May

31

Singapore, from Yishen Kuik

May 31, 2007 | 2 Comments

The local Singapore business paper had an article breaking down performance of local equities in various sectors. There is triple-digit performance in the construction sector, 40 to 50 percent performance in the finance sector and healthy rises across the board.

The local Singapore business paper had an article breaking down performance of local equities in various sectors. There is triple-digit performance in the construction sector, 40 to 50 percent performance in the finance sector and healthy rises across the board.

Swanky new nightspots are mushrooming and expensive cars are seen in greater numbers. Property sells for record prices with each new development. Recently there was a story of professional speculators who purchased condos to get on their boards in order to urge residents to agree to flip the entire building to a developer, essentially merger arbitrage in real estate.

From Ryan Carlson:

Yesterday, I just returned from a week in Singapore and am wildly bullish on it as well. So bullish that I'm planning on moving there in about six months and this trip was to help lay the groundwork for it.

Apparently, I'm one of many. The current cover of Time's Asia edition is on Singapore and the lead story is Singapore Soars.

In regards to construction stocks, besides riding along for the sharp upturn in local real estate values, I think it's a great way to play region growth as many have projects in China, Vietnam, Indonesia, and other countries where I wouldn't/couldn't invest directly.

The mention of expensive cars really is a great wealth indicator judging on how expensive it is to have a car in Singapore. I certainly won't have one once I move. An easy estimate is that whatever a car costs in the US, double it for there.

I strongly believe Singapore is the most dynamic place to live in the world today, and if I had to choose what investment I would buy and hold for the distant future, Singaporean equities, real estate, and the currency would be my choice.

Geographically, it's at the hub of three of the four most populous countries in the world (Indonesia is the 4th), which makes it an excellent place to watch developments in those other countries. No other place in the region can even remotely offer the quality of life or cleanliness and I firmly believe that wealthy citizens of India, China, Vietnam, Indonesia, etc, will all aspire to live in Singapore's cleaner, safer and more orderly society. If not full-time, then perhaps a pied-a-terre as a hedge against trouble in their homeland.

Regardless, the most important thing that will find a home in Singapore is capital. Private banking in the country has been a particular highlight as bank secrecy laws are in some instances stricter than in Switzerland. As the saying goes, "when it comes to large amounts of money, it's advisable to trust no one." And I certainly wouldn't trust the banks in other regional countries to hold a large amount of my money.

To help with inviting capital, Singapore offers favorable low tax rates, doesn't tax capital gains, and also provides numerous incentive programs including one aimed at attracting derivatives traders. I agree with the method of taxing consumption rather than income, which is generally how the system allows for a lower direct tax.

A reason why so many policies are correct in my view is that almost every Singaporean I've ever met was educated at a university overseas in the UK, US, Canada, or Australia. In turn, they take back home the best policies but also get a firsthand view of damaging policies elsewhere to avoid.

Those civil servants who enact and draw up policies in Singapore are some of the highest paid in the world. Although there is understandably some backlash to government officials paid so highly, I like how it retains those who would be bid away to the private sector. It's hard to take care of others if you can't take care of yourself first and the policy discourages corruption.

Quite often the mentality of Singapore is summed up simply with the word 'kaisu' which translates from Chinese into 'afraid to lose.' The small island has to compete globally in almost every facet and most notably with Malaysia in terms of many regional competitions. Because of the mindset and no shortage of competitors, Singapore will always have to continue the pace of development to drive the economy. Those in Singapore have built a tremendous global city through their ingenuity, and I hope that I can make my contribution by moving there myself soon.

Nigel Davies asks:

Why is Singapore considered to be a good place to live? Is it really freedom, or is there an unspoken 'biggy-like' respect for property rights? Here are some sample laws in Singapore:

- Bungee jumping is illegal.

- The sale of gum is prohibited.

- Homosexuals are not allowed to live in the country.

- Pornography is illegal.

- As it is considered pornographic, you may not walk around your home nude.

- Failure to flush a public toilet after use may result in very hefty fines.

