. I find it inspiring to see so much success, so many people adding value through consenting exchange, something no government could ever hope to create, such prosperity enjoyed by all, that I never cease to be inspired no matter how many times I go there. They are religious, thus they are closed on Saturdays, and close early on Friday. Open Sunday through Friday.

The most beautiful room in (I think) the world is the Rose Reading Room in the library that is on 5th Avenue between 40th and 42nd Street. From there you can walk two blocks east to Grand Central Terminal, the largest and (I think) most beautiful train station in the world at Park Avenue and 42nd Street. If you want to see some of the natural beauty of the NorthEast take a Hudson Line train from Grand Central Terminal to Cold Spring – trains leave at least one per hour and take 70 minutes. You can see the antique stores or eat lunch or dinner in Cold Spring, then get another train back. Do not bring anything to read on the train – the river and The Hudson Valley are too beautiful for you to get any reading done.

Much of midtown is too touristy to easily find good eats, but in Hell’s Kitchen there are many good restaurants, especially all along 9th Avenue between 45th Street and about 54th Streets.

Downtown:

In Greenwich Village, at 53 Christopher Street, which is between 6th and 7th Avenues at about 8th Street, is The Stonewall Inn, which is famous for the start of the gay liberation movement. When King, Malcom, and Kennedy were already dead, the pill had been invented, and women could vote, homosexuality was still a crime, even in NYC. The law defined things rather broadly: it was a crime for two men to stand facing each other in any bar, and lots of people were arrested for doing just that. There was no gay rights movement, no newspaper, no organization, no nothing until The Stonewall Rebellion, in the summer of 1969.

Then walk East on West 4th Street, cross 6th Avenue, then another block into Washington Square Park, and see the arch. The French built a similar one in Paris.

Go two blocks South to Mamoon’s Falafel at 119 MacDougal Street. Best falafels in town for $4.50, or with Hummus for another $0.50. It is normally easy to tell if someone is not from New York – you don’t see New Yorkers waiting on line. But even New Yorkers wait on the line at Mamoon’s if it is busy. Down the block at 99 McDougal Street, upstairs on the right, is The Kati Roll company. Get a chicken kati roll, or an alu (potatoe) kati roll. Very good eats, but not worth the wait if there is a line, as the line moves very slowly.

Then walk South on Wooster Street to Canal Street, then down West Broadway to the World Trade Center. Then go West to the river and down along the water (clears your head after the WTC) to South Ferry, and take the Staten Island Ferry (clears your head more, except the sniffing dogs “protecting” the ferry terminal since 9/11). Ferry is “free,” runs at least every half hour, runs 24 hours, 20 minutes across the harbor, they kick you off and you get another ferry back 5 minutes later, and see The Statue of Liberty the way my grandparents saw it, which is much better than waiting on line for 4 hours, getting searched, and then taking a boat to the statue itself, where you are too close to it to see anything but the feet.

Then walk up to Wall Street and then over The Brooklyn Bridge, then eat in Junior’s at 386 Flatbush Avenue Extension (corner of Dekalb Ave). Up the block from Junior’s are almost all the subway lines to wherever you want to go.

And, if you don’t go to Central Park on a nice day I’ll never speak to you again.

Aug

21

I adore NYC, from James Lackey

August 21, 2021 | Leave a Comment

I may have been born in Chicago. I may live in the NC mountains. However I belong in Manhatten. I can't understand how people do not understand NYC. The people are amazing and beautiful. There is every color size smell and that's absolutely wonderful.

Henry Gifford suggests:

Please do an experiment while you are in Manhattan. Go to the booth in the subway with the person sitting inside (some entrances do not have them). Ask for a subway map. They are free. Then stand on a corner and unfold the map and make believe you are trying to find out which way to go (it includes all the major streets, and is the best map of the city I’ve ever seen).

See how many people come over to offer help without being asked, and let us know.

Yesterday a neighbor asked me “If you could live anyplace, where would you live?” I told him “I can live anyplace, and I choose to stay here in Manhattan."

James Lackey runs the experiment:

Henry!

I had 6 people help just by over hearing I needed a route stop from a stop 135th street Harlem. That's absolutely amazing and wonderful.

The joke was the older the person the more complicated the answer. A young man said here, stop, grab that bus, 2nd stop hit subway the 2 or 3 train. The express gets off 30th street it's only six blocks dude.

