Jan

31

Composition project, from Adam Grimes

January 31, 2022 | Leave a Comment

Given the recent music discussions on the list, I thought I would share a few things. First, I spent much of last year (as a pianist) digging into Bach. Over the past few months, I've been playing a lot of Chopin, and reading contemporary accounts of his teaching and playing–always trying to understand this music more like the composer himself might have.

I recently recorded this famous Nocturne. It's not a difficult piece by any means, but is a gorgeous aria for piano. (There's a little bit of sparkle at the end that often captures amateur performances off guard!) My performance of this piece isn't flawless, but I hope you enjoy it!

This piece also has some famous tie-ins with yesterday's Holocaust Remembrance Day which you can read about in the wiki.

Also, I'll be doing 100 days of composition, and sharing some of the progress daily. This is primarily a tool for myself to create some accountability, as I've been inexcusably lazy on the creative front over the past year. I invite you to follow along here. I'll update that post and probably share some snippets of work as I produce them. I've never done a project like this publicly, so I don't quite know what to expect–it may be a complete flop, but let's see what happens.

Vic replies:

very good and relevant post thank you

James Lackey responds:

Yea man awesome. So what’s the musical that beats describes this week? We had more dipsy than doodle weak close big up open ground hog days. My deal if trading I’d be so exhausted I’d be flat by lunch and not look at those screens again til Sunday night. I can only imagine how costly that was to Mr Vic and my bank balances years ago.

Stefan Jovanovich offers:

Sviatoslav Richter - Chopin - Etudes

Adam Grimes responds:

I absolutely love Richter's playing. His Bach was one of the biggest reasons I became a musician…as a kid, I was transfixed by some of his Bach recordings.

Jan

30

Loving and Loathing Kenny G

January 30, 2022 | Leave a Comment

Penny Lane on Loving and Loathing Kenny G

Love it or hate it, but you've definitely heard it: the so-called "smooth jazz" of saxophonist Kenny G. Filmmaker Penny Lane talks about her documentary, Listening to Kenny G, with EconTalk host Russ Roberts. They discuss the pursuit of perfection, the power of vulnerability in art, and why Kenny G is loved by the people and reviled by the critics.

Here is the trailer for the documentary.

Jeff Watson comments:

If I was forced to listen to Kenny G, I would welcome an increase in the rate of my deafness, in fact deafness would be my safe space.

Zubin Al Genubi writes:

In contrast to Kenny G I've really been into John Coltrane. Took a number of years to truly appreciate his music.

Adam Grimes adds:

I absolutely loathe smooth jazz and New Age music (Einaudi, et. al.). I'm not completely sure why, but I've always had a very strong visceral reaction to music like this. And I DO embrace a lot of simplicity and minimalism… so it's not that… Perhaps it's music that is obviously intended to be trivial.

James Lackey writes:

Well joy! Who loves listening to the same key trillion not low tech music? Kenny G blah blah blah. Charlie Parker on a 50s Miles album. If the ever frustrates me is because I can’t play it. Branford Marcellus probably the best ripper sax ever but whatever. Some may think taking pop tunes re sketch them into EDM is silly or lazy. It’s not hard but it’s hard to do and who wants women to dance anyways.

The point was Kenny G hit a note and held it then. Did not hit a note a rest then hit a note on same scale coming from and angle and your eyebrows raised. Damn!

And guys the emotional response to music rests rhythmic beats to each his own. Like the markets please remember the scientific evidence. Down 20% is always going to be emotional. The first 10, I’m not sure if any of us should lift a brow.

Jeffrey Hirsch writes:

I get into some of that old jazz from time to time. But I am a rocker at heart. Recent highlights:

Grateful Dead in Honolulu Jan 23, 1970, with Pig Pen and an extended Turn On Your Lovelight. It's on Dicks Picks.

Little Feat - Electric Lycanthrope – recent release of a live studio performance in 1974

Laurel Kenner responds:

I'm with Adam — I hate the phony sentimentalism/exhibitionism.

Antonio Porres Miranda suggests:

I end up always defaulting to what ever has to do with Antonio Carlos Jobim.

Laurel Kenner approves:

Jobim is impeccable — good choice!

Vic offers:

i always and continuously listen to Verdi. every aria is a perfect blend of instrumental music and singing. each aria is designed to please. and he's very innovative in his orchestration, sometimes 7 basses, other times 4 clarinets. beautiful augmentation of life for me, heartily recommend it.

Maria Callas - Early Verdi arias

Dec

28

Contrarian view, from Nils Poertner

December 28, 2021 | Leave a Comment

America is not what it used to be, it’s people are easily manipulated and weak. They do everything the government says without a 2nd thought. It’s sad.

from a chap on Twitter - his name is irrelevant. too many ppl go on about that easy to be bullish about many things in particular in the US of A in my humble view.

Stefan Jovanovich comments:

If that statement were made about any other country of any size from Denmark to China, it would not be taken seriously. What literally unites "informed" and "educated" people worldwide is the hope and belief that this country full of fat people who don't learn foreign languages and do not surrender to the metric system can somehow be brought to heal. What they cannot accept is the fact that the country is so large and various and so maddeningly Democratic that "policy" only gets decided for good after, as Van Buren said, Americans have taken the time to have "sober second thoughts". So, after nearly two years of stupidity, we are to the point where the rules for Covid will, as Biden just said, have to be made by the states. Just in time to disappoint all those "responsible" conservatives there is a majority who want to joinThe Anti-Federalist Society.

Nils Poertner adds:

each country, continent, etc faces its own unique challenges now - eg Germany (and the rest of EU - also UK) sitting on the tracks and the train is coming in form of an energy crisis, among others. and one can say to ppl 3 times that the train is coming ![]() but better to walk away or profit from it. i don't live in the US. am sure you guys will manage - defeatism was never an American thing anyway.

but better to walk away or profit from it. i don't live in the US. am sure you guys will manage - defeatism was never an American thing anyway.

James Lackey responds:

Hubbert Peak was 1957 and my dad god rest his soul made fun of that til the end of his times. There will never be an energy crisis. It goes against physics. Like jobs and government they can not be created nor destroyed just the way we pay or play is different.

What we fail to realize as American men is the women and children adapt quickly like a finger tap snap! They bitch moan complain and then say ok cool let’s do it differently

Just don’t ask first lol.

What’s remarkable about consulting for me is this general quote: "Everyone wants to know why why why!" I say yes sir so what? I get a death stare then quote von Steuben then shake my head Yes! As I state good enough for General Washington should be ok cool with us.

Nils Poertner replies:

Adapting to a new econ landscape, creating new jobs, finding new mkts, trading etc… and so on - is one thing and Americans are indeed quite good at this. that said…if you step back for a moment and look at the status of human beings around you with some compassion and benevolence - from the heart level - and at what level they are /we are - or society in general - then you surely see or sense that there is a lot of upside potential to say the least….

Dec

27

Beating the Stock Market

December 27, 2021 | Leave a Comment

Beating the Stock Market, by R. W. McNeel (1926), could have been written by Graham in 1950 and contains the worst advice for customers that could have been given 1000 years ago and is still being given today: "Stocks are to be bought at low price - and only by so doing can one make money." the idea is that when stocks are low, people get frightened and at these times they would not think of taking money out of their banks and buying stocks. the idea is to sell when stocks are high, get out of the market, wait for the inevitable decline and then get back in. This is almost like it was written by Alan Abelson and his current day followers except that even after the 1987 fall where stocks fell 30% to Dow 400 the former was still bearish and called the decline a start.

What are the problems with this approach? (1) the market is more bullish at a new high than at a new low. (2) the stocks that go up the most have a higher expectation than the stocks that are down the most. (3) the market has a 10,000 fold a century drift upwards and thus you can never never be successful if you get out and wait for the "inevitable drop". (4) growth stocks perform much better than value stocks.

Other bad advice in the book which reads like it was written today is never buy new flotations as Rockefeller and Morgan lost money. Rock and Morgan lost money when they didn't stick to their list and invested in railroads. New Haven and Colorado Fuel and Iron were their downfall.

all these counter to the terrible and destructive advice in the book and other uttered today in the media must be tested. I will endeavor to provide such tests here in the near future.

here's a more current version of McNeel but the original book that Alan Millhone gave me as present was written in 1926.

