Jan

21

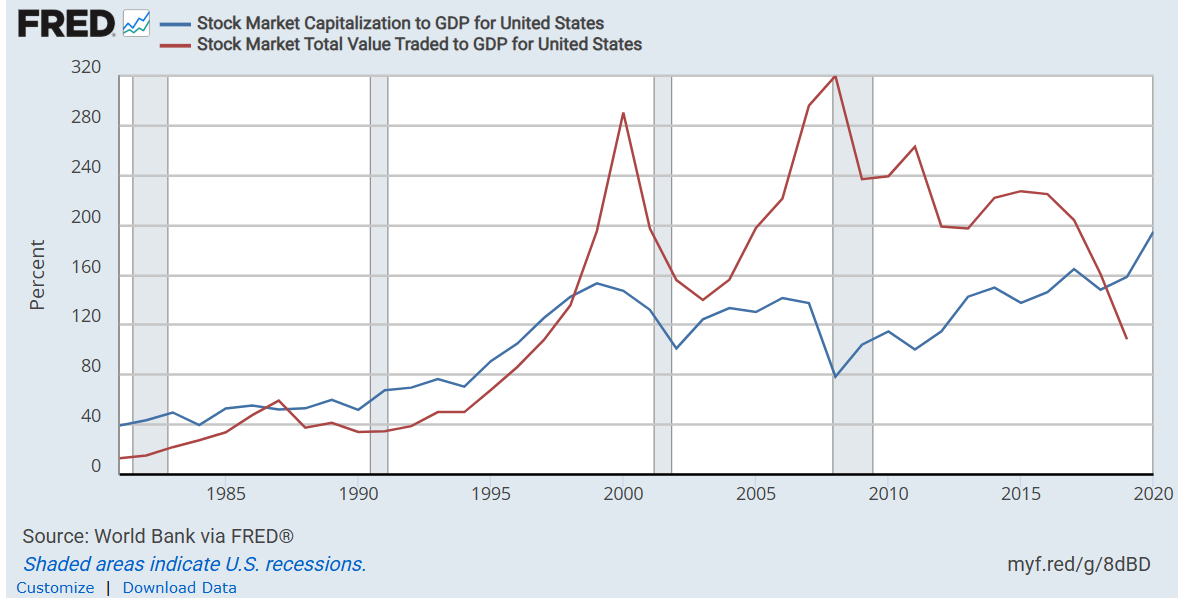

US Stock Mkt Value as pc of GDP (US), from Humbert X.

January 21, 2026 | Leave a Comment

Used to be like sub 50pc in the 1990 and now well over 200pc. Not meant to be of any value for speculation (would have been rubbish in the past and don't think any value for future). but one wonders what it does in terms of tension (internal/ external) as we as shareholders would not like to give back gains so easily (and there is the drift etc). Tricks to be used to keep it up - see v recent events- not judging here.

Larry Williams offers a chart:

Big Al wonders:

I wonder to what extent the decline in "Stock Market Total Value Traded to GDP" reflects a shift to dark-pool/off-exchange trading.

Peter Ringel writes:

TY Larry, great data! looks like we are severely undervalued. A 90s style party is coming.

@BigAl this too is a valid point. If founders don't go the exchanges anymore. Is there data on this off-exchange size? At least for their exit they will most likely show up in equities. Why should early backers not do this in the end? Its too juicy.

related: If off-exchange sector really gets dominant, then FED policy becomes even more toothless.

They have no tools to influence this.

Big Al asks Gemini:

In the US, how much stock trading occurs in dark pools or otherwise off exchanges?

Over 50% of all U.S. stock trading volume now occurs off-exchange, in venues such as dark pools and through internalizers at major firms, exceeding the volume on public exchanges for the first time in early 2025.

Overall Off-Exchange Volume: While dark pools specifically account for a smaller portion of the off-exchange activity (around 13% of consolidated turnover), the overall off-exchange market, including internalizers and bilateral trades, accounts for the majority of U.S. equity trading volume.

Purpose of Dark Pools: Dark pools and other off-exchange venues are primarily used by large institutional investors to execute big orders anonymously, which helps them avoid significant market impact and predatory high-frequency trading (HFT) strategies that can occur on public "lit" exchanges.

Regulatory Oversight: Despite their name, dark pools are regulated as Alternative Trading Systems (ATS) by the SEC and must report executed trades to regulators like the FINRA on a delayed basis.

Market Share Trends: Off-exchange trading share has been on a general upward trend for years, driven by the desire for better execution quality and anonymity. This shift has implications for traditional price discovery on public exchanges.

Steve Ellison does some analysis:

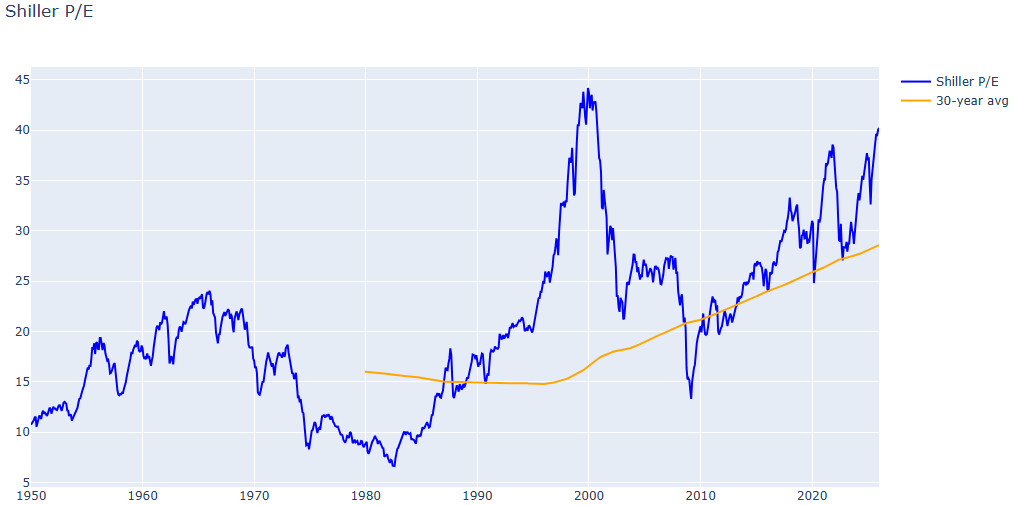

The Shiller Cyclically Adjusted Price Earnings (CAPE) ratio is at its second highest level in history, exceeded only in 1999-2000. What I find interesting is that the 30-year moving average of this ratio has nearly doubled since 1990. My theory is that permanently lower interest rates in an aging population support generally higher stock valuations than in past eras when large families were the norm.

And in the spirit of the old Spec List, here is the Python code I used (.text file) to generate this graph.

Big Al adds:

Another issue is the effect of Mag7 stocks which are global in a new way, beyond US GDP.

Jan

18

Traders and Art/Music, from N. Humbert

January 18, 2026 | Leave a Comment

Noticed many of my trading friends have an affinity for either ART or MUSIC or both (active or passive) It occurred to me the other day, that both offer ways to somewhat stay sane, it allows the adult to play and have some fun /relax.

Because society as a whole has something matrix like (going to school, learn about consensus reality, fill out the forms, get a BS job, keep up with the JONES, feel empty..) and this is a nice way to see beyond it and feel a bit at ease. That is all.

Here is a lovely Schubert piece. enjoy

Schubert, Trio No. 2, Op. 100, Andante con moto | Ambroise Aubrun, Maëlle Vilbert, Julien Hanck

Asindu Drileba responds:

Narrator: "Fate had already determined that he will die childless and penniless."

Epilogue: "It was in the reign of George III that the aforesaid personages lived and quarreled; good or bad, handsome or ugly, rich or poor, they are all equal now."

Whenever I hear that piece, I think of those words from Barry Lyndon. It was such a good "slice of life" type film.

Jeffrey Hirsch recalls:

Yale was quite a composer. I tried to produce the musical he wrote about the Elephant Man called Merrick & Melissa. But he was a better composer than I was a producer.

Jan

14

Manipulation, from Humbert X.

January 14, 2026 | Leave a Comment

The allegation of “manipulation” is inevitably just code for “I just badly hosed a trade that seemed so good on paper.” Whereas the proper response to a bad trade is introspection and examination of one’s system. In the markets as elsewhere, there can be a general tendency towards the rejection of personal responsibility. This regularly surfaces in the “manipulation” allegation.

William Huggins responds:

not an opinion on anyone's trading but there is a "fun" bit of psych referred to as the fundamental attribution error in which my successes are the result of hard work and skill while the success of others boils down to luck. similarly, when things go wrong for me, its bad luck (or nefarious forces, "them") but when things go wrong for others, its their bad choices or immorality. pretty much every single person falls into this trap unless they spend a great deal of effort fighting back against the heroic narrative.

Humbert X. comments:

I find it does me little good to think about others, other than to identify when they are travelling in a herd and at an extreme level of emotion, for contrarian purposes. Though sometimes it is possible to learn from their successes and failures assuming they are being transparent about what went right or wrong, which is rare.

Nils Poertner writes:

Good to read Hannah Arendt on this note (free floating anxiety within any society have to go somewhere and sinister groups will use it for their advantage - if not a virus, then some other "Country-" Phobia, then climate change etc… So it would not be enough to change politicians , the anxiety is within the masses (and mostly unconscious).

The key for a speculator is to travel light in life and take things with a bit of distance (2 inches are often enough) - and focus on the process of making money!