Hahaha. Absolutely fantastic. People run over each other to be helpful! Post covid NYC is dynamite. People act as if they were locked up and forgot why they live in NYC and now absolutely love to share.

Bo Keely adds:

As usual, Henry Gifford is thorough, and takes you places no others will or can. I will never forget our boiler room tour of Manhattan.

The Manhattan map trick works not only in NY but around the world. I've used it in many cities in many countries. Holding a guidebook with a puzzled look works almost as well as long as there's a pic of the country on the front. The best method in no-English nations is to shout in a bus or restaurant, 'Does anyone speak English?' you will meet professionals and students. Another style is to wander a tourist spot with a backpack (travelers use backpacks while tourists carry luggage) that has your country's little flag sewn on it. Many travelers sew on the flags of all the nations they visit, immediately identifying them as an interesting person to approach for conversaation and invitation to dinner.

Aug

20

How is it possible for the non-market maker to make money in foreign exchange?

August 20, 2021 | Leave a Comment

1. banks take about 1000 billion out of market.

2.the algos run in front of you at all times. see the recent enforcement actions against white shoe firm.

3. after worst decline in us prestige in decades, the us dollar is only down to 116.80 from 20 day high of 118.20.

why do new traders trade foreign exchange when they could trade stocks and why do results show the futility of same?

Aug

19

Checkers wisdom

August 19, 2021 | Leave a Comment

in these perilous times and in honor of allen millhone's recent visit here, it seemms appropriate to turn to some of tom wiswell's proverbs.

i can hear tom looking over games i played with master and saying "red is strong". rite now the afghans are strong. we are begging them for mercy.

in addition to the afghans…afghans are strong — and the dax is strong. presumably the professor is contemplating the broach of a constructal number.

the us abandons bagram airport. "we dont have the forces to protect the airport." another of tom's proverbs and mine also: "the mouse with one hole is quickly cornered."

Aug

18

Sennett & Aiken: S&P 500 pullback probabilities. Afghanistan effect

August 18, 2021 | Leave a Comment

S&P 500 pullback probabilities. Afghanistan effect. 2021/08/17

Aug

17

The Gold Standard: Retrospect and Prospect, Edited by Peter C. Earle and William J. Luther

August 17, 2021 | Leave a Comment

The American Institute for Economic Research: The Gold Standard: Retrospect and Prospect

“In general, the gold standard effectively managed the money supply to stabilize the purchasing power of money over time. This was no accident.” ~Peter C. Earle and William J. Luther

On August 15, 1971, President Richard Nixon closed the gold window, thereby preventing foreign governments from converting United States (U.S.) dollars into gold.

The Nixon shock created a clear dividing line in American monetary history. Prior to August 15, 1971, the U.S. dollar had been tied to gold in one way or another since the nation’s founding.

Fifty years after the Nixon shock, it is difficult for many to imagine a dollar connected to gold. Most Americans have never used a gold-backed dollar. They do not understand how the gold standard worked. They have not considered the merits of returning to the gold standard. The gold standard, in their minds, is a relic of a bygone era.

The contributions in this volume help to bridge the knowledge gap created by fifty years of fiat money.

Aug

16

The Limits to Growth, from George Devaux

August 16, 2021 | Leave a Comment

The Limits to Growth, Meadows et al (1972), used the systematic model technique promoted by Jay Forrester at MIT. “All models are wrong. Some are useful.”

Reading the book started me looking at demographic trends. In 2010, I developed a very simple model for world population growth. The peak population occurs in 2047 at 8.54 billion, which is only 11 percent more than the current population.

Each year, I compare the model results to the actual numbers published by the CIA in The World Factbook. In 2021, the CIA reports a world population of 7.772 billion and a growth rate of 1.03 percent. The numbers from the model are 7.708 billion and 0.80 percent. Because the differences are small, I will not change the model.

I also calculate the impact of the 10 largest countries. (Note that I retain Japan as the 10th largest country even though Mexico now has a larger population. Including Mexico in the top ten in place of Japan would introduce “drift” such as that encountered by the Dow 30 and Fortune 500.)

The 10 largest countries have 57 % of the world’s population. The combined fertility rate of these countries has declined from 2.17 in 2014 to 2.09 in 2021. The current rate of fertility is about the level needed for replacement. Two of the countries, Russia and Japan, have declining annual growth rates of -0.20 % and -0.37% respectively. Of the ten largest countries, only India, Pakistan, and Nigeria have fertility rates above the replacement level. The fertility rates in all ten large countries either continue to fall or remain below replacement levels.