James Lackey writes:

My immediate question is why are these books sellable? We realized they get published because as Pam might say that’s what book sellers do. She’s one of the many book published experts on this list.

Perhaps Vic's advice which is granite rock solid is that it seems too easy! To be honest I thought that as a young spec. Now I realize this:

It’s hard to be bullish all the time.

Everyone calls us fools.

Then they point out our faults.

If we dare share logic and my goodness statistical data to prove why we are bullish all the time they weaponize our insecurities. The bears are smart and have very good arguments. They can be spiteful mean men. I’d be an old mean SOB too if I was wrong on average about everything.

Alex Castaldo adds:

It has been more than 25 years since I read this book in the reading room of the New York Public Library and I don't have a full recollection of it. I went to read it because it was mentioned in another book (or article) by Dean LeBaron and the library seemed to be the only place to find it. At the time I was reading as much as I could about investing, both recent works and what others considered "classics".

The main point of the book I thought was the importance of independent thinking in investment. The author points out that most people are like sheep and follow what they hear from others. A good investor should guard against this and try to come up with his own judgements. If I recall correctly the author coined the term "contrarian investing" to describe this. He explained that "contrarian investing" does not mean believing or doing the opposite of what everyone else does or believes. Rather it means doubting what others believe and being willing at times (but not all the time) to take a different position.

I did not dislike the book. I did think it perhaps a bit too obvious. If you are going to "outperform the market" almost by definition you have to do something different than what everyone else is doing. Also, it may be easier said than done. Some people, such as the Chair, seem to be good at coming up with their own opinions, but most people are somewhat conventional and it is not clear what they could do to change. Would just being aware of the need to think independently be enough?

I also thought the term contrarian does not seem the best choice for what McNeel is trying to describe. (It sounds like mulish opposition to what everyone believes). "Independent thinking" or the term coined by Michael Steinhardt "variant perception" seem more appropriate to me. But still it was interesting to see what the originator of the term thought it should mean.

Dec

21

Faith in the process, from Nils Poertner

December 21, 2021 | Leave a Comment

Most farmers plant a seed but don't constantly check every 5 minutes whether the seed has grown. They can live with some basic uncertainty called faith in the process. (may be changing now with new farming methods…)

Compare that with modern human behaviour of constantly checking a phone or a stock price or social media - that is not natural behaviour - it is normal though.

If enough behave unnaturally, perhaps we adversely effect the outcome? Too much attention then..? Am wondering whether constantly looking at a topic, or talking about something may adversely affect the outcome, e.g., way too many ppl talk about some strange health issue that started early in 2020.

Stefan Jovanovich comments

Farmers do, in fact, check their field crops regularly using GPS, moisture monitors and cross-checks against the prices of corn, beans and natural gas (used for drying). We humans with our opposable thumbs are permanently addicted to the use of tools. That is the one consistent behavior that has identified our species since we became one. Why? For the same reason sea otters play with rocks and then use them to break abalone shells - making things is fun and profitable.

Nils Poertner responds:

yes, I know modern farmers using more high-tech equipment to survey and manage their crops etc - not all bad - there must be some happy medium though? too much control or trying hard is a sign of deep rooted anxiety and lack of trusting the process. we may see that playing out in many ways now in politics etc.

James Lackey writes:

My brother created a work game. He hired our X bmx team kids that are now young men. He turned work into a game. The pay rate is a days labor. There is no time kept. Play all we want and there is 9 innings. Rain outs only happen in a hurricane. We play a full game. The slaughter rule is if we are up by 10 in the bottom of the 6th we pack up for tomorrow. 70% of the games are slaughtered. He never changes the rules of the game.

Dec

14

The market goes where it wants

December 14, 2021 | Leave a Comment

the bonds were up as usual on the inflation number, -10 today but up 48 ticks yesterday. but stocks went down on the ppi number which presumably has wholesale prices of 1 month ago. as always the market goes where it wants regardless of the news.

James Lackey writes:

Mr Vic Wrote: "calumniate, traduce - wrongfully accuse." the 6.8% inflation rate announced on the cpi for friday was good enough to raise the S&P futures to an ATH on a 1% rise. as mentioned repeatedly the inflation is not a problem. bonds and mortgages predict a 5 year rate of 1.5%.

what's worse is that the current administration is being wrongfully accused of driving inflation up by miles to this rate. when it comes down as will be seen on all future cpi's and eci, one should not credit with the great miracle of driving it down. its was front page news about the horrible spike. its not the fault of bbb so much, what's wrong with all these programs is the opposite of capitalism (i dare not use the word for fear of total cancelation). in any case a great opportunity to go long sp on future releases like last friday.

There is something I need to say. This statement took 20 years to pass. Guys I have never agreed with Victor Neiderhoffer publicly because I had to or for any other reasons than this one: He’s correct.

If we need a reason inflation isn’t ever a problem outside of the printing press or the rigged short term rates set by the central’s for their 12 and only 12 clients, when businesses are left alone to do their thing it is this one which probably comes from Vics books but the gist is: Business men drive profit to Zero!

If you can’t wrap your head around that one think of Trucks in transportation services. There are times in history where Trucks have lost money. It’s not that truck drivers cost too much or fuel or repairs. It’s the business. A truck will take a lower load vs no load at all dead head.

That’s easy to understand. What is driving me more insane, more crazy or best stated by my bmx racing kids is your crazier than usual Mr Lack. Why do industries as a whole seemingly lose on purpose? An example is BBBY or cars in general like Autonation, Sonic et al? Why would any business not.

Text book "pure competition" was described as agriculture in my old books. Why? How why what in the world are they doing driving profit to zero? Please help with anecdotal evidence and stats if we get them.

Here is why: Covid rigged shortage some of these old line businesses like food service Carz and others are running 10% non levered margin profit or triple of what was stasis and as usual driven to zero.

My hypothesis is men never learn as a people. A person is smart but people can be toxic as hades and let’s not forget Every day is better than the years 1942 to 45 at least for Americans.

Duncan Coker observes:

5-year TIPS yield -1.6%, with 5-year Treasuries yield 1.2%, implies a 2.8% inflation rate over the period. Wake me up when it hits 5%.

Dec

12

Arrival of the Queen of Sheba - G.F. Händel, from Nils Poertner

December 12, 2021 | Leave a Comment

A music piece by Händel - the Arrival of the Queen of Sheba. One could tell that the organ player is enjoying himself.

So many of us finance do terribly well - financially speaking. But then we see it as toil. Some go to the theater or listen to concert in the eve- but perhaps we got it all backward then?

Laurence Glazier writes:

Let’s remember that Handel was enjoying himself too.

Nils Poertner replies:

Wasn't he a pretty good investor as well?

Most (good) musicians experience life in greater fullness than ordinary folks (like us) and express it via their music, eg, the late US singer Johnny Cash…same thing with him. also good lyric with toil and feeling depressed and the sun comforting him etc. some of my more narrow minded friends are like: "I am rich, I can buy happiness." No, you can't. It is an illusion.

Vic adds:

i listen to verdi whenever i need cheer. every one of his arias and chorus pieces is bite sized to enjoy. verdi was a genius in all things like mozart and brahms. a great investor also was about the richest man in Italy when he passed. maintained amazing secrecy about his mistresses also.

Jeff Watson offers:

Whenever I need cheering up, I listen to Steve Fromholz sing his epic Texas Trilogy, and his Man With a Big Hat. (If that one doesn’t bring a tear to your eye, have someone check you for a pulse.)Beautiful music that celebrates real men, freedom, and the open range.

Adam Grimes writes:

Thank you for the share, Nils. This is a fun piece… I've played arrangements of it literally hundreds of times in church services and weddings, etc.

By the way, if any of you play piano, Handel's keyboard music is vastly underrated. Almost all of it is super accessible and a real joy to play. Worth checking out!

I've been more successful in the past few years finding a balance between my artistic, creative life as a musician and the markets. It's a terribly hard balance to maintain and I haven't quite got it right yet.