Jan

7

News, from Duncan Coker

January 7, 2026 | Leave a Comment

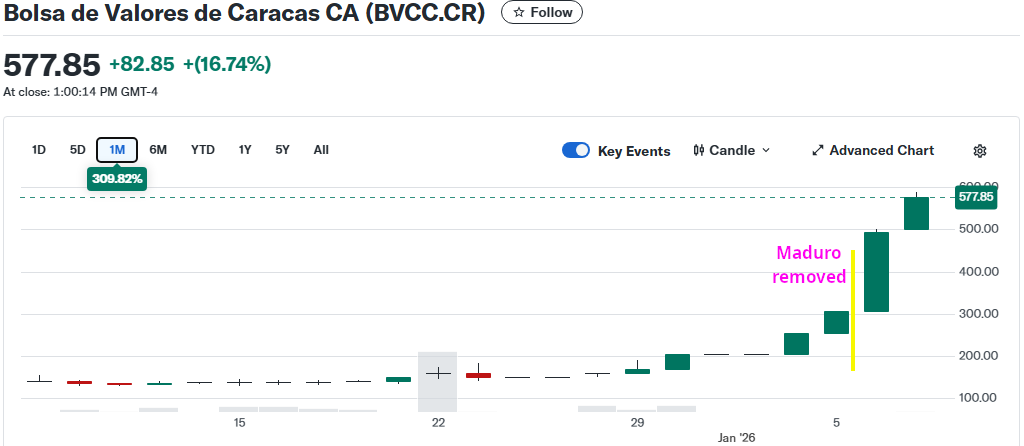

Interesting 40% move in Caracas stocks the days Before the capture. It is as if someone knew about the plans and acted on that information. News follows the markets as Larry has taught us.

Dec

30

Jobs: Rebirth, from Bill Rafter

December 30, 2025 | Leave a Comment

Monitoring the U.S. economy through job growth has been unusually difficult in recent months. Under normal circumstances, the labor data would offer a clean read on economic momentum. Instead, a politically driven government shutdown temporarily removed millions of workers from payrolls, distorting every major employment indicator. The strategy failed to achieve its political aims, but it forced millions of Americans to forgo paychecks until the shutdown ended—leaving analysts with a statistical mess to untangle.

The central question now is straightforward but critical: How much of the current job growth reflects genuine economic expansion, and how much is simply the reinstatement of furloughed workers—or seasonal part-time hiring for the holidays?

The next Non-Farm Payroll Report arrives Friday, January 2, 2026, and for the first time in months we may get a clearer signal. Our estimate points to a substantial increase in jobs, driven entirely by the behavior of Payroll Tax Receipts, which have long been our most reliable real-time indicator of labor market strength.

After a period of negative growth, Payroll Tax Receipts have turned sharply upward. As shown in the accompanying chart, the leading indicator (red line) has lagged the actual receipts (blue line) during the shutdown distortions, but is now crossing above and beginning to lead the series higher. This is not a temporary blip. It marks the beginning of a multi-year positive trend—one we forecasted months ago and which is now unfolding exactly as expected.

Our estimate for the January 2nd NFP Report: +162,000 jobs

If this projection holds, it will confirm that the underlying economy has regained its footing and that the Payroll Tax Receipt signal is once again pointing the way forward.

Sorry — 4.3% GDP Growth Isn’t Real

Several major outlets (Bloomberg, CNBC, Axios) recently reported that the U.S. economy grew at an annualized 4.3% pace in Q3 2025. The number comes from a delayed BEA release (12/23) that extrapolated partial quarterly data into an annual rate. But that headline figure simply doesn’t match real-time economic activity.

Payroll Tax Receipts Tell the Truth

Our most reliable indicator of economic momentum has always been Payroll Tax Receipts. They reflect actual wages and actual jobs — not model-based projections.

Here’s what the tax data shows:

During Q3 2025, Payroll Tax Receipt growth was never positive.

Annualized growth for the quarter averaged 1.42%, and that’s looking back over a full year.

Current annualized growth through Christmas 2025 is under 0.5%.

Those numbers are nowhere near 4.3%.

Why the BEA Estimate Misleads

The BEA’s figure is:

Annualized — multiplying a partial quarter by four

Distorted by the government shutdown, which delayed data collection

Contradicted by real-time tax flows that never showed a surge

Even the BEA notes this is an initial estimate, replacing two missed releases. It is unusually fragile and backward-looking.

Interpretations Will Vary — But the Data Doesn’t

Some may speculate that an unexpectedly high GDP print could influence monetary policy by suggesting renewed inflation pressure. Whether or not one believes that, the conclusion is straightforward:

The 4.3% GDP claim cannot be supported by real economic data.

Payroll Tax Receipts — the cleanest, least-manipulable indicator we have — show growth well under 1%, not 4%.

Larry Williams adds:

One of the best predictors of jobs is the stock market, which is also forecasting more people back to work.

Dec

26

Fantastic Veritasium video on power laws, from Asindu Drileba

December 26, 2025 | Leave a Comment

With direct application to speculation (featuring VC's):

You've (Likely) Been Playing The Game of Life Wrong

The world is not Normal.

Dec

24

Stubby Pringle’s Christmas, from Dailyspeculations

December 24, 2025 | 8 Comments

This is one of my favorite stories. I hope you enjoy it, and I wish you a Merry Christmas. — Victor Niederhoffer

This is one of my favorite stories. I hope you enjoy it, and I wish you a Merry Christmas. — Victor Niederhoffer

High on the mountainside by the little line cabin in the crisp clean dusk of evening Stubby Pringle swings into saddle. He has shape of bear in the dimness, bundled thick against cold. Double stocks crowd scarred boots. Leather chaps with hair out cover patched corduroy pants. Fleece-lined jacket with wear of winters on it bulges body and heavy gloves blunt fingers. Two gay red bandannas folded together fatten throat under chin. Battered hat is pulled down to sit on ears and in side pocket of jacket are rabbit-skin earmuffs he can put to use if he needs them.

Stubby Pringle swings up into saddle. He looks out and down over worlds of snow and ice and tree and rock. He spreads arms wide and they embrace whole ranges of hills. He stretches tall and hat brushes stars in sky. He is Stubby Pringle, cowhand of the Triple X, and this is his night to howl. He is Stubby Pringle, son of the wild jackass, and he is heading for the Christmas dance at the schoolhouse in the valley.

[For the entire text of the story, please follow this link].

Dec

23

Force of destiny

December 23, 2025 | Leave a Comment

force of destiny sp at 7000 now at 6900.

Dec

22

Bitcoin Historical Drawdowns, from Cagdas Tuna

December 22, 2025 | 1 Comment

It will be the first time mainstream institutions, such as ETFs, banks etc. are so heavily involved with this asset class if it is repeating the historical pattern.

Cycle 1 (2010 - 2013)

• Peak: December 2013

• Drawdown: 93% from ATH

Cycle 2 (2014 to 2017)

• Peak: December 2017

• Drawdown: ~86-87% from ATH

Cycle 3 (2018 to 2021)

• Peak: November 2021

• Drawdown: ~75-77% from ATH

Cycle 4 (2025 to ???)

• Peak: October

• Drawdown: 30% from ATH for now

If 70-80% drawdown repeats, Bitcoin will be below 40000 and Crypto Treasury geniuses will be meeting with Trump for a bailout! But Who will bailout Trump?

Dec

22

Tales from the pit, from Jeff Watson

December 22, 2025 | Leave a Comment

Chuck Proctor (video interview)

In this episode of In The Harbor, we sit down with Chuck Proctor, a seasoned spread trader specializing in 30-year Treasury bond futures. Chuck takes us through his remarkable rise on the trading floor—from starting as a runner, to becoming a clerk, and ultimately earning his place as a local trader.

Together, we revisit the golden era of open-outcry pit trading: the chaos, the camaraderie, the competition, and the moments that shaped a generation of traders. Chuck shares firsthand stories of what it was like to survive—and thrive—in an environment built on instinct, speed, and human connection.

We then shift to the present day to examine the “death of the pits” and the takeover of markets by computers and algorithms. Chuck offers candid insights on how the culture of trading has evolved, what was lost, and where opportunity still exists for those willing to adapt.

Dec

20

Low range of S&P

December 20, 2025 | Leave a Comment

amazingly low range of sp last 2 months with half of all prices in 6800 handle and sd of 9.

Dec

16

Oil at $55

December 16, 2025 | Leave a Comment

oil at $55 a barrel. all inflation numbers very bull for S&P and USD. definitely deserving of a rate reduction. except for chance gardner posturing.

Dec

4

A large piece of history from the age of sail

December 4, 2025 | Leave a Comment

The Battle of Trafalgar and the Ensign of the San Ildefonso: A Testament to Naval Supremacy

The Battle of Trafalgar, fought on October 21, 1805, marked a defining moment in history, securing Britain’s unchallenged supremacy as a naval power. Under the brilliant leadership of Admiral Horatio Nelson, the British Royal Navy triumphed over a larger Franco-Spanish fleet, despite being outnumbered in both manpower and firepower. This clash not only demonstrated tactical brilliance but also symbolized the resilience and innovation of the British naval force.

One of the most remarkable artifacts from this legendary battle is the massive ensign flown by the Spanish warship San Ildefonso. This flag, an enduring symbol of Trafalgar's legacy, provides an extraordinary glimpse into the scale and intensity of 19th-century naval warfare.

Measuring an astonishing 33 feet wide and 47.5 feet long, the San Ildefonso’s flag is a colossal piece of history. Made of wool, it served as the ship’s battle ensign—a flag so large that it could be seen through the dense smoke of cannon fire, ensuring that allies and enemies alike could identify the ship’s status.