Examining the age and gender cohorts of the populations reveals some interesting facts. The 25 to 54 age brackets of males plus females are 652 million in China compared to 551 million in India. The 15 to 24 age bracket of females are 74 million in China compared to 108 million in India. Given the respective fertility rates of 1.6 and 2.23, the annual birth rate in India will soon be twice that in China. Within ten years, the 25 to 54 age cohort in India will exceed that of China. Soon thereafter, India will be larger and the difference will be material. This change in relative levels will impact geo-political calculations and perhaps investment decisions.

In other notes, I have pointed out that peak farmland is in the past. Improved agriculture practices (productivity is much greater than population growth) will continue to improve diets. Technology advances in manufactured foods (Quorn, Heme) will compete with protein from animal husbandry and perhaps with protein from agriculture. Urban farming will reduce the need for farmland. In ten to fifteen years, electric vehicles will reduce materially the need for corn to ethanol in the United States. Marginal farmland in remote areas may not be a good investment.

The models used in The Limits to Growth were based on continuous exponential growth. The rates assumed in the models have changed. Therefore, many of the conclusions in the book are no longer valid.

Aug

15

Why do the Bigs love progressives?

August 15, 2021 | Leave a Comment

why does big corp, big sports, big unions, big centrals, big media love progressives, and why does the market go up as the trend continues? some hypotheses:

1. the progressives and those who favor centralized versus individual action are in control. better to be with them than against them.

2. they appoint all the regulatory officials, and these officials constantly make decisions that favor their supporters.

3. the big tend to be educated at the iveys and stanford where the dangers of socialism are not taught and centralized planning is lionized.

what are your explanations for while the market keeps going up as woke increases?

for big players - especially formerly investment banks, now banks - can directly make profits by becoming more woke, and having their executives make the rules that profit them especially meshing with the Fed and fellow travelers in all branches of government.

the mass person always prefers a system of handout to working, and the pickadees that nock mentions and galton talks about who are born to herd and not lead. as the handwriting becomes clearer, that is a stampede of surrender as in afghanistan now. better to live than be executed.

Aug

14

Sennett & Aiken: Will the market pull back next week after disappointing consumer sentiment data?

August 14, 2021 | Leave a Comment

Will the market pullback next week after disappointing consumer sentiment data? 2021/08/13

Aug

13

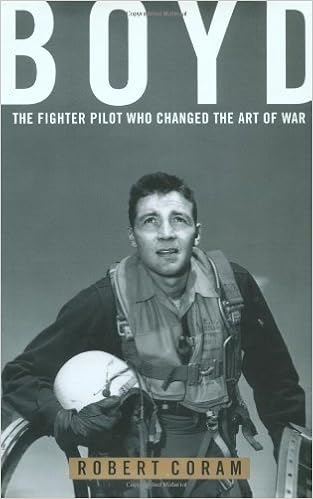

Boyd: The Fighter Pilot Who Changed The Art of War

August 13, 2021 | Leave a Comment

Christopher Tucker recommends:

Christopher Tucker recommends:

Boyd: The Fighter Pilot Who Changed The Art of War, by Robert Coram

John Boyd, or "Forty Second Boyd", had a standing bet against any and all comers at the Air Force Fighter Weapons School at Nellis AFB in the fifties that, beginning from a position of disadvantage, he could out maneuver and defeat any opposing pilot in air combat in less than forty seconds. He was never beaten.

Boyd knew in his gut that he had stumbled upon a very deep principle of combat and it took him years to finally articulate it, one of the results of which is the OODA loop. (Which is much more complicated in practice than simply Observe Orient Decide and Act.)

His theories led to a complete rewrite of the curriculum at the Marine Corps Amphibious Warfare School and the development of the Marine Corps Maneuver Warfare tactics.

He was also the originator of the energy- maneuverability theory which revolutionized combat aircraft design and the way pilots think about controlling their aircraft.

Great book, not particularly well written, but tons of practical ideas.

Stefan Jovanovich points out:

A recent paper on Boyd's OODA Loop

Abstract: The concepts of the late US Air Force Colonel John R. Boyd have influenced military thought in profound ways, from the design of modern fighter aircraft to the tactics used by the US Marine Corps in both Gulf Wars. This paper describes the best known aspect of his strategic thought, the OODA “loop,” and how practitioners in war and business can use the loop to implement a framework that has proven successful since the time of Sun Tzu.