- It is considered an offense to enter the country with cigarettes.

- Cigarettes are illegal at all public places.

- It is illegal to come within 50 meters of a pedestrian crossing marker on any street.

- If you are convicted of littering three times, you will have to clean the streets on Sundays with a bib on saying, "I am a litterer."

May

31

China, from Sushil Kedia

May 31, 2007 | Leave a Comment

China stocks advance, rebounding from a $161 billion rout:

China stocks advance, rebounding from a $161 billion rout:

Bloomberg.com reports China's stocks rose, rebounding from a rout that yesterday wiped out $161 billion of market value. The CSI 300 Index gained 41.49, or 1.1%, to 3927.95 at the close, having earlier lost as much as 5.2%. It yesterday plunged 6.8%, the most since Feb. 27, after the finance ministry tripled the tax on share trades to cool a rally was drawing more than 300,000 new investors a day. "The government definitely doesn't want to see a big correction,'' said Howard Wang, who helps manage JF Asset Management's $443 mln JF China Pioneer A-Share Fund in Hong Kong. "What it wants is for local investors to think of returns as more symmetrical than they have been. If the market comes off 20 percent, then you're looking at a social issue.''

From government-administered resource markets in the USSR to government-administered financial markets is truly not much of a leap. Power corrupts and absolute power corrupts absolutely, said an illustrious British Prime Minister. It applies well today.

This reminds me of when the Hong Kong market went on to create its peak in the first half of the 90s and then the government was on the defending end of a hedge funds' selling blitzkrieg. Eventually the government came out a winner, having made enormous profits, but not before the market capitalization was cindered.

If such a thing plays out in China, which is unlikely given the cautious administration, it would be by some other handle the mistress would inevitably pull. As was true the last time it happened in Hong Kong, men with canes will be hobbling yet again in the financial marts of Shanghai.

May

31

A Symphony in the Markets, from Victor Niederhoffer

May 31, 2007 | 4 Comments

It would take a Beethoven to do justice to the final triumphant rise in the stock market yesterday, the one that carried the S&P to an all time high of 1530.2 in the index, and 1534.5 in futures. Indeed, Beethoven could have written the ninth symphony about the last few days in the markets, with the long battle between minor and major in the first movements finally giving rise to the triumphal Ode to Joy at the end.

It would take a Beethoven to do justice to the final triumphant rise in the stock market yesterday, the one that carried the S&P to an all time high of 1530.2 in the index, and 1534.5 in futures. Indeed, Beethoven could have written the ninth symphony about the last few days in the markets, with the long battle between minor and major in the first movements finally giving rise to the triumphal Ode to Joy at the end.

It was particularly apt and 'Beethovian', that the market had failed to eclipse the old high four times in a row the previous week, having spurted above it at the beginning of each day, only to get hammered down every afternoon because of concerted selling by bearish forces. Finally, yesterday, with the futures market at 1524 at 2:30p.m., the market rallied a nice ten points to finish at 1534 for the day — an all time high.

The rise was almost symmetrically opposite to Thursday 24th of May, when the market had rallied eight points above the Wednesday close, to 1532.5, and then promptly dropped 25 points to 1508. Yesterday, six calendar and three trading days later, the markets opened down nine points , dropped one below that, and then raced up 21, for a 21 point range (compared to last Thursday's terrible 25 point range on the down side).

Also 'Beethovian' was the way that the China downturn set everyone up to be bearish. Yesterday China tripled its trading tax, making it prohibitive for

anyone with proper knowledge of vig. to day trade, and the U.S. markets

once more went down a fast one or two percent in sympathy, but this

time only briefly. Recently of course, there was the February 27th, 58 point down day that happened on the first news of China trying to cool its markets down. Since that time, everything that looked like that day, as is almost invariably the case, has actually been a signal to buy.