Nov

30

Sometimes those elevator door buttons actually work, from Henry Gifford

November 30, 2025 | 1 Comment

Once upon a time I measured how much electricity it takes to ride on an elevator – I measured about 50 elevators – and seem to be the only person who ever measured that and got the results published. Before, there were numerous scholarly papers published on elevator energy use, all guesses or estimates or computer models (same thing), very “scholarly” because they had footnotes referencing other published guesses and because you paid a lot of money for someone to do that “research”. Several multinational elevator companies were selling energy efficient elevators, but none of the companies knew how much energy a ride took – they had “data” on how much their elevator used in one year vs. an ordinary elevator – an unspecified number of rides, unspecified number of stops (floors), unspecified weight in the cab, etc. All just made up “data”. Surprise, none of the manufacturers wanted me to measure their elevator.

Read the full post with additional comments.

Nov

28

Lucky charms, from M. Humbert

November 28, 2025 | Leave a Comment

Anyone have any favorite good luck charms/rituals to help with trading results?

Peter Ringel writes:

some of the old floor traders, we had on this list, reported how superstitious some of the traders were. Cloths, bathroom time…

Asindu Drileba comments:

Lucky charms may sound delusional but they are actually more common than we think. They are more like placebos. I take pill X, my headache goes away. (But pill X is made from wheat flour and a bitter "filler" and has exactly zero pharmaceutical contents, yet it works).

Have you ever pushed the button that opens the door of an elevator? Well, those buttons are completely fake! Elevator doors are pre-programmed to open and close at hard coded intervals. Pushing the button does nothing. They simply exist to give people a sense of control.

Nils Poertner writes:

To have a strong belief one can learn (from mkts or others) is a good start.

ie allowing for mistakes to happen, not fretting them. (many cultures are guilt-ridden, like the German culture on so many fronts. All it takes is sometimes to muster up enough courage and learn from mistakes and don't judge).

Zubin Al Genubi offers:

I'm reading Kidding Ourselves, Hidden Power of Self Deception, by Hallinan, in which he describes real physical and psychological effects of psychosomatic causes such as death, hallucinations. You see what you want to see. You are and become what you believe yourself to be. It affects health, performance, money. He also describes how a feeling of lack of control can be debilitating and even deadly. Some feel a lack of control in that they don't control the market, but one can easily (physically at least) click the keys to buy and sell any time.

From scientific studies: Our results suggest that the activation of a superstition can indeed yield performance-improving effects.

Nov

13

The $38 Trillion Question, from Humbert X.

November 13, 2025 | Leave a Comment

The $38 Trillion Question: An Interview with Stanford Professor Hanno Lustig

Hanno Lustig: I started thinking about the valuation of government debt by looking at the valuation of all Treasuries. What do we have to believe to get to a number like $38 trillion? You must believe there will be a huge fiscal correction, because ultimately the value of debt should be backed by future primary government surpluses. When you do the numbers, you realize that either bond investors are pricing in a huge fiscal correction that seems impossible, or Treasuries are significantly overpriced.

Carder Dimitroff notes:

The interest on debt is approaching $1 trillion per year and continues to compound. Interest costs currently exceed Department of Defense spending.

Larry Williams disagrees:

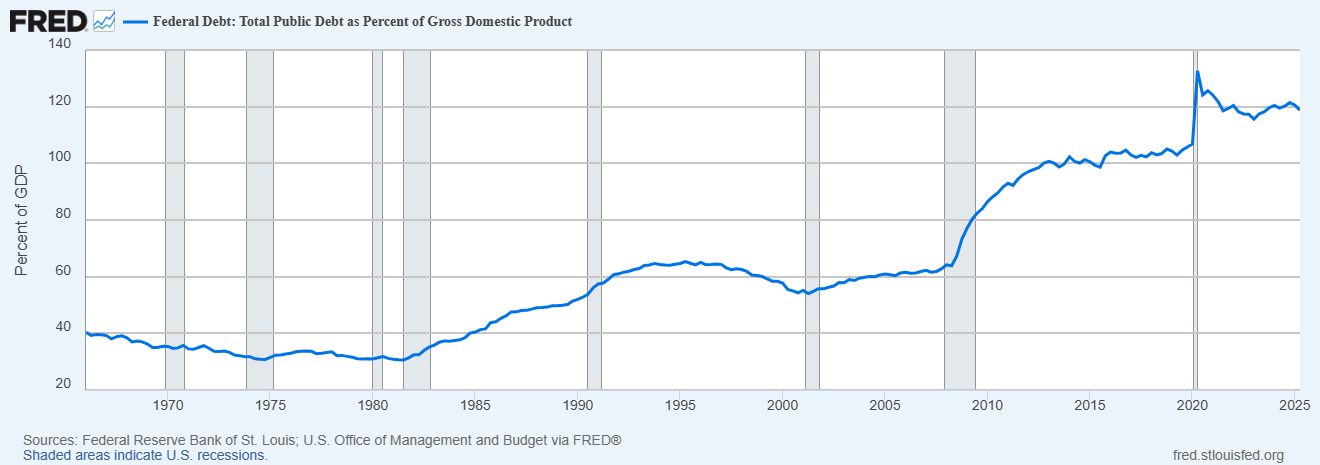

Meaningless measure look at debt vs gdp

Carder Dimitroff responds:

Yes, that makes sense. However, from a different perspective, it becomes meaningful under the One Beautiful Budget Bill when automatic sequestrations are implemented. Unless new legislation is passed, sequestrations will result in Medicare cuts and other reductions in expenditures. Current projections suggest sequestration will present in early 2026.

Big Al checks with FRED:

Nils Poertner writes:

recession + zero short term rates + lots of QE ….leading to a lot more public debt

maybe that is more likely path.

Stefan Jovanovich offers some history:

This chart shows the solvency ratios that can be found from the Census and other data [by decade 1880 to 2020] - how much "we the people" have in money divided by how much the American governments promise to pay.

Nov

12

David Hand’s probability lever, from Nils Poertner

November 12, 2025 | Leave a Comment

intellectual support / motivation to look at more extreme scenarios from time to time (extreme only appearing in the moment of course).

Hand writing: The Improbability Principle

The law of the probability lever is to do with choosing models. With poor assumptions even highly likely events can seem very improbable. Small changes in initial conditions can have an extremely large effect on outcomes.

Nov

11

Deutsche Bank sums it up, from Humbertus B.

November 11, 2025 | Leave a Comment

Long-Term Asset Return Study - The Ultimate Guide to Long-Term Investing

This study examines how asset classes have performed across a wide range of macroeconomic, policy, and valuation environments. Drawing on data that in some cases stretches back to the 18th century, we analyse both nominal and real returns to understand how different assets have behaved under varying conditions. We explore correlations with key drivers such as real and nominal GDP growth, inflation, interest rates, bond yields, debt and deficit levels, and more — with the goal of helping investors tilt the odds in their favour.

Nov

10

Best indicators for inflation, from Asindu Drileba

November 10, 2025 | Leave a Comment

The more goods cost, the more money visa makes since the fees they charge Issuing banks & acquiring banks are based on a percentage basis. So, higher prices (inflation) –> better predicted revenues for Visa? Inspired by a nice documentary on the history of VISA.

I wonder what the best indicator for inflation would be for testing this? CPI? Oil?

Cagdas Tuna writes:

I was thinking as to find a similar indicator for economic slow turn, spending cuts. It came to my mind to follow sales slips. I live in Malta which is a very tech friendly country for spending habits such as Apple/Google Pay availabilities, many digital banks access etc. I often asked if I need a receipt that I usually don’t. It depends for every country but if there is a rule for stores/restaurants to keep at least a copy for each transaction then it might be the indicator to follow. It might be used for inflation as well but of course needs detailed information.

Pamela Van Giessen comments:

To the best of my knowledge, merchants are not required to keep receipts. We track each sale but it will be the credit card processor or platform such as Square that holds the credit card or Apple or Google pay receipts. I can’t imagine that merchants would be willing to share their sales data. I know I wouldn’t.

Visa doesn’t care how much goods cost. They get their nearly 3% processing fee (+ .10 or .15 per transaction) whether there are 20 transactions for $100/ea or 40 transactions for $50/ea. In fact, they make more $ on a higher volume of transactions.

I don’t think tracking Visa or MC, etc could be a meaningful prediction of inflation as all the credit card companies continuously fight for market share. Note that they all send out multiple credit card offers to everyone all the time. Then, you have a store like Costco that only accepts their credit card (Citibank).

Additionally, there are people who use primarily cash. Those $ would be left out. You may say that cash use is low, and maybe it is. What I can tell you is that today at a market 80% of my sales were cash and that was likely the case for all the other merchants at this market. Older people especially use cash a lot. Just like drug dealers.

I have a theory that the cash economy is much bigger than everyone thinks. Insight into that might be more interesting.

Carder Dimitroff responds:

After considering Panela's cash sales point, I remembered that several companies required customers to switch from credit card payments to bank transfers. Additionally, several small establishments offer incentives for customers to pay in cash. They may be attempting to simplify their accounting and tax reporting. I do know that the federal government has immediate access to individual credit card transactions.

Pamela Van Giessen adds:

I thought it was the Fed that used to report on aggregated credit card data.

The other challenge with using credit card financials is that the credit card processors raise their % cut all the time. This is not due to actual inflation; it is due to them having a government protected moat that allows them to take more and more whenever they want because merchants are stuck with the whole system and consumers don’t realize that they will pay for the service — in increased prices. Every time Square, PayPal, etc., send me notices that they will be increasing fees, I increase my prices. I guess that is a kind of proxy for inflation but it’s a lousy sort of financial market induced inflation not based on anything more than their desire for more profits. I am all about free markets but the credit card processing biz is not even close to a free market.

The government using credit card processing to surveil us may be one reason I see more and more people using cash.

Larry Williams suggests:

Stock market is good predictor of inflation.

Nov

9

Prestigious consulting firm, from Nils Poertner

November 9, 2025 | Leave a Comment

Came to our financial firm 2007 and gave a 100 page presentation full of bullet points and cartesian logic (why housing boom will last). Either 3,5, or 9 bullet points per page.

