Feb

5

Gaming tournament going on between AI versions, from Big Al

February 5, 2026 | Leave a Comment

Liv Boree, poker pro, interviews Deep Mind guy:

Why Google Made ChatGPT, Gemini & Claude Play 900,000 hands of Poker…

…before going on to earn a First Class Honours degree in Physics with Astrophysics at the University of Manchester. During this time she played lead guitar in heavy metal bands Dissonance and Nemhaim and modelled for a number of alternative clothing brands such as Alchemy Gothic.

Victor Niederhoffer comments:

especially if you live in denmark

Feb

1

Does January predict the next 11 months?, from Big Al

February 1, 2026 | Leave a Comment

In this quick study the answer is no.

Jeffrey Hirsch has a different take:

From my newsletter issue published last night:

Jan

21

US Stock Mkt Value as pc of GDP (US), from Humbert X.

January 21, 2026 | Leave a Comment

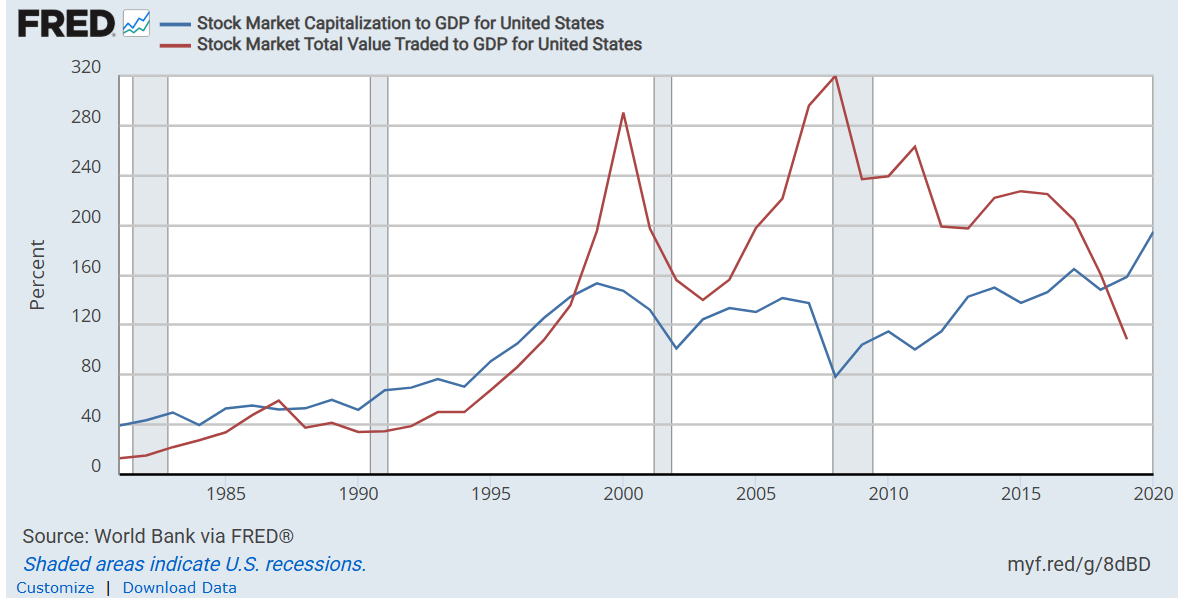

Used to be like sub 50pc in the 1990 and now well over 200pc. Not meant to be of any value for speculation (would have been rubbish in the past and don't think any value for future). but one wonders what it does in terms of tension (internal/ external) as we as shareholders would not like to give back gains so easily (and there is the drift etc). Tricks to be used to keep it up - see v recent events- not judging here.

Larry Williams offers a chart:

Big Al wonders:

I wonder to what extent the decline in "Stock Market Total Value Traded to GDP" reflects a shift to dark-pool/off-exchange trading.

Peter Ringel writes:

TY Larry, great data! looks like we are severely undervalued. A 90s style party is coming.

@BigAl this too is a valid point. If founders don't go the exchanges anymore. Is there data on this off-exchange size? At least for their exit they will most likely show up in equities. Why should early backers not do this in the end? Its too juicy.

related: If off-exchange sector really gets dominant, then FED policy becomes even more toothless.

They have no tools to influence this.

Big Al asks Gemini:

In the US, how much stock trading occurs in dark pools or otherwise off exchanges?

Over 50% of all U.S. stock trading volume now occurs off-exchange, in venues such as dark pools and through internalizers at major firms, exceeding the volume on public exchanges for the first time in early 2025.

Overall Off-Exchange Volume: While dark pools specifically account for a smaller portion of the off-exchange activity (around 13% of consolidated turnover), the overall off-exchange market, including internalizers and bilateral trades, accounts for the majority of U.S. equity trading volume.

Purpose of Dark Pools: Dark pools and other off-exchange venues are primarily used by large institutional investors to execute big orders anonymously, which helps them avoid significant market impact and predatory high-frequency trading (HFT) strategies that can occur on public "lit" exchanges.

Regulatory Oversight: Despite their name, dark pools are regulated as Alternative Trading Systems (ATS) by the SEC and must report executed trades to regulators like the FINRA on a delayed basis.

Market Share Trends: Off-exchange trading share has been on a general upward trend for years, driven by the desire for better execution quality and anonymity. This shift has implications for traditional price discovery on public exchanges.

Steve Ellison does some analysis:

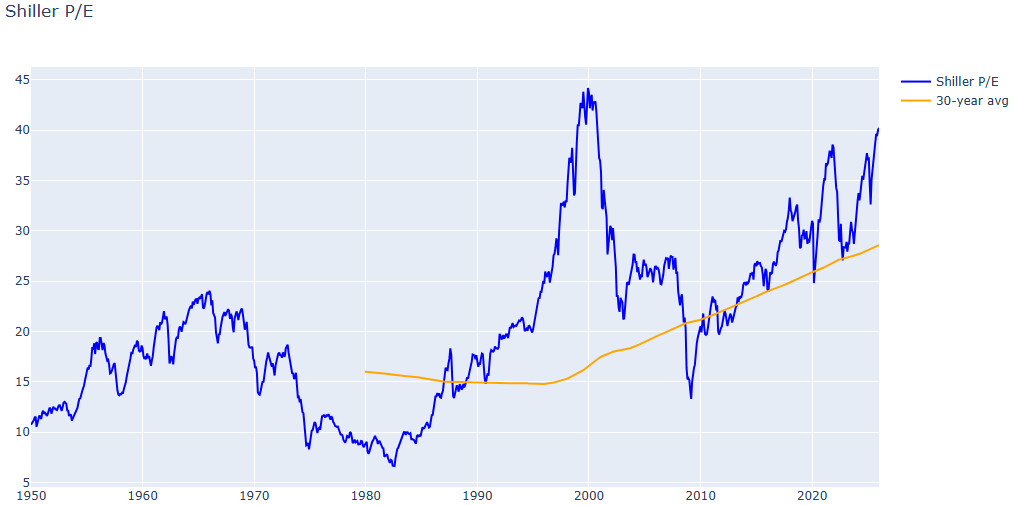

The Shiller Cyclically Adjusted Price Earnings (CAPE) ratio is at its second highest level in history, exceeded only in 1999-2000. What I find interesting is that the 30-year moving average of this ratio has nearly doubled since 1990. My theory is that permanently lower interest rates in an aging population support generally higher stock valuations than in past eras when large families were the norm.

And in the spirit of the old Spec List, here is the Python code I used (.text file) to generate this graph.

Big Al adds:

Another issue is the effect of Mag7 stocks which are global in a new way, beyond US GDP.

Jan

8

Relevant animal behavior study, from Big Al

January 8, 2026 | Leave a Comment

Self-control is definitely an issue in trading! I kept thinking of the crayfish pov. They probably shined him up by telling him he was "preferable".

Can this Cuttlefish Pass an Intelligence Test Designed for Children?

Nils Poertner responds:

Very good. For specs / traders the self-control is tested now with media trying to steal our energy (emotional vampires) with high amygdala stories - whereas the mkts does whatever it does. "get the joke"

Dec

9

Interesting AI read, from Big Al

December 9, 2025 | Leave a Comment

The Structural Collapse: How Google’s Integrated Stack Is Dismantling the OpenAI Thesis

Shanaka Anslem Perera

Nov 22, 2025

A leaked internal memo reveals the tectonic shift reshaping artificial intelligence, where platform economics are defeating venture-backed innovation at the exact moment markets assumed the opposite.

Carder Dimitroff writes:

My Australian daughter is a Google employee. She recently completed Google's 3-month AI training program in the US. From what I understand, Google's AI capabilities are big. When demonstrated to Google's large-cap clients, they were surprised.

Based on her comments, I've concluded that AI technologies will displace accountants, engineers, lawyers, financial analysts, medical staff, educators, sales, and more.

Obviously, leaders in those disciplines will continue to do well. While most normal positions can be eliminated, there must be a human somewhere in the mix. There's an ongoing need to manage the architecture of the questions and review AI responses. Anyone who wants to remain in the game may wish to develop expertise in leadership, program management, systems management, and communication.

Then again, there will be an ongoing need for the crafts. They will reap while others weep.

Musk is right. Work will become optional. But he was not the first.

Nov

17

Corporate earnings, from Zubin Al Genubi

November 17, 2025 | Leave a Comment

I see they are down [at least through Q2]:

FRED: Corporate Profits After Tax (without IVA and CCAdj)

Steve Ellison responds:

Interesting. S&P 500 earnings per share were up both year to date and year over year. And Q3 so far looks better than Q2.

S&P source spreadsheet: Click link to download file: S&P 500 Earnings.