A reader adds:

The article briefly mentions Japanese samurai defense concepts. The part of Musashi Miyamoto's Rin Go No Sho I like for trading is the part about attacking while running away.

It seems as contrarians, a lot of the time you are running away, but attacking at the same time. In a combat situation, the pursuer's mind is set on attack and his attitude is forward, then has a hard time adjusting when the escapee turns suddenly and attacks, creating confusion and hesitation.

Aug

13

Trouble ahead?

August 13, 2021 | Leave a Comment

Jeff Watson writes:

Jeff Watson writes:

The market weathermen, self described sage like realists, always see trouble on the horizon and are compelled to give all knowing, logical reasons the market will get hit. Sometimes even invoking "science." To them the pressure is dropping hard, the seas are building, and we're about to get hit with sustained gale force winds. It's always doom and gloom to them. They want the little guy to get scared, pitch his position and make the broker money, rinse and repeat. Meanwhile, Steve provides some perspective and his chart lists 49 reasons for the market to get hit…while the S&P went up 35X during that time. Unfortunately the brokers don't want their clients looking at charts like this or reading Dimson.

James Lackey agrees:

Jeff says what we all learned the hard way. The market in stocks is an engine designed to go up. Any business decisions based otherwise are in between risk-based conservative - which in most cases is a good thing - and ruinous, as the vigorish will grind you to a long-term guaranteed loser.

Michael Cook responds:

I broadly agree with this but let’s not take it as written on tablets of stone.

One of the nastiest human failings in my opinion is recency bias and for investors in US stocks, an entire career (unless a very seasoned investor indeed) has been a basic bull market tempered by the bear markets of 1997, 2002 and 2008 and whatever the hell March last year qualifies as. Recency bias on steroids.

But it doesn’t mean it must always be like that. Just ask eg the investors in the Japanese stock market 40 years ago who pretty much are still waiting to be making money now…

Leo Jia adds:

Even if there is a sharp drop, it will only be shallow and short term. This is not a big bubble and there is no euphoria yet. If one suspects big money are selling, the question is what is the alternative to the US market. Perhaps the worry will be legitimate when Turkey and China become out of any concerns.

Nils Poertner writes:

what makes the difference between folks who are in the market - and trade successfully in the long-term and those who don't is often the acquisition of implicit knowledge. Things we know are true on some level, and that we need to experience personally many times to know that they are true - not in the absolute sense but more intuitively - and percentage-wise.

we live in a very explicit world now everything needs to be spelled out. but the "absense" of something is a better guide than the appearance of an event.

an example would be that SPX drops by 3pc one one day (after months of overheating) - AND the financial press is somwheat quiet aout the drop. as long as they are loud…one can normally relax a bit more.

not to be confused with long-term investing. eg, some of my English friends who bought prime real estate in the 90s in London, and levered up every year with new flats, are all fabulously rich now. was it being lucky or smart? who knows? implicit knowledge is underrated - was my point to say.

Leo Jia comments:

Even if there is a sharp drop, it will only be shallow and short term. This is not a big bubble and there is no euphoria yet. If one suspects big money are selling, the question is what is the alternative to the US market. Perhaps the worry will be legitimate when Turkey and China become out of any concerns.

Duncan Coker writes:

Agreed, it's worth noting that the 00's were the worst decade since the 30's for stocks. I'd propose there was a bearish recency bias going on during the 2010s.

I liked the video about carnival scams. I recall "winning" an album at age 13 from a darts game on the boardwalk at Asbury Park, NJ. No doubt I overpaid. It was a vinyl from a band I had never heard of at the time called the The Allman Brothers which forever changed my life in music.

Aug

13

Gladwell’s “Bomber Mafia”, from Stefan Jovanovich

August 13, 2021 | Leave a Comment

Oh dear, oh dear. Gladwell's book is bad military history and even worse moralizing. The Norden bombsight, etc. were the Army's attempt to do even better than the Navy's Bureau of Ordnance. For more than half of WW 2 the U.S. Navy had torpedoes that not only didn't explode but were a positive danger to our own submarines. See:

The "precision bombing" of the US Army Air Force consisted of having the bombers fly a straight course and a constant speed and altitude over the target. The Germans - being clever people - quickly figured out that they did not have to aim at the bombers; they could simply aim at the airspace that the bombers were going to fly into. The result was that the U.S. Army Air Force bomber crews were the only Allied warriors whose casualty rates matched those of the German's U-boat crews. The odds of survival were 1 out of 10 if you served 2 years or longer.