At the end of the presentation I was tempted to go over to the presenter and ask him "why do you love your wife? (I didn't). The answer might have been bullet points.

Pamela Van Giessen writes:

Michael Korda tells in his memoir, Another Life, of the time that Simon & Schuster hired probably the same prestigious consulting firm to study how to improve revenues/profitability. Prestigious consulting firm (after taking the prestigious consulting firm fee) told the publishing company that they should publish more bestsellers.

Laurel Kenner comments:

I bet the prestigious firm concluded with ‘Key Takeaways’ as a final insult to the intelligence of the client.

Asindu Drileba writes:

I heard that people pay consultancy firms not for their knowledge, but for the fact that executives use them as a scape goat. If an executive wants to pursue policy X. They simply hire a consultancy to recommend policy X. If policy X ends up as a disaster (legally, morally or financially). They can simply say "Policy X was an idea from XYZ consultancy", we had nothing to do with it.

Peter Ringel adds:

a variation of this are fighting owners/ partners about policy. If decision pipelines are blocked, external council is used. Like a neutral arbitrator. I think, these are the main situations externals are used. Usually a good reason to short the entity, especially outside of markets. If they don't have the capability to decide and act on strategy in-house, it‘s a red flag.

Henry Gifford responds:

Even better is hiring a licensed engineer to instruct everyone to do something stupid that they know won’t work, so everyone who did as the engineer decided is blameless.

Jeff Watson offers:

A consultant is a person who knows 1000 ways to make love to a woman…..but he doesn’t know any women.

Nov

8

Tevye the Dairy Man

November 8, 2025 | Leave a Comment

"Tevye the Dairy Man" - one of my favs in High school.

In those days I was not the same person I am now. That is, I was the same Tevye, but different. As they say, the same old woman but under a different veil was then - may this never happen to you - as poor as poor can be, although, to tell the truth, I am by far no rich man today. You and I together should this summer earn what I would need to be as rich as Brodsky, but as compared to those days I am today a well-to-do man with my own horse and wagon, with a couple of, knock on wood, milch cows and another cow that is due to calve any day now. It would be a sin to complain, we have cheese and butter and fresh cream every day, all earned with our own labor, we all work, nobody is idle. My wife, bless her, milks the cows, the children carry the jugs and churn the butter, while I myself, as you see, drive to the market early every morning and call at every Boiberik dacha. I get to meet this person, that person, all the important people from Yehupetz, I chat a while with them and this makes me feel that I am also worth something in the world, that I am, as they say, no "lame tailor".

Tevye the Dairyman and the Other Stories, by Sholom Aleichem.

Nov

7

Ten days since an ATH

November 7, 2025 | Leave a Comment

10 days since all-time high. very bullish.

Steve Ellison comments on CAPE:

[Click chart for original post on X.]

6637-6660 is an important level for the ES December contract; not breaching this level (yet) in today's selloff is short-term bullish in my opinion, but the second highest valuation in history means the longer-term risk is high.

And I'm not sure exactly what the "rolling historical average" is, but by my calculation, the 30-year average CAPE is 28, which might make 40 somewhat less overvalued.

Nov

6

Percentages versus discrete values, from Duncan Coker

November 6, 2025 | 1 Comment

I notice how journalist select for stories to use percentages versus discrete values to server their own interests and the "public" is easily confused. Today, they pick the number nearing 1T to describe Mr. Tesla's pay which seems high. But they could have framed the story as he could be raising his ownership to 12% to 25% of a company he founded. Not much of a story there. Other places like crime statistics they usually go with the %. As in violent crime has risen 100%, this could mean 1 homicide to 2. Without the data with percent's the conclusions are obfuscatory. Percents can never go down more than 99.9%, but they can rise by an infinite amount. This fact also leaves much room for spurious selection.

Nov

4

Edmund Clarence Stedman, from Stefan Jovanovich

November 4, 2025 | Leave a Comment

Edmund Clarence Stedman was the editor of this history, The New York Stock Exchange, quoted below on this site.

From Grok:

Edmund Clarence Stedman (1833–1908) was a prominent American poet, literary critic, and essayist, often dubbed the "Bard of Wall Street" for his successful dual career in literature and finance. Born in Hartford, Connecticut, on October 8, 1833, he was orphaned young after his father's death from tuberculosis and raised by relatives. He briefly attended Yale University (expelled after two years but later honored with a degree) before launching into journalism in the 1850s, working for outlets like the New York Tribune and New York World, including as a Civil War correspondent. He studied law and briefly served as private secretary to U.S. Attorney General Edward Bates.

Connection to the New York Stock Exchange

Stedman's ties to the New York Stock Exchange (NYSE) spanned over three decades, from 1865 to 1900, where he worked as a banker and stockbroker on Wall Street. This financial role provided stability amid his literary endeavors, allowing him to support his family while pursuing poetry and criticism. After retiring from the Exchange in 1900, he remained deeply involved in its institutional history. In 1905, at age 71, he served as editor of the landmark publication The New York Stock Exchange: Its History, Its Contribution to National Prosperity, and Its Relation to American Finance at the Outset of the Twentieth Century, a comprehensive two-volume work commissioned by the Stock Exchange Historical Company. Co-edited with Alexander N. Easton and others, it chronicled the NYSE's evolution from its founding in 1792 under the Buttonwood Agreement through its role in American economic growth. The book, limited to 3,000 copies (with a rare signed edition of 50 for select members), is a key historical resource on early 20th-century finance.

Literary and Other Achievements

Parallel to his NYSE career, Stedman produced influential works like Poems, Lyrical and Idyllic (1860), Victorian Poets (1875), and massive anthologies such as A Library of American Literature (1888–1890, 11 volumes) and An American Anthology (1900). He also dabbled in science, proposing an early rigid airship design in 1879. Elected to the American Academy of Arts and Letters in 1904, he died in New York City on January 18, 1908, from heart disease, survived by two sons.

Nov

2

Optimism fulfilled

November 2, 2025 | Leave a Comment

The New York Stock Exchange

Its history, its contribution to national prosperity, and its relation to American finance at the outset of the twentieth century

Edmund Clarence Stedman, Editor

Stock Exchange Historical Company

New York, 1905

From the preface:

The present writer remembers the impression left upon an educated Englishman, a well-known publicist, who made a visit to Wall Street some eighteen years ago. He had been taken through the largest commercial structures in the vicinity, and even to the Stock Exchange itself, without giving expression to unusual interest. But on returning to his friend's offices, upon the upper floor of a building in the rear of the Exchange, he saw a sight that instantly gave him a realization of the extent of our peopled territory, and of the meaning of the Stock Exchange as the focus to which all currents of American purpose and energy converge. It was shortly before the time when the wires of New York's electric system were buried, by enactment, out of sight. Through the air, over New Street, hundreds, seemingly thousands, of these wires stretched toward the Exchange. No bird could fly through their network, a man could almost walk upon them; in fact, they darkened the street and the windows below their level. The visitor's host suggested that those going north, west, south were carrying messages to and from scores of inland cities and towns — financial ganglia of this land of national wealth and effort — names of which were mentioned. Certain wires were transcontinental, communicating with the towns of the Pacific States. Others served the uses of Montreal, Toronto and kindred points in the Great Dominion. Finally, the competing ocean cables were of course laden with incessant "arbitrage" and other messages to and from London, Paris and Berlin. This ocular demonstration of the relations of the New York Exchange to the Republic in its entirety, and even to the world overseas, proved almost startling to the English traveller. He asserted that within this central field of financial energy and intercommunication it was impossible not to have the imagination aroused, and the reason convinced of the enormous interests of which Wall Street, through its representative Exchange, is the ceaseless regulator. With philosophic impartiality, he predicted the time when even the largest money centres of the old world would become more or less subsidiary to this dominant market of the Western hemisphere.

Oct

30

Demand, Supply, and Electricity Prices, from Carder Dimitroff

October 30, 2025 | Leave a Comment

Funded by the U.S. Department of Energy, five scientists associated with California's Lawrence Berkeley National Laboratory claim that data centers are not a significant cause of retail electricity price increases. Counterintuitively, they suggest that data centers could have a beneficial effect in lowering costs. But more research is needed.

Factors influencing recent trends in retail electricity prices in the United States

Summarizing their "Ten Key Findings":

4.1. National-average retail electricity prices have tracked inflation in recent years.

4.2. State-level retail electricity price trends vary widely.

4.3. Residential customers and investor-owned utilities experienced greater increases.

4.4. Load growth has tended to depress retail electricity prices in recent years.

4.5. Behind-the-meter solar was associated with higher prices.

4.6. Utility-scale wind and solar are not—alone—broadly related to recent price increases.

4.7. State renewables portfolio standards are associated with recent price increases.

4.8. Exposure to natural gas price risk increases electricity prices when gas prices rise.

4.9. Hurricanes, storms, and wildfires have increased retail prices.

4.10. Several other variables appear to have limited statistical explanatory power.

Oct

29

An attempt

October 29, 2025 | Leave a Comment

An attempt by chair to halt margin of victory in 2026 for opposition.

Oct

29

The latest from Laurel Kenner

October 29, 2025 | 1 Comment

70++ Trades the Miners

Laurel Kenner

When China suggested Oct. 9 it would strangle rare earth metal exports to the U.S., U.S. mining stocks looked like the easiest way to make a killing since the Internet bubble in 1999.

Being arrogant enough to believe myself among the few who saw the opportunity, I bought a mining stock targeted by Goldman Sachs for a 100% gain.

The stock rose. Then swooned. I sold.

It quickly rose past the earlier high. I bought again. It tumbled below where I had sold the first time.

Greed had led me to forget old investment wisdom. Such as a warning against trying to get even, from Max Gunther’s 1985 “The Zurich Axioms.” Entitled “Stubbornness”, the 11th Major Axiom accurately describes my trade.