Big Al wonders:

So maybe the big firms are doing better than the smaller ones?

Nils Poertner remembers:

Investment Bank earnings 2007…My very cerebral friend Maurice at the time: "IBs are cheap - look at their PE ratios."

Nov

13

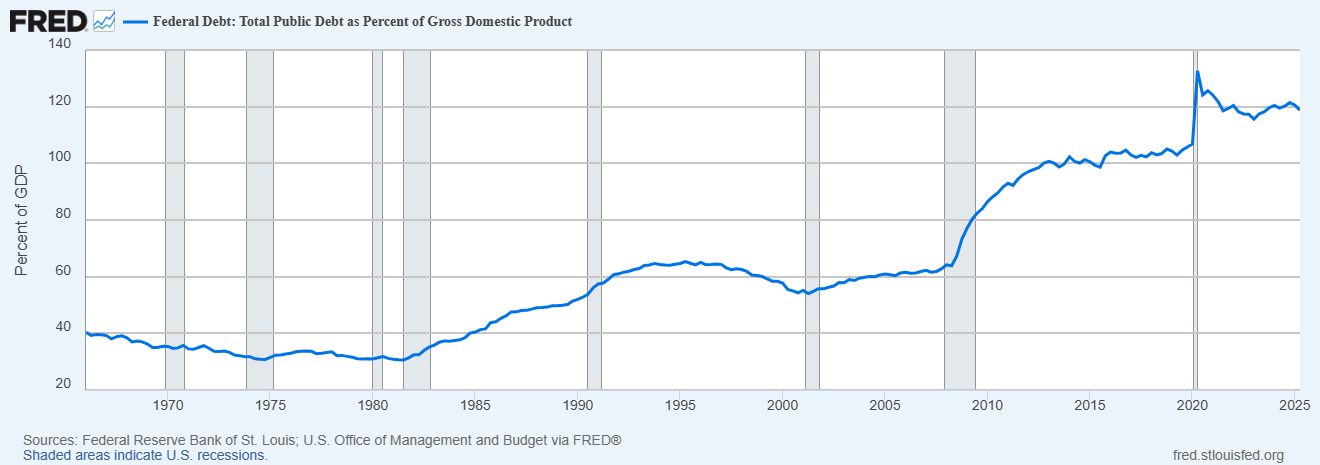

The $38 Trillion Question, from Humbert X.

November 13, 2025 | Leave a Comment

The $38 Trillion Question: An Interview with Stanford Professor Hanno Lustig

Hanno Lustig: I started thinking about the valuation of government debt by looking at the valuation of all Treasuries. What do we have to believe to get to a number like $38 trillion? You must believe there will be a huge fiscal correction, because ultimately the value of debt should be backed by future primary government surpluses. When you do the numbers, you realize that either bond investors are pricing in a huge fiscal correction that seems impossible, or Treasuries are significantly overpriced.

Carder Dimitroff notes:

The interest on debt is approaching $1 trillion per year and continues to compound. Interest costs currently exceed Department of Defense spending.

Larry Williams disagrees:

Meaningless measure look at debt vs gdp

Carder Dimitroff responds:

Yes, that makes sense. However, from a different perspective, it becomes meaningful under the One Beautiful Budget Bill when automatic sequestrations are implemented. Unless new legislation is passed, sequestrations will result in Medicare cuts and other reductions in expenditures. Current projections suggest sequestration will present in early 2026.

Big Al checks with FRED:

Nils Poertner writes:

recession + zero short term rates + lots of QE ….leading to a lot more public debt

maybe that is more likely path.

Stefan Jovanovich offers some history:

This chart shows the solvency ratios that can be found from the Census and other data [by decade 1880 to 2020] - how much "we the people" have in money divided by how much the American governments promise to pay.

Oct

28

Entertaining valuation exercise, from Big Al

October 28, 2025 | Leave a Comment

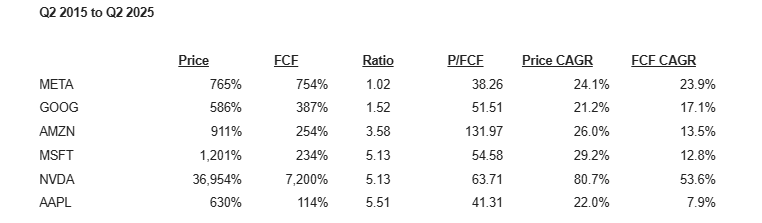

Looking at some of the megacaps and comparing their share price growth and FCF growth between Q2 2015 and Q2 2025. The price/FCF figures are the most recent.

Oct

24

Another Historical Analogy, from Stefan Jovanovich

October 24, 2025 | Leave a Comment

Grok and I have produced this summary of the growth of the electric utilities industry in the United States from 1910 to 1930. [Click on chart for full view.]

Bud Conrad comments:

Not sure what you take from this data. Electrification was probably more important than AI. Its growth rate was big at first in %, but slowed. Recessions were big downturns. What do you apply to today?

Steve Ellison writes:

My grandmother was a telephone operator in the 1920s. It was a high-tech industry at the time.

Carder Dimitroff clarifies:

The definition of an "electric utility" changed over time.

Big Al suggests:

An excellent series available on Prime:

Shock and Awe: The Story of Electricity

Professor Jim Al-Khalili tells the electrifying story of our quest to master nature's most mysterious force: electricity.

Books I haven't read yet, which get lots of stars:

The Power Makers: Steam, Electricity, and the Men Who Invented Modern America

The power revolution is not a tale of machines, however, but of men: inventors such as James Watt, Elihu Thomson, and Nikola Tesla; entrepreneurs such as George Westinghouse; savvy businessmen such as J.P. Morgan, Samuel Insull, and Charles Coffin of General Electric. Striding among them like a colossus is the figure of Thomas Edison, who was creative genius and business visionary at once.

Empires of Light: Edison, Tesla, Westinghouse, and the Race to Electrify the World

In the final decades of the nineteenth century, three brilliant and visionary titans of America’s Gilded Age—Thomas Edison, Nikola Tesla, and George Westinghouse—battled bitterly as each vied to create a vast and powerful electrical empire. In Empires of Light, historian Jill Jonnes portrays this extraordinary trio and their riveting and ruthless world of cutting-edge science, invention, intrigue, money, death, and hard-eyed Wall Street millionaires.

Oct

20

Calming musical interlude for spicy markets, from Big Al

October 20, 2025 | 1 Comment

I first heard this piece as a teenager, sitting in the theater

watching Barry Lyndon, and I was transfixed:

The Messiaen Trio performs Schubert's Trio No. 2 in E-flat Major, D. 929

I did not know this Mendelssohn work until today and I wondered if

somebody said to her, "Oh yeah? Well, try it in heels!"

Yuja Wang Mendelssohn Songs Without Words Op 67 No 2

Peter Ringel writes:

my emergency high vola setup always includes Chopin. everything to stay off tilt.

Big Al responds:

Gotta love Chopin for the workday playlist.

Chopin: 24 Preludes, Op. 28, Vladimir Ashkenazy

Another discovery for me (fades out but still enjoyable):

Interpreti Veneziani, Antonio Vivaldi RV711 Gelido in Ogni Vena, Davide Amadio

Sep

11

Power Laws in Economics and Finance, from Big Al

September 11, 2025 | Leave a Comment

Gappy (Giuseppe Paleologo) posted this on X, and it prompted me to wonder if a power law would apply to the skill differences and win rates of tennis players viz their rankings. Need to find some easily accessible data for that. And of course, how PLs apply to the distribution of returns with the S&P 500 in a given time period. But could it be predictive?

Power Laws in Economics and Finance

Xavier Gabaix, Stern School, NYU

A power law (PL) is the form taken by a large number of surprising empirical regularities in economics and finance. This review surveys well-documented empirical PLs regarding income and wealth, the size of cities and firms, stock market returns, trading volume, international trade, and executive pay. It reviews detail-independent theoretical motivations that make sharp predictions concerning the existence and coefficients of PLs, without requiring delicate tuning of model parameters. These theoretical mechanisms include random growth, optimization, and the economics of superstars, coupled with extreme value theory. Some empirical regularities currently lack an appropriate explanation. This article highlights these open areas for future research.

Asindu Drileba writes:

One of the funniest commodities traded in Uganda (my country) is Vanilla. The price fell from, $156 per kilo, to $1.14 per kilo. A -99% drop during the 2020 covid lock down.

Vanilla cultivation is special in that it can't be farmed mechanically.

- It only flowers once a year

- The flower is only open for 24 hours in one year

- It can only be hand pollinated

- If you miss those 24 hours in one year, your done, wait for the next season.

So a lot of the cultivation is by small "artisanal" farmers.

Madagascar produces close to 80% of the world's vanilla. All other countries produce the rest. So its a power law distribution. The smallest hiccup in Madagascar can cause the vanilla price to skyrocket or drop.

I think power laws outside prices (like supply chains of vanilla) can be used to predict what asset, commodity or instrument will be volatile (large moves both up & down). I think these underlying setups in assets are what echo as power law distributions into prices.

Sep

6

The Evolution of Infantry War-Fighting, from Stefan Jovanovich

September 6, 2025 | Leave a Comment

The greatest single success of the Japanese Army in WW 2 - the capture of Singapore - came directly from the use of bicycles as the primary means of troop transport.

From the Army and Navy Journal of 1896

BICYCLE “CORPS,” 25TH Inf

2d Lieut. James A. Moss, U.S.A., Commanding

The Bicycle Corps of the 25th. U.S. Inf., under the command of 2d Lieut. James. A. Moss, appears to have had a very successful, but very fatiguing, trial in their recent expedition from Fort Missoula, Mont., to test the bicycle for military purposes.