James Lackey writes:

The Blues Travelers Run Around, the blues brothers and the prison movies Shawshank Redemption, Clint Eastwood Alcatraz always cheer me.

Verdi is fantastic for its simple yet full and rich chord structure and the similar movie sound tracks. Or how about that chord and crescendo on the TDX patented movie surround sound vrrrrmph there is nothing like the sounds of a properly tuned full blown racing engine at idle then a single thump of the throttle and shut it down to silence.

Simon and Garfunkel the sound of silence is wonderful with the remakes of recent rockers.

The sound of silence trading is one thing, like sunshine itself that is either one of the most beautiful things a day or annoying. The sounds of a single fan on in a room across the hall, a car door, mumbled sounds of laughter on the next block. In a panic as your fingers cut plastic keyboard buttons and you search for an honorable retreat. A big rally, the escape with a proper reduction, back to even you laugh as your holding what you’ve got for the duration as we mumble we should have had the balls to hold all to close.

Then like the sun rising over a few covered manicured field of dreams. You whisper, Put some music on brother…Why is it so quiet in here?

Life without music is death.

Laurence Glazier responds:

Nicely put, Lack, with a great rhythm and turn of phrase. Music is a force of nature we cannot tame, but we can be its instrument.

A quote from the painter David Hockney's latest book, Spring Cannot Be Cancelled:

I intend to carry on with my work, which I now see as very important. We have lost touch with nature, rather foolishly as are a part of it, not outside it. This will in time be over and then what? What have we learned? I am almost 83 years old, I will die. The cause of death is birth. The only real things in life are food and love, in that order, just like our little dog Ruby, I really believe this and the source of art is love. I love life.

Larry Williams suggests:

Food and love?? How about air? How about something to be passionate about—like trading or whatever turns you on.

James Lackey :

Larry as you know "trading for a living" opens up self - I we me - to the world in a very simple output PnL and you can not fake it for long. To complete on the worlds stage full time is to immerse yourself. If you give the market 80% effort perhaps you’ll end up with a 20% loss. Give it 98% maybe you’ll get a 2% profit after expenses and paying yourself a working wage. Go all in and it’s literally limitless. All the money fame fortune a many can ever want.

Take back 2% of your time? The mistress of the market is a very jealous person. If she doesn’t kill you your cohorts running at 100% will.

Trading is one of the best things that has ever consumed me and mine. Yet it consumes me.

Laurence Glazier comments:

Better the passion is in the art than the artist.

Nils Poertner writes:

well said. there is nothing wrong with some healthy ego. but the ego that modern man (modern woman) has formed is perhaps way too narcissistic. We are co-creators in fife and that spirit is encapsulated in many religious books- even by Ralph Walter Emerson. one has to feel it - it has nothing to do with IQ.

In The Gospel of Emerson, Ralph Waldo Emerson is quoted as saying:

"There is a principle which is the basis of things . . . a simple, quiet, undescribed, indescribable presence, dwelling very peacefully in us . . . we are not to do, but to let do; not to work, but to be worked upon."

James Lackey adds:

The gist of whatever m saying comes from my dad and army guys and y’all:

Give a smart man time he finds problems.

Give a real smart guy time he finds solutions.

Give a genius time they find the right questions.

With leadership all 3!work together and create the undiscovered unlimited human potential. Alone without leadership and a dose of pain you get what my dad called "lost souls". Time is the 21st century issue most have too much time to think of problems. Those with solutions have no voice as they live in fear. The genius sit alone talking to the connections.

The genius around the globe never before without a middle man or government wishing some one would take charge and get it done. What is it? That list is now so long it’s an infinity symbol. No begging. No end.

Alston Mabry suggest:

Speaking of music, the Fresh Air podcast has a 3-part Sondheim

retrospective. It's really interesting to hear somebody at that level

talk about his work.

Nov

12

There’s a great deal of money to be made, from Larry Williams

November 12, 2021 | Leave a Comment

There's a great deal of money to be made being bearish…as an investment advisor or publisher.

There is a great deal of money to be made being bullish as a real investor.

Nils Poertner comments:

generally true agree. easier to sound scepitcal in life - no academic person normally wants to sound like a constant cheerleader

that said, maybe next 2 yrs different than last 2 yrs - and lots of refinement, creativity, imagination needed as in right hemisphere type of job

James Lackey writes:

Of course there is a lot of money made by doing nothing as well. Sell premium but the argument is not how to make money the argument was: What’s the cost? Time and price are currently market marked and what’s the mystery? The future time and prices. What’s the cost of carry the opportunity cost how many calories are being expended by being long short flat

Thermodynamics of the entire system comes to mind:

The market eco system

The firms eco system

Family

Your inner voice peace or

In my case: Brain damage from Cognitive Dissonance

Nils Poertner expands:

Health (incl mental health) is already a huge topic not just for ppl on this list. coz our lifestyle is often normal these days but still unnatural. And we have lost touch with what is natural a bit..

Eg. light. we need light - daylight eg. the amount of time we spend indoor is like 3pc on average in the US (compared to 10 many decades ago)- am speaking about kids - it is probably the same for adults or worse.. Also ppl chroincally jetlagged without ever having taken a flight as they use too much artificial light /don't get enough darkness /sleep at nite. (eg I used to trade Asian fx during European hours …. - you can imagine how my body clock got out of whack etc etc etc)

see Jacob Libermangood intro on light, vision and health

James Lackey responds:

This is fantastic! The Huberman Lab agrees a… The brain is the eyes and the eyes literally pop out of the skull during development. Light is s key to good mental health!

Andrew advises to watch the sunrise and sunset daily. My Lack Hack to reset or to maintain the body clock meme is Planet Fitness. My hypothesis is if we watch the fireball in the sky dip from horizon it’s about 2 minutes from bottom to top if your on a British Navy ship a few hundred years ago it was a simple task and all hands on deck. If we are on the equator this is 12 hour days.

Shakelton in his arctic voyages had a big problem. In Alaska Army guys have a point in the year of incredibly low sunlight or 24 hours of dark like an eclipse day and 24 hours of blue skies at night. The Army and the British navy always find life hacks to be fit for duty

Ok so you want to fall asleep by let’s say 9 pm tonight? Get up 3 am and blast yourself in stand up tan room at planet fitness! It’s close then a few minutes before dawn get outside and literally stare at the color change of the shy at nautical sunrise which is before the fireball

The Huberman lab falsified my hypothesis that’s it’s the 2 minutes it take for fireball to go from top to bottom. That doesn’t work. What does work is the change and range of colors of the sky the light refraction. Then why the lack hack do planet fitness 18 hours before exact bed night go to sleep in a cool dark silence room?

Because like trader it’s the duration and the magnitude of the sunlight daily! Ya see in S Florida a very light skinned person has to be careful due to the magnitude of the sun on skin cancer spectrum. Therefore the duration and Magnitude is imperative for physical and mental health. When I realize that I shut all lights off in my house when my daily sun limit was maxed out IR too much sun at beach and bmx track I said omg!

So the falsified hypothesis led to another it’s not only the eyes signal the brain chemistry the sun rise plus 16/18 hours you see sunset and boom you can sleep. You need f(X) amount of physical sunlight and duration and magnitude must be maximum for your body skin etc/brain chemistry and dna what ever the hades all that must mean.

I’m genetic white Nordic and I’m tricking my eyes to signal it’s brain to think it’s Summer Solatice in Fall or best Winter

PS trade the Dax vs SPU for a bit and live dad bmx dad life it was too hard until we used science!

Larry Williams adds:

Increase telomere length

[For example: Lifestyle Changes May Lengthen Telomeres, A Measure of Cell Aging]

Nov

8

J. S. Bach, from Nils Poertner

November 8, 2021 | Leave a Comment

JS Bach was once asked why he wrote so much music.