The fake Doctor, with his cursory knowledge of the situation, blatant attempts to aggrandize himself, and his usual amateurish use of past patterns, has tried to gain purchase by 'bearing' the market down repeatedly over the recent weeks, with warnings similar to his original February 27th clarion. Each time he has tried, the day has started with doomsday activity, which has then given way to substantial rises, like yesterday's.

Also beautiful in its perversity and symmetry was how the announcement of the minutes of the May FOMC meeting led to an action completely the opposite of what occurred after the meeting itself.

Of course this is descriptive, and tests of markets that bounce back immediately from substantial declines, contrary to popular belief, show that the faster the excursion from big down to up, the more bearish it is. However, after an all time high, the statistics on the table favor up moves over a three to six month horizon.

There must be many bears who will finally throw in the towel now that they can't hold onto the mantra 'we're still in a bear market because we haven't exceeded the old highs.' The three main unexplored reasons for bullishness, which I wrote about over the weekend, still exist, and these are augmented by the tremendous and predictive gap between the earnings yield and bond yield of some one and a half percent.

There were also many other records set in the markets yesterday, like the Dax at 7847, a seven and a half year high, but still ten percent below its 1999 high. Google was at 498.60, almost breaking 500, and even Saudi Arabia was up at 7492, after a twenty day intra-day low of 7346. The Nikkei futures were at 17,865 at 2 a.m. New York time, with the three month high very close.

The amazing thing is how little the U.S. markets are up this year (approximately nine percent) relative to 100 plus other markets around the world. Markets are up approximately twenty percent in South America and Canada, twenty percent in Germany, and fifteen to twenty five percent in the typical Asian market.

As a final note, the fifteen positive sequences of 100 points in the Dow, with its new base of 13600, would seem to indicate a new regime. Of course there are markets that are up 100% or so, and they are vulnerable, but could those be pilot fish as to what the U.S. may go on to do? We are so used to meager gains and bearish scenarios, that one forgets how high a bull market can go. This is not a prediction but a remembrance of how much money I have lost by shorting markets that kept going up after seemingly bearish opens, like yesterday.

May

31

Unnatural Highs, from Kim Zussman

May 31, 2007 | Leave a Comment

Today's all-time high close on the S&P 500 was first such since 3/00, about an 1800 trading day wait. In the past long-term highs were much more frequent, so in order to find analogous long waits (S&P 500 index 1956-07), conditioned:

Today's close is a 2000 day high, and there were no 2000 day highs for prior 100 days.

Then I checked return for subsequent 10, 20, 50, and 100day, as well as wait times between occurrences:

date 10d 20d 50d 100d wait

02/14/95 0.01 0.02 0.06 0.15 376

08/19/93 0.01 0.01 0.02 0.04 268

07/29/92 -0.01 -0.02 -0.03 0.05 368

02/13/91 -0.01 0.01 0.03 0.02 181

05/29/90 0.02 -0.02 -0.06 -0.15 212

07/26/89 0.03 0.02 0.06 0.04 1140

01/21/85 0.03 0.03 0.03 0.06 560

11/03/82 -0.03 -0.03 0.03 0.06 581

07/17/80 0.00 0.03 0.04 0.07 2112

03/06/72 -0.01 -0.01 -0.02 -0.01 947

04/29/68 0.00 -0.01 0.04 0.05 246

05/04/67 -0.02 -0.05 -0.02 0.03 924

09/03/63 0.01 -0.01 0.01 0.06 461

11/01/61 0.04 0.04 0.00 0.02 192

01/27/61 0.00 0.03 0.09 0.06 590

09/24/58 0.03 0.03 0.05 0.09 641

mean 0.01 0.01 0.02 0.04

stdev 0.02 0.03 0.04 0.06

z 1.16 0.78 2.10 2.51

The returns going forward are positive, with the most analogous wait gap ending 7/80. Regression of returns vs. wait days suggested slight (NS) positive correlation.

May

30

I'm fascinated by bubbles and crashes. They have a romantic feel, with all the theatrical elements reflected in a simple chart: enthusiasm, greed, madness, drama, fear, despair, and deception. My website has an entire section devoted