I also should have remembered advice from Nick Colas, head of DataTrekResearch, who made his bones at Credit Suisse and Steve Cohen’s SAC Capital. It’s my job, he explained years ago, to know things before they land in the media.

Meaning that if someone is giving tips to news outlets, keep in mind that he inevitably will take better care of his interests than yours.

Read the full post:

Oct

28

Entertaining valuation exercise, from Big Al

October 28, 2025 | Leave a Comment

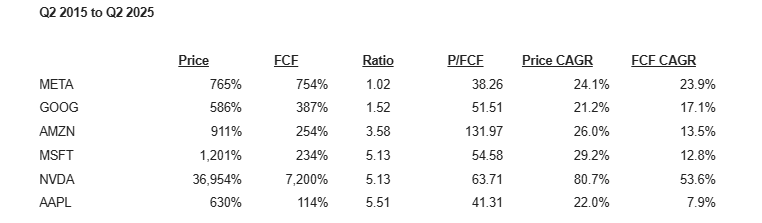

Looking at some of the megacaps and comparing their share price growth and FCF growth between Q2 2015 and Q2 2025. The price/FCF figures are the most recent.

Oct

27

State debt, from Jeff Watson

October 27, 2025 | Leave a Comment

Here’s an interesting breakdown and analysis of the debt of individual states. All the usual subjects are near the top.

Report ranks every state’s debt, from California’s $497 billion to South Dakota’s $2 billion

State governments had $2.7 trillion in debt at the end of 2023, a new Reason Foundation analysis finds. This state debt is equivalent to approximately $8,000 per person nationally.

On a per capita basis, Connecticut had the highest state debt, with $26,187 of debt per state resident at the end of 2023. With $22,968 in debt per resident, New Jersey was the only other state with more than $20,000 in liabilities per capita.

Reason Foundation finds 13 states—Connecticut, New Jersey, Hawaii, Delaware, Illinois, Massachusetts, Wyoming, Alaska, North Dakota, California, Washington, New York, and Vermont—had more than $10,000 in debt per resident.

Oct

26

The forgotten janitor who discovered the logic of the mind, from B. Humbert

October 26, 2025 | Leave a Comment

AI relevant:

Finding Peter Putnam

The forgotten janitor who discovered the logic of the mind

Every game needs a goal. In a Turing machine, goals are imposed from the outside. For true induction, the process itself should create its own goals. And there was a key constraint: Putnam realized that the dynamics he had in mind would only work mathematically if the system had just one goal governing all its behavior.

That’s when it hit him: The goal is to repeat. Repetition isn’t a goal that has to be programmed in from the outside; it’s baked into the very nature of things—to exist from one moment to the next is to repeat your existence. “This goal function,” Putnam wrote, “appears pre-encoded in the nature of being itself.”

Stefan Jovanovich offers, with a bit of irony:

From Grok:

Peter Putnam (1927–1987) was an American physicist and theoretical neuroscientist whose work anticipated many modern concepts in cognitive science, artificial intelligence, and philosophy of mind. He studied under prominent figures like Albert Einstein, Niels Bohr, and John Archibald Wheeler, and his ideas influenced early developments in computational theory of mind, though he remained largely unpublished and obscure during his lifetime. Putnam's writings, now digitized and discussed in recent scholarship (particularly following the 2025 rediscovery and publication of his papers), propose a functional model of the nervous system that integrates physics, game theory, and neuropsychology. His theory emphasizes how the brain achieves order and learning through mechanisms like Hebbian plasticity, distributed neural networks, and conflict resolution—ideas that predate similar concepts in predictive processing and reinforcement learning. Putnam's work is not a single, neatly packaged "theory of repetition" but rather a core principle woven throughout his model of cognition and behavior. Repetition serves as a foundational "goal function" for existence, learning, and induction (the process of generalizing from specific experiences).

Oct

25

Second favorite Hungarian, from Venkatesh Medabalimi

October 25, 2025 | Leave a Comment

György Buzsáki is my second favorite Hungarian [after Paul Erdős]. Brain Prize winner, he is from a later cohort. One of the few neuroscientists with a good theory for the Brain, a field that was ~mostly into measuring neural responses in parts of the brain to external stimuli and then telling a story around it. A great talk by him for the interested:

Ways to think about the brain: Emergence of cognition from action | ISTA Lecture with Gyorgy Buzsaki

Oct

24

The gentlemen don’t believe

October 24, 2025 | Leave a Comment

a new all time high at 6825 but the gentlemen don't believe it as it drops 20 points in the last 30 min.

Oct

24

Another Historical Analogy, from Stefan Jovanovich

October 24, 2025 | Leave a Comment

Grok and I have produced this summary of the growth of the electric utilities industry in the United States from 1910 to 1930. [Click on chart for full view.]

Bud Conrad comments:

Not sure what you take from this data. Electrification was probably more important than AI. Its growth rate was big at first in %, but slowed. Recessions were big downturns. What do you apply to today?

Steve Ellison writes:

My grandmother was a telephone operator in the 1920s. It was a high-tech industry at the time.

Carder Dimitroff clarifies:

The definition of an "electric utility" changed over time.

Big Al suggests:

An excellent series available on Prime:

Shock and Awe: The Story of Electricity

Professor Jim Al-Khalili tells the electrifying story of our quest to master nature's most mysterious force: electricity.

Books I haven't read yet, which get lots of stars:

The Power Makers: Steam, Electricity, and the Men Who Invented Modern America

The power revolution is not a tale of machines, however, but of men: inventors such as James Watt, Elihu Thomson, and Nikola Tesla; entrepreneurs such as George Westinghouse; savvy businessmen such as J.P. Morgan, Samuel Insull, and Charles Coffin of General Electric. Striding among them like a colossus is the figure of Thomas Edison, who was creative genius and business visionary at once.

Empires of Light: Edison, Tesla, Westinghouse, and the Race to Electrify the World

In the final decades of the nineteenth century, three brilliant and visionary titans of America’s Gilded Age—Thomas Edison, Nikola Tesla, and George Westinghouse—battled bitterly as each vied to create a vast and powerful electrical empire. In Empires of Light, historian Jill Jonnes portrays this extraordinary trio and their riveting and ruthless world of cutting-edge science, invention, intrigue, money, death, and hard-eyed Wall Street millionaires.

Oct

23

Regional US banks, from Nils Poertner

October 23, 2025 | Leave a Comment

As a European, I am asking: Are US regional banks in trouble (maybe even some larger banks - incl Investment banks). Dodgy consumer loans, then those silly "AI-related" loans? Am agnostic here - I suspect the typical analyst from JPM down the road won't enlighten us here.

Paul O'Leary comments:

No. Looks like over-reaction to a couple credit blips. Then algos pile on and observers who don’t follow the sector conjure up doom scenarios. Zion Bancorp - the main sinner, lost $1B in market cap for a $50mm write down.

Nils Poertner responds:

Hear you, Paul. If enough people would start to worry now, I would worry less (let us see).

Cagdas Tuna adds:

We are at a level any reaction will be exaggerated. If market adds $200bln to NVDA market cap with additional $1blnn revenue then $50m loss will have the same effect on a smaller company's share.

Oct

22

Government shutdown question, from Cagdas Tuna

October 22, 2025 | Leave a Comment

Are the furloughed government employees going to be counted as unemployed? I believe they will be which will be considered as a huge green light for 50bps rate cut in the December FOMC. This shutdown is the perfect storm for Trump’s “Fire Powell and get rates to 0%” scenario.

Bill Rafter responds:

The requirements for being “Unemployed” are that (a) the person is not working , and (b) that person is “looking for work”. I believe the latter qualification would disqualify those furloughed from being considered as unemployed. Not only the shutdown [will delay BLS releases], but the recently nominated BLS head, E.J. Antoni has withdrawn his name from nomination. So BLS is headless.

Alex Castaldo comments:

That is good news for all statisticians, I am sure he is a wonderful guy but he had a reputation for mistakes in calculations.

Oct

22

The Tipster

October 22, 2025 | Leave a Comment

The Tipster:

As he walked, a great sense of loneliness came over him.

He was back in Wall Street. At the head of the Street was old Trinity; to the right the subTreasury; to the left the Stock Exchange.

From Maiden Lane to the Lane of the Ticker — such had been his life.

"If I could only buy some Cosmopolitan Traction!" he said. Then he walked forlornly northward, to the great Bridge, on his way to Brooklyn to eat with Griggs, the ruined grocery-man.

from Wall Street Stories by Lefevre circa 1895 and similar to many who i've known and similar to many get-rich ads of today.

Oct

21

Oil and PPI

October 21, 2025 | Leave a Comment

correlation between the price move of oil in the last month and the ppi rep. it's hard to believe that any except chauncey chair would be worrying about inflation with oil at $56 per barrel.

Oct

21

Trading the transition to AV1, from Asindu Drileba

October 21, 2025 | Leave a Comment

AV1 is a new video compression format that may reduce the size of a video file by up to 50%. The big advantage is that videos will be up to half the size, with the exact same image and audio quality.

Two big consequences may ensue (when AV1 is fully adopted):

- Internet bills for streaming Netflix will reduce.

A 2 GB movie will only cost 1 GB from the perspective of a customer paying their Internet Service Provider. So more frequent subscriptions?

- Netflix will cut its bandwidth costs by 50%. So the profit margin (respective to bandwidth costs) will go up by 50% if users fully adopt AV1?

Currently, AV1 is only available on select hardware chips (listed table on Wikipedia) Maybe as users get new devices, use of AV1 will grow. This will likely happen gradually over several years (maybe half a decade). But an obvious winner would be Netflix & YouTube (Google Stock). Maybe bandwidth is so cheap it won't make a dent in the business revenues? But all major companies seem very enthusiastic about implementing AV1. Maybe bandwidth has it's (less talked about) variant of Moore's law. Where after a few years it gets easier to move stuff around the internet.