His answer:

1. "To the glory of God" (not sure whether he meant it, nevermind)

2. To amuse himself.

Maybe some like this piece here as well:

Bach - Concerto in D minor BWV 596 - Van Doeselaar | Netherlands Bach Society

In the first notes of the Concerto in D minor, performed by Leo van Doeselaar for All of Bach, it is immediately clear that this is not the usual Bach. This piece is an organ version of a concerto for two violins and orchestra from Antonio Vivaldi’s L’Estro Armonico. Vivaldi’s music was popular throughout Europe and Germany was no exception. During his years at the court in Weimar, Bach made a series of arrangements of Italian concerto music for organ and harpsichord, including six concertos by Vivaldi.

Gyve Bones adds:

From 20 arguments for the existence of God, from Prof. Peter Kreeft, Department of Philosophy, Boston College:

17. The Argument from Aesthetic Experience

There is the music of Johann Sebastian Bach.

Therefore there must be a God.

You either see this one or you don't.

Alston Mabry writes:

There is a scene in Professor T (Antwerp version) where T is talking to his cellmate and says very sadly something like, "Is there a God?". And his cellmate says something like, "There is Bach. Bach is God." And T smiles and says "Yes, Bach is God."

Peter Saint-Andre offers:

A quote from Pablo Casals:

For the past eighty years I have started each day in the same manner. It is not a mechanical routine but something essential to my daily life. I go to the piano, and I play two preludes and fugues of Bach. I cannot think of doing otherwise. It is a sort of benediction on the house. But that is not its only meaning for me. It is a rediscovery of the world of which I have the joy of being a part. It fills me with awareness of the wonder of life, with a feeling of the incredible marvel of being a human being. The music is never the same for me, never. Each day it is something new, fantastic and unbelievable. That is Bach, like nature, a miracle!

Nils Poertner responds:

that's great. I always try to listen in the moment - whatever works for ppl - life works a bit by invitation anyway. one can't force stuff. a basic sense of joy and harmony is certainly missing in our era (the media, the drama etc outside).

Jeffrey Hirsch recalls:

An English professor whose class I was in asked the question why people write poetry. Answer: Because they have to. Similar reason why Bach wrote so much music. Because he had to.

Richard Owen wonders:

Does Bach have an Onlyfans? I can't see it in the search.

Laurence Glazier suggests:

There are free versions of Sibelius. May I recommend the pleasures of composing now available to all?

Richard Owen admits:

Thank you Laurence, an answer from a real musician of note I think? I should therefore disclose, because you are a decent and proper individual of good character and standing… my question was touched with satire. Google Onlyfans via google news, and you might learn something about the debasement of our culture.

Nils Poertner makes a connection:

btw…I always wondered whether one could re-train a musician becoming good trader? Why? Coz good musicians (of any style) tend to enjoy the process of learning - and are the complete opposite of end-gainers. perhaps they are not interested in financial markets enough- otherwise it would be an interesting project. any idea?

Duncan Coker writes:

I am not in the class or universe of LG in terms of composing, but I do write country songs as a hobby. One thing I have found useful is, often I have to throw something away that I thought was good, a melody, a lyric and start from scratch. The more easily and quickly I scrap an idea, the easier it is to start over. You can't force it. This is true for trading.

James Lackey expands:

Dunc is not gonna get mad at me because we never argue. However sure we can force it and to add to the comment of "those people". As if a career makes a man!?)@“”

Anyways path dependence omg I sound like the geek I am. Ok in a sport or music the pleasure has to be the process of practicing or doing it every damn day. As parents we teach this as in brush your hair teeth good girl boy kiddo! The pleasure of rewriting written words must be higher than start from scratch or least effort kicks in no?

I do not care if she likes my poems. I love them. I’m not sure if it’s a coin toss but I can’t fathom whether I like the poems I wrote in one blast or over 6 hours weeks days or? Good is good and great is better than 6 years ago and awesome is when she says so.

I wrote an awful poem once. Many bad but awful because you can hear the blood hit the floor. I gave it to a song writer buddy and he said damn that’s awesome. I said write a song. He said no man you never write over another mans blood sweat or tears.

In trading the get the joke one liners or 5 lots are cute and won’t hurt anyone much can’t kill you but will never inspire romance. The all in big line can and will get you the one, the forever girl or death one way or the other every 7 years death to the marriage of business and of the romantic life.

They say you’ll get what you need out of trading the market. I think perhaps that’s what separates us from the other guys. We need we want we just can’t help ourselves, we need everything. We want it all!

Adams Grimes writes:

I do think there are some fairly intense connections between music and successful trading/investing. There are the obvious issues of "sticktuitiveness" and grit… I'm currently working my way through one of the Bach Partitas and spent about 4 hours yesterday on 2 measures of music. (For reference that's probably 4-6 seconds, when performed). That degree of focus on detail is absolutely normal for musicians, but is not normal for most peoples' experience, at least in the modern world.

In markets, we get kicked in the head (if we're lucky) or the balls (or, more likely, both) on a regular basis. Some degree of stubbornness and a willingness to just not give up.

I think there are also some profound tie-ins in terms of pattern recognition. For me, I think this worked both ways… after taking a decade away from music I discovered my "musical brain" and compositional skills were probably better than they were, in some ways, when I was focusing my life around music. (My keyboard technique emphatically DID NOT improve, as that's something that does take a fair amount of maintenance.)

Serious, important, and maybe even interesting epistemological questions lurk here.

It's hard to have a favorite Bach piece… his works are surprisingly even in quality across his output, but let me share one that is at the top of my list. This has always been one of my favorites:

Bach: Trio Sonata in G major BWV 530 - I. Vivace - Koopman

(And, for sounding so simple and transparent, it's a nasty little nightmare to perform!)

Gyve Bones harmonizes:

I first heard this performed in the 1970s by Walter/Wendy Carlos on the “Switched-On Bach” on Moog synthesizer, and it has remained a favorite piece of music since then. There are various settings of the piece for guitar and piano as well. Here is a full symphony rendition… It is a song of gratitude to God for his many blessings.

Bach - Sinfonia from Cantata BWV 29 | Netherlands Bach Society

Peter Saint-Andre responds:

I had a similar experience with one of the Bach Cello Suites last night. There is much effort (both time and concentration) involved in learning these pieces. And he probably just dashed them off!

BTW, many years ago there was a software company that specifically recruited music majors because they were highly trainable for programming. And music majors also scored quite high on the even older IBM Programmer's Aptitude Test.

Adam Grimes comments:

And he probably just dashed them off!

This, for me, is one of the biggest and probably eternally unanswerable questions in music history. I suspect our performance standards today are probably far higher than they were historically. It's possible we have an army of at least highly technically competent instrumentalists who've devoted more time to, say, the Chopin scherzi than he ever did himself. We know that Beethoven's playing of his own pieces was, according to contemporary accounts, thrilling but filled with mistakes. When Czerny (a student of Beethoven) proposed playing Beethoven's pieces from memory, Beethoven replied that it was impossible to get all the details without looking at the score… and then admitted he was incorrect on that assumption.

Reading between the lines of what CPE Bach wrote (the Essay on the True Art… is a must-read) I suspect contemporary performance practice was much more improvisatory and perhaps less detail-oriented than we'd expect. We know many of these Bach cantatas were written, rehearsed, and performed in a week. These performers were not super human… the only thing that makes sense to me is that our performance standards and expectations (which approach technical perfection, due to the advent and growth of recording) might be much higher than in past ages.

But perhaps I'm wrong on that.

Interesting on the programming front. I would think those are two quite different modes of thinking (and knowing the expertise is domain-specific in many cases), but I'm a far better programmer than I should be given my level of actual training in the discipline. Maybe there's something to that.

Peter Saint-Andre writes:

In his book "Baroque Music Today", Nikolaus Harnoncourt notes that before music was recorded, people most likely heard any given piece of music only once and didn't want to keep listening to the same music over and over as we do but instead continually sought out whatever was new. Perhaps there was a sense of discovery as composers explored the potentials of the tonal system; once those potentials were exhausted and composers started to produce extremely chromatic or even atonal music in the 20th century, listeners were turned off by the new and sought refuge in the old (thus Western art music ceased to be a living tradition for most listeners). Thankfully composers like Adam Grimes and Laurence Glazier are bucking that trend!