The corps left Fort Missoula Aug. 15 with rations, rifles, cooking utensils, shelter tents, ammunition, extra bicycle parts, repair material, etc., etc. They reached Fort Harrison on the 17th, having covered 132 miles in 22 hours of actual travel. They got new rations at Harrison and left for Yellowstone at noon Aug. 19, reaching Mammoth Springs, Wyo., at 1:30 Aug. 23. The distance of 101 miles was made in 31 hours of actual traveling. So far they had traveled in 53 hours of actual traveling, 323 miles of the hilliest and rockiest roads in the United States, fording streams, going through sand, mud, over road ruts, etc. Every day, except only one, they had wind against them. Aug. 25 the corps left for a days’ trip through the park.

When they left Fort Missoula, their lightest wheel [i.e., bicycle] packed, weighed 64 pounds, the heaviest 84 pounds, an average of 77½ pounds; the lightest wheel with rider, weighed 205 pounds, the heaviest, 272 pounds. The wheel used was the 26-pound Spalding bicycle, geared to 66½. The weights of the members of Bicycle Corps were as follows: Lieut. Moss, 135 pounds; Corp. Williams, 153½; Musician Brown, 145½; Pvt. Proctor, 152; Pvt. Findley, 183½; Pvt. Foreman, 160; Pvt. Haynes, 160; Pvt. Johnson, 151½.

Previous to making this trip, Lieut. Moss made a preliminary excursion to Lake McDonald, leaving Fort Missoula at 6:20 A.M., Aug. 6 and reaching there on return at 1:30 P.M., Aug. 9, having ridden and walked 126 miles in 24 hours of actual traveling under most adverse circumstances. They were delayed quite a number of times in tightening nuts, adjusting handle bars, etc. The wheels were not spared in the least, and did the work extraordinarily well. On their trip the men found the roads muddy from recent rain, and were impeded by the clay-mud sticking to the tires of their bicycles. They had to dismount frequently to scale heights, and over six miles of road they dismounted twenty times on account of mud puddles and fallen trees. While crossing Finley Creek on wheels two men fell in the stream. Part of the journey was made in a driving rain, which covered the wheels with mud and filled the shoes of the riders with water, making it difficult for them to keep their feet. on the muddy pedals. [Another creek] was forded through three feet of swift water, each wheel being carried across on a pole suspended from the shoulders of two soldiers. "Had the devil himself," says Lieut. Moss, “conspired against us, we would have had little more to contend with.”

The party attracted great attention along the way from the inhabitants, and their dogs and cattle. Dogs ran after them, cattle away from. them, and residents stopped work and stood in open-mouthed wonder as they passed. Every once in a while they would strike an Indian cabin and the dogs barking would announce their approach, while the occupants would stand in the door and gaze at them. Every other soldier carried a complete Spalding repair kit. The large tin [water] case (carrying about 11 gallons) was attached to the front of bicycles on a frame and strapped to the handle bars. The men wore the heavy marching uniform, and every other soldier was armed with a rifle and 30 rounds ammunition. The rifles were strapped horizontally on the top side of the side of the bicycles with the bolt on top. Those not so armed carried revolvers on belt with 30 cartridges.

Big Al adds:

More detail:

The Twenty-Fifth Infantry Bicycle Corps

On June 12, 1894, James A. Moss graduated from the United States Military Academy at West Point. Moss was assigned to the all-Black Twenty-Fifth Infantry, headquartered at Fort Missoula, Montana. It was one of four all-Black regiments in the Army at the time, nicknamed the Buffalo Soldiers.

Sep

3

Data centers and power demand, from Big Al

September 3, 2025 | Leave a Comment

I post these wondering what Carder D thinks:

Big Tech’s A.I. Data Centers Are Driving Up Electricity Bills for Everyone

Electricity rates for individuals and small businesses could rise

sharply as Amazon, Google, Microsoft and other technology companies

build data centers and expand into the energy business.

14 August, 2025

AI Boom Reshapes Power Landscape as Data Centers Drive Historic Demand Growth

Monday, March 3, 2025

The power industry was once considered slow-moving and perhaps even boring. That is no longer the case as technology has expanded and power demand projections skyrocket. New reports released by analysts at Enverus and Deloitte are examined to provide insight on what’s likely to evolve in the power industry over the coming year and beyond.

Carder Dimitroff responds:

I believe these articles present several issues that could benefit investors:

1) Transformers (not pole transformers). The queue for new transformers is long, and about half are manufactured offshore. Data centers need transformers as do new power sources.

2) Gas turbines. Same situation as transformers. For efficient turbines, the queue is about 5 years.

3) Solar panels. Those who previously invested in solar will see their ROIs grow faster than they expected.

4) Retail consumers. They will see their gas and electric utility bills grow as they pay for higher costs of energy and subsidize infrastructure costs to support new loads.

5) New manufacturing. Several geographical options will present better opportunities than others, as the cost of power is regional and seasonal.

6) Forget new nuclear as a near-term solution.

Asindu Drileba asks:

What do you think about nuclear fusion? Is it really close? The joke is that nuclear fusion has always been ready in 5 years for many decades. But I recently heard Chris Sacca (one of the best VCs ever, made over 250x for his entire fund), mention it is genuinely close and that his new fund, Lower Carbon existing partly to capture the incoming advancements in nuclear fusion.

Carder Dimitroff replies:

Today, nuclear fusion is a science project. Keep in mind that fusion requires operating temperatures of over 100 million degrees (at this level, the distinction between Fahrenheit and Celsius is irrelevant). Producing bulk power from this technology is more than ten years away. At these temperatures, it's unlikely they will be operating near population centers.

Aug

17

Best video on Punnett square, from Asindu Drileba

August 17, 2025 | Leave a Comment

Concerning the transitions of colour, on the daily spec website. The chair recommended The Punnett square as a research topic. This was the best video I could find. It's amazing how he broke down the essentials in just 6 minutes:

Genotype, Phenotype and Punnet Squares Made EASY!

Big Al offers:

Great vid on Markov, and Markov chains leading to LLMs:

The Strange Math That Predicts (Almost) Anything - Markov Chains

Aug

1

How do you fight the Vig?, from Asindu Drileba

August 1, 2025 | 1 Comment

I interpret the "Vig" as the collective term for:

1) bid-ask spread (difference in prices between buying & selling) due to market makers

2) transaction fees (for limit & market orders) charged by the exchange

3) slippage (an instrument is more expensive the deeper in the order book you go) due to how liquid an asset is.

Possible solutions for each?

1) Can be fought with the exclusive use of limit orders instead of market orders.

"Be patient and you will have the edge", The Chair in, Practical Speculation — The fine art of bargaining for an edge

2) I noticed (at least in crypto markets) that the more volume you trade, the less fees you pay (on a percentage basis)

3) Restrict yourself to deep and very liquid markets.

Also, one technique is to trade as less often as you can (buy & hold). That way you will automatically pay less of all the three sources of Vig. I think this is so important as I often found many "edges", then accounted for the vig and they often became loosing strategies.

Big Al writes:

I would also add "opportunity cost" as part of the "Meta Vig" (MV), i.e., the total costs associated with trying to trade the markets. The MV would also include the negative effects of cortisol on the human body.

Henry Gifford suggests:

I think two good steps are to ask others what the big is, and to try to calculate it yourself. Both exercises will no doubt be educational. A few times over the years I have asked horse bettors what the big is, but none seemed to know. As for calculating yourself, one hopefully will learn how much it varies by, and maybe also gain insight into hidden vig.

Steve Ellison responds:

There is no free lunch with limit orders because of adverse selection. Sooner or later, you will place a limit order on a security that simply moves up and never looks back. It would have been your best trade ever, had you actually been filled. In the opposite scenario, for example when I bought Coca-Cola in 1998, and it was already down 25 percent by the T + 3 settlement date, you will of course be filled.

Studies of retail investing accounts have shown a negative correlation between number of transactions and investment returns. In one study, accounts that had been inactive for 18 months because their owners had died, and their estates had not been settled, outperformed the vast majority of their retail account peers.

Peter Ringel writes:

Generally, the lower you go ( smaller time frame - smaller scope of the trade ) the larger the relative Vig costs. a subclass of opportunity costs is spent time of (daily) preparation. my required prep is nearly the same over many time-frames - but the scope of a trade is way lower for lower time-frames. in cash equities, the resale of your order-flow by your broker to some HF shop can be counted as Vig too. is this a common practice in option markets too? Yes, the Vig greases the fin-industry, but it is mostly unavoidable paying / avoiding the Vig does not lead to success or failure in mkts IMHO.

Vic simplifies:

just trade once a quarterfrom long side

Zubin Al Genubi comments:

The biggest vig is capital gain taxes. The richest people in the world hold their single company stock 10000x and realize no gain. Its very hard to beat a long term hold.

Jul

26

Dispersion, from Big Al

July 26, 2025 | Leave a Comment

There is a debate over the effects of passive investing, eg, whether it causes all stocks to be more correlated in their movements, makes markets less efficient, etc. Here's an interesting take:

Index Investing Makes Markets and Economies More Efficient.

I’m going to argue that the trend towards passive management is not only sustainable, but that it actually increases the accuracy of market prices. It does so by preferentially removing lower-skilled investors from the market fray, thus increasing the average skill level of those investors that remain. It also makes economies more efficient, because it reduces the labor and capital input used in the process of price discovery, without appreciably impairing the price signal.