Cagdas Tuna wonders:

How many nuclear plants we need to feed that endless “technology”?

Nils Poertner asks:

How would you express this into a trade idea, Asindu? I find it easy to put ideas into a trade - it encourages deeper thinking and gives a feedback when wrong. eg, I was bullish housing London property 2007, but short-term it didn't really work out at all! longerterm yes. it was fuzzy thinking of my behalf.

Asindu Drileba answers:

Going long $NFLX since the business is largely about streaming video. The same pattern occurred in Tesla when the cost of efficient batteries dropped by like 90%. So margins automatically go up. (in theory) Tesla could have still gone under due to debt or something else. So, of course it may may fail (most likely)

Another big draw back is that such "qualitative" insights cannot be tested in the past. Maybe a good analogy would be to go long Starbucks $SBUX if you think the price of coffee wil drop the next 5 years by 50%.

So the ideas may be generalized to:

- Find key Ingredient company X uses in thier products

- Find out if the drop in key ingredient's price over 5 years improves profit margin over X years -> positively impacts stock prices.

This general idea, may then be tested across several industries for example:

- MacDonalds (drop in price of beef)

- TSMC, ASML, INTEL, NVDA (drop price of silver) as silver is very essential in chip manufacturing.

Hopefully testing this across multiple industries on different historical accounts may yield some consistent patterns.

Nils Poertner responds:

Good to write it down in a trading journal and look in a few months what happened. Started writing hand-written letters to friends now. In our digital age, everyone incl me, is going for speed, but deeper thinking - also quality in thinking /research is underrated. Intuitively speaking - we are prob getting some unexpected moves coming, as well.

Oct

20

Calming musical interlude for spicy markets, from Big Al

October 20, 2025 | 1 Comment

I first heard this piece as a teenager, sitting in the theater

watching Barry Lyndon, and I was transfixed:

The Messiaen Trio performs Schubert's Trio No. 2 in E-flat Major, D. 929

I did not know this Mendelssohn work until today and I wondered if

somebody said to her, "Oh yeah? Well, try it in heels!"

Yuja Wang Mendelssohn Songs Without Words Op 67 No 2

Peter Ringel writes:

my emergency high vola setup always includes Chopin. everything to stay off tilt.

Big Al responds:

Gotta love Chopin for the workday playlist.

Chopin: 24 Preludes, Op. 28, Vladimir Ashkenazy

Another discovery for me (fades out but still enjoyable):

Interpreti Veneziani, Antonio Vivaldi RV711 Gelido in Ogni Vena, Davide Amadio

Oct

19

Le Chiffre attacks, from Asindu Drileba

October 19, 2025 | Leave a Comment

In Casino Royal (2006) there is a speculator called Le Chiffre. He would manage money for war lords & other "underground" clients. He would take positions in markets, and then "manipulate them". For example in this clip, he takes a short position in an airlines company, then later bombs a plane belonging to it.

This year, I am starting to think that Le Chiffre is real. Someone opened a crypto account on Hyperliquid (decentralized exchange) and made an $88m profit from short positions that very day.

Cagdas Tuna responds:

Good catch! I have been reading these whales news since March-April 2025 mostly tied to Trump’s policy shifts. It is not difficult to guess who those Le Chiffres might be related to!

Peter Ringel writes:

I wanted to place 1 Nov in my calendar - as a new Mkt Risk date based on Trumps post. Only to realize, I placed this date regarding tariffs before. This makes this old news to some degree. And all of this is potentially an overreaction / a play.

Ed. - lagniappe: Forget Sean Connery, Watch James Bond Make His Real Debut on TV

Before Connery registered his license to kill in the 1962 hit Dr. No, millions of viewers were introduced to Barry Nelson’s “Bond, Jimmy Bond” in a 1954 episode of the CBS anthology series Climax! The show’s producers secured the rights to adapt Ian Fleming’s just-published debut Bond novel, Casino Royale, during their first season.

Since the Climax! version of Casino Royale is only 50 minutes, the plot has obviously been shortened considerably. And yet, if you’ve read the book or, more likely, seen the 2006 movie version that launched Craig’s Bond career, you’ll recognize the basic narrative, even though none of the familiar 007 flourishes are in place. In fact, Nelson doesn’t enjoy “00” status at all — he’s merely identified as a “Combined Intelligence” agent who is tasked with competing head-to-head against the mysterious Le Chiffre (Peter Lorre) in a rousing game of baccarat.

Jeff Watson does some research:

James Bond, the complete list…there are more than you think:

Please list every James Bond on film, TV, and radio. Grok: Alright, here goes-starting with the big-screen Bonds: Sean Connery, George Lazenby, Roger Moore, Timothy Dalton, Pierce Brosnan, Daniel Craig. Then David Niven in the 1967 spoof Casino Royale. On TV, there's Barry Nelson from a 1954 Climax! episode of Casino Royale. Radio Bonds? Bob Holness in a 1956 BBC Casino Royale adaptation, Tom Hiddleston in a 2014 Heart of the Matter series, and Toby Stephens in various BBC radio dramas.

Oct

18

Lessons from The Godfather

October 18, 2025 | 1 Comment

many accomlished and very successful specs and investors have told me that the most helpful book for the young spec to read is The Godfather (and the movies, part 1 and part 2). what advice would you say is the most helpful in these works?

one lesson that is very improtant is never interfere with a relative's marriage and never say anything bad about a relative's spouse.

family and loyalty are keys to success.

never let the others know what you are thinking. and above all never disagree with the boss in front of rivals.

Big Al adds:

The Offer is a really enjoyable derivative work.

Oct

17

George B Shaw, from Nils Poertner

October 17, 2025 | Leave a Comment

You see things; and you say 'Why?' But I dream things that never were; and I say 'Why not?'

- George Bernard Shaw

English Cyperpunk /hacker I met in 2005 had this quote on his screen - and I recall him talking about some digital ccy back then (little did I know back then, was so busy structuring CDOs and keeping up with the Jones.

If we want to nail mkts in coming years and have some fun, it def pays to surround ourselves with ppl outside trad finance (group think!) - from the art, music, acting world, hacker etc…whatever.

There is a certain type of fatalism in the West as well (David Hand, the British statistician, speaks about it as well in his "miracle" book. It has something to do how we perceive the world.)

Oct

16

Hubris is going to a New All Time High, from Sushil Kedia

October 16, 2025 | Leave a Comment

Saudi Arabia has announced the Rise Tower that is likely to have a height twice that of Burj Khalifa! 2000 meters up from the ground! It is likely to cost 5 Billion Dollars. One is left wondering in a world where everyone manages to almost manages to get decent enough sleep every night with Trillion Dollar deficits, what is Hubris doing having been left so far behind!

Nils Poertner writes:

Wondering what to make of this though, Sunil. Saudi Arabia's main stock Index (TASII peaked in 2006. and never fully recovered properly. Any idea how to express it into some trading idea so we can test our hypothesis?

William Huggins comments:

The 2006 Saudis run is very similar to the soul al manakh run up 20 years before. In particular for Saudis though, it's a market that forbid ahoet selling so when the bulls got started there was no guardrail until they simply could find no bigger fool.

Nils Poertner responds:

Thanks William. Maybe one needs to look at oil (bearish oil story?) - oil doesn't move forever and then it moves a lot. (not an oil trader though - just something that came to mind)

Alex Castaldo offers:

For those too young to remember the events of 1981:

The Souk al-Manakh Crash

From 1978 to 1981, Kuwait’s two stock markets, one the conservatively regulated “official” market and the other the unregulated Souk al-Manakh, exploded in size, growing to the point where the amount of capital actively traded exceeded that of every other country in the world except the United States and Japan. A year later, the system collapsed in an instant, causing huge real losses to the economy and financial disruption lasting nearly a decade. This Commentary examines the emergence of the Souk, the simple financial innovation that evolved to solve its rapidly increasing need for liquidity and credit, and the herculean efforts to solve the tangled problems resulting from the collapse. Two lessons of Kuwait’s crisis are that it is difficult to separate the banking and unregulated financial sectors and that regulators need detailed data on the transactions being conducted at all financial institutions to give them the understanding of the entire network they must have to maintain financial stability. If Kuwaiti officials had had transaction-by-transaction data on the trades being made in both the regulated and unregulated stock markets, then the Kuwaiti crisis and its aftermath might not have been so severe.

Oct

13

Advice from the past, from Humbert X.

October 13, 2025 | Leave a Comment

Stock market advice from 1944 - how would one test it?

This Is the Road to Stock Market Success

Page 30:

If one cannot profit by trading in the highest grade issues — one certainly cannot profit by trading in "cats and dogs". If our industrial giants cannot advance — what prospects arc there in the stability of others? Although this sounds logical there are exceptions, and the "time element" has much to do with the selection.

At the top of a Bull market, when uncertain as to whether the upward movement is exhausting itself or not, it is comparatively safer to have your money in investment, rather than speculative, issues. Of course, it is most advisable to be out of the market entirely at such periods. Investment stocks are not the leader in a Bear movement and, therefore, it is safer to have your money invested in this category — and to watch the market closely. If the speculative and "cheap" stocks begin to decline — you can still dispose of your investment issues without much loss — as they follow rather than lead the Bear movement. Likewise, when you note that investment stocks stand still — and "cats and dogs" or even the better grade issues advance — it should put you on your guard as the market may be "topping" and in line for a good reaction. The 1937 Bear market was foretold by investment stocks in November, 1936. They refused to go higher.

Larry Williams comments:

I learn so much from his writings, such as comparative strength and targets.