Laurence Glazier writes:

One would expect coding and music skills to be correlated. A symphony is partly an encoded instruction set, whether performed by a computer or an orchestra. The conductor is the "crystal", the timer that pumps the flow. But oh, so much more, than that.

It would be very hard to combine the music and trading fields. To be attentive to the Muse and the S&P at the same time? Surely both are all-consuming. But trading, with its psychological dimension, of self-awareness and development, is a fine path. Alexander Borodin managed to combine composing with a distinguished career in science, as did Charles Ives in insurance.

Oct

20

Energy - Things that make you go hmmmm, from Zubin Al Genubi

October 20, 2021 | Leave a Comment

The energy crunch in China and Europe may grow into a bigger trend worldwide. Its one of those small line notes you notice and go hmmm. Like the pandemic was in early 2020. Hmmm, shortage of masks. Hmmm, Shortage of gas, coal. Things that make you go hmmm.

Water shortages also coming up. See how this winter is. Reservoirs are quite low. Look at weekly chart of FIW water etf.

Jeff Watson adds:

I’m noticing many holes where product should be on shelving at every retail establishment we patronize. I’ve been waiting on a part for my Jeep that’s been on back order for 6months. Still see little to no ammo in stores. The system is full of hiccups.

Tim Melvin notes:

I saw a lot of empty shelf space at Costco last week. Very unusual.

Pamela Van Giessen writes:

No joke. We have a huge problem. This is what happens when the world gets shut down and everything is all covid fear all the time. No workers. Test school kids constantly and they will end up being sent home and parents won’t be able to work. Then stuff won’t get made or shipped to where it needs to be. Freight train, fully loaded, sat parked in Livingston MT for nearly 2 weeks. Just left the other day.

As someone running a business that relies on actual commodities (flour, sugar, etc) I find myself overbuying out of concern that I will not be able to get basic ingredients. I had a hard time getting boxes about 2 weeks ago. It’s ridiculous.

Laurence Glazier writes:

It’s getting reminiscent or the Atlas Shrugged movie.

Nils Poertner suggests:

UK is worth to watch as most things we are going to see here in Eurozone or you guys in the US are happening a touch earlier over there (UK being such a tiny, little, open, exposed, econ).

Laurence Glazier adds:

Yes, over here in London it's harder to get petrol (i.e. gas) for the car, less things available in online stores.

James Lackey writes:

I can get everything to build a car a bike or a motorcycle and mysteriously no spikes no single bearing or one simple chip - I call BS. This is almost as big as a Vatican scam.

Jeff Rollert adds:

The most common boat engine, the Merc Cruiser, is quoting deliveries of full engines for next summer.

Duncan Coker notes:

Motors being taken out of production. Sounds a lot like a book I know.

Oct

20

Sleep patterns and disruption, from Big Al

October 20, 2021 | Leave a Comment

How do traders deal with sleep patterns or disruption? Especially with markets in different time zones, etc.

Circadian Rhythm and Sleep Disruption: Causes, Metabolic Consequences, and Countermeasures

Abstract

Circadian (~24-hour) timing systems pervade all kingdoms of life and temporally optimize behavior and physiology in humans. Relatively recent changes to our environments, such as the introduction of artificial lighting, can disorganize the circadian system, from the level of the molecular clocks that regulate the timing of cellular activities to the level of synchronization between our daily cycles of behavior and the solar day. Sleep/wake cycles are intertwined with the circadian system, and global trends indicate that these, too, are increasingly subject to disruption. A large proportion of the world's population is at increased risk of environmentally driven circadian rhythm and sleep disruption, and a minority of individuals are also genetically predisposed to circadian misalignment and sleep disorders. The consequences of disruption to the circadian system and sleep are profound and include myriad metabolic ramifications, some of which may be compounded by adverse effects on dietary choices. If not addressed, the deleterious effects of such disruption will continue to cause widespread health problems; therefore, implementation of the numerous behavioral and pharmaceutical interventions that can help restore circadian system alignment and enhance sleep will be important.

Larry Williams comments:

That’s one of the hardest parts of this business 'secially when you live in 2 places.

Zubin Al Genubi writes:

Haha. I sleep when I trade. Wake up . Sell too soon.

Jeff Watson responds:

Sell too soon? My life story is that I always pay too much and sell too cheaply. It's a bad habit.

James Lackey adds:

In Ecuador your perfect 12 hours of sunlight all year 365 sure beats fall back to dark at 5pm here. The fall back time change and the further/ farther your from the equator is

More difficult than staying up 100 hours a few times a year.

Oct

12

Economists win Nobel prize for proving laws of economics don’t exist, from Duncan Coker

October 12, 2021 | Leave a Comment

No it is not the Onion.

3 economists awarded Nobel for work on real-world experiments

"The Royal Swedish Academy of Sciences said that Card's studies from the early 1990s "challenged conventional wisdom." By comparing what happened when New Jersey hiked its minimum wage to labor market conditions in neighboring Pennsylvania, he was able to upend the accepted theory that increasing the minimum wage would lead to fewer jobs."

Peter Saint-Andre adds:

Why don't we raise the minimum wage to $200/hr so everyone can be rich?

James Lackey relates:

True story: What is the probability old lack would sell a unit to University PhDs in Econ in a year? They both asked why I sell Carz. That I blew up again peaked their interest. What they didn’t realize is the Econ profession told me the exact same thing the Law clerks told me: Go trade lack.

Anyhoo they always bring up the big short movie book or some other mumbo story then they quote their book. I exhale and call bs.

I get very upset at men calling me a not ummm honorable man or imply that whether it’s Carz or trading for a living.

I blast them with a 11 minute data dump and why the street works and how and Mr Vics ecology the story of the elephants and like Gresham law they know they never read Albert K Nock and they do implicitly understand the law of least effort. I end my discussion with the same to all business men: It’s the pay plan man!

I’ve been asked to speak at MBA classes and seminars and for sure interviews for their next book. After blow up artist and hour interviews and a one line quote that was actually the get the joke true real deal about Mr Vic "he always found a way for all of us to make money". Which in bmx or drag racing terms means to win! I say no thanks have a nice day.

A year later I see the profs new book at the library. I flip through it and I’ll be damned. Ya can’t make a jackass drink the koolaid.

Henry Gifford comments:

The thing frequently referred to as the Nobel Prize in Economics is misleading, at best.

The original Nobel Prizes were established in 1895, and financed (the word "funded" implies "free" government money in some circles) by Alfred Nobel's will.

The prize in economics was established in 1968 by a donation from Sweden's central bank. Perhaps the central bank has some economic agenda to pursue, but if so, they didn't state that as their goal.

In 1995 the prize in economics was redefined as a prize in social sciences for the stated purpose of widening the field of possible recipients to include people who are not economists.

While the prize in economics is often called "The Nobel Prize in Economics" in the US, that has never been the official translation to English agreed on by the people giving the award. The official English translation of the name has changed eleven times since 1971 - perhaps they are striving for the most confusing and politically correct name possible. The official names in English usually include the words "Memorial" and "Alfred Nobel."

At a minimum, the prize should be referred to with the word "Memorial" in the name, to distinguish it from a genuine "Phone call from Sweden."

Oct

6

VIX term structure, from Nils Poertner

October 6, 2021 | Leave a Comment

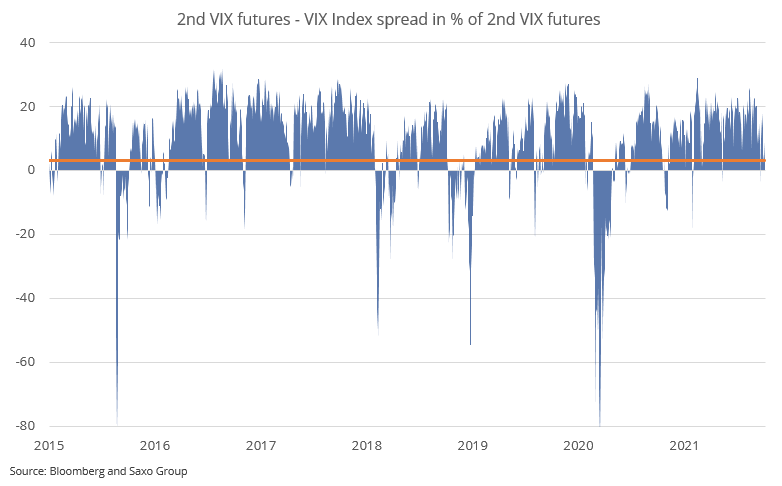

in proper sell-off in equity, one eventually gets a massive backwardation - and we haven't seen this - almost the opposite- it slightly steepened yesterday - that is odd - and could mean a lot more stress but who knows, am not an equity guy just noticing it on the side and it needs to be tested more…

Zubin Al Genubi comments:

Decay of hi vol over time is a regular tendency. This leads to pennant like structures. The most dangerous time is at the expansion phase where the rate of expansion rapidly increases.