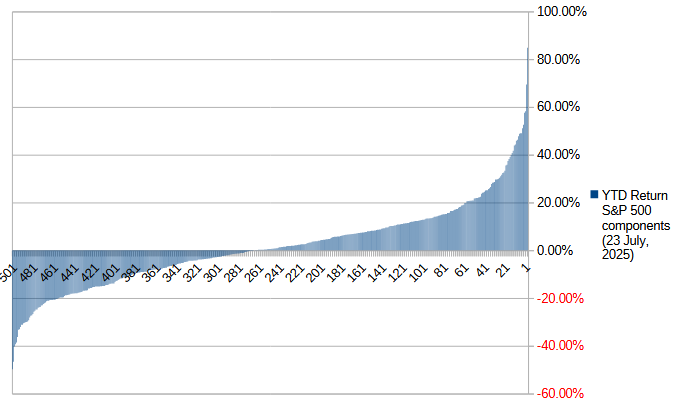

As for the correlation issue, one can still see dispersion. Here are the S&P components sorted by YTD % return as of 23 July (data source), with stocks such as PLTR, NRG and NEM on the right (+) end, and UNH, LULU, ENPH and DECK on the left (-) end:

Jul

22

Smörgåsbord

July 22, 2025 | Leave a Comment

Big Al offers:

Very nice Veritasium vid on randomness and information:

Asindu Drileba likes a new interview:

I learned about Gappy Paleologo from this list. He has a new interview on a Bloomberg podcast. In it, he talks about:

- Why he suspects Astrophysicists make good quants

- Why AI can't fully take over trader's jobs (in principle)

- What makes a "good quant"

Jeff Watson is following the floor traders last stand:

Old-School Floor Traders Finally Get Their Day in Court Against CME

Trial opens in the Chicago plaintiffs’ long-running lawsuit claiming harm from the launch of electronic markets

The plaintiffs, who estimate that they are owed about $2 billion in damages plus interest, say the company broke its promises to them when it opened a data center for electronic trading that effectively doomed the old trading floors. CME has called the lawsuit baseless.

A spokeswoman for CME declined to comment. The company repeatedly tried to get the suit thrown out, but failed each time.

The lawsuit, filed in 2014, has dragged on so long that one of the original plaintiffs has died. Hundreds of former floor traders could be affected by the outcome. The trial, being held at a county courthouse in downtown Chicago, kicked off Monday with jury selection. It is expected to last several weeks.

Jul

21

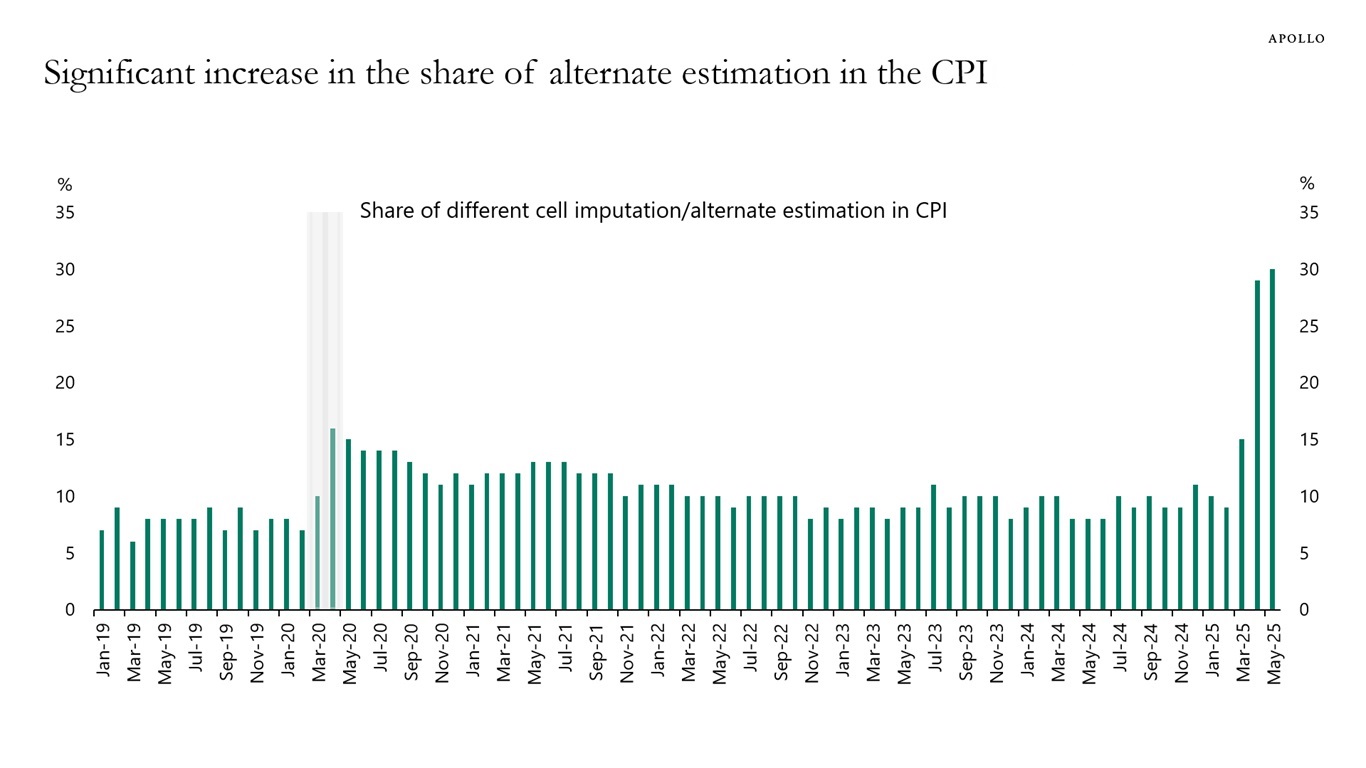

CPI Data Quality Declining

July 21, 2025 | Leave a Comment

CPI Data Quality Declining

June 20, 2025

Torsten Sløk

Apollo Chief Economist

To calculate CPI inflation, BLS teams collect about 90,000 price quotes every month covering 200 different item categories, and there are several hundred field collectors active across 75 urban areas.

When data is not available, BLS staff typically develop estimates for approximately 10% of the cells in the CPI calculation. However, in May, the share of data in the CPI that is estimated increased to 30%, see chart below.

In other words, almost a third of the prices going into the CPI at the moment are guesses based on other data collections in the CPI.

Bill Rafter writes:

Would anyone in the data business be surprised by this? I’m not.

Peter Ringel wonders:

Doge related?

Big Al offers:

US Labor Department reducing CPI collection sample amid hiring freeze

By Reuters

June 4, 2025

The U.S. Labor Department's economic statistics arm said on Wednesday it was reducing the Consumer Price Index collection sample in areas across the country due to resource constraints, but the move should have "minimal impact" on the overall CPI data.

Jul

5

DailySpeculations calendar colors, from Big Al

July 5, 2025 | Leave a Comment

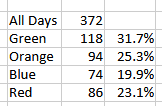

The calendar here at Daily Speculations puts market days into four groups, based on the daily changes in S&P futures and bond futures:

Green = Stocks Up, Bonds Up

Orange = Up, Down

Blue = Down, Up

Red = Down, Down

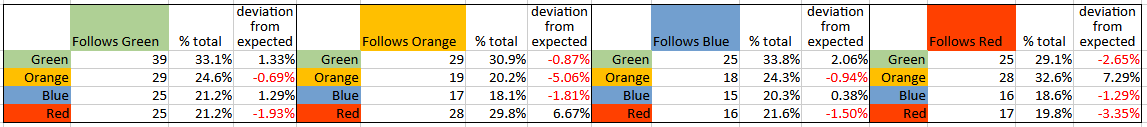

Using daily data for the S&P and for TLT, from 2 January, 2024, to 28 June, 2025, I determined which color each day is, and then did the count for each color, and what % that color day is of all days:

Then I counted what follows each day, i.e., a Green day could be followed by another Green day, or an Orange, or Blue, or Red day. With a random distribution of days, you would expect random following days, i.e., if 40% of days are Green, and 30% are Orange, then you would expect any given day to be followed by a Green day ~40% of the time and an Orange day ~30% of the time. You could then look at deviations, e.g., Blue days followed by Orange days only 25% of the time could be counted as -5%-point deviation.

So I did this kind of counting with the calendar days, with these results, where you see, for example, the number of times a Green day follows a Green day (39), what % of the time this represents (33.1%), and the deviation from expected, measured in % points (1.33%).

• What follows Green days looks random (i.e., the numbers in the deviation column are close to zero percent).

• Orange days are somewhat more likely to be followed by Red days and less likely by another Orange day.

• Blue days look random.

• Red days are more likely to be followed by Orange days.

I keep thinking I should study Markov processes, especially "Hidden". I don't know if this kind of counting is a simple version of a Markov process, and if there is more that could be done.

Jul

3

Sports $$$, from Big Al

July 3, 2025 | Leave a Comment

The news is the Buss family selling the Lakers (and the online discussion whether the Lakers were a better investment over time than, say, the S&P).

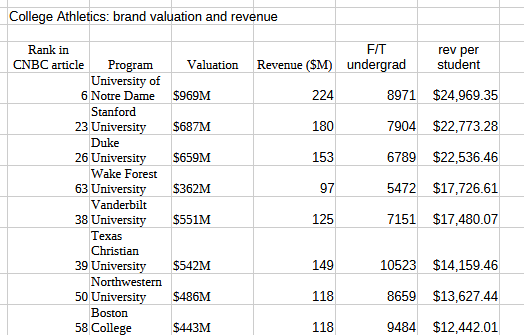

I wanted to look at the value of college athletics and found this page:

What the top 75 college sports programs are worth

Then I used Perplexity and elbow (or mouse finger) grease to build this table showing revenue per student, sorted high-to-low. There are many possible errors in this data but it's just for fun and seems intuitively roughly correct.