There are a dozen more howlers from the 30 pages of Gladwell's book before I gave up on it - this Amazon reviewer was strong-minded enough to keep reading all the way to the end.

Aug

12

Inflation, stocks, bonds, gold

August 12, 2021 | Leave a Comment

ridiculous and naive editorials in the wsj talk about how the other side has an inflation problem. but bonds went up today on the inflation numbers and it's forcasting a 1% or so inflation rate in the next 10 years and about 1.5% in next 30 years. problem is socialism.

stocks refuse to go down and bonds after many a yellow and red day refuses to go down more than its 20 day rather harmonious low.

everythings progressive today stocks should harmonize with capture of profits by master 1000.

gold finaly not being displaced entirely by crypto, makes a comeback down 75$ in a week.

as usual stocks go down on inflation numbers but bonds go up. who is rite and who is topsy turvy?

Aug

12

Will S&P 500 pullback this week? Buy Coinbase? 2021/08/10

Aug

12

A reader fondly remembers

August 12, 2021 | Leave a Comment

Spec Party Highlights, from Jim Sogi - August, 2007

Scott brooks recalls:

I remember the 2007 spec party. I believe I still have my 2007 spec party t-shirt somewhere hidden so my wife can't throw it out (she hates it when I keep ratty old clothes ![]()

That was such a great gathering.

What I recall most about those parties was the kindness that Vic showed to me and my family, specifically, my son David.

David has great memories of running around Vic's house, playing with Austin Lackey. He still tells me stories about how he and Austin played in Vic's squash court trying to blast each other with the balls. He had some welts on him that I had to explain to my wife (she was none too happy about it) but I just shrugged and said, "boys will be boys" (BTW, that was not the answer she was looking for ![]()

What fantastic experiences for a young man to have…to hang around so many learned and successful people, all of whom treated him with such kindness and were so welcoming.

David still talks about that to this day!

Now, he's in his third year of dental school and hoping to get an oral surgery residency and on his way to a bigger and better life….and some of the credit for that goes to the eye opening experience of hanging around such smart people at the spec party!

What a wonderful blessing to have been a part of this group for the last for 16+ years (or is it 17+ years…time flies when you're having fun).

Anyway, thank you to Mr. Sogi for the trip down memory lane and thank you especially to Vic for inviting me to be a part of this wonderful group!

It was by sheer coincidence that I got invited to be a part of the Spec List (I think it's a fairly interesting story how Vic and I became acquainted….and to this day I'm not completely sure that Vic doesn't have 6 toes on one of his feet…but that's another story for a different day ![]() , but suffice it to say, it's been one of the great blessings of my life!

, but suffice it to say, it's been one of the great blessings of my life!

Aug

10

Bonds and inflation

August 10, 2021 | Leave a Comment

with bonds forecasting inflation of 1/2% or so, one would hope that the other side mite concentrate on the dangers of socialism not inflation.

gold in uncharted territory never been down as much. swamp now aims at desantis. aggregated weekly figures to make him look bad. but he's gaining on pele.

the chronic bear says bonds stop forecasting inflation. but if market participants felt that bonds were not consistent with no inflation, they would sell bonds and make a sure profit. markets are very smart and don't allow an oppportunity like that to pass.

Aug

10

Is Turkey a good buying opportunity now for holding 5 years?

August 10, 2021 | Leave a Comment

Leo Jia asks:

Any thoughts on the prospect of Turkish economy? Is Turkey a good buying opportunity now for holding 5 years?

Larry Williams clarifies:

Is the Turkish economy about the same as the Turkish stock market?

Some references:

The CIA World Factbook: Turkey/economy

iShares MSCI Turkey ETF (symbol: TUR)

Nils Poertner responds:

as we know from other EM countries, listed equity can be really a good play - even with fx tanking. see Latam and many Asian countries. a vast "play" on the USD (as lots of banks are financed in USD - and EUR) and a bet on the faith in the current regime. cap controls an issue.

understanding EM requires study of previous bull-and bear mtks for EM mkts itself- doing the tedious work - building implicit knowledge over time, cycles, mass psychology, whateever it takes - it is worth it, Jia and a lot of fun - as one learns from it and can share with others.