[Ed. - Note on the photo:

In 1943, when World War II came, Helen Hanzelin, a Merrill Lynch, Pierce, Fenner, & Beane telephone clerk, became the first woman to work on the NYSE Trading Floor.

Another three dozen women answered the country’s call to duty and filled vacant posts vacated by soldiers sent overseas on the trading floor but were booted out when the war ended, and men returned home.

Women of the New York Stock Exchange ]

Oct

12

Counting and measuring, from A. Humbert

October 12, 2025 | Leave a Comment

We use quantitative tools - "counting" - to measure and analyze markets, and I enjoy coming across scientific measurements that are new to me and also amazing in scope, such as the sverdrup. The sverdrup is a unit describing the volume of water transport in ocean currents. One sverdrup is a volume flux of one million cubic meters per second (1 Sv = 10^6 m^3 per second). Named after Harald Sverdrup.

From the web:

The strongest ocean current measured in sverdrups is the Antarctic Circumpolar Current (ACC), the largest and most powerful current system on Earth. The ACC is a wind-driven current that flows clockwise around Antarctica, uninterrupted by landmasses.

Measurements of the ACC's volume transport vary, but all figures show it is in a class of its own:

Estimates of the ACC's mean transport range from 100 to over 170 sverdrups (Sv). One study found an average transport of 173.3 Sv through the Drake Passage, the current's narrowest choke point. To put this in perspective, this is over 100 times the combined flow of all the world's rivers.

The graphic shows how relatively narrow the Drake Passage is.

We certainly measure volume in markets. Are there specific flows and currents? Choke points?

Asindu Drileba writes:

In a book recommended by The Chair, This is the Road to Stock Market Success, the author mentions that (paraphrased), "When the trading volume of a stock changes by a large amount, yet the price doesn't move by much, it is time to get out of the market."

Oct

9

Jewish Hungarian, from Nils Poertner

October 9, 2025 | Leave a Comment

What is it with Hungarian Jewish who came to the US - so many of them achieved great things. My book shelf is full of them, Darvas (Trading), S Meisner (Acting)…..even my trading platform Interactive Brokers was founded by one (Thomas Peterffy).

Maybe a combo of rare language ??/ culture + hardship first + grid + ability to flourish in the US gave them superpower. Soros, I guess was (Jewish) Hungarian as well.

Venkatesh Medabalimi asks:

Where is my no.1 Hungarian? May I remind everyone about Paul Erdős.

Laurel Kenner offers:

An amusing book on the subject: Made in Hungary : Or Made by Hungarians, by György Bolgár.

Nils Poertner responds:

Thanks both. Found this on Erdős:

Paul Erdős: The Oddball’s Oddball

He would appear on the doorstep of fellow mathematicians without warning–a frail, disheveled, elderly man, hopped up on amphetamines and wearing a ratty raincoat–and announce, in a thick Hungarian accent, “My mind is open.” For a day, or a week or a month, the man or woman who answered the knock would have to take nonstop care of this helpless guest who couldn’t figure out how to cut a grapefruit or wash his underwear–and in return would be permitted the exhausting, exhilarating experience of following the thought processes of Paul Erdős, the most prolific and arguably the cleverest mathematician of the century.

Oct

8

Charles Ranlett Flint

October 8, 2025 | Leave a Comment

a key figure of the 1900s, according to Sobel:

Charles Ranlett Flint (January 24, 1850 – February 26, 1934) was the founder of the Computing-Tabulating-Recording Company which later became IBM. For his financial dealings, he earned the moniker "Father of Trusts". He was an avid sportsman and member of the syndicate that built the yacht Vigilant, that was the U.S. defender of the eighth America's Cup and was the owner of the yacht Gracie.

Oct

7

Miscellany

October 7, 2025 | Leave a Comment

Asindu Drileba has been watching the Daily Spec calendar:

After being hammered in Aug, Orange did well in Sept. It transitioned to a positive day in the S&P 5/6 times.

Nils Poertner is getting wisdom from the classics:

The most certain sign of wisdom is cheerfulness.

- Michel de Montaigne

some type of cheerfulness def relevant for us in markets /trading - in particular when social moods go south / ppl fall for chatboxes (overuse it !) and confuse with reality etc.

Big Al is going for history:

This is the audio version:

The History of the United States Navy

but I am also watching the video version for free on Amazon Prime. The author:

Craig Lee Symonds (born 31 December 1946, in Long Beach, California) was the Distinguished Visiting Ernest J. King Professor of Maritime History for the academic years 2017–2020 at the U.S. Naval War College in Newport, Rhode Island. He is also Professor Emeritus at the U. S. Naval Academy, where he served as chairman of the history department. He is a distinguished historian of the American Civil War, World War II, and maritime history. His book Lincoln and His Admirals won the Lincoln Prize. His book Neptune: The Allied Invasion of Europe and the D-Day Landings was the 2015 recipient of the Samuel Eliot Morison Award for Naval Literature, and his book Nimitz at War: Command Leadership from Pearl Harbor to Tokyo Bay won the Gilder-Lehrman Military History prize.

Oct

5

The Pursuit of Wealth

October 5, 2025 | Leave a Comment

The Pursuit of Wealth by Robert Sobel is a quirky but informative history of wealth creation, introducing such things as the use of ice, and beer, and cattle as drivers of wealth. there is a very good discussion of the start of Merrill Lynch, also the history of IBM.

An epic saga that recounts the turbulent history of money. The Pursuit of Wealth is a fascinating 5,000 year journey through the evolution of money and investing. From risk versus return in Mesopotamia through today's rough-and-tumble, high-stakes stock markets, this behind-the-scenes tale will intrigue both financial historians and history-minded investors alike.

The Ancient World — The Imperial Age of Alexander and Rome — The European Middle Ages: The Birth of a New Economic Age — The Italian Bankers and their Clients — The Atlantic Age — Europe's American Empires — The English Advantage — The American Paths to Wealth — Industrial Wealth — The Mechanization of Agriculture — Infrastructure and Wealth — Emperor Wheat and King Cotton — Gold, Silver, and the Civil War — The Impact of the Transcontinentals — The Arrival of Big Business — The Government-Industrial Complex, 1914-1929 — The Great Bull Market of the 1920s — The Old and the New in Post-World War II America — The Revival of the Securities Markets — Creating Wealth During the Great Inflation — The Democratization of Wealth.

Oct

3

Where am i wrong, from Larry Williams

October 3, 2025 | 2 Comments

Zero sum game: for every $ that wins the same amount will be lost. REALLY? you bought at 7 sold to me at 10 I sell at 20 and the contract goes off the board and delivered at 22 who lost? We lost that we could have made more $$ but where is a net loss?

Steve Ellison comments:

Adverse selection can make us all feel like losers. If I sold at 10, I should have held to 22. Or I should have put on more size. If I bought at 7, and it went to 5, that would have been even worse.

Jeff Watson goes literary:

But Yossarian still didn't understand either how Milo could buy eggs in Malta for seven cents apiece and sell them at a profit in Pianosa for five cents.

[ … ]

Milo chortled proudly. "I don't buy eggs from Malta," he confessed… "I buy them in Sicily at one cent apiece and transfer them to Malta secretly at four and a half cents apiece in order to get the price of eggs up to seven cents when people come to Malta looking for them."

"Then you do make a profit for yourself," Yossarian declared.

"Of course I do. But it all goes to the syndicate. And everybody has a share. Don't you understand? It's exactly what happens with those plum tomatoes I sell to Colonel Cathcart."

"Buy," Yossarian corrected him. "You don't sell plum tomatoes to Colonel Cathcart and Colonel Korn. You buy plum tomatoes from them."

"No, sell," Milo corrected Yossarian. "I distribute my plum tomatoes in markets all over Pianosa under an assumed name so that Colonel Cathcart and Colonel Korn can buy them up from me under their assumed names at four cents apiece and sell them back to me the next day at five cents apiece. They make a profit of one cent apiece, I make a profit of three and a half cents apiece, and everybody comes out ahead."

Oct

2

Academic panic

October 2, 2025 | Leave a Comment

a tragedy from not followinig drift

UChicago Lost Money on Crypto, Then Froze Research When Federal Funding Was Cut

While Stanford responded to the federal funding research freeze by halting administrative hiring and protecting research, the University of Chicago panicked.

Oct

1

Lebanon, from Nils Poertner

October 1, 2025 | Leave a Comment

Lebanese traders from the 1980s tell me how chaotic that decade was - high vol ever day - for yrs. Survival was key! Started reading every bit about it in the last few weeks. (The thing that Stefan is right about is that the self-image we have in West and realtiy - there is a huge gap for sure!! Am not speaking about military though - I meant anything else)

The Lebanese Economic Crisis: How It Happened; the Challenges that Lie Ahead

September 27, 2021

Lebanon is experiencing one of the worst economic collapses in recent history. The currency has lost more than 90 percent of its value; an estimated three in four Lebanese citizens are now below the poverty line, and the country is beset by food, gas, and medical shortages. The power grid can barely maintain electricity for cities, with frequent blackouts occurring. Finally, the country had to default on its debt payment, launching its debt crisis. The debt crisis didn’t come suddenly, but was building up over time due to economic decisions made by previous governments. To understand how this crisis came to be, an examination of Lebanon’s modern history is in order, starting with the civil war in 1975.

Larry Williams writes:

Chaotic? In 1973 Shearson AmEx had me go there to lecture an teach trading - some high flyer commodity mooches had come in and lost lots of $$ for some locals who did not understand margin calls. The high flyers from Chicago were found gutted on a barb wire fence out in the country! The war broke out we could not get out for about a week so hung low then finally bribed our way home.

Nils Poertner responds:

my 2 cents are on Larry and all savvy Lebanese traders going forward. Good idea to live in more rural areas in the US, UK etc to see things unfolding as well. And keeping the internal chatter to a minimum (as always).