Below is the top set of rows - click here for the full sheet (all 75 schools) which will appear zoomed out - click on it to zoom in.

Jun

26

Increase in yields, from Jeff Watson

June 26, 2025 | Leave a Comment

Adam Grimes comments:

Cool chart. Interesting data. We have some farmers in the family but I would not have expected such a big difference.

Peter Ringel writes:

I think, this productivity boost shows Norman Borlaug‘s Green Revolution. There would be no India or China as we know it . And in the West too. The topic seems close to not being politically correct in our upside-down world.

Michael Ott brings expertise:

The Y axis is Mg/hectare, which is a different way to measure weight per unit area. Technically, a bushel is a unit of volume (8 gallons) that is understood to be equivalent to 56 pounds of corn or 60 pounds of soybeans. Most US farmers measure in bushels per acre, which is a different way to express weight per unit area.

The major increase in corn came from breeding AND fertilization. GMO corn was introduced in 1996 and reached 50% market share around 2001, which is pretty fast adoption for agriculture. Biotech traits certainly help with yield, but more so prevent disasters from insects and weeds, which harm yields.

Big Al finds another chart interesting:

May

28

Adapting to the situation, from Big Al

May 28, 2025 | Leave a Comment

Street smarts: how a hawk learned to use traffic signals to hunt more successfully

But what was really interesting, and took me much longer to figure out, was that the hawk always attacked when the car queue was long enough to provide cover all the way to the small tree, and that only happened after someone had pressed the pedestrian crossing button. As soon as the sound signal was activated, the raptor would fly from somewhere into the small tree, wait for the cars to line up, and then strike.

Easan Katir predicts:

Next iteration: the hawk will be pressing the pedestrian crossing button!

Michael Brush quips:

Pavlov’s birds.

Henry Gifford writes:

When I was hiking down The Grand Canyon I sat on a rock at the edge of the trail and took out a sandwich and started to eat. A bird came flying from my left side, toward the sandwich in my right hand. I reacted by pulling the sandwich back, to the right side of my head. Another bird came from behind and grabbed it.

Later I heard the birds’ favorite food is tuna fish, which they steal cans of from hikers. They open the can by grabbing it in their beak and flying above the one of the three cabins at the bottom of the canyon where the park rangers live and dropping it on the roof. The rangers have been trained to comply by opening the can and placing it on a convenient rock.

Pamela Van Giessen responds:

Was it a raven? They are particularly smart birds when it comes to getting food out of visitors to the national parks we have visited.

Asindu Drileba writes:

Crows & ravens would make good scientists. Here for example a video of a crow showing that it understands water displacement in different scenarios.

Bo Keely, from the desert:

Yesterday at the meteor crater in Death Valley two crows perched on the rim. They had grown feather sunglasses and asked for food. I went to the car & they followed and I gave them whole wheat bread. Then I got in & drove a couple miles down the road, pulled over to check directions, and they landed outside the driver's door asking for more bread.

May

22

Books on markets before 1900, from Asindu Drileba

May 22, 2025 | Leave a Comment

I noticed that I know of very few books on the stock market before 1900. I only know of:

Confusion of Confusions, by Joseph De La Vega (1688)

The Art of Investing, by John F Hume (1888)

Are there any books about the market before 1900 that can help me grow this list?

Big Al replies:

Lombard Street: A Description of the Money Market, by Walter Bagehot

Fifty Years in Wall street, Henry Clews

Francesco Sabella suggests:

The Stock Exchange: A Short Study of Investment and Speculation, by Francis W. Hirst

Stefan Jovanovich offers:

The Stock Exchange from Within, by Van Antwerp, William Clarkson

Martin’s Boston Stock Market, by Joseph Gregory Martin

Wall Street in History, by Martha J. Lamb

May

17

Runs of “up” days in the S&P, from Big Al

May 17, 2025 | Leave a Comment

An analysis of runs of "up" days (i.e., Close-Close change is positive) in the S&P, through 2 May of this year:

And then I asked an AI to model flipping a coin biased in the same way (53.7% heads), and you can see the results here.

Anatoly Veltman comments:

Yes you're putting numbers out - no complaint there. Huge complaint on the premise: why would 9-day "run" into tomorrow bear same fruit as some totally different 9-day "run"?? What's a "run"; why would different-size price increases under all different relevant variables have the same impact on further trajectory - just because you assigned the same "9-day length" value to current "run"??? IMHO this sort of input can't be expected to help much.

Big Al responds:

That's actually the point: when we assign importance to runs of days, we have to be careful because the run distribution in actual data looks like the distribution you get doing a coin-tossing exercise with a market-biased coin. Which doesn't mean that analyzing runs can't produce anything useful, just that there is a high hurdle.

Anatoly Veltman adds:

My point is mostly about DIFFERENTLY-SIZED up-days. Some days could've been up $2, while others $200…Some days might have been not up-days in SP500 index, while up-days in SP500 futures. And dozen other variabilities that would make one "9-day run" be vastly different from other "9-day run" in impact on future expectations. Not that there are many ideal ways of Input, but this sort may just be prohibitively flawed.

May

13

A call for great new books, from Jeffrey Hirsch

May 13, 2025 | Leave a Comment

I am putting together a list of the Best Investments Books of the Year. I am not seeing many great books on trading, investing, finance, markets, crypto, options, futures, cycles, etc. I would love to hear if you folks know of any great books out in the past 6 months or so or coming soon.

Matthew Gasda is justifiably proud:

Big Al offers:

This is high-level quant stuff - ie, over my head, and despite "Elements" in the title - but a fun stretch:

The Elements of Quantitative Investing (Wiley Finance) 1st Edition, by Giuseppe A. Paleologo

His more basic 2021 book is "Advanced":

Advanced Portfolio Management: A Quant's Guide for Fundamental Investors, by Giuseppe A. Paleologo

Carder Dimitroff suggests:

This book is about historical finance and may not be a direct response to the question.

Empire, Incorporated: The Corporations That Built British Colonialism, by Philip J. Stern

William Huggins responds:

on a similar (historical) note, one of my students just recommended this title to me. looking forward to cracking it later this month:

Ages of American Capitalism: A History of the United States, by Jonathan Levy

Asindu Drileba adds:

If you would regard a speculator/investor as someone who also builds businesses:

Never Enough: From Barista to Billionaire, by Andrew Wilkinson

Andrew is building Tiny. His intention is to build the Berkshire Hathaway of Tech and software. He is inspired by Monish Pabrai (The Dhando Investor). So he is more in the "Value investing" camp not really quantitative.

May

3

Domestication, from Big Al

May 3, 2025 | Leave a Comment

Some in these areas of science (genetics, animal development and behavior) have proposed that humans have essentially domesticated ourselves during the Holocene.

The domesticated silver fox (Vulpes vulpes forma amicus) is a form of the silver fox that has been to some extent domesticated under laboratory conditions. The silver fox is a melanistic form of the wild red fox. Domesticated silver foxes are the result of an experiment designed to demonstrate the power of selective breeding to transform species, as described by Charles Darwin in On the Origin of Species. The experiment at the Institute of Cytology and Genetics in Novosibirsk, Russia, explored whether selection for behaviour rather than morphology may have been the process that had produced dogs from wolves, by recording the changes in foxes when in each generation only the most tame foxes were allowed to breed. Many of the descendant foxes became both tamer and more dog-like in morphology, including displaying mottled- or spotted-coloured fur.

But there has been criticism of the breeding experiment and conclusions.

Asindu Drileba responds:

My definition of "domestication" used to be that of "Animals simply living under the care of other animals". When I watched a PBS Eons video some years back, I learned that Paleontologist's had a very different definition of "domestication". They define it as "the dependence on the care of other living things, to the extent that they cannot no longer live in their natural environment (the wild) anymore."

In the animal context, humans domesticated dogs and stray dogs (dogs with no owner) are riddled with wounds and in general don't do well. They would probably die if left in a forest. Foxes however look good in the wild.

In the human context, a human being with no owner (a government, a parent or an employer) usually does as badly in the manner of the stray dog. This human would perfectly fit the paleontological definition of what would be a "domestic human". The same applies for the ownership class/ruling class. They have used the working classes to domesticate themselves so they too, also can't survive with out them either. An undomesticated human would be people that can survive in an environment urban dwellers can't, the natural environment.

Like how the Khoisan do well in the desert, or tribes in the deep Amazon also do well. If you dumped a random urban dweller in the Amazon rain forest or the Kahalari desert (under same circumstances as the natives) 99% of them would die within weeks.

Apr

24

Planck’s principle, from Nils Poertner

April 24, 2025 | Leave a Comment

A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die and a new generation grows up that is familiar with it…

An important scientific innovation rarely makes its way by gradually winning over and converting its opponents: it rarely happens that Saul becomes Paul. What does happen is that its opponents gradually die out, and that the growing generation is familiarized with the ideas from the beginning: another instance of the fact that the future lies with the youth.

— Max Planck, Scientific autobiography, 1950, p. 33, 97

relevance of how new ideas are being adopted in science, markets, everywhere.

Jeff Watson responds:

Science by consensus is not science. Just ask Galileo.

Pamela Van Giessen writes:

John McPhee wrote extensively about this and how the science of geology advanced over a few centuries in Annals of the Former World. Scientific community consensus is pernicious, and it is clear that there is mostly no convincing it.