John Floyd writes:

Larry has somewhat taken the words out of my mouth on the economy and stocks in Turkey. I would expand on that somewhat given the unorthodox nature of the current Turkish administration and the expanding Taliban presence and thus likely growing chance of further friction with the US, following recent and historical comments by the head of Turkey on the topic.

As economy and FX it does sure have the potential to get things right and turn for the better. But, the odds of that happening and the headwinds against it seem rather large at the moment. The current path is one of further unorthodoxy in policy and leadership combined with expanding debt that will likely lead to a default or restructuring and FX going from 8.6 north of 10.

Reserves are tenuous at best, local capital outflows a perennial risk, and the need to continue to pump up the economy through credit, tourism headwinds given COVID, current account deficit of 5%, etc…

Given the circa near -20% returns for the Turkish indices there may be some gems within the them with careful selection, as is needed in China given the P-like oligarch crackdown there as the aim by X is to stay in power for life and control data and tech to do so.

James Lackey suggests:

As John clearly said the news risk..what about the derivative of the big Mac index and or the hot dog stand.

If I'm forced to value a stock on foreign exchange correctly, I'd go to Turkey, rent a flat, and open a food stand and sell Harley Davidson T Shirts. The McDs index of brands is HOG. I can sell merchandise like a roadie at a show and let's use the most recognized brands in the world.

Sell shirts for 6 weeks and my guess is you're going to learn exactly what's going on.

Larry Williams adds:

Bring lots of NIKE stuff to sell.

Jayson Pifer provides local insight:

Fwiw, I can offer some boots on the ground perspective. I spend a few weeks a year in Turkey and have done so for the past 15 years, missing last summer due to covid however please take the below comments with an appropriate amount of salt. Each time the conversations come up on investing in real estate there. And each year, I come away boggled at the lack of progress and steadfast in keeping money away.

If I were to hazard why the Turkish economy isn't more than it could be, I would suggest that it is the general absence of faith in any of the government constructs. Without commenting much on their current 'populist' leadership, I mean to say that the average person has little faith in the police, courts, and laws and work around or without them. (plied with a bit of scotch and I could relate some Keeleyesque tales of my encounters there with these systems ![]() )

)

Absent true legal financial recourse, trust stays in small personal circles that are difficult and slow to grow and this has various and deep side effects. As an example, if one were to meet a VP of a bank in the US or UK, you might assume they had interviewed for the role from a range of candidates and/or had been in the role for a while and knew the business and their area. One would likely be correct in those assumptions. In Turkey, you do not have that assurance as they will probably have gotten their role through a circle of acquaintances. They may be qualified or not, but they are almost certainly in somebody's inner circle.

The low trust and inner circle workings are seen in both the political and business environments. When new leadership comes in, it is typical and considered normal to bring in their trusted group, reward them for their loyalty and displace anyone they do not trust. Partisanship there compounds the issue, similar to the partisan wars in Google but with more serious consequences if one supports an out of favor party (eg. non-AKP).

Wrt the stock market, my impression is that it's a lottery. There is money to be made, for sure, by smarter and luckier people than me. But the risks are real.

I don't have numbers, but my anecdata shows a worsening brain drain with talented turks leaving the country and those that have returned are struggling.

Taking a further step back for the five year horizon posed originally, my impression like Mr. Floyd's is that Turkey has headwinds and not much to stop it from falling. My questions are what could change to reverse this trend? A change in leadership is often cited, but it would not create an overnight increase in trust. I could barely speculate how long it might take, but would guess decades if all went well. While it's not exactly fair and I'm out of my historical depth, I compare it with Iran when it went down the path of Islamic leadership in '79. How will Turkey not fall into the same trap?

Theodosis Athanasiadis comments:

Historically real exchange rates have been a good predictor of emerging market economies and equities through the mechanism of cheap exports, labor, external investments etc. they are a form of valuation for the whole economy. I see them currently at multi-year lows which has been bullish for equities in Turkish lira for the long term.

John Floyd responds

Yes, on real rates in Turkey that is true and can be seen in the standard OECD PPP, but that has been like that for ages and you need the positive catalyst for change…..move to orthodoxy one way or another….monetary, fiscal, and geopolitics…should gradually grow confidence in varying degrees and speeds and drive capital flows in a positive fashion if it occurs and given valuations you can find some gems I am sure…perhaps on well capitalized companies that can benefit from the inflows and cheaper FX…plenty of meals for a lifetime if you look at Argy, Venny, Russia, SA, Zimbabwe, etc…

If anyone is bored, I did an interview on Turkey last August - it somehow has gotten just under 20k views that highlights both contemporaneous points at the time and some of these longer term issues.

Alex Forshaw writes:

Erdogan is in bed with the asset heavy industrial elite of Turkey… this is China but with very ineffective capital controls (mainland Chinese stock performance has been terrible for 12+ years btw, altho indices don't include juicy dividend yields). They're all massively overleveraged, and basically long and wrong The only way is devaluation / financial repression (forcing inflation >> cost of capital) until they deleverage… but Erdogan can't really let them deleverage because the economy would implode, Turkey is poor, the opposition is highly organized with high recourse to violence (Kurds), so Erdogan would be dead. So they just keep building and building, but who's going to come?

Seems to me that Turkey is uninvestable until Erdogan is gone…but he's a de facto dictator…so he can't go.

Leo Jia offers more data:

New home sales are down lately, which may be caused by the pandemic:

Turkey: new home sales

But existing home sales shot up sharply in recent years:

Turkey: existing home sales

Aug

8

Goldman, State Street Face Antitrust Claims Over Currenex

August 8, 2021 | Leave a Comment

Paolo Pezzutti suggests:

I think this article may be interesting to those into markets microstructure:

Goldman, State Street Face Antitrust Claims Over Currenex

Goldman Sachs & Co. and State Street Bank & Trust Co. were hit with federal antitrust claims in Manhattan over an alleged scheme to rig foreign currency transactions through Currenex Inc., a State Street affiliate that operates a leading exchange platform.

The proposed class action accuses Currenex of fraudulently telling traders its software relied on the industry-standard “first in, first out” system for matching “bids” and “asks,” when in fact it gave State Street and Goldman the ability to “jump in line” and cancel transactions at the last second.

A reader reacts:

Omg that's hilarious…GS traders would benefit if that suit became case law. However I'd need a good lawyer to tell us about law.

The joke is HFT must have the ability to cancel and front the que.

I'm very good at visualizing all of this as "The Watcher" was a program we bought circa 1996 and that was my career as a "day trader" 96 to Feb 2002 when Vic bailed me out the first time of 4 times.

The NASD was computer Market making system.

The nasd sec said mm must be on both bid and offer electronic and be if= fx % away from inside bid ask spread. By 2002 the nasd worked much better than nyse or a pit.

My first button was a 20% price riser. We called it the monster buy button.

Bid 995 ask 1000 my buy would be 1200! I'd take offer go straight to que.

This worked for 2 months.

I got an instinet machine and was so arrogant they called 1000 share does orders dumb pikers and they didn't care. A year later they tried to ban us.

Get the joke trading is like all racing you invent an edge and wait for everyone to copy or steal it. Or you lose all the times as those with unlimited funds. Or friends in DC have the inside starting position the fastest car best engineering and if you drive for them and do not win constantly I'd try a new sport like catfishing.

A reader comments:

I am of no help with any question of securities law. The farthest I ever got in the test-taking you all have endured was getting the license for being an investment adviser, and after a very short time (I think it was a year and a half) I realized that I had put my head in the noose of a second bureaucracy whose mission statement was "enjoy playing gotcha with the small mammals and be ultra nice to all reptiles large enough to be able to hire you for a 'private sector' job with porn benefits."

Aug

8

Is Nasdaq pullback coming? Crypto regulation? 08/06/2021

Aug

5

Did Beethoven need mathematics?

August 5, 2021 | Leave a Comment

those who know about music: it is well known and accepted that beethoven couldn't multiply and couldn't dance. yet he wrote many pieces with complicated rhythms like 13/12 in the Appassionata. and many other unusual rhythmic pieces - how could this be? wouldn't he have had to notate such pieces? and wouldn't that require a very high degree of mathematics?

Laurel Kenner responds:

No, musical rhythm is not like, say, linear algebra. It’s even different from multiplication. Beethoven was a master of syncopation. He probably didn’t get dancing lessons.

Christopher Tucker comments:

A lot of mathematics can be done without the use of numbers and their operators. A lot of it can be done visually without ever mentioning numbers and I think it is safe to assume that the same applies for auditory - tempos, rhythms, scales, finding notes that are all in the same key without having to think about it in a way that is normally associated with doing math.

Peter Krupp adds:

We all have an innate sense of rhythm, to a higher or lesser degree, which can be developed. I was fortunate to have studied for a few years with a professional pianist who was a student of Artur Schnabel, one of the great Beethoven pianists of the 20th century. She played and demonstrated many of the Beethoven sonatas and had me listen to many of Schnabel's recorded performances. Not once did she count out the rhythms or do any sort of mathematical analysis. She demanded "feeling & sensing" the rhythm. I never developed the pianistic skill that she had. I played for my own pleasure. My first love was science and mathematics but prior to her tutelage I lacked awareness of music as a sensory-based art. My experience with her completely changed that outlook.

An historical note:

Statistics of Mental Imagery

Francis Galton (1880)

First published in Mind, 5, 301-318.

Laurence Glazier writes:

The inspiration comes ready made. The composer has to write it out. A steady rhythm is a social construct. The blackbird and nightingale know nothing of it.

I am just now orchestrating Andaluza by Falla, and have been removing a beat from some of the bars which sounds more natural to me.

Had Beethoven actually used the time signatures which came, maybe, to his mind, there would have been resistance from the players. He had enough trouble anyway getting people to play well.

A corollary - the not dancing is helpful, as that would have predisposed the mind to a steady rhythm. However you can be sure of his math prowess.

Nils Poertner writes:

the use of the trampoline (the mini-rebounder) can be a very useful tool on the aspect of re-learning rhythm.

it is probably the case the vast majority of the population these days has got some aspect of blockage or a lack of sense of rhythm - and also learning disabilities - except they don't perceive it that way.

here is good old Ray Gottlieb (former eye doctor from Rochester, New York- who inspired me with his work):

Attention and Memory: A Stress-Point Learning Approach

James Lackey adds:

Army marching singing cadence they are very good at every task as the US Army tells you what to do, how to do it and even explains why.

Anyhow it was 1% that CAN'T dance. It's a heck of a lot lower than all think.

Aug

5

The Most Profitable Company, from James Lackey

August 5, 2021 | Leave a Comment

We try to never look at a new generator. This AM we noticed more masks. My brother mentioned they are trying to make covid a deal again to hold onto their corner. The brilliance of X traders is they look at everything as a hustle. "How are we getting it today and for sure we are the last to know."

The covid hustle is a two team teaser on the old meme, "we can not find qualified candidates." That was the 50's race bait turned into an econ pay class war keeping the man down. I turned many a biz owner red faced when they couldn't find qualified help by saying either let the moths out of your wallet or train them yourself. A day trader with a Union BA pops and all athletes we become difficult to convince it was about "they" and not You.

The covid hustle keeps them masked and the dining rooms closed. If you have x sales and you lose zero sales and can reduce labor costs by running the drive thru only, who blames them? Not me I don't like your food anyways. However when it comes to the DMV OMG you sucked at your job before allowing me to do all this online, cool! I hope this lockdown will close your store and keep the Churches open.

Okay I will not go that far as I do not want a new enemy, the brother in law of the law.

I found out that APPL is the most profitable company in the world. Here is how they do it! They win on skill. After all these years, 08 to 21 I have fought the good Android fight. I don't even know why except I despise closed systems. The libertarian in me lost to the artist in me. I bought an APPL 11 phone and a new carrier today. I called uncle to my uncle as he said, He Jimmie if you're so damn smart why are you trying youtube video production when all you need to do is buy an APPL and pay for their cloud. Done deal as uncle is 7 years my senior and actually taught my cousin and brother how to ride dirt bikes at 5-7-11 years old respectively as we went up in racing classes. At 16 he said I am done, turn pro. We did and today we turned on the Apple pro video.

Aug

5

S&P is range bound, as vaccine stocks run up. Novavax NVAX? 08/03/2021

Aug

1

Archives

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- Older Archives

Resources & Links

- The Letters Prize

- Pre-2007 Victor Niederhoffer Posts

- Vic’s NYC Junto

- Reading List

- Programming in 60 Seconds

- The Objectivist Center

- Foundation for Economic Education

- Tigerchess

- Dick Sears' G.T. Index

- Pre-2007 Daily Speculations

- Laurel & Vics' Worldly Investor Articles