Stefan Jovanovich analogizes:

If LW disagrees, he will, I hope, correct this latest folly from the List's history channel wannabe. The reason the Oregon Trail came first was that it was the one safe destination for the missionaries. The Indians of the rain forest coastal Northwest were the tribes with no history of revolt against the Brits, Russians and Americans. The wars on the Plains started when some smart money decided that they could colonize the spaces between Council Bluffs and the Dalles. That analogy comes to mind every time I look at the modern history of the adventures of the Americans in Lebanon.

Larry Williams offers:

My brother on law who is better read than I am an a deeper thinker says this is a good read on the western adventure:

The Undiscovered Country: Triumph, Tragedy, and the Shaping of the American West

Sep

29

Declines from 20-day highs

September 29, 2025 | Leave a Comment

since 01-01-2001 there have been 6341 days where the sp was open — on 1303 of those days, sp closed at 20-day high.

535 of those days witnessed a decline in sp from a 20-day high 5 days ago, a highly bullish event.

Sep

28

Scaling problems in ship design, from Nils Poertner

September 28, 2025 | Leave a Comment

Scale effects and full-scale ship hydrodynamics: A review

Scaling problems in ship design refer to the difficulties of translating performance data from a small-scale model to a full-scale ship, as physical forces like viscosity and wave drag do not scale proportionally with size.

Crypto space here? Trading strategies that work in niche mkts or early on, may not work when they are larger /more mature etc.

Henry Gifford writes:

The problems with water include the size of water droplets – they won’t form larger than a certain size – and Reynolds Number, which has to do with viscosity (mentioned below), and how to calculate it. Basically, a certain flow velocity in a small pipe (or river) will be turbulent, while in a larger pipe it might not.

Movies that use models of ships to show dramatic events with ships always show water droplets that are way, way too large, making it obvious to those who notice that they are looking at a model.

Nils Poertner responds:

Makes a lot of sense, Henry, thanks! (Equity sell-side analysts love to scale things (to the point it makes no sense anymore). Wile E. Coyote moment for NVDA et al coming soon perhaps.

Stefan Jovanovich predicts:

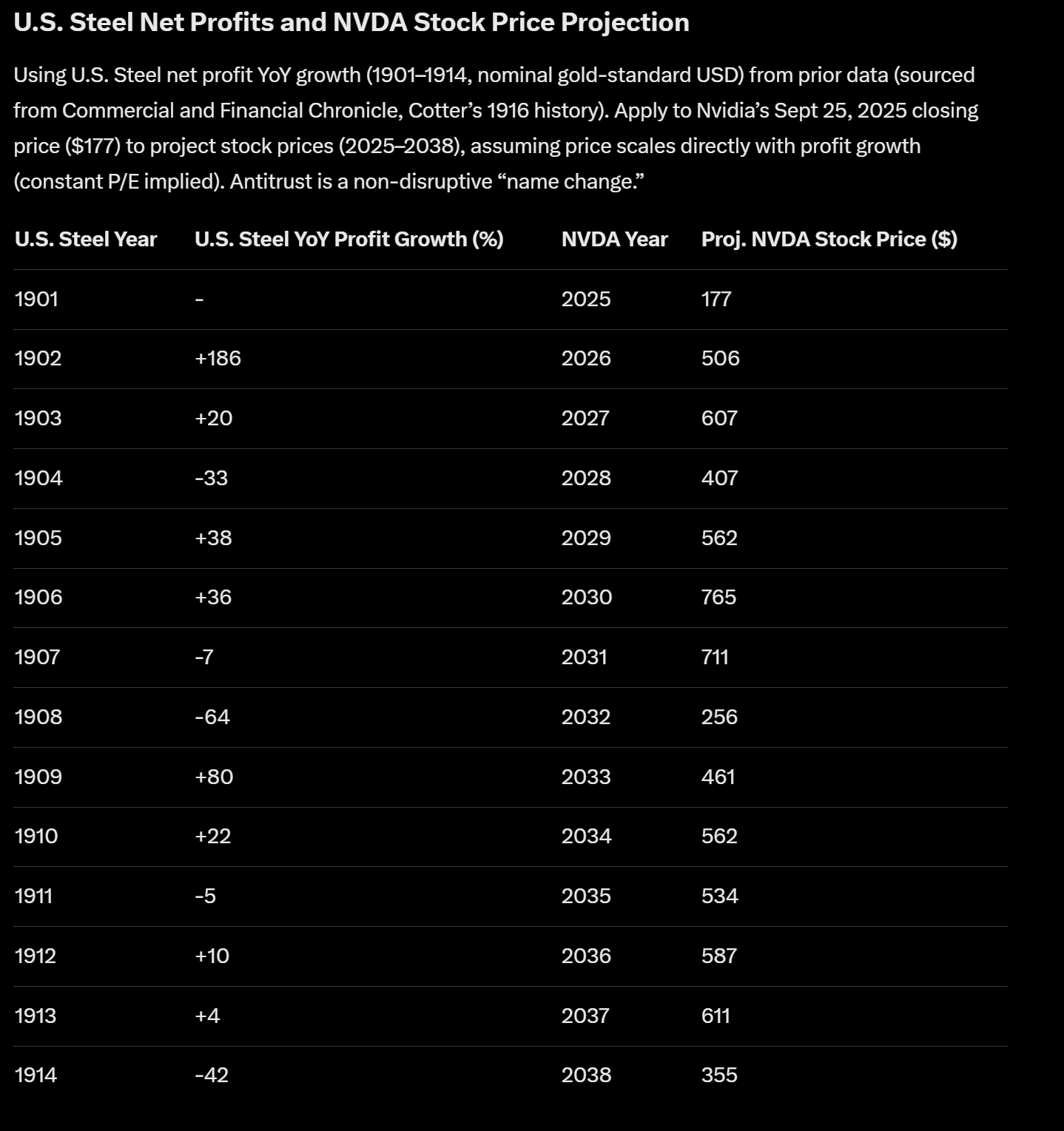

Grok - our FO's new member (he/she/it works for free like Harry Potter's Dobby) - thinks the moment will be 2031-32. [Click on chart at right.] We take the current AI events as a direct comparison to the creation of U.S. Steel.

Sep

27

An increase in output bearish?

September 27, 2025 | Leave a Comment

what is the evidence that an increase in output, e.g., gdp, is bear for sp? (aside from ignoramos at fed)

[as of Friday, 26 Sept] it's been 5 days since last all-time high on sep 21 at 2712.

Sep

26

A clever counting device, from Humbert B.

September 26, 2025 | Leave a Comment

The Curta is a very clever counting device as demonstrated in this video.

It was invented by Curt Herzstark.

In 1943, perhaps influenced by the fact that his father was a liberal Jew, the Nazis arrested him for "helping Jews and subversive elements" and "indecent contacts with Aryan women" and sent him to the Buchenwald concentration camp. However, the reports of the army about the precision-production of the firm and especially about the technical expertise of Herzstark led the Nazis to treat him as an "intelligence-slave".

Inevitably, one comes back around to the abacus:

Learning how to calculate with the abacus may improve capacity for mental calculation. Abacus-based mental calculation (AMC), which was derived from the abacus, is the act of performing calculations, including addition, subtraction, multiplication, and division, in the mind by manipulating an imagined abacus. It is a high-level cognitive skill that runs calculations with an effective algorithm. People doing long-term AMC training show higher numerical memory capacity and experience more effectively connected neural pathways. They are able to retrieve memory to deal with complex processes. AMC involves both visuospatial and visuomotor processing that generate the visual abacus and move the imaginary beads. Since it only requires that the final position of beads be remembered, it takes less memory and less computation time.

Sep

25

Insights from A Year in the Maine Woods

September 25, 2025 | Leave a Comment

A Year in the Maine Woods insights: "whenever i have an idea, i must act on it as soon as possible. conditions are never ideal, and if one waits long enough for ideal conditions, then the hypothesis slips away."

"Of all the animals that migrate, we are surely among the most restless. But humans retain the influence of the geophysical habitat in which they pass their formative years. And often, it seems we are drawn back to our childhood homes, if not physically then mentally; it not out of love, then out of curiosity; if not by necessity, then by desire."

you often get more insights from nature about markets than from markets themselves.

[Below from the Author's Note - Ed.]

By the time I was ten years old, I had lived for six years as a refugee in a northern German forest. My family survived on very little. But I had a lot — I had a pet crow, and I could collect beetles. Sometimes lately I have begun to wonder if it is still possible to taste the world up close as I did as a child. I long to see nature again as I did then — fresh, clear, timeless, and shrouded in magic. Would it be possible to rediscover the vividness that I now experience only as brief, tantalizing flashbacks?

Sep

23

Health care costs, from Nils Poertner

September 23, 2025 | Leave a Comment

health care costs, our Achilles heel.

Health Insurance Costs for Businesses to Rise by Most in 15 Years

Insurers say that the rising premiums are driven by growing healthcare costs

(on a personal note: no-one is really fully healthy, not even kids normally! science uses a lot of Aristotelian logic (which is an either/or logic) but there are limits to it - and we take it way beyond its usefulness. Nature does not have those clear mental compartments - it is way more fluid /dynamic).

Steve Ellison writes:

Until the public announcement that Warren Buffett had bought shares in UnitedHealth, health care was by far the worst performing of the 11 S&P 500 sectors in 2025.

Nils Poertner responds:

Yes, the whole sector / subindex looks bullish (XLV). (the type of logic in the West (logic from Aristoteles) that dominates MODERN SCIENCE cripples our society. Why? Because in many cases, whatever the doctor says, "it is not" - it is only an image of something abstract (like the apple painting by Rene Magritte).

Pamela Van Giessen comments: