Feb

18

Vol in percent versus dollars, from Zubin Al Genubi

February 18, 2026 | Leave a Comment

More on the points vs % argument. % vol or Vix is misleading and inaccurate measurement of vol. A better measure is abs vol in points/$ because we live and measure ultimately in dollars.

Accordingly at 7000 abs vol is 350% of what is was a few years ago at 2000. Trading has to adjust accordingly to maintain the same portfolio volatility of returns. Thus leverage, targets, systems, time have to adjust to match.

Adam Grimes disagrees:

because we live and measure ultimately in dollars

This does not strike me as coherent. Returns are the only reasonable way to understand market movements. Just imagine a portfolio of two assets, one at $1 and the other at $100,000 (or other arbitrarily wide handles). The only way to think about those is to normalize for price via %, so it follows that volatility would be equally incoherent measured in points. (Sorry for the Finance 001 example, but I think 'Explain It Like I'm Five Years Old' cuts through a lot of confusion.)

% and vol measured as vol of %'s (i.e., returns) is the only thing that makes actual sense here unless I'm misunderstanding the argument. What am I missing?

Accordingly at 7000 abs vol is 350% of what is was a few years ago at 2000.

Scratching my head here. "So what?" and "of course" are the only things I could manage to say here.

I'm probably missing something, though. What is it? (btw VIX sucks as much as any other clunky measurement of implied vol. I'll agree with you on that one, but I don't think that's your point.)

Zubin Al Genubi responds:

1 ES contract used to move 7 points as an average range 20 years ago. You made or lost $350. 1 contract now moves 50 or 100 points a day, same percentage, but your account is up or down $5000. The volatility in your account in dollars is higher than 20 years ago. If you lost 1% in 2000, its $600, but 1% now is $3500 per contact. You don't see too many 2% days like before. Abs vol is up while Vix or % vol is down. Its apples and oranges.

The trading style, research should change. Straight percentages for expectations, returns, targets don't work like they used to, especially using historical data. Silver now has micro contract because $5000 a dollar too is high volatility in dollars with $20 or more ranges. I guess I'm suggesting using abs vol as a better measure of vol.

Appropriate here, Feynman in 6 Not so easy pieces, cites Wyle on symmetry, "Suppose we build a certain piece of apparatus, and then build another apparatus five times bigger in every part, will it work exactly the same way? The answer is, in this case, no!" My point is the market does not the same way as it did 25 years ago in large part because it is bigger. The fact that the laws of physics are not unchanged under a change of scale was discovered by Galileo. He realized that the strengths of materials were not in exactly the right proportion to their sizes. [Ibid]

Adam Grimes writes:

I'm sorry, but I still find these points trivially obvious. Of course nominal price swings are bigger because price levels are higher, so of course holding a single contract would result in larger dollar swings. Who's holding a single contract? Position size takes care of all of this.

And I don't think the physical analogs add anything beyond confusion. Physical properties scale differently. For instance volume scales as cube and surface area as square. This is why we could not have a science fiction 100 ft tall lobster in reality…because of material constraints. There's no market analog to this. A 1% move is a 1% move. There's no hidden non linearity there.

If your claim is that markets don't move the same they did 25 years ago I would challenge that claim. What's the evidence for this? Statistically there's always the issue of non-stationarity but it seems to me you're claiming there's something more meaningful here. What am I missing?

Asindu Drileba comments:

I think Zubin is simply trying to say that he had found measuring volume in dollar terms (absolute terms) more relevant than measuring it in percentage terms.

Richard Hamming has an interesting talk, You get what you measure

Here us a good summary:

You may think that the title means if you measure accurately you will get an accurate measurement, and if not then not; it refers to a much more subtle thing - the way you choose to measure things controls to a large extent what happens. I repeat the story Eddington told about the fisherman who went fishing with a net. They examined the size of the fish they caught and concluded there was a minimum size to the fish in the sea. The instrument you use clearly affects what you see.

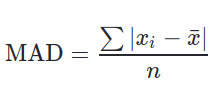

I for example, completely stopped measuring market returns in percentage terms a few years ago. I now exclusively use log returns. Why did I stop using percentages? The problem with percentages is that they are not equal to each other (ignoring the negative sign). (a 50% move) + ( a -50% move ) does not give you 0 in dollar terms. But what you get is 0% in percentage terms. Percentages are not symmetrical. Does this mean they don't measure growth? They actually do. But they simply should not be compared. As the absolute values may mean something different.

- A 0% return percentage may (erroneously)

indicate that you have broken even.

- The same 0% percent return may also show that you are actually loosing money in absolute (dollar) terms

Adam Grimes writes:

Of course log returns are well known, and this is more finance 101. There are several qualities that make them more attractive for some analyses. (just dont mix percents and log returns!)

But that's not the same as measuring market movements in raw dollars (which is the only reasonable companion to volatility measured in absolute dollars (or points).

And as for measuring what you see, methodology (and perhaps even experimenter expectations) greatly affecting outcomes and conclusions, we're on the same page there. This is fascinating territory for discussion and I'd welcome it.

But his point about volatility only extends to someone trading a single contract in 2001 and also trading a single contract today. That is irrelevant.

If there's something at work here and legitimately some way the market "doesn't move the same way" it did decades ago… I'm all ears and very interested. Always looking to learn more about what I don't know or might be missing.

Zubin Al Genubi does some counting:

There were 31 days in 2006 and 67 days in the last year with percent moves >1%. This is due to Big Tech being 32% of ES with higher beta and the speed and intraday persistence of algorithmic trading. Lastly, it 'feels' different. A 120 point drop trades different than a 13 point drop in 2002.

Stated quantitatively, now nearly half of our trading days have abs vol hi-lo >1% while in 2006 only a quarter of days had abs vol >1%. That is a big difference and clearly explains why trading is different (better) now. Today is just 1 of the many such days.

Cagdas Tuna adds:

All futures contracts of index products have adjusted to gross notional value of underlying stocks. At the same time VIX contract specifications and notional value it can represent almost remain unchanged. Although calculation method of VIX is the same, the number of futures contracts hedgers need to cover notional values they trade in underlying assets are totally different.

Adam Grimes writes:

Stated quantitatively, now nearly half of our trading days have abs vol hi-lo >1% while in 2006 only a quarter of days had abs vol >1%.

I'm sorry but I have to be direct. I find this annoying. You have moved the goalposts and are now making a completely different argument. You began advocating for measuring volatility in absolute dollars and now you are using a percentage measure. You are literally using the metric you said was wrong to support your argument that the metric is wrong.

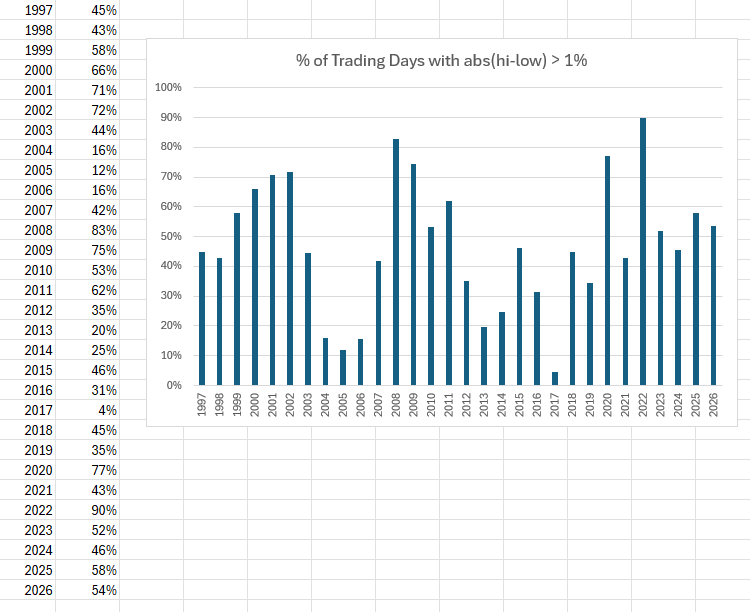

Furthermore, your data are bad. It's simply a volatile measure. Volatility is volatile. Here's a look at the FULL history of the ES futures [first chart] (back-adjusted so this may not be fully accurate, but I think the % adjustment fixes the back-adjustment distortion) counting the number of trading days in each calendar year that had abs(high-low) / close > 1%. It's simply an unstable measure and I don't know what is to be drawn from this.