James Lackey responds:

This is a fabulous lesson for new specs that fall for the bear memes then get whacked post dip rally buying.

Look there are times for all things. We can make money short but it's so crazy risk dangerous and the vigorish is insane. I love Mr Vic's "never short" advice!

However if you must sell them without owning them I'd test when the vix is increasing in the short term ie today's vix is higher than 5 days ago then keep it to something like no more than a few trading days hod short et al.

My gist is paying huge vig and buying strength and selling weaknesses is the stupidest system ever! However I'm a man that made it happen and allot over many years even prior to my spec list school.

In closing don't lol but if you must: It makes sense to move all the contracts you can, all day every day when the vix is over let's say 25 and my hypothesis is when it's expanded rather than contracted.

With love honor and respect for those that trade for a living.

Nils Poertner adds:

whenever this graph (from Peter Garnry at Saxo Bank) is -20 or -30, it is possibly a contrarian buy.- that is how I read it. in other wards, in strong backwardation in the vix curve…eventually one needs to switch and be bullish - in context perhaps with other indicators? treat with caution - have not done study myself. always test for yourself

Oct

6

Books, from Zubin Al Genubi

October 6, 2021 | Leave a Comment

1. Human Error, James Reason. A rather disappointing academic treatise on cognitive analysis of how humans make errors which is really dragged down by obtuse academia speak. Two major sources of error are lapses and slips, and secondly errors of reason and rules. Slips are when you forget steps, lose your place, get distracted, fall into a habitual practice inappropriate for the situation. Errors of reason are using the wrong rule for the situation, where the plan does not go as expected, or the plan was wrong. When the rule doesn't fit, the expert acts like a novice.

There are the raft of heuristics. One is how humans utilize familiar patterns rather than calculate or optimize a current new situation. It is cognitively difficult to consciously think through a new situation.

An interesting section was about how the brain uses "autodrive" to do many familiar things to make room for conscious thought. I was driving down somewhere thinking, and look up and arriving at my destination, realize that I basically had no recollection of the drive there - just on autopilot. A lot of daily life is on auto pilot thus ripe for error.

It's a difficult read. Better to rent, than buy.

2. The Genetic Lottery: Why DNA Matters for Social Equality, by Kathryn Paige Harden

A flawed book addressing a difficult subject. Galton's biggest failing was his theory on eugenics. One of Harden's main points is to debunk the misconception that the genetics of race has any meaning. Race is close to meaningless in genetics. For example, people with genes from people from Africa have a much larger variation in genes than in all the other races, and the categorization of Black and White becomes meaningless.

Genetics does have an effect on personal traits. It predicts certain diseases. The attempt at connecting genetics with achievement in education, life satisfaction, and wealth, suffers from too many variables to have any use.

Their statistical studies, not disclosed, I think will not be robust.

3. John Steinbeck, Sea of Cortez, recommended by Andrew Moe. A beautifully written book and a joy to read.

4. Yottam Ottolenghi, Plenty More. Highly recommended cook book with smashing recipes for vegetarian dishes with a mideastern influence. He has other cookbooks such as Jerusalem with recipes that are real home runs. I've made a number with great success.

5. Michael Lewis, The Premonition. Excellent book about the sad state of the lack of preparedness for a pandemic in the US. Outlines some of the goings on in California to deal with pandemics and disease. Lewis is a fine writer and easy to read.

Pamela Van Giessen comments:

Lewis is a facile writer who performs a parlor trick by bringing forward, in Vanity Fair like story telling, that which will convince you that his view is the correct view. He will not be remembered 100 yrs from now.

A reader writes:

There are three sentences in the short review of The Genetic Lottery that are utter nonsense:

"Galton's biggest failing was his theory [sic] on eugenics."

"Race is close to meaningless in genetics."

"The attempt at connecting genetics with achievement in education, life satisfaction, and wealth, suffers from too many variables to have any use."

These sentences could probably be accepted in, say, the NY Times given that and other leading publications' denial of much of genetic science, but not on this Spec List.

James Lackey appreciates:

Fantastic report! I dig Lewis because moneyball was a great movie lol but really love him because his Wife is so amazing that he must be a good dude to keep her.

Duncan Coker

Thanks for the list. Has anyone read the latest from Steven Pinker, Rationality? It seems like a more scientific analysis of what Kahneman failed to do. We humans have trouble with advanced probability in every day life, so appear to be irrational, but there is more to the story. Do the shortcuts we use help or hurt. Try doing Bayesian Analysis at the grocery story. I think Pinker is one of the best writers we have at present.

An excerpt from Pinker's latest:

Why You Should Always Switch: The Monty Hall Problem (Finally) Explained

By Steven Pinker

Oct

5

Could traders learn from other traders?

October 5, 2021 | Leave a Comment

"Decoded Neurofeedback (DecNef) is the process of inducing knowledge in a subject by increasing neural activation in predetermined regions in the brain, such as the visual cortex. This is achieved by measuring neural activity in these regions via functional magnetic resonance imaging (FMRI), comparing this to the ideal pattern of neural activation in these regions (for the intended purpose), and giving subjects feedback on how close their current pattern of neural activity is to the ideal pattern. Without explicit knowledge of what they are supposed to be doing or thinking about, over time participants learn to induce this ideal pattern of neural activation. Corresponding to this, their 'knowledge' or way of thinking has been found to change accordingly."

Nils Poertner comments:

interesting. personally, I found cross-training v helpful - so honing skills in non-work areas, too. eg, professional trader in equity who has singing as hobby might benefit a lot from taking professional singing classes to open up new pathways (also re creativity in trading. also) - am happy to be the subordinate then whereas in trading there can be some unconscious resistance in learning from others.

Jeff Watson adds:

Ben K Green wrote a book called Horse Tradin'. The entire book is cross-training and might even be on Chair's list of recommended books. If it isn't on a list, then it should be.

James Lackey writes:

I've been working on this for a while now 3 years. Path duration outcome based on neuroscience. Dr Andrew Huberman my skate park guy is one of the best - Prof from Stanford University and Army special forces fan. It's fantastic to study.

Nils Poertner responds:

yes excellent. the thing is it can't be an endgaining experience, one needs to have an intrinsic interest in something /also the learning part. if ppl love skateboarding for the sake of skateboarding and hire a teacher to get better, this enthusiasm may carry over for trading (learning /improve process here as well) too.

(our whole culture is way too much based on endgaining - maybe not in all areas - but in a lot of them which is part of the problem why are in this situation altogether)

Oct

5

An Armor Conspired: the Global Shipping Freeze, by Peter C. Earle

October 5, 2021 | 1 Comment

An Armor Conspired: the Global Shipping Freeze

First, the foundations. While bottlenecks are occurring everywhere, at present US ports are disproportionately affected. Docking locations along US coasts are among the slowest in the world: not because of size or technological capacity but collective bargaining hindrances. As Dominic Pino recently wrote,

Why are our ports so far behind? Not because we don’t spend enough on infrastructure, as the Biden administration would have you believe. The federal government could spend a quadrillion dollars on ports, and it wouldn’t change the contracts with the longshoreman unions that prevent ports from operating 24/7 (as they do in Asia) and send labor costs through the roof. (Lincicome finds that union dockworkers on the West Coast make an average of $171,000 a year plus free healthcare.) The unions also fight automation at American ports today, “just as they fought containerized shipping and computers decades before that.”