William Huggins comments:

the foundation of science rests of replicability - anyone with the same data should be able to replicate results (even if they disagree about the mechanism). once replication is established, the difficult questions come from "is this data sufficient and representative?"; "is the data generating process stable or dynamic?"; "did i gather data in support of my hypothesis or to try to disprove it?". the fun stuff.

philosophy of science ensures we ask good questions and have good tools to tackle them with. this is why the Ph in PhD is short for "philosophy."

correction: "same data" is the wrong phrase - "equivalent, out-of-sample" would be a better choice of words.

Asindu Drileba writes:

The problem with the human mind is that it has too many glitches. You can verify data successfully and still be wrong. Here are two examples from Astronomy. First, The Mayans had models that would accurately predict eclipses. So, your data of when eclipses occur would replicate really well with their model. However the model of the solar system the Mayans used, had the Earth at the centre and the Sun revolved around it. The assumptions of the model were completely wrong, but the data (predictions) were accurate.

Second, is Newton's models, that predicted the movement of a comet accurately. Then you often here people say that Einstein proved Newton wrong with Relativity.

I think when it comes to science, explanations are very flimsy. What should matter is if the idea useful or not.

Francesco Sabella responds:

I think it’s a very good exercise to start from the point of view that our mind is bound to make mistakes, have glitches and start to work from that assumption; even if it’s not always true but it can be good as working hypothesis.

Big Al recalls:

Years ago, doing simple quantitative analyses to post to this list, I learned that one of the biggest pitfalls was my own desire to get a nice result.

Apr

18

I know The Chair uses linear regression and so do some hedge funds. But what are you people using it for? Predicting earnings? Stock Returns? Stock Prices?

What kind of inputs make sense to insert into a linear regression model? What mistakes do you think people make when using linear regression?

Big Al responds:

A book the Chair has recommended:

Applying Regression and Correlation: A Guide for Students and Researchers

I've used correlation for exploring lots of simple questions like, "Does the move on Monday predict the move on Tuesday?" The basic model is just "does A predict B?"

One mistake often made when looking at time series like stock prices is to use absolute dollar/point changes rather than % changes. Always use % changes.

Apr

16

The Invisible Gorilla in the Room, from Stefan Jovanovich

April 16, 2025 | Leave a Comment

That is the creature Hugh Hendry - the Acid Capitalist - says we have to find in order to profit from our speculations.

The events in Ukraine are that gorilla. They are predicting the likelihood that Trump, Putin and the Muslim oil producers will establish a Drill, Baby, Drill world of orderly energy production and supply priced in U.S. $. The effects on the European and Asian consumers will be comparable to what happened to the German-speaking world and its silver standard when the French fulfilled the terms of the Treaty of Frankfurt by paying their reparations in gold.

Big Al needs some help:

Perplexity answers the question, "What happened to the German-speaking world and its silver standard when the French fulfilled the terms of the Treaty of Frankfurt by paying their reparations in gold?"

Stefan Jovanovich answers:

They = "events, dear boy". The prediction is that the new cartel of oil and gas exporters will establish "orderly production" that manages the risks of overproduction in the same artful manner that OPEC once operated before the invention of fracking.

William Huggins responds:

So you are suggesting us producers will submit to directives from moscow or Riyadh to limit their production? No evidence of anything but predation among those players but somehow trump purs them all on the same page? I have a bridge for sale….

Mar

30

The hypothesis is that at the end of a quarter in which bonds are up while stocks are down, institutions need to rebalance their asset allocations by selling bonds and buying stocks.

I found 14 such quarters since 2002, not including the current quarter. In the last 5 trading days of those 14 quarters, SPY was up 8 times and down 6 times, with an average net change of 0.9% with a t score of 0.76–statistically insignificant.

My Python code that I used to obtain the above results.

Big Al responds:

That's an event I hadn't thought about in a long time. It's hard to imagine a lot of big institutions running a simple strategy like that these days, which doubt your study would appear to support. But it does make me wonder if there are other, more complex balances or relationships that big players do manage on a calendar basis.

Alex Castaldo comments:

The general idea of trying to take advantage of "fixed behavior" by others is a good one IMO.

Paolo Pezzutti agrees:

It's like finding regularities end of month or Holiday's behavior or several others. I think there may be many still uncovered. Steve on Github has made public a number of Python notebooks. Very nice work to stimulate curiosity in searching patterns. It's not rocket science based on Artificial Intelligence, but I think this methodology has still value.

Asindu Drileba writes:

The rebalancing edge is real. In BTC for example, I realized that the most consistently active, "high activity" period is the time around 0:00 UTC (Server time). Something interesting is always happening during that period.

It turns out alot of people trade BTC daily and it just makes sense to rebalance the position size at midnight. I too even choose it sub-consciously. I don't think many people are choosing 03:00 UTC , 17: 43 UTC etc. Unfortunately, you need second by second, price quotes over many days, weeks, months and years to investigate this activity further. So I put it on pause. But the "activity" still exists.

M. Humbert adds:

Window dressing at quarters end is probably still occurring as well.

William Huggins writes:

several years ago i followed in Markman's steps of investigating the S&P500 drops and additions for irregularities (they did exist but have since been arb'd out). the driving mechanism was that index fund managers were paid to minimize tracking errors, not maximize performance so they would all trade at the same time, causing a secondary effect on the day the change actually took place (there was a preliminary change the day of announcement). it was a pretty basic academic event study but the most valuable part was uncovering "why" big money was doing a thing that created opportunities for fast moving traders (email me if you want it, but the trade doesn't work anymore)

Mar

27

Spec roundup

March 27, 2025 | Leave a Comment

Jeff Watson has been watching the CME:

Anyone else notice the increase in seat prices (trading rights) recently?

Big Al found a history lagniappe:

BabelColour

@StuartHumphryes

Travel back in time 117 years to the Russia of 1908. I have enhanced for you this rare colour photo of the Russian writer Leon Tolstoy, regarded as one of the greatest and most influential authors of all time. It was taken in the grounds of his house at Yasnaya Polyana, near Tula, Russia. It is original colour, not colourised.

Steve Ellison provided his own:

Since one might be well advised to beware the Ides of March, here is a picture I took in 2017 of the ruins of the Theater of Pompey.

Asindu Drileba has been reading:

The importance of contrarianism emphasized by Jeff Bezos, from the Amazon 2020 Letter to Shareholders:

Differentiation is Survival and the Universe Wants You to be Typical

Our bodies, for instance, are usually hotter than our surroundings, and in cold climates they have to work hard to maintain the differential. When we die the work stops, the temperature differential starts to disappear, and we end up the same temperature as our surroundings….While the passage is not intended as a metaphor, it’s nevertheless a fantastic one, and very relevant to Amazon. I would argue that it’s relevant to all companies and all institutions and to each of our individual lives too. In what ways does the world pull at you in an attempt to make you normal? How much work does it take to maintain your distinctiveness? To keep alive the thing or things that make you special?…This phenomenon happens at all scale levels. Democracies are not normal. Tyranny is the historical norm. If we stopped doing all of the continuous hard work that is needed to maintain our distinctiveness in that regard, we would quickly come into equilibrium with tyranny….We all know that distinctiveness – originality – is valuable. We are all taught to “be yourself.” What I’m really asking you to do is to embrace and be realistic about how much energy it takes to maintain that distinctiveness. The world wants you to be typical – in a thousand ways, it pulls at you. Don’t let it happen.

Mar

15

The Cosmic Distance Ladder, from Big Al

March 15, 2025 | Leave a Comment

Maybe the most fundamental thread on Spec List has been counting/data/figuring things out, so here is a marvelous two-part video by 3Blue1Brown, with Terrence Tao, about how we determined various cosmic distances.

The Cosmic Distance Ladder, Part 1

The Cosmic Distance Ladder, Part 2

Additional commentary and corrections from Prof Tau

Gyve Bones writes:

This was a fascinating lunch lecture. Thank you. I first became fascinated with the story of how science and technology developed with the 1977 PBS series by James Burke "Connections" which told the story, without the aid of CGI graphics in my high school years. I was given the companion book for the series that Christmas by my very thoughtful mom. (It's also the story that launched my falling away from the Catholic faith in which I was raised, my teenage rebellion.)

Here's the episode which details how the Babylonian star tables by Ptolemy used by Copernicus were preserved from the destruction of the Library of Alexandria, found on papyrus scrolls in a cave backup library:

James Burke Connections, Ep. 2 "Death in the Morning"

Asindu Drileba responds:

Connections is so good. I really wish there was a remastered version (in HD at least). One of the things I still don't understand is how government funded broadcast corporations like PBS, BBC and DW make such high quality non-fiction films. I would go to say the have the best non-fiction documentaries. Capitalism doesn't apparently do well when it comes to making non-fiction. What makes them so good? Are they just structured properly?

Gyve Bones replies:

Here is a very well mastered set of the videos for Connections (1978).

Peter Ringel adds:

there is a Conjecture, that astronomers are the more happy and humble people. I guess, this is because, it is all so vast and relative.

Mar

10

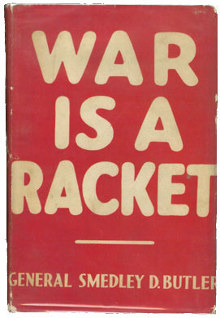

If war is a racket, where are the market gains?, from Asindu Drileba

March 10, 2025 | Leave a Comment

A few years ago, I read Brig. General Smedley Darlington Butler's War is a Racket (full text). Sample passages:

In the World War a mere handful garnered the profits of the conflict. At least 21,000 new millionaires and billionaires were made in the United States during the World War. That many admitted their huge blood gains in their income tax returns. How many other war millionaires falsified their income tax returns no one knows.