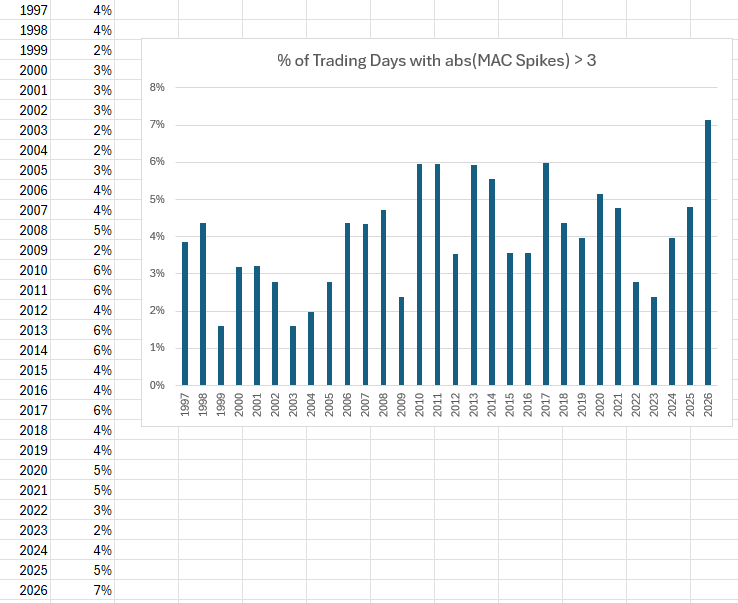

If your argument is that there are more days with "surprise" distortions, this is maybe nominally true, but better measured with better tools. I use a tool that expresses each day in terms of the mean average absolute closing difference [second chart]. Taking an arbitrary bound of 3 for that, the argument that this year is on track to show more surprise shocks than usual is true (but also reflective of a generally lower baseline).

You've flipped to percentage measures and we're left with hand waving "it feels different now." That's a different claim and it's qualitative, perhaps has value, but not in supporting your original claim.

I'll reiterate my position: percentage measures are the only thing that make sense. Point values are arbitrary and can be easily handled via position sizing (within the limits of granularity of instruments vs account size.) I don't think this is revolutionary or controversial. This is truly finance 101.

Feb

15

6950, from Ani Sachdev [Updated]

February 15, 2026 | 1 Comment

I counted the number of crossings of the ES future past 6950. I counted the using the nearest expiry future. I counted using 30 min increments. Since October 29, 2025:

ES crossed from close to close across 6950, 78 times. 39 times up, 39 times down - true Logbola.

ES traded through and touched 6950 at any time at least 154 times (counted when there was low < 6950 < high).

Curious if any specs have used data like this to predict future prices.

Zubin Al writes:

14 hourly crosses night and open [Friday, 13 Feb.].

Cagdas Tuna comments:

I find the fact that whether call it NY Fed or Blackrock or other main street banks whoever single handedly controls and manage to keep VIX below 20 that is ultimate power controls the US stock market.

Larry Williams responds:

No one is holding anything down—or up—my vix fix is essentially same as $vix it cannot be controlled.

Cagdas Tuna is skeptical:

Yes, nothing is controlled!

Zubin Al Genubi prefers market dynamics:

Vix suppression is caused by: 1) heavy ODTE trade, while VIX is calculated on options 23-37 days out; 2) dispersion in SP index (dispersion meaning Mag 7 vs other 493; see RTY almost up 2%); 3) Big fund/ETF imbalances balancing deltas; 4) mean reversion of VIX/and buy the dip, which can break down at some point.

Larry Williams gets cosmic:

The universe is always expanding, Hawking proved. Stocks are part of that.

Feb

10

Stops, from Zubin Al Genubi

February 10, 2026 | Leave a Comment

![]()

We should never get stopped out of a trade just because we have lost money. We exit trades if we no longer like them—losing money, while deeply unpleasant, should never be the sole criterion for exiting.

Peter Penha responds:

The last stop I left was a stop loss in Platinum futures sub $800 and the market took the contract down $65 and stopped me out, made one lower print $5 below me, and then came back up. Probably was the low print post March 2020.

I have had horrific experience with Schwab/thinkorswim…they once sold me out (partially) of calls on Sugar that were deep in the money at a make believe bid price way off market and below intrinsic value. When I challenged them noting that equity markets were open and they could easily have raised cash in many liquid ways - they told me they reserve the right to do what they want. I have multiple snapshots of them marking positions below intrinsic value, and lately while I was long silver futures they would mark my long Sugar contract to zero (I would see a negative futures cash position equivalent to the notional value of my long position).

I have been thinking of Marty Zweig and how he did very well leaving trailing stops on individual stocks and need to find my copy and revisit Winning on Wall Street and see how he did it (successfully).

Rich Bubb writes:

I AI'd trailing stops info thru Gemini.

The rule-of-thumb I currently/usually use is 8%-15% TSL% (trailing stop loss %). And typically use a lower-is-better TSL%. The volatility and economic tea leaves divination determine the TSL%. If I have less conviction in a position, I'll reduce TSL% to (sometimes) let the Market tell me how wrong I initially was.

And I got burned at the start of Great Recession, where I had TSL%s way-too relaxed; upper teens TSL%. The TSL%s all worked, but by then I'd lost about 15%+. Painful lesson.

Feb

8

CIO predicts 2026, too

February 8, 2026 | Leave a Comment

Expect Equity Markets to Broaden in 2026, Led by Small Caps, International

Both fiscal and monetary stimulus should boost earnings in the U.S. and abroad, with dollar weakness continuing to underpin international stocks.

Nils Poertner comments:

Back in High School, they gave a 1 pager of Latin and we had 1 hour to translate it (since it is an ancient language I was spending a lot of time to see what this all meant.) We all know English more or less. These days, I read a 1 pager in English (like this page) in 1 minute. My modern brain actually agrees with the whole article. Yummy. In reality there are probably a lot of cliches in it….

Zubin Al Genubi writes:

AI is about training data otherwise it gets stale and cliched. Like a person reading the same newspaper every day. Google has lots of data. Musk is merging SpaceX with AI because as internet provider he will have access to unlimited global data. I wonder what their contract disclosures say about data privacy.

Steve Ellison responds:

"Expect"? I have seen the broadening occurring since November. There was an extended non-confirmation of Dow Theory last summer into fall as the Industrials were making new highs, but the Transports remained below their November 2024 high. Not only did the Transports finally make an all time high, now they are making new highs before the Industrials do. Similarly, the equal-weighted S&P 500 ETF RSP, which was badly lagging the cap-weighted SPY in the 2025 rally off the "Liberation Day" tariff lows, made a new high yesterday while the cap-weighted index only partially regained some of its losses from earlier in the week.

I said on X [6 Feb.], "Lots of strength in the broader market. While technology stocks were selling off the last few days, the Industrial, Materials, Consumer Staples, and Energy sector ETFs all made new highs".

Feb

5

6 new lows, from Zubin Al Genubi

February 5, 2026 | Leave a Comment

The last few down swings each had 6 new lows before a bottom. Today, marking a new low for this swing after hours will end up a new low number 5 by the end of tomorrow.

Steve Ellison writes:

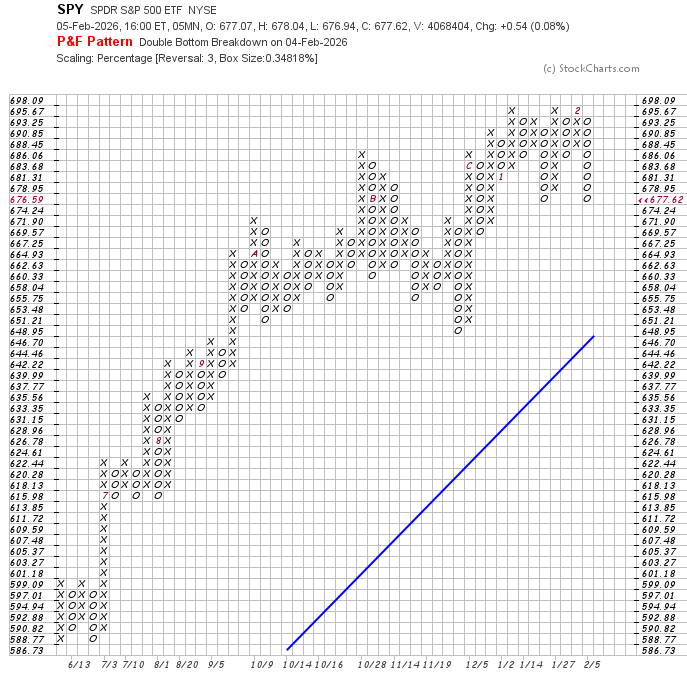

Interesting. I have been experimenting with multi-level point and figure charts. Using a box size of 1.4% (a long-term average true daily range) and a 3-box reversal, SPY is still within 4.2% of its all-time high and hence in an uptrend. Drill down with smaller box sizes and shorter time intervals, and interesting price structures appear. At a 1/4 ATR box size, today's close was at a similar level to the Jan. 20 low.

Lots of sector rotation under the surface. If 2025 was the year of the magnificent 7 and the flatlining 493, this year may be the opposite. While technology was getting beaten down this week, the Industrial, Materials, Consumer Staples, and Energy sector ETFs all made new highs.

Zubin Al Genubi adds:

Lots of late night shenanigans going on. Asian markets trading open in late thin US futures creating imbalances. Price action appears algo driven.

Nils Poertner comments:

I like the pattern with 6 new lows. Well spotted. Otoh, if the pattern does not repeat the surprise for mkts is bigger. nature offers "patterns" and "break of patterns" and both are relevant - else it would be a museum.

Cagdas Tuna predicts:

Then it is going to be a rough year for market cap weighted indices in US.

Peter Ringel writes:

While I would always give a study, like Big Al‘s more weight to remove opinion. I wonder, if there is a January effect regarding regime type or sector or general trading type. Not necessary % performance. Will the rest if the year trade like January? Would give a 2015 type year.

Nils Poertner responds:

yes. for practical purpose, it may be easier to trade mkts which receive less attention by the wider financial community /media.

Jan

30

Another volatility measure, from Zubin Al Genubi

January 30, 2026 | 1 Comment

Take a price corridor by forming a double barrier (rounds might be nice) delta up and delta down from the initial spot price. When the barrier is touched, we note the exit time, t1, and reset the barrier around the current price. This generates a sequence of exit times t1, t2,…,tn from which we want to estimate volatility. This shows how fast price moved.

Peter Ringel writes:

TY, this looks like a clever approach. I do something similar with zigzag vol and time. It is computational heavier. Yours sounds lighter. Will try it.

Jan

25

The Chair’s quest, from Peter Ringel

January 25, 2026 | Leave a Comment

Vic gives out a quest (a research quest).

I swear, I did see Vic's X post only afterwards. I too was thinking about the levels / rounds and how to test them today during my drive. Probably everybody is tired of starring at the same levels and so the mind wonders and wanders.

I am thinking of this approach:

utilize volume profile / volume per price level

(here a buffer bin can be applied / granularity from tick to x points)

(this will become important)

slice / bin the time series in segments of x

x needs to be defined,

I am thinking simple price ranges right now

normalize the segments

create a summary volume profile of all the segments ( an average or total sum )

plot it and hope something stands out

then a deeper statistical analysis of the volume profile, which is a frequency distribution

another approach could be to look at the "rejection power" of a price level after a crossing / touching event.

the crossing / touching events are often fuzzy in time

maybe remove time here a la range bars

after the event qualify the price range traveled for a fix time interval

so price-no-time vs price-time

Zubin Al Genubi writes:

The sample generally is biased bullish. Maybe take a look at bear regimes to see how hypothesis hold up. Also need to use unadjusted prices to retain rounds.

Peter Ringel responds:

TY. I am also thinking cash and virgin levels (around ATHs). the question of prices vs percentages will come up here too again.

If one sticks to prices and assumes an underlying behavioural cause of rounds, there probably are regimes with more or less black and white borders (fast transition) from 50 with weight to 100 with weight to maybe back to 50 in low volatility environments. Also the question, what difference does it make, if the index is 7000 vs 700.

William Huggins suggests:

it may be worth seeing if there are "liquidity cliffs" at rounds rather than sticky prices (order clustering as opposed to price clustering)

Peter Ringel adds:

The open interest at rounds at the option chain is usually noticeable higher vs all other steps.

Now I am thinking to look at the waning of these. Are they getting eaten up. Would explain the multiple crossings of a round needed till we get new ATHs.

Jan

12

Zugzwang, from Zubin Al Genubi

January 12, 2026 | 1 Comment

In chess, zugzwang refers to a situation where a player has to move, but every move worsens the player's position. When a portfolio manager's risk limits are hit or losses are thought to be unacceptable, the situation is quite the same. - Hari Krishnan

The Immortal Zugzwang Game is a chess game between Friedrich Sämisch and Aron Nimzowitsch, played in Copenhagen in March 1923. It gained its name because the final position is sometimes considered a rare instance of zugzwang occurring in the middlegame. According to Nimzowitsch, writing in the Wiener Schachzeitung in 1925, this term originated in "Danish chess circles".

Nils Poertner writes:

on this note (lack of imagination), see David Hand's probability lever concept:

The Law of the Probability Lever essentially states that slight changes in the circumstances or assumptions of a statistical model can dramatically change the calculated probabilities of events.

Larry Williams states:

ZUGZWANG The life of a trader in one word—always in too early or out too late, also out too early or too late.

Nov

28

Lucky charms, from M. Humbert

November 28, 2025 | Leave a Comment

Anyone have any favorite good luck charms/rituals to help with trading results?

Peter Ringel writes:

some of the old floor traders, we had on this list, reported how superstitious some of the traders were. Cloths, bathroom time…

Asindu Drileba comments:

Lucky charms may sound delusional but they are actually more common than we think. They are more like placebos. I take pill X, my headache goes away. (But pill X is made from wheat flour and a bitter "filler" and has exactly zero pharmaceutical contents, yet it works).

Have you ever pushed the button that opens the door of an elevator? Well, those buttons are completely fake! Elevator doors are pre-programmed to open and close at hard coded intervals. Pushing the button does nothing. They simply exist to give people a sense of control.

Nils Poertner writes:

To have a strong belief one can learn (from mkts or others) is a good start.

ie allowing for mistakes to happen, not fretting them. (many cultures are guilt-ridden, like the German culture on so many fronts. All it takes is sometimes to muster up enough courage and learn from mistakes and don't judge).

Zubin Al Genubi offers:

I'm reading Kidding Ourselves, Hidden Power of Self Deception, by Hallinan, in which he describes real physical and psychological effects of psychosomatic causes such as death, hallucinations. You see what you want to see. You are and become what you believe yourself to be. It affects health, performance, money. He also describes how a feeling of lack of control can be debilitating and even deadly. Some feel a lack of control in that they don't control the market, but one can easily (physically at least) click the keys to buy and sell any time.

From scientific studies: Our results suggest that the activation of a superstition can indeed yield performance-improving effects.

Nov

25

Book recommendation from Zubin Al Genubi

November 25, 2025 | Leave a Comment

Zapped: From Infrared to X-rays, the Curious History of Invisible Light

From beloved popular science writer Bob Berman, ZAPPED tells the story of all the light we cannot see, tracing infrared, microwaves, ultraviolet, X-rays, gamma rays, radio waves and other forms of radiation from their historic, world-altering discoveries in the 19th century to their central role in our modern way of life, setting the record straight on health costs (and benefits) and exploring the consequences of our newest technologies.

Nils Poertner suggests:

The HoHo Dojo, by Billy Strean.

Laughter and humor are therapeutic allies in healing.

Nov

23

Suprises, from Nils Poertner

November 23, 2025 | Leave a Comment

Whether it is the "Mambani win", Brexit, Covid, Ukraine war, whatever - had someone told me 6 months before that this could happen - the answer would have been "no-way…" whereas in 20-20 hindsight - it is always like "oh yes, there were obvious signs."

Zubin Al Genubi responds:

History is made on the edges by outliers which shifts the averages way over in its direction.

Nov

17

Corporate earnings, from Zubin Al Genubi

November 17, 2025 | Leave a Comment

I see they are down [at least through Q2]:

FRED: Corporate Profits After Tax (without IVA and CCAdj)

Steve Ellison responds:

Interesting. S&P 500 earnings per share were up both year to date and year over year. And Q3 so far looks better than Q2.

S&P source spreadsheet: Click link to download file: S&P 500 Earnings.

Big Al wonders:

So maybe the big firms are doing better than the smaller ones?

Nils Poertner remembers:

Investment Bank earnings 2007…My very cerebral friend Maurice at the time: "IBs are cheap - look at their PE ratios."

Sep

8

Dutch scientist Christiaan Huygens, from Nils Poertner

September 8, 2025 | Leave a Comment

Dutch scientist Christiaan Huygens found in the 17th century that larger pendulum clocks will sync smaller ones.

Video by Veritasium: The Surprising Secret of Synchronization

Pendulums in the human world = our various belief systems (which are sometimes in competition to each other and go deep). Two examples perhaps: in finance: a trader has religious reasons why he /she does not think he deserves the STELLAR gains. Ways are found to turn accumulated gains into a loss! in health: why do some ppl stay sick and others recover miraculously against all odds?