James Lackey adds:

Pete there is another one you can add to your list: The conspiracy to collude. The ftc is looking the other way whilst all car manufacturers minus Toyota Subaru and Mazda are limit up on next years ie 2022 sticker prices and it's not collusion - if you're not cheating, you're not winning in racing.

Oh, and the help wanted signs are bullshiza as they do not want to hire anyone as their wage offers are limit down. They can't pay back the ppp - they are all broke.

Bud Conrad comments:

The article is long on the sequence of events that colluded to a Perfect Storm of shipping delays. But he doesn't pick the specific culprit (Labor Unions? Government Port Investment? COVID Rebound? Trucking and intermodal capacity inadequacies? and I'll throw in another: Some kind of government or business sector conspiracy to get prices higher.

Regardless of the cause, the impacts on our economy are likely to be most felt in surprisingly high price inflation, for a broad range of products, that the US no longer knows how to make.

We will also see prices rising from the expanded money supply. Wage price inflation is already visible.

Pete Earle responds:

I don’t pick a specific culprit as the current state is not the product of a singular influence. Very simple, and the entire point of my article.

"Some kind of government or business sector conspiracy to get prices higher." [Not a reasonable theory.]

Bud Conrad clarifies:

I learned a lot in reading your article, and the problems you so well identify, including presenting the many charts. Yes: the world and its movements do work with multiple influences.

My challenge was rooted in my hope for identifying an overriding cause that could be addressed, and thus be the course of action to get things back into balance. Of course solutions will require many many efforts. And that was your point. What do you expect to happen?

I also threw out what I expected to be the consequence, that we would have very high price inflation, which will have obvious implications for all of us.

Aug

24

Wondering why the FTSE has lagged, from James Lackey

August 24, 2021 | Leave a Comment

One of the things that make me a poor manager but perhaps a leader mindset is to me pointing out problems with out a proper solution seems, well, silly.

At the trading desk here in Weston with Mr Vic, the one thing that caught my eye quickly was the FTSE and it's low prices. I have no clue so google landed the link below. any ideas?

Has the FTSE 100 really performed as badly this century as it appears?

Nils Poertner muses:

good spot - many other indices are rich (and firms, too, eg. Apple)?

long FTSE is probably the next big thing for Cathy Woods - am mentioning her name since she gets a lot of bad press in Europe but her calls have been quite good in last few yrs.

Paul O'Leary is skeptical:

FTSE an unlikely place for Cathie Wood to find the hyper growth she looks for.

A reader offers a critique:

The author shoots himself in the foot when he says if you bought all the companies in FTSE 100 in 2001 this is what you would have got…the constituents have changed. I skimmed the rest because it was clear the author didn't really know what was going on.

James Lackey clarifies:

Thank you paul, my apologies to all. My better question is what is wrong with English stocks or is that a bad question, i.e., nothing is wrong? I've lost so much money buying laggards and value, specs forgive me.

Big Al theorizes:

Here's a theory: The Digital Revolution has been one of the greatest expansions of human activity/productivity/wealth in history and it has been centered in the US, as have the stocks of the companies surviving the competition for doing the revolutionizing. The winners have been added to indices, and the losers dropped. This equity/index mechanism has far outperformed all others.

James Lackey responds:

Big, that is what I needed! I was lost (did not get the joke) and as usual was the last to know.

Stefan Jovanovich provides an historical perspective:

Big Al nails it, once again. The British invention of industrial production achieved the same startling results; within a third of a century, the center of the world's low-cost production of fabrics shifted from the hand-looms of India to the "infernal machinery" of the Midlands.

Aug

21

I adore NYC, from James Lackey

August 21, 2021 | Leave a Comment

I may have been born in Chicago. I may live in the NC mountains. However I belong in Manhatten. I can't understand how people do not understand NYC. The people are amazing and beautiful. There is every color size smell and that's absolutely wonderful.

Henry Gifford suggests:

Please do an experiment while you are in Manhattan. Go to the booth in the subway with the person sitting inside (some entrances do not have them). Ask for a subway map. They are free. Then stand on a corner and unfold the map and make believe you are trying to find out which way to go (it includes all the major streets, and is the best map of the city I’ve ever seen).

See how many people come over to offer help without being asked, and let us know.

Yesterday a neighbor asked me “If you could live anyplace, where would you live?” I told him “I can live anyplace, and I choose to stay here in Manhattan."

James Lackey runs the experiment:

Henry!

I had 6 people help just by over hearing I needed a route stop from a stop 135th street Harlem. That's absolutely amazing and wonderful.

The joke was the older the person the more complicated the answer. A young man said here, stop, grab that bus, 2nd stop hit subway the 2 or 3 train. The express gets off 30th street it's only six blocks dude.

Hahaha. Absolutely fantastic. People run over each other to be helpful! Post covid NYC is dynamite. People act as if they were locked up and forgot why they live in NYC and now absolutely love to share.

Bo Keely adds:

As usual, Henry Gifford is thorough, and takes you places no others will or can. I will never forget our boiler room tour of Manhattan.

The Manhattan map trick works not only in NY but around the world. I've used it in many cities in many countries. Holding a guidebook with a puzzled look works almost as well as long as there's a pic of the country on the front. The best method in no-English nations is to shout in a bus or restaurant, 'Does anyone speak English?' you will meet professionals and students. Another style is to wander a tourist spot with a backpack (travelers use backpacks while tourists carry luggage) that has your country's little flag sewn on it. Many travelers sew on the flags of all the nations they visit, immediately identifying them as an interesting person to approach for conversaation and invitation to dinner.

Aug

13

Trouble ahead?

August 13, 2021 | Leave a Comment

Jeff Watson writes:

Jeff Watson writes:

The market weathermen, self described sage like realists, always see trouble on the horizon and are compelled to give all knowing, logical reasons the market will get hit. Sometimes even invoking "science." To them the pressure is dropping hard, the seas are building, and we're about to get hit with sustained gale force winds. It's always doom and gloom to them. They want the little guy to get scared, pitch his position and make the broker money, rinse and repeat. Meanwhile, Steve provides some perspective and his chart lists 49 reasons for the market to get hit…while the S&P went up 35X during that time. Unfortunately the brokers don't want their clients looking at charts like this or reading Dimson.

James Lackey agrees:

Jeff says what we all learned the hard way. The market in stocks is an engine designed to go up. Any business decisions based otherwise are in between risk-based conservative - which in most cases is a good thing - and ruinous, as the vigorish will grind you to a long-term guaranteed loser.

Michael Cook responds:

I broadly agree with this but let’s not take it as written on tablets of stone.

One of the nastiest human failings in my opinion is recency bias and for investors in US stocks, an entire career (unless a very seasoned investor indeed) has been a basic bull market tempered by the bear markets of 1997, 2002 and 2008 and whatever the hell March last year qualifies as. Recency bias on steroids.

But it doesn’t mean it must always be like that. Just ask eg the investors in the Japanese stock market 40 years ago who pretty much are still waiting to be making money now…

Leo Jia adds:

Even if there is a sharp drop, it will only be shallow and short term. This is not a big bubble and there is no euphoria yet. If one suspects big money are selling, the question is what is the alternative to the US market. Perhaps the worry will be legitimate when Turkey and China become out of any concerns.

Nils Poertner writes:

what makes the difference between folks who are in the market - and trade successfully in the long-term and those who don't is often the acquisition of implicit knowledge. Things we know are true on some level, and that we need to experience personally many times to know that they are true - not in the absolute sense but more intuitively - and percentage-wise.

we live in a very explicit world now everything needs to be spelled out. but the "absense" of something is a better guide than the appearance of an event.

an example would be that SPX drops by 3pc one one day (after months of overheating) - AND the financial press is somwheat quiet aout the drop. as long as they are loud…one can normally relax a bit more.

not to be confused with long-term investing. eg, some of my English friends who bought prime real estate in the 90s in London, and levered up every year with new flats, are all fabulously rich now. was it being lucky or smart? who knows? implicit knowledge is underrated - was my point to say.

Leo Jia comments:

Even if there is a sharp drop, it will only be shallow and short term. This is not a big bubble and there is no euphoria yet. If one suspects big money are selling, the question is what is the alternative to the US market. Perhaps the worry will be legitimate when Turkey and China become out of any concerns.

Duncan Coker writes:

Agreed, it's worth noting that the 00's were the worst decade since the 30's for stocks. I'd propose there was a bearish recency bias going on during the 2010s.

I liked the video about carnival scams. I recall "winning" an album at age 13 from a darts game on the boardwalk at Asbury Park, NJ. No doubt I overpaid. It was a vinyl from a band I had never heard of at the time called the The Allman Brothers which forever changed my life in music.

Aug

10

Is Turkey a good buying opportunity now for holding 5 years?

August 10, 2021 | Leave a Comment

Leo Jia asks:

Any thoughts on the prospect of Turkish economy? Is Turkey a good buying opportunity now for holding 5 years?

Larry Williams clarifies:

Is the Turkish economy about the same as the Turkish stock market?

Some references:

The CIA World Factbook: Turkey/economy

iShares MSCI Turkey ETF (symbol: TUR)

Nils Poertner responds:

as we know from other EM countries, listed equity can be really a good play - even with fx tanking. see Latam and many Asian countries. a vast "play" on the USD (as lots of banks are financed in USD - and EUR) and a bet on the faith in the current regime. cap controls an issue.

understanding EM requires study of previous bull-and bear mtks for EM mkts itself- doing the tedious work - building implicit knowledge over time, cycles, mass psychology, whateever it takes - it is worth it, Jia and a lot of fun - as one learns from it and can share with others.

John Floyd writes:

Larry has somewhat taken the words out of my mouth on the economy and stocks in Turkey. I would expand on that somewhat given the unorthodox nature of the current Turkish administration and the expanding Taliban presence and thus likely growing chance of further friction with the US, following recent and historical comments by the head of Turkey on the topic.

As economy and FX it does sure have the potential to get things right and turn for the better. But, the odds of that happening and the headwinds against it seem rather large at the moment. The current path is one of further unorthodoxy in policy and leadership combined with expanding debt that will likely lead to a default or restructuring and FX going from 8.6 north of 10.

Reserves are tenuous at best, local capital outflows a perennial risk, and the need to continue to pump up the economy through credit, tourism headwinds given COVID, current account deficit of 5%, etc…

Given the circa near -20% returns for the Turkish indices there may be some gems within the them with careful selection, as is needed in China given the P-like oligarch crackdown there as the aim by X is to stay in power for life and control data and tech to do so.

James Lackey suggests:

As John clearly said the news risk..what about the derivative of the big Mac index and or the hot dog stand.

If I'm forced to value a stock on foreign exchange correctly, I'd go to Turkey, rent a flat, and open a food stand and sell Harley Davidson T Shirts. The McDs index of brands is HOG. I can sell merchandise like a roadie at a show and let's use the most recognized brands in the world.

Sell shirts for 6 weeks and my guess is you're going to learn exactly what's going on.

Larry Williams adds:

Bring lots of NIKE stuff to sell.

Jayson Pifer provides local insight:

Fwiw, I can offer some boots on the ground perspective. I spend a few weeks a year in Turkey and have done so for the past 15 years, missing last summer due to covid however please take the below comments with an appropriate amount of salt. Each time the conversations come up on investing in real estate there. And each year, I come away boggled at the lack of progress and steadfast in keeping money away.

If I were to hazard why the Turkish economy isn't more than it could be, I would suggest that it is the general absence of faith in any of the government constructs. Without commenting much on their current 'populist' leadership, I mean to say that the average person has little faith in the police, courts, and laws and work around or without them. (plied with a bit of scotch and I could relate some Keeleyesque tales of my encounters there with these systems ![]() )

)

Absent true legal financial recourse, trust stays in small personal circles that are difficult and slow to grow and this has various and deep side effects. As an example, if one were to meet a VP of a bank in the US or UK, you might assume they had interviewed for the role from a range of candidates and/or had been in the role for a while and knew the business and their area. One would likely be correct in those assumptions. In Turkey, you do not have that assurance as they will probably have gotten their role through a circle of acquaintances. They may be qualified or not, but they are almost certainly in somebody's inner circle.

The low trust and inner circle workings are seen in both the political and business environments. When new leadership comes in, it is typical and considered normal to bring in their trusted group, reward them for their loyalty and displace anyone they do not trust. Partisanship there compounds the issue, similar to the partisan wars in Google but with more serious consequences if one supports an out of favor party (eg. non-AKP).

Wrt the stock market, my impression is that it's a lottery. There is money to be made, for sure, by smarter and luckier people than me. But the risks are real.

I don't have numbers, but my anecdata shows a worsening brain drain with talented turks leaving the country and those that have returned are struggling.

Taking a further step back for the five year horizon posed originally, my impression like Mr. Floyd's is that Turkey has headwinds and not much to stop it from falling. My questions are what could change to reverse this trend? A change in leadership is often cited, but it would not create an overnight increase in trust. I could barely speculate how long it might take, but would guess decades if all went well. While it's not exactly fair and I'm out of my historical depth, I compare it with Iran when it went down the path of Islamic leadership in '79. How will Turkey not fall into the same trap?

Theodosis Athanasiadis comments:

Historically real exchange rates have been a good predictor of emerging market economies and equities through the mechanism of cheap exports, labor, external investments etc. they are a form of valuation for the whole economy. I see them currently at multi-year lows which has been bullish for equities in Turkish lira for the long term.

John Floyd responds

Yes, on real rates in Turkey that is true and can be seen in the standard OECD PPP, but that has been like that for ages and you need the positive catalyst for change…..move to orthodoxy one way or another….monetary, fiscal, and geopolitics…should gradually grow confidence in varying degrees and speeds and drive capital flows in a positive fashion if it occurs and given valuations you can find some gems I am sure…perhaps on well capitalized companies that can benefit from the inflows and cheaper FX…plenty of meals for a lifetime if you look at Argy, Venny, Russia, SA, Zimbabwe, etc…

If anyone is bored, I did an interview on Turkey last August - it somehow has gotten just under 20k views that highlights both contemporaneous points at the time and some of these longer term issues.

Alex Forshaw writes:

Erdogan is in bed with the asset heavy industrial elite of Turkey… this is China but with very ineffective capital controls (mainland Chinese stock performance has been terrible for 12+ years btw, altho indices don't include juicy dividend yields). They're all massively overleveraged, and basically long and wrong The only way is devaluation / financial repression (forcing inflation >> cost of capital) until they deleverage… but Erdogan can't really let them deleverage because the economy would implode, Turkey is poor, the opposition is highly organized with high recourse to violence (Kurds), so Erdogan would be dead. So they just keep building and building, but who's going to come?

Seems to me that Turkey is uninvestable until Erdogan is gone…but he's a de facto dictator…so he can't go.

Leo Jia offers more data:

New home sales are down lately, which may be caused by the pandemic:

Turkey: new home sales

But existing home sales shot up sharply in recent years:

Turkey: existing home sales

Aug

5

The Most Profitable Company, from James Lackey

August 5, 2021 | Leave a Comment

We try to never look at a new generator. This AM we noticed more masks. My brother mentioned they are trying to make covid a deal again to hold onto their corner. The brilliance of X traders is they look at everything as a hustle. "How are we getting it today and for sure we are the last to know."

The covid hustle is a two team teaser on the old meme, "we can not find qualified candidates." That was the 50's race bait turned into an econ pay class war keeping the man down. I turned many a biz owner red faced when they couldn't find qualified help by saying either let the moths out of your wallet or train them yourself. A day trader with a Union BA pops and all athletes we become difficult to convince it was about "they" and not You.

The covid hustle keeps them masked and the dining rooms closed. If you have x sales and you lose zero sales and can reduce labor costs by running the drive thru only, who blames them? Not me I don't like your food anyways. However when it comes to the DMV OMG you sucked at your job before allowing me to do all this online, cool! I hope this lockdown will close your store and keep the Churches open.

Okay I will not go that far as I do not want a new enemy, the brother in law of the law.