The Nye Committee uncovered some astounding information about the munitions industry, including a confession to profits as high as 800 percent.

Inspired by the book, I looked up publicly listed defense companies and marked out dates for conflicts like the Gulf War, Iraq invasion, Assassinations, Ukraine Vs Russia, Palestine Vs Gaza. While there were some blips on defense stocks, they were not that impressive. So if people say the US defense "complex" is fleecing the government, where exactly is this money going? What doesn't it reflect on stock prices?

Gold on the other hand frighteningly has so many coincidents, when it actually "predicts" aggression. The price of Gold for example went up for a moment before Qasem Soleimani was killed in a drone strike by the Trump regime. Not to mention how it behaved during the previous "Gaza - Israel" & "Ukraine - Russia" conflicts. I also found a similar observation in The Education of a Speculator:

Then, out of the clear blue, from 2 P.M. to 3 P.M., gold jumped $7. No reason for the rise, just technical buying by the funds, we were told. But that weekend, around 4 A.M. on Sunday, U.S. Navy fighter planes shot down a Libyan jet flying over the Mediterranean. This caused tremendous tension, always good in those days for at least a good run in gold. After all, nuclear war in the Mideast was now possible.

— Chapter 4, Subsection (Practical Losses)

Why is Gold way better at predicting political aggression than defense stocks?

Big Al responds:

I find the tricky thing with macro events is being precise enough with dates. Some events, like Fed announcements or other econ data releases, can be timed more precisely. With bigger, geopolitical events, it's less definite. With defense stocks, I would look at their performance in the months before the event, on the assumption that the market would be anticipating rather than reacting. As for strong reactions, look at the chart of Rheinmetall since the start of the Ukraine war and also since the US election.

As for gold, here's an interesting approach, looking at market sectors:

Navigating crises: Gold's role as a safe haven for U.S. sectors

This paper investigates the correlation between U.S. sectors and gold, and whether gold can serve as a safe haven for investors in specific U.S. sectors during the global financial crisis, COVID-19, and the Russia-Ukraine war. We use data from the Standard & Poor's Depository Receipts (SPDR) Select Sector Exchange Traded Fund (ETF) to capture the performance of the respective sectors. Our findings document that gold is a weak safe haven for most U.S. sectors. Gold is not a safe investment for energy, materials, utilities, and consumer staples. Gold does provide vital protection for financial, consumer discretionary, industrial, technology, and healthcare.

Asindu Drileba comments:

Thanks for pointing me to RHM.DE. I didn't even know the company existed. It is exactly how I expected US defense stocks to behave during the Ukraine-Russia & Gaza-Palestine conflicts.

Feb

21

Spec sampler

February 21, 2025 | Leave a Comment

Asindu Drileba recommends:

The Count of Monte Cristo was my favourite movie of 2024. I would recommend it to specs as it has a very interesting stock market trading segment. The stock trading segment was brilliant in that it incorporated ideas from poker (previously discussed in this list). It's also a good demonstration Howard Mark's "Second level thinking", and the use of deception in the market.

Also, the best description of the Fourier transform I have seen so far.

Jeffrey Hirsch is on IBD:

How To Trade Trump 2.0 And Why DeepSeek Is Not The End Of The AI World | Investing With IBD

Big Al offers:

Humorous and with many lessons:

How I Helped to Make Fischer Black Wealthier

Jay R. Ritter, Cordell Professor of Finance at the University of Florida

Hillary Clinton wasn't the only person who made money speculating in the futures market during the late 1970s and early 1980s. A lot of finance professors did, including me. However, I used a different strategy than Hillary. Following the advent of stock index futures trading in 1982, many finance professors started playing the turn-of-the-year effect. The most popular approach was to buy the Value Line futures and short the S&P 500 futures. This is what I did. Of course, if there is easy money to be made, prices should adjust as the market learns, and a perpetual money machine will cease to exist. But I figured out a way to still make money. Or so I thought. Unfortunately, there was an unexpected danger in my strategy. In 1986, Fischer Black of Goldman Sachs figured it out and took me to the cleaners.

Feb

19

Strange AI twist, from Larry Williams (updated)

February 19, 2025 | Leave a Comment

We sent my 2025 annual forecast to the Copyright office. They would not copyright it saying, “it was AI generated so could not be copyrighted.” We replied it was not AI, showing why so were finally approved. This raises an unraised question about AI protection. What is/will be the law??

Asindu Drileba comments:

The purpose of AI regulation is just so the big players can build a cartel and lock in the market. This is why people like Sam Altman say they "welcome it".

Big Al gets conspiratorial:

Not to be too conspiratorial, but…

OpenAI whistleblower found dead at 26 in San Francisco apartment

A former OpenAI employee, Suchir Balaji, was recently found dead in his San Francisco apartment, according to the San Francisco Office of the Chief Medical Examiner. In October, the 26-year-old AI researcher raised concerns about OpenAI breaking copyright law when he was interviewed by The New York Times.

Peter Ringel writes:

I always suspected, that the senator is a robot. His performance is inhuman!

Your work is obviously your work. But, what if one uses AI for ones work, creations and everything? It should be still your IP. We have musicians on this list, who use AI for inspirations and research. I constantly lookup code via AI, b/c I am not a good coder. But the final script is mine. I even run AI models locally. The opensource models like Facebook's LAMA. (for an easy install, i can recommend: msty.app)

There is creativity in asking questions, to squeeze the right results out of AI. Prompt engineering is a thing.

Pamela Van Giessen prompts:

No doubt every single publishers’ lawyers are fighting the ability for AI generated anything to be copyrighted because so much AI is taking from existing copyrighted works, usually without permission or payment. Some publishers are feeding into AI programs with permission/payment (I think my previous employer, Wiley, is feeding at least some content into AI, for instance). This is a lousy deal for the authors and artists. The publishers will make vast sums, much like Spotify, and the content creators (I really hate that phrase) will get less than pennies on the dollar.

Liberals have done a great job of deflecting the real problem with platforms (omg, no content moderation or fact checking, TikTok is spying on Americans, the world will end!). The real problem with platforms is that they steal content, outright theft. And where is your government protecting you from this theft? NOWHERE.

Easan Katir relates:

I sent an unpublished manuscript to an Oxford-educated editor, asking her to edit. She asked if any of it was AI. I replied truthfully that I wrote most of it but I asked AI to add some. She declined the job, I guess making a stand: humans vs. AI. Fortunately or not, we know which is going to win.

Peter Ringel offers:

Pamela Van Giessen comments:

I imagine that the courts are going to get involved at some point. Since much AI is from existing copyrighted material, some (most?) used without permission, someone is going to challenge copyrighted AI that is really someone else’s material.

Jordan Low agrees:

precisely. i have been seeing a lot of content creators complain that their work is just automatically reworded into another article without attribution.

Update: Big Al offers an historical lagniappe:

The battle of Cúl Dreimhne (also known as the Battle of the Book) took place in the 6th century in the túath of Cairbre Drom Cliabh (now County Sligo) in northwest Ireland. The exact date for the battle varies from 555 AD to 561 AD. 560 AD is regarded as the most likely by modern scholars. The battle is notable for being possibly one of the earliest conflicts over copyright in the world.

Stefan Jovanovich writes:

The first written mention of the Battle of the Book occurs in the Life of Saint Columba composed by Manus O'Donnell in 1532. Britain did not have a formal copyright law until the passage of the Statute of Anne in 1710; that gave authors their first ownership claim to their writings. Until then the Stationers' Company had an exclusive right to all printing and publishing in Britain. The term "copyright" comes from the right a member of the Stationers' Company had to copy a written manuscript into print after the text had been registered with the Stationers' Company. The charter for the Stationers' Company was granted in 1557 by Queen Mary and King Philip, then confirmed in 1559 by Queen Elizabeth. The Company had the authority to seize "offending books".

Carder Dimitroff adds:

From March's Library: Early printed books were customized with hand-painted illumination for the wealthy.

Feb

10

Sports betting; prediction markets (updated)

February 10, 2025 | Leave a Comment

Gambler: Secrets from a Life at Risk, by Billy Walters. A spectacle of compulsive gambling in every field by a very flawed individual with a template of ever changing factors that influence football betting.

Andrew Moe agrees:

Would also recommend Gambler, by Walters - in particular for the two chapters where he details his method of handicapping NFL games. He uses a variety of factors to build his own line and compares that to the public line. The bigger the difference, the bigger the bet. Lots of quantitative factors, for example being the home team on a Thursday night game is worth 0.4 spread points. If home and away have different playing surfaces (grass/turf), it's worth 0.2 spread points. A great team coming off a bye and away is worth 1.6 points - if they are home off a bye, it's worth 1.4 pts.

Big Al writes:

I have read various pieces re online sports betting recently. I also have been listening to season 4 of Michael Lewis's podcast, Against the Rules, which is all about sports betting.

The podcast reinforces points made by others, the main one being that Draft Kings and Fan Duel weed out the winners and allow only losers to make bets. Pros try to find ways around this, but amateurs are just suckers. Also, thanks to software, the system is largely automatic.

When I compare this to markets, I think of market makers on one side, and retail traders on the other, along with the whole ecology of touts that try to get retail's attention and make you think you should be buying this or selling that.

One specific bit from the Lewis podcast I thought was interesting: A pro was talking about prop bets on individual player performance and he said that people like to see things happen as opposed to not happen, so usually betting the under is advantageous because the over is over bet.

Asindu Drileba comments:

I think the days of the bookies are numbered. I am confident the future of sports betting rests in prediction markets like Khalshi, Poly Market, Smarkets etc. The odds will be better, will change in real time, and best of all, there will be no need to kick out winners. It will be like the futures market.

Only two reasons why bookies still exist: 1. The infrastructure for these "Event Derivatives" has not yet been built. 2. Regulatory hurdles.

Big Al offers:

A very interesting deep read:

Why prediction markets aren’t popular, by Nick Whitaker & J. Zachary Mazlish:

Rather than regulation, our explanation for the absence of widespread prediction markets is a straightforward demand-side story: there is little natural demand for prediction market contracts, as we observe in practice. We think that you can classify people who trade on markets into three groups, but each is largely uninterested in prediction markets.

Savers: who enter markets to build wealth. Prediction markets are not a natural savings device. They don’t attract money from pensions, 401(k)s, bank deposits, or brokerage accounts.

Gamblers: who enter markets for thrills. Prediction markets are not a natural gambling device, due to various factors including their long time horizons and often esoteric topics. They rarely attract sports bettors, day traders, or r/WallStreetBets users.

Sharps: who enter markets to profit from superior analysis. Without savers or gamblers, sharps who might enter the market to profit off superior analysis are not interested in participating. They also largely don’t need prediction markets to hedge their other positions.

Update: Asindu Drileba remains confident:

I see the article was written in May 2024. Towards the US presidential election, close to $2B in real money was placed on Polymarket. Polymarket is extremely difficult to use (you need to buy the right crypto, install the proper wallet, just to get it working). Last year Americans spent $100+ Billion on sports betting.

Sports betting books can simply be restructured to work by having their odds computed by a prediction market and not bookies. It would also be the best way to buy insurance. On say hurricanes, earthquakes, fires. I see a lot of catastrophe insurance gravitating towards prediction markets.

If someone asked me. "What trillion dollar business is no one building?" I would respond, "A well done prediction market." Trust me, the demand is there.

Feb

3

Inflation and it’s Causes, from Asindu Drileba

February 3, 2025 | Leave a Comment

What causes inflation? Suppose we define inflation simply as the rise in prices of commodities, stocks, real estate etc. What causes it?

1) A generic explanation people offer (acolytes of Milton Friedman & Margaret Thatcher for example) is to blame monetary policy. Simplified as, inflation is caused by "too much money chasing too few goods."

Many people blamed President Trump's COVID stimulus packages for the rise of prices during that period. It seems specs in this list agree upon this when it comes to stock prices, i.e., lower interest rates (higher money supply) -> Higher stock prices (inflated stock prices).

2) An alternative explanation is that higher prices are caused by supply chain issues.

So they would claim that higher commodity prices were so because it was extremely difficult to move them around during lockdowns, let alone processing them in factories. A member also described that egg prices may be going up because of disease (a chink in the supply chain) not necessarily monetary policy. I am thinking that supply chain issues are more important to look at, than monetary policy.

Larry Williams predicts:

Inflation is very, very cyclical so maybe the real cause resides in the human condition and emotions. It will continue to edge lower until 2026.

Yelena Sennett asks:

Larry, can you please elaborate? Do you mean that when people are optimistic about the future, they spend more, demand increases, and prices go up? And then the reverse happens when they’re pessimistic?

Larry Williams responds:

Just that it is very cyclical— as to what drives the cycles I am not wise enough to know…though I suspect…some emotional pattern dwells in the heart and souls of as all that creates human activity—along the lines of Edgar Lawrence Smiths work.

Jan

10

Energy, from Carder Dimitroff

January 10, 2025 | Leave a Comment

I believe 2024 will be remembered as the year of great awakening. First, the so-called "hydrogen economy," pushed by several administrations and countries, is struggling. Plug Power, Ballard Power, Bloom Energy, and Hyyvia have all experienced losses and related financial challenges. Wood Mackenzie warns that green hydrogen projects are near collapse, with several projects likely to be canceled or deferred (how does it make economic sense to consume electricity to make hydrogen, compress it, move it, store it, and then consume it to make electricity?).

Second, Big Tech is colonizing local power grids at a scale and speed few anticipated. Policymakers are slowly realizing that demand is eclipsing supplies, and at the current rate that demand grows, supplies will quickly be exhausted.

Third, there are unrealistic expectations that the industry can respond in time to avert troubles by increasing supply. Many assume that energy supplies are commodities and can respond to market forces. With new baseload power projects taking at least five years and an average of ten years to initiate and complete, the only realistic option is to manage demand. This conclusion presents significant implications for Big Tech and local consumers.

Like biotech, the electric and gas industries will face an uncertain future in 2025. In the United States, states and Regional Transmission Operators have ultimate control, with the federal government's role limited to providing economic incentives. Consequently, the nation will likely witness various responses depending on local interests.

In any case, Big Tech's demand for power may be severely checked. If investors see unlimited growth in AI and related technologies, they may want to consider the challenges.

The alternative is less pleasant. If Big Tech successfully colonizes the nation's grids to the needed levels, the price of electricity and gas for other industries, commercial properties, and residential consumers will jump, resulting in more inflation.

Either way, the current situation is not sustainable. Solutions will be implemented in 2025 and beyond, but new nuclear power and transmission lines will not be among them for several years.

Remember that there are always winners and losers in energy; there's rarely an easy win-win opportunity. Higher prices produce substantial margins for those previously invested. For cost leaders, supply-demand mismatches present a happy outcome at the bottom line. Even marginal assets, like old nuclear and coal, could become more attractive. However, pipeline capacity issues could create growing challenges for natural gas assets.

The consumer is at risk. Self-generation is attractive to upper-income consumers. Avoiding the purchase of any watt-hours at any time of the day could produce significant savings.

Stefan Jovanovich writes:

The appeal of the income tax was that it promised a tiered system of pricing - i.e. the rich would pay more. There could be an Americans First progressive movement in this century that demanded the same system of pricing for electricity, health care and other services that have become rights. The "average" Americans could pay one rate; the corporations and wealthy users could pay a higher one.

A question for CD. Assuming that politics produces an Americans First tiered system for utility and other pricing where the "average" Americans are guaranteed priority over the large volume consumers, what would the effects be for the utilities? Don't current rate structures give large users a unit discount because they provide so much more demand?

Carder Dimitroff responds:

Remember, a utility's primary mission is/should be to rent its wires or pipes. Every wire and pipe used by utilities in the United States is economically regulated to ensure its owners earn a margin above its levelized costs. Theoretically, utilities' gross margins for wires and pipes are guaranteed no matter how individual tariff books are constructed.

In states where utilities have not deregulated their power plants, utility commissioners may create sophisticated tariffs where utility returns consider the combination of wires, power plants, commodities, and services. If a utility upsets its state commissioners, it could see margins thinned. This frequently happened with nuclear utilities when they delivered new power plants late and over budget. But the penalty is temporary; their full returns were restored later.

Tariffs are [intentionally] complicated. Large power users are frequently offered a break on their energy costs. However, they pay more for services that are not charged to residential consumers. Historically, one hefty example has been the utilities' demand charges, which large consumers hate. Another is for power factor charges, which require large customers to actively manage how they consume energy. In addition, many states require large power users to pay the utility for their capital costs to place transformers on customers' properties and to compensate utilities for stringing high-voltage power cables to those transformers. However, every state is different, and utilities within states negotiate different tariffs.

Big Al adds:

AI Needs So Much Power, It’s Making Yours Worse

AI data centers are multiplying across the US and sucking up huge amounts of power. New evidence shows they may also be distorting the normal flow of electricity for millions of Americans, threatening billions in damage to home appliances and power equipment. 75% of highly-distorted power readings across the country are within 50 miles of significant data center activity.

Dec

12

Positively aging, from Kim Zussman

December 12, 2024 | Leave a Comment

Want to Live a Long and Fulfilling Life? Change How You Think About Getting Old

Research consistently shows our attitudes and beliefs influence our health and longevity.

Data is mounting, much of it from research by Yale epidemiologist Becca Levy, about the impact our attitudes and beliefs have on our health and longevity. Levy’s interest in the connection began in the 1990s, when she traveled to Japan to try to understand why the Japanese had the longest lifespan in the world. She was familiar with explanations that attributed this longevity to diet—Japanese people consume less meat, dairy products, sugar and potatoes than other wealthy countries. But what stood out to her was how the culture respected and celebrated older people.

“It struck me as very different to what I had observed in the U.S.,” she told me. “So I began to wonder if these positive age beliefs could contribute to the longer lifespan in Japan.”

Nils Poertner writes:

Psychology plays a huge role here - eg. excessive nostalgia means one does not appreciate the moment - in my view it is also linked to far-sightedness (went farsighted at the age of 15! which is rare and then recovered). there is somewhat a placebo in life - and the joke is on us really.

Big Al comments:

There are maybe complicated issues around causality, e.g., do people with a positive attitude live longer and better, or do people with underlying factors that promote health and longevity tend to have a positive attitude? But I will stipulate that we might as well try it. Which leads to the issue of people feeling like they have failed if they *don't* have a positive attitude. Perhaps as a way of avoiding this pitfall, we could be given information on how to *practice* a positive attitude. Then, over time and with practice, we might see a benefit.

Nov

30

Productivity and AI, from David Lillienfeld

November 30, 2024 | 1 Comment

When do we start seeing the effects of AI show up in national economic data? If you had invested $5K in a laptop and a word processing program, you could replace a secretary at multiples of the cost. When the web came in, there was Amazon squeezing out the costs of the middlemen.