Zubin Al Genubi writes:

The Kuramoto mathematical model describes synchrony in networks. The line between order and randomness occurs at the phase transition when the network nodes synchronize.

Building on Kuramoto's model, the Watts and Strogatz model makes testable predictions about interventions most likely to trigger cascades.

In small world network terms there are "vulnerable clusters" in the market. In market terms the vulnerable clusters are weak hands, funds faced with margin calls, or fund hitting a stop losses. Obvious 2d points or tipping points are stop points at prior lows. If a vulnerable cluster is close to the second tipping point, it can ignite a cascade.

Nils Poertner responds:

Mathematicians often find something which ordinary people know intuitively. 2 more examples:

1. Five teenagers bully a victim. Knock-out the strongest in the group and the rest will fall too (big bully was the dominant pendulum, trumping the small ones).

2. When the most valuable firm(s) in an index suddenly struggle (NVDA?), it often means bad things for wider index.

Asindu Drileba adds:

I found the same pattern in the "Complex Systems" community. An example in Secrets of Professional Turf Betting: The idea of "copper the public opinion" & "principle of ever changing cycles" are an intuitive description of the minority game & El farol Bar problem in complex systems. Statistical arbitrage is almost exactly what Robert Bacon describes as a "dutch book."

In Neil Johnson's Simply Complexity, he derives an insight that currency traders have (knowing what currency is "in play") using graph theory.

I think Simply Complexity is a very good book for speculators, since it uses accessible analogies and no complicated math. The book has a lot of analogies regarding the market. The most relevant section for Specs would be, Chapter 4: Mob Mentality (I however enjoyed the entire book).

A Few excerpts:

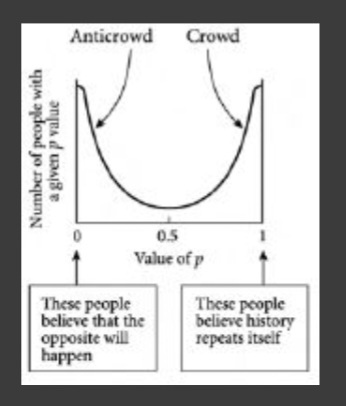

The bar-goers who tend to shift opinions about whether to go with history or against it, tend to lose more and hence eventually change their p value.

This reminded me of people that both go short & long in the market (I am long only). P is the probability of an event happening.

Figure 4.3 from the book and its caption:

We are naturally divided. The final arrangement of a collection of people, in the case of a bar where the comfort limit is around half the number of potential attendees. This shows the emergent phenomenon of a crowd who think that history repeats itself, and an anticrowd who think that the opposite will happen. Hence the population polarizes itself into two opposing groups. This polarization of the population represents a universal emergent phenomenon. It will arise to a greater or lesser extent in any Complex System involving collections of decision-making objects such as people, which are competing for some form of limited resource.

The figure is similar to the Arc Sin law of PnL. Something that appears in Ralph Vince's book The Mathematics of Money Management and Nassim Taleb's Dynamic Hedging. Unfortunately, I don't have a good intuition on the Arc Sin law of PnL.

Aug

1

How do you fight the Vig?, from Asindu Drileba

August 1, 2025 | 1 Comment

I interpret the "Vig" as the collective term for:

1) bid-ask spread (difference in prices between buying & selling) due to market makers

2) transaction fees (for limit & market orders) charged by the exchange

3) slippage (an instrument is more expensive the deeper in the order book you go) due to how liquid an asset is.

Possible solutions for each?

1) Can be fought with the exclusive use of limit orders instead of market orders.

"Be patient and you will have the edge", The Chair in, Practical Speculation — The fine art of bargaining for an edge

2) I noticed (at least in crypto markets) that the more volume you trade, the less fees you pay (on a percentage basis)

3) Restrict yourself to deep and very liquid markets.

Also, one technique is to trade as less often as you can (buy & hold). That way you will automatically pay less of all the three sources of Vig. I think this is so important as I often found many "edges", then accounted for the vig and they often became loosing strategies.

Big Al writes:

I would also add "opportunity cost" as part of the "Meta Vig" (MV), i.e., the total costs associated with trying to trade the markets. The MV would also include the negative effects of cortisol on the human body.

Henry Gifford suggests:

I think two good steps are to ask others what the big is, and to try to calculate it yourself. Both exercises will no doubt be educational. A few times over the years I have asked horse bettors what the big is, but none seemed to know. As for calculating yourself, one hopefully will learn how much it varies by, and maybe also gain insight into hidden vig.

Steve Ellison responds:

There is no free lunch with limit orders because of adverse selection. Sooner or later, you will place a limit order on a security that simply moves up and never looks back. It would have been your best trade ever, had you actually been filled. In the opposite scenario, for example when I bought Coca-Cola in 1998, and it was already down 25 percent by the T + 3 settlement date, you will of course be filled.

Studies of retail investing accounts have shown a negative correlation between number of transactions and investment returns. In one study, accounts that had been inactive for 18 months because their owners had died, and their estates had not been settled, outperformed the vast majority of their retail account peers.

Peter Ringel writes:

Generally, the lower you go ( smaller time frame - smaller scope of the trade ) the larger the relative Vig costs. a subclass of opportunity costs is spent time of (daily) preparation. my required prep is nearly the same over many time-frames - but the scope of a trade is way lower for lower time-frames. in cash equities, the resale of your order-flow by your broker to some HF shop can be counted as Vig too. is this a common practice in option markets too? Yes, the Vig greases the fin-industry, but it is mostly unavoidable paying / avoiding the Vig does not lead to success or failure in mkts IMHO.

Vic simplifies:

just trade once a quarterfrom long side

Zubin Al Genubi comments:

The biggest vig is capital gain taxes. The richest people in the world hold their single company stock 10000x and realize no gain. Its very hard to beat a long term hold.

Aug

24

Meaning of “Counting”, from Asindu Drileba

August 24, 2024 | Leave a Comment

I remember an interview by Vic where he said he did a lot of "counting". Does he mean combinatorics? Or something else. What are some resources where he has talked about this "counting" in more detail?

William Huggins replies:

he literally meant count the data/do the math. at its most basic, statistics is about counting and comparing to the results we would have expected from randomness. too many people form their beliefs because they were told something, or were presented with cherry-picked "supporting" data so the chair's injunction has been to actually check before committing capital.

Zubin Al Genubi adds:

Count the number of: Private Jets, pretty girls, closed businesses, for lease signs, big market drops, increase in vix, number of down days, number of days since last high/low, volume of trades, bids, offers, crashes, all time highs, stocks at new highs/ lows, crosses of round numbers, cigarette butt length, change in price, etc etc.

Test: is number above or below mean/ median? How many standard deviations away from mean? What happened after the time of count?

Penny Brown adds more:

I'll add to the list: the price of thoroughbred horses sold at auction and the length of women's dresses. (long hem below knee is bearish as was style in 70s, short hem in mini skirts is bullish)

Asindu Drileba responds:

Thank you. "Test Everything" is definitely something that keeps coming up whenever I listen to the chair.

Humbert H. asks:

In all these years I could never understand how this approach can coexist with affirming the reality of the ever-changing cycles. Like how do you know when to trust this counting and when the cycles changed on you?

Laurence Glazier offers:

Music is the pleasure the human mind experiences from counting without being aware that it is counting.

- Gottfried Leibniz

Jul

28

Inflection points, from Zubin Al Genubi

July 28, 2024 | Leave a Comment

Inflection points at prior highs and lows seem pretty obvious recently especially in lowered liquidity. The market makers seem to thin and spread their markets for protection resulting in bigger directional moves. The vol gives a small trader good opportunity as the big boys dump large orders creating large auto trade moves like escalators.

Anatoly Veltman wants more information:

every word I read on three lines of text appears totally (?) random. It would be extremely impressive, if you ventured to explain at least ONE of these, and how this could be used as edge. P.S. Bonus would be to know the approximate date (?) of "lowered liquidity"

William Huggins responds:

It's not random, it's about microstructure. MMs spread their risk as they usually get caught out by information driven moves while they supply liquidity. When they spread their capital to diversify, or withdraw from choppy markets, the price impact of trading rises (Kyle's lambda).

Steve Ellison comments:

My takeaway from Zubin's post is that there are edges to be found in studying market microstructure and looking for clues in price action of what some of the key players are doing. A specific example I have found is, if you bin trading days by number of days before or after options expiration, options expiration day has had the worst total return in the S&P 500 of any day of the month in the past 6 years or so. Apparently the need for a large number of market players to adjust and re-establish hedges can create imbalances in supply and demand of various assets.

I could form a hypothesis about liquidity that a sustained price move in one direction, as happened a couple of times to the downside in the S&P 500 since July 17, is toxic for market makers and forces them to widen their spreads lest they be saddled with unwanted inventory. I'll leave it as an exercise for the reader to test this hypothesis.

Jul

24

Mega-Tinderbox buy-and-hold, from Kim Zussman

July 24, 2024 | Leave a Comment

‘Greatest Bubble’ Nearing Its Peak, Says Black Swan Manager

Universa’s Mark Spitznagel, who has made billions from past crashes, sees last hurrah for stocks before severe reckoning

Humbert H. asks:

His job is to make money on black swans, not to predict black swans. What kind of black swan is it if it can be predicted?

Asindu Drileba writes:

Black Swans are relative. If you have tail risk protection it means you are aware of tail risk. If you don't have tail risk protection, the notion of a "surprise" when it happens means you encounter a black swan. So Mark may be speaking form the perspective of those that actually don't think they will encounter a black swan.

Humbert H. responds:

Is there anyone who invests in the magnificent seven and NVDA in particular who isn't aware of their elevated valuations, possible bubble formation, and the risk of a major decline? There's some level of obviousness to warning people of this possibility. It's like he is suddenly preaching "past performance is no guarantee of future results" or "correlation does not equal causation". Is he doing this to help humanity? Someone will make more money and someone will make less money if they act on his warning, and there will be bagholders either way, so humanity will not benefit as a whole.

Asindu Drileba adds:

I think for his case, he is just marketing his fund.

Zubin Al Genubi observes:

Cheap Deep OTM puts are up 45% on a 3% decline showing exponential gearing in place from ATH as a directional trade or as a hedge. Surprisingly unidirectional.

Asindu Drileba expands:

His philosophy is more like that of "insurance" for stocks. I think Uncle Roy also has the same philosophy. I remember his describing portfolio protection akin to having fire insurance for your house. To benefit from fire insurance on your house, you don't need to predict when it will burn down. Just make sure you always have coverage for it. So most of the time, percentage wise, your predictions of having a fire are going to be wrong. He mostly advocates that everyone should have "fire insurance" for your portfolio.

To learn more about Mark's strategy:

1) A section called "The Forest In the Pine Cone" inside his book The Dao of Capital

2) His solution to the "narrow framing" problem

3) How he sizes his positions

Nils Poertner comments:

good to be open minded. that said: the more stories (like this one) we can read in mass financial media (FT, WSJ, etc) - the less likely this is going to play out anytime soon. "get the joke"

Humbert H. writes:

I don't think it makes any difference unless "everybody" has the opposite view of the future from what the market is doing. Every single day multiple people prognosticate both doom and gloom and full steam ahead. Since the motivation for this warning is clearly suspect this is white noise. But if his prediction comes true soon which it obviously has a reasonable chance of doing he'll be venerated for decades as the great prophet. This guy is clearly a disciple of Taleb, and they even collaborated in the past. Victor's take would be interesting.

Jul

20

Looking deeper into employment, from Bill Rafter

July 20, 2024 | Leave a Comment

First the chart. The two data sets are of different magnitude, so to compare them they must be normalized. The chart represents the slope of the data divided by the trend of that data. Both are determined by regression over 12 months. Each point on the chart is effectively the expected rate of change of the data as determined by the moving trendline. As such, the data is NOT lagged, and presents a truer picture than that of lagged data.

Interpretation. Periods of higher part-time employment tend to coincide with recessions. However, if the employment picture is recessionary, then how would one explain the growth in Payroll Tax Receipts, which I have shown separately? Well, it turns out that the growth from January to June in Part-time employment matches the growth in Payroll Tax Receipts. Thus, the economy is growing solely by the increase of part-timers.

Zubin Al Genubi writes:

Many young people I know do gigs, seasonally or part time. Recent employment numbers (with temp way up and full-time way down)support the theory.

Humbert H. adds:

I’ve seen a lot of information on part-time vs full-time. Often it’s accompanied by foreign-born vs native-born, where the dichotomy is similar, in favor of the foreign-born.

Jul

15

Possible demand-supply mismatch coming in the power markets, from Carder Dimitroff

July 15, 2024 | Leave a Comment

Only some people agree, but the power industry believes there may be a demand-supply mismatch from AI data centers. Here are some summary views - from the American Nuclear Society's Nuclear Newswire (April 2024):

Major tech companies see artificial intelligence (AI) as something that will transform their industry, and there is a race to be first. When they look for clean, dependable power 24/7, nuclear clearly stands out as a good match. Constellation [the nation's largest nuclear utility] summarized it best in its recent forecast:

• AI and data center growth will drive power demand.

• Major tech companies are expected to invest $1 trillion in data centers over the next five years.

• In the next five years, consumers and businesses will generate twice as much data as all the data created over the past 10 years.

• AI data center racks could require seven times more power than traditional data center racks.

• Between now and 2030, domestic data center electricity consumption is expected to grow anywhere from 6.5 percent to 7.5 percent (335 terawatt-hours to 390 terawatt-hours).

• In its report, Data Centers 2024 Global Outlook, global real estate services company JLL has said that "AI is driving extreme scale for new developments with requirements now ranging from 300 megawatts (MW) to over 500 MW."

From the IEEE Spectrum (June 2024):

Scientists have predicted that by 2040, almost 50 percent of the world's electric power will be used in computing. What's more, this projection was made before the sudden explosion of generative AI.

From Data Center Dynamics (May 2024):

US utility Dominion expects to connect 15 more data centers to the grid in Virginia over the course of 2024, after connecting 15 facilities last year totaling almost a gigawatt of capacity [1 gigawatt = 1 nuclear plant]. In its most recent earnings presentation this week, the company said it had connected 94 data centers with more than 4GW of capacity in Northern Virginia since 2019. This included 15 data centers totaling 933MW in 2023, and 15 more are due to be connected in 2024. The company didn't include the capacity of those 15 facilities going live this year, and in the earnings call, CEO Robert Blue said he doesn't know how quickly they will ramp up to full capacity.

For those who think new nuclear power is the solution (2024), this is not a quote but a fact: The new Vogtle nuclear power plant took about 20 years to design and build, from concept to commercial operations. This recent construction schedule was set by an experienced nuclear utility that previously built access to transmission on a nuclear site they've owned for decades.

The critical metric is not the overall demand. Data centers' demand sits on the grid 24/7, so generating capacity must be available 24/7. While massive amounts of energy are already oversupplying some US power markets, most new sources originate from part-time wind, solar, and battery assets. Those part-time assets cannot serve the 24/7 load demanded by data centers. Therefore, the critical metric is the difference between the base supply and the constant load.

With growing 24/7 demand, a fleet of legacy power plants (natural gas, nuclear, coal) is needed to fill in the [significant] gaps left by part-time renewable energy sources. That fleet currently exists, but its overall capacity is declining. Retired plants (to the extent they can be summoned) and new generation will be needed.

However, any new base generation will experience poor capacity factors and difficult gross revenues. Both impair investors' revenues and erode their expected levelized cost of energy. Even if investors overcome profitability concerns, the time it takes to commercialize any new traditional generating asset exceeds the expected demand for new power (extreme example: Georgia Power).

These projections and concerns appear to contradict current trends. Demand has declined in the United States, Europe, and the United Kingdom. Current reporting suggests there could be too much supply, particularly in Europe. However, if projections described by ANS, IEEE, and utilities are correct, the opposite problem could be presented: insufficient supply. If supply becomes the issue as expected, scarcity curves will be taxed, unprofitable generating assets will become profitable, and residential, commercial, and industrial consumers will pay more. This issue is not limited to North America.

Humbert H. writes:

I was listening to an interview of some fund manager from Reno earlier today and he was talking about power shortage around where he lives due to AI server farms. He said they could be quickly and cheaply addressed with new gas powered plants, but due to the Biden administration now requiring all such plants to have complete carbon sequestration this stopped them from being a practical solution.

H. Humbert writes:

Increased the energy supply for data centers is the obvious and near-term brute-force solution. Of course (almost) everybody not in the tech industry assumes that the joule per bit per second for data centers can't be improved and hence producing more energy is the only solution using nuke. In fact Sam Altman said that too, what conventional thinking can possibly go wrong, right?

Zubin Al Genubi asks:

What would be a good way to invest in modern nuclear power? How about Bill Gates project?

Asindu Drileba adds:

I would suspect via buying Uranium ETFs? I first saw this conjecture from following the financier Lyn Alden.

Mark Zuckerberg of recent also mentioned in an interview that Energy and not Compute will be the number 1 bottle neck to AI progress.

H. Humbert responds:

The energy being the presumed AI investment proxy won't last in the long term. Increasing the energy supply is just an incremental engineering no-brainer approach to solve a longer term problem and the approach is not disruptive and it doesn't change the world.

Stefan Jovanovich offers:

Radiant Nuclear

Kaleidos: a Portable Nuclear Microreactor that Replaces Diesel Generators

Peter Penha writes:

A relevant interview on the Hidden Forces podcast with Brian Janous who was hired by Microsoft in 2011 to focus on energy (Google had just hired someone themselves as they thought the cloud might become something) - wound up as VP of Energy.

AI data centers need to be where they can individually draw the electricity of a city like Seattle (800 MWh) - so away from major urban areas - discusses the history of the grid from Sam Insull through to where we are going…also on the efficiency / consumption of AI chips - his view with AI is Jevons Paradox will apply and the more efficient the chips and the (new) grid gets the more consumers will demand.

Jun

29

Canary?, from Zubin Al Genubi

June 29, 2024 | 1 Comment

Seen yesterday in Kona Hawaii, billionaire's playground:

1 private jet at FBO. Very unusual.

25% commercial vacancies in prime retail.

Tourism down 9%

(Galtonesque count)

Stefan Jovanovich comments:

ZAG's reports are a treasure - and a source of future profits.

Nils Poertner wonders:

easier to be bullish on European /UK equities than having bearish view on US stocks?

Jun

15

Megacaps in Random Land, from Big Al

June 15, 2024 | Leave a Comment

Lots going around about how NVDA dominates; and MSFT, NVDA and AAPL now account for about 20% of the S&P 500. I was curious to see what happened in a toy index and so did an experiment (using R):

1. Create an index of 500 stocks, each with a starting value of $100.

2. Each year, for 40 years, each stock's value is multiplied by 1 + a value randomly drawn from a normal distribution with mean 8% and sd 15%, roughly what you might see with the S&P 500.

3. The starting value of the index was $50,000. The final value after 40 years was $1,152,446.

4. The final summed value of the largest 10 out of 500 stocks was $142,320, or 12.35% of the 500-stock index.

I was curious to see if megacaps would emerge from a simple toy model. I ran it only once, and they did. For me, this is a comment on the perennial alarm stories about "Only X% of stocks account for Y% of the market!" Even with a simple model, you wind up with something like that.

Adam Grimes agrees:

Can confirm. Have done variations of this test with more sophisticated rules, distribution assumptions, index rebalancing, etc. Get similar results.

Peter Ringel responds:

so we can take this ~12% of the index as a base value, that develops naturally or by chance? Then a clustering of being 20% of a total index (only greater by 8%) does not look so outrageous.

William Huggins is more concerned:

keep in mind it's 10 companies making up 12% (~1.2% each) vs 3 companies making up 20% (8.3% each) - in that sense, the concentration DOES look pretty high. am reminded of when NT was 1/5 of the entire CDN index in 99/00.

Peter Ringel replies:

You are right, I failed to catch this difference of only 3 stocks. In general, I am not so much surprised about the concentration. Money always clusters. Always clusters into the perceived winners of the day. Should they blow up, money flows into the next winner. To me, the base for this is herd mentality.

Adam Grimes comments:

It's Pareto principle at work imo. I'm not making any claims about exact numbers or percents, but as you use more realistic distribution assumptions (e.g., mixture of normals) the clustering becomes more severe. There's nothing in the real data that is a radical departure from what you can tease out of some random walk examples. Winners keep on winning. Wealth concentrates. (As Peter correctly points out.)

Asindu Drileba offers:

Maybe you try replacing the normal distribution of multiples with a distribution of multiples constructed with those historically present in the S&P 500? It may reflect the extreme dominance in the market today.

To me, the base for this is herd mentality.

It is also referred to as preferential attachment:

A preferential attachment process is any of a class of processes in which some quantity, typically some form of wealth or credit, is distributed among a number of individuals or objects according to how much they already have, so that those who are already wealthy receive more than those who are not. "Preferential attachment" is only the most recent of many names that have been given to such processes. They are also referred to under the names Yule process, cumulative advantage, the rich get richer, and the Matthew effect. They are also related to Gibrat's law. The principal reason for scientific interest in preferential attachment is that it can, under suitable circumstances, generate power law distributions.

Zubin Al Genubi writes:

Compounding of winners is also at work and returns will geometrically outdistance other stocks. No magic, just martini glass math.

Anna Korenina asks:

So what are the practical implications of this? Buy or sell them? Anybody in the list still owns nvda here? If you don’t sell it now, when?

Zubin Al Genubi replies:

Agree about indexing. Hold the winners, like Buffet, Amazon, Microsoft, NVDIA. Or hold the index. Compounding takes time. Holding avoids cap gains tax which really drags compounding. (per Rocky) Do I? No, but should. It also works on geometric returns. Avoid big losses.

Humbert H. wonders:

But what about the Nifty Fifty?

Jun

1

Demonstration of Non-linear Effects Using Volumes of Cones, Asindu Drileba

June 1, 2024 | Leave a Comment

Numberphile Video demonstrating that a cone that is 80% full in height is actually 50% full in volume. You will also know if your getting scammed in a bar.

Cones are MESSED UP - Numberphile

Zubin Al Genubi writes:

This is why convexity, compounding, and geometric or exponential growth are hard to comprehend.

Kim Zussman comments:

Geometric returns are important when assessing performance. From an investor's perspective, average returns underweight when a manager loses everything (because it is sum-based), but geometric returns don't (because it is a product).

May

27

Weekend Reading, from Zubin Al Genubi

May 27, 2024 | Leave a Comment

Right, that Comey, fired as head of the FBI. But the book is a good murder mystery by someone who obviously knows law enforcement and investigation, and has a real nice human touch. Recommended. Also it has a pretty funny dig on the hedgies…right, that Westport.

Westport, by James Comey:

It's been two years since Nora Carleton left the job she loved at the US Attorney's Office to become lead counsel at Saugatuck Associates, the world's largest hedge fund. The career change also meant a change of scenery, relocating her to Westport, Connecticut, fifty miles north of New York City. But it was worth it to get her daughter, Sophie, away from the city. Plus, she likes the people she works with. Especially Helen, who recruited Nora because of her skills as an investigator.

Then, Nora's new life falls apart when a coworker is murdered and she becomes the lead suspect. Nora calls in her old colleagues from the US Attorney's Office, Mafia investigator Benny Dugan and attorney Carmen Garcia. To clear Nora's name, Benny and Carmen hunt for the true killer's motive, but it seems nearly everyone at Saugatuck has secrets worth killing for. As Benny sets out to interrogate her colleagues, Nora examines her history with the company to determine who set her up to take the fall.

May

26

The Oceans and the Stars, from Zubin Al Genubi

May 26, 2024 | Leave a Comment

This modern Jack Aubreyesque story of naval warfare is some of the best fiction I've read recently. Lots of action written in beautiful prose.

The Oceans and the Stars, by Mark Helprin.

A Navy captain near the end of a decorated career, Stephen Rensselaer is disciplined, intelligent, and determined to always do what’s right. In defending the development of a new variant of warship, he makes an enemy of the president of the United States, who assigns him to command the doomed line’s only prototype––Athena, Patrol Coastal 15––with the intent to humiliate a man who should have been an admiral.

Big Al recommends:

Covers key psychological issues around trading, with clear action steps:

The Mental Game of Trading: A System for Solving Problems with Greed, Fear, Anger, Confidence, and Discipline, by Jared Tendler.

Khilav Majmudar is reading:

Models.Behaving.Badly.: Why Confusing Illusion with Reality Can Lead to Disaster, on Wall Street and in Life, by Emanuel Derman.

In this bitterly funny novel by the renowned Polish author Witold Gombrowicz, a writer finds himself tossed into a chaotic world of schoolboys by a diabolical professor who wishes to reduce him to childishness. Originally published in Poland in 1937, Ferdydurke became an instant literary sensation and catapulted the young author to fame. Deemed scandalous and subversive by Nazis, Stalinists, and the Polish Communist regime in turn, the novel (as well as all of Gombrowicz’s other works) was officially banned in Poland for decades. It has nonetheless remained one of the most influential works of twentieth-century European literature.

Vic adds:

The Oceans and the Stars, and The Whole Story: two excellent books that have similar trajectories and conclusions - struggle, with love conquering adversity.

May

12

Cost of Carry, from Zubin Al Genubi

May 12, 2024 | Leave a Comment

A carry trade is borrowing/buying at low interest and selling/lending at higher interest rates using leverage. Its used in currencies. The authors propose the trade had become systemic including the FED such that the markets have disconnected from fundamentals and are moved by dynamics of the carry/bust pattern. Further that it is the main driver of economic cycles not classic economic supply and demand.

If so, maybe the Fed watch traders are not always wrong as I've stated and the bad news is good news idea has merit under the carry trade.

Humbert H. writes:

Is there anyone who has done this for decades and not blown up, other than maybe Palindrome? Leverage combined with simultaneous forex and interest rate bets seems like it will eventually blow up, unless you always get advance warnings from central bankers.

Jeff Watson expands:

In the grain markets we determine the cost of carry as Futures price = Spot price + carry or carry = Futures price – spot price. Carry consists of storage costs, insurance, and interest. Carry provides the farmer with signals helping with crop marketing decisions while it provides a trader an opportunity to capture the carry. As an aside, here’s a handy dandy little formula to play around with:

F = Se ^ ((r + s - c) x t)

Where:

F = the future price of the commodity

S = the spot price of the commodity

e = the base of natural logs, approximated as 2.718

r = the risk-free interest rate

s = the storage cost, expressed as a percentage of the spot price

c = the convenience yield

t = time to delivery of the contract, expressed as a fraction of one year

Steve Ellison adds:

The US stock market had a carry trade from 2008 to 2018 and again in 2020 and 2021 when zero interest rate policy made it possible for traders to buy stocks with borrowed money, and cover the interest costs using the stock dividends. Philip L. Carret wrote in his 1931 book The Art of Speculation that the best time to buy stocks is in such situations when stocks "carry themselves".

As a quick approximation, the prices of the front-most ES contracts are:

June 5225

September 5282

So the cost of carry at the moment is roughly 47 points per quarter, and the S&P 500 is not carrying itself (if it were, the contracts would be in backwardation).

May

2

Smörgåsbord for the beginning of May

May 2, 2024 | Leave a Comment

Smörgåsbord for the beginning of May

Zubin Al Genubi recommends:

Market Tremors: Quantifying Structural Risks in Modern Financial Markets

Clear exploration of potential causes of and prediction of volatility events caused by Dominant Agents. Explores imbalances created by ETFs ETNs Banks, FED Market Makers.

Asindu Drileba suggests chaos:

Doyne Farmer describes the relationship between Roulette Wheels, The Weather, Financial Markets, and Economies as a whole. He thinks companies that don't make the energy transition from fossil fuels will all go bankrupt in the next 5 years. He is also promoting his new book:

Here is the discussion:

Simplifying Complexity: Making sense of chaos with Doyne Farmer

Nils Poertner points to probability:

stochastics is really quite counter-intuitive - it deals with "uncertainty" rather than basic algebra or geometry which one learns in schools. good training ground for learning about markets as well. (always found that stochastics often attracts folks who are a bit off the normal conventions / and have an genuine curiosity in things rather than go with what is fashionable)

Apr

17

Bits and pieces

April 17, 2024 | Leave a Comment

Zubin Al Genubi on market prices:

Twenty S&P points used to be a good trading day. It still is, but now 50 points is the new normal. Need to recalibrate mentally and recalibrate old systems. It's a dichotomy between points and percentages as the prior Rocky/Vic argument discussed. The higher price has resulted in a stealth increase in leverage. Announcements widen spreads and create great small entry points. The FED speak traders are always wrong and offer great opportunity. Why are they wrong? Bad news is not good news.

I've read that the current market price is always right. I disagree. The market price is set at the margin by a few, maybe several hundred participants with a variety of reasons for transacting. The reasons are often wrong and the price is wrong at that moment. This can be used to advantage either in patterns prospectively, or in the case of liquidity holes on the fly.

Big Al suggests:

Daniel Kahneman on Cutting Through the Noise | Conversations with Tyler

Andre Agassi tennis hack against Boris Becker

Nils Poertner on effortless learning:

When learning a foreign language, we learn the best when being PRESENT and don't fret to get it right all the time. This being right puts a huge amount of unnecessary stress on the student. To some extent it seems the same in trading: we don't need to know everything in advance - far more important is to be PRESENT.

Easan Katir on an old book:

NHK offers a sensitive review of In Praise of Shadows. The book is by Juni'chiro Tanizaki, one of Japan's eminent novelists. Market relevance? One can muse on how much of market activity takes place in the shadows, the dark pools, the anonymous orders whizzing by on level 2… is there a shadowy level 3, 4, 5 where identities are revealed?

Kim Zussman responds:

Relatedly to spec interests, A Taxing Woman, a nice film about Yazuka/tax evasion at Nippon ATH ca late 80s.

Apr

16

Higher for longer, from Nils Poertner

April 16, 2024 | Leave a Comment

Investors wrongfooted as ‘higher for longer’ rates return to haunt markets

Zubin Al Genubi asks:

Interest alone on US debt is 1 trillion dollars a year! Anyone concerned?

Larry Williams is definite:

NOPE. NOT AT ALL.

Art Cooper, however:

*I* am certainly concerned, in the long term. When the coverage ratio on gov't debt auctions drops close to 1.0, it will be time to take meaningful action, with a major re-allocation of investment portfolios.

Larry Williams responds:

Not to worry…says MMT guys…as long as we are not gold-backed $, it's all just accounting numbers.

Kim Zussman wonders:

Reallocate to what? (he says looking around twice with stocks near ATHs)

Art Cooper suggests:

There are a universe of hard assets out there, including gold (though GLD could easily go far higher). Because I like to emulate the Sage and shop in the bargain basement, I personally find extremely distressed income-producing real estate of interest. Babies are being thrown out with the bath water.

Larry Williams writes:

The public debt is just $ in savings accounts at the Federal Reserve Bank. When it matures the Fed transfers those dollars to checking accounts (aka reserves) at the same Fed. It's just a debit of securities accounts and a credit of reserve accounts. All internal at the Fed. When gov sells new Tsy secs, the Fed debits the reserve accounts and credits securities accounts. Those $ only exist as balances in one account or the other.

Asindu Drileba adds:

David Graeber once mentioned that the US can never default on its debts since the Fed is the largest holder of Treasuries.

William Huggins comments:

its not that the US -can't- default on its debts, its that 70% of those debts are to americans. so what is the probability of americans voting to default on themselves when they have the ready alternative of printing money? more important might be whether or not the 30% foreign holders will keep playing along but that analysis is an exercise in ranking "next best alternative" for them. when one starts looking under the hood at the alternatives, its boils out like china's bank regulator said in early 2009, "except for treasuries, what can you hold? gold? you don't hold japanese government bonds or uk bonds. us treasuries are the safe-haven. for everyone, including china, it is the only option: "we hate you guys but there is nothing much we can do."

H. Humbert replies:

The Americans would be about equally unlikely to default if most of the debt was held by foreigners. If you can print money there is no need to piss off any of your "customers". It's not like things worked out super well for Argentina, at least until they hit bottom.

Apr

15

Reading (and viewing) recommendations

April 15, 2024 | Leave a Comment

From Easan Katir:

The Hall of Uselessness: Collected Essays, by Simon Leys.

Simon Leys is a Renaissance man for the era of globalization. A distinguished scholar of classical Chinese art and literature and one of the first Westerners to recognize the appalling toll of Mao’s Cultural Revolution, Leys also writes with unfailing intelligence, seriousness, and bite about European art, literature, history, and politics and is an unflinching observer of the way we live now.

From Zubin Al Genubi:

Pathogenesis: History of the World in Eight Plagues, by Jonathan Kennedy.

According to the accepted narrative of progress, humans have thrived thanks to their brains and brawn, collectively bending the arc of history. But in this revelatory book, Professor Jonathan Kennedy argues that the myth of human exceptionalism overstates the role that we play in social and political change. Instead, it is the humble microbe that wins wars and topples empires.

From Asindu Drileba:

Math Without Numbers, by Milo Beckman.

Math Without Numbers is a vivid, conversational, and wholly original guide to the three main branches of abstract math—topology, analysis, and algebra—which turn out to be surprisingly easy to grasp. This book upends the conventional approach to math, inviting you to think creatively about shape and dimension, the infinite and infinitesimal, symmetries, proofs, and how these concepts all fit together. What awaits readers is a freewheeling tour of the inimitable joys and unsolved mysteries of this curiously powerful subject.

Peter Ringel is watching:

Voltaire: The Rascal Philosopher

I discovered a terrible knowledge gap and missed details of a great one. so many angles to be impressed. his writings seem to be the least of it. he even gamed the king's lottery and won with a group of investors & mathematicians.

William Huggins suggests a somewhat older work:

A General History of The Most Prominent Banks, by Thomas H. Goddard, published in 1831.

its dry - but if you are interested in the 1819 panic, there are some good details. the book is mistitled imo as 3/4 of its pages and 2/3 of its text centers on the history of central/national banking in the united states from 1786 through 1831 (publication). on titular matters, it had a couple of interesting tidbits on the bank of genoa and some "interesting" statistical information for archivists but there are better modern sources on major banks in venice, the netherlands, england, and france (for example, the author skips over how the bankers of geneva funded the french revolution to knock the bank of genoa off its perch, etc). i suspect such deficiencies are because the text was designed as ammo in the "bank wars" of the early 1830s rather than a deep exposition on titular topics.

its exposition on us matters feels remarkably haphazard, i presume because the author's intended audience would have the context to appreciate why it includes what it does, including a description of the bank of north america, hamilton's report to congress on the need for a bank, and a brief on the First Bank of the US. where it begins to shine is in the next set of docs, which includes an auditor's report and statement by the president of the Second Bank of the US on how the panic of 1819 was navigated. it follows with mcduffie's 1930 report to congress on the SBUS (includes more details on the rise and fall of FBUS), and closes with a statistical archive of the "monied institutions of the US" and an appendix on how banking and commercial exchange granularly worked in the 1800s.

Stefan Jovanovich comments:

I was puzzled by the "decline and fall" description, since the Bank did not fail but simply had its charter expire without renewal because George Clinton did not like what Thomas Willing had done as President of the Bank. (Clinton failed to cast what would have been the winning vote for renewal.)

William Huggins responds:

"fall" referring to its near brush with survival, not any sort of mismanagement or fraud as in 1819. mcduffie describes FBUS as the victim of partisan politics, but one of such import that the same party who killed it started calling for a replacement almost immediately.

Stefan Jovanovich adds:

They wanted what Willing would not give them - a central bank that would do what the Fed does now - discount the Treasury's IOUs at par. Can't have a war without that.

Apr

13

Memorylessness, from Asindu Drileba

April 13, 2024 | Leave a Comment

This is a topic that keeps appearing when people talk about probability. I don't seem to have a good intuition for it. Is the stock market with memory or without memory? Why? What would be your intuitive explanation of what memory is?

From Memorylessness:

In probability and statistics, memorylessness is a property of certain probability distributions. It usually refers to the cases when the distribution of a "waiting time" until a certain event occurs does not depend on how much time has elapsed already. To model memoryless situations accurately, we must constantly 'forget' which state the system is in: the probabilities would not be influenced by the history of the process.

Only two kinds of distributions are memoryless: geometric distributions of non-negative integers and the exponential distributions of non-negative real numbers.

Humbert H. responds:

Of course it's not completely memoryless otherwise there would be no point to any spec of this list trying to beat the market. It's ALMOST memoryless, and that's why it's hard to beat, but there are still some irregularities, like days of the week, month, season, reaction to events, like increased volatility following a big change. It would have a lot more memory if people didn't try to take advantage of the irregularities, because market participants have emotions and also information doesn't spread instantaneously even in this day and age.

Eric Lindell comments:

Blackjack is with memory, provided the number of decks is finite. As you play with more and more decks, the game becomes less memory-dependent. A small player in a huge market makes trades that are less memory-dependent than a big player's trades. The bigger the portion of the total market a trader trades, the more memory-dependent it becomes.

Wikipedia's discussion of a memoryless probability distribution refers to a poisson process. The time before the next car arrives at a toll booth doesn't depend on the time since the last car arrived — provided the cars' arrivals are truly random. This would NOT be the case with a nonrandom distribution, as when more cars arrive per minute during rush hour.

Zubin Al Genubi writes:

A normal distribution of a series of events, indicates that the events are independent of each other, in that the occurrence of one does not affect the probability of another. Of course the market has memory and emotion. We are looking for the regularities to trade that are not random with a high degree of confidence.

Larry Williams agrees:

Amen! People react in similar fashion to events and those reactions create patterns. Plus, there are unique time elements to many markets; jewelry is mostly sold at Christmas, hogs live and die in 18 months etc.

Penny Brown adds:

Investors who suffer a big, sudden decline in a stock remember it. Often they vow to hold on until they are made "whole". This can cause a stock to sell off as it approaches that spot. But if the stock clears this area, the weak hands are gone, and the stock can move up sharply.

Big Al suggests:

For further study, re the quality of "memoryless" and possible applications:

Also, Vic has referred to Markov processes relating to the market calendar at the top of this site.

Mar

29

Weekend reading

March 29, 2024 | Leave a Comment

Recent list recommendations:

From Zubin Al Genubi:

The New Money Management: A Framework for Asset Allocation, by Ralph Vince.

The Crowd: A Study of the Popular Mind, by Gustave Le Bon.

The Crowd. Must read. In crowds individual lose their intelligence, morals, and judgement and a new entity acts without credulity, irritably, and subject to whims, heroism and depravity.

1177 B.C.: The Year Civilization Collapsed

William Huggins adds:

I enjoyed 1177 BC a few years back as it gave a general overview of the geopolitical state of play towards the end of the Bronze Age. It summarized most of the theories underpinning the "bronze age collapse" which occurred around that time and left less than half the "civilized" world in the state it had been a century before. Doesn't offer much in terms of new evidence but it a decent quick read.

From Nils Poertner:

Tech Stress: How Technology is Hijacking Our Lives, Strategies for Coping, and Pragmatic Ergonomics

Tech Stress offers real, practical tools to avoid the evolutionary traps that trip us up and to address the problems associated with technology overuse. You will find a range of effective strategies and best practices to individualize your workspace (in the office and at home), reduce physical strain, prevent sore muscles, combat brain drain, and correct poor posture. The book also provides fresh insights on reducing stress and enhancing health.

Mar

24

An alternate understanding of a market being at all time high (market reaching new prices it has never encountered) is this: "Everyone that has ever bought that stock or instrument is now in profit". What might be the psychological implications of this?

Kim Zussman comments:

It is possible (and probable) to buy, then sell after a decline and stay out only to see it reverse and go up further. This (timing) is one reason it is so much easier to do better with B/H than trading.

Big Al adds:

The other advantage to B&H is that the opportunity cost viz time/attention required is basically zero. I have looked at various index timing approaches and have not found anything that beats B&H, especially when considering the vig and opportunity cost. However, should one need to scratch the itch, timing strategies may work better with individual stocks. But again, opportunity cost.

Humbert H. writes:

I've always been believer in B&H vs. trading. But even in B&H the debate between indexing and individual stock selection never dies. I don't like indexing, but I don't have a mathematical basis for that. It's a fundamental belief that buying things without any regard to their economic value has to fail in time, at least relative to paying some attention to it.

Zubin Al Genubi adds more:

Another aspect of buy and hold that Rocky pointed out is the capital gain tax severely eats into returns. The richest guys hold for years and have only unrealized untaxable gains.

Art Cooper agrees:

There was an excellent article in the Jan 7, 2017 issue of Barron's by Leslie P. Norton on VERY long-lived closed end mutual funds which have surpassed the S&P's performance. They have all followed buy and hold strategies.

Michael Brush offers:

Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.

- Peter Lynch

Steve Ellison brings up an important point:

And yet trading is one of the focal points of this list. The way I square this circle is to keep most of my trading account in an equity index fund at all times. When I think I have an edge, I make trades using margin.

Larry Williams writes:

B&H is the keys to the kingdom, but…the massive fortunes of Livermore were short term trades despite his comment about sitting on your hands. Even the current high performers, Cohen, Dalio, Tudor etc use market timing. When I won world cup trading $10,000 to $1,100,000, it was all about timing and wild crazy money management. One approach wins big the other wins fast. A point to ponder.

Bill Rafter writes:

What we found in studying only the SPX/SPY is that in the long run a buy-and-hold yielded 9.5 percent compounded annually. That was from 1972 to recent. Our argument is that studies before 1972 are flawed. That 9.5 was great considering there were several collapses of ~50 percent. However if you could just eliminate the collapses you could raise the return to 13.5 percent compounded annually.

Eliminating the down moves did not involve prescience. You did not need to forecast recessions, only identify them when you were in one. That was not difficult, and timing was not a critical as one might think. We identified several algos that worked well.

When you were out of equities, you could either simply hold cash, or go long the 10-year ETF. The bonds were better, but not by much. Interestingly, long term holding of bond ETFs yielded low single-digit returns. Best avoided. Which also means that the Markowitz 60/40 strategy was a sub-performer.

Taxes are investor/vehicle specific. For example, if you use a no-tax vehicle, there are no taxes. Regarding turnover, there are very few transactions, as there are very few recessions. The strategy is basically B&H, but with holidays.

Asindu Drileba has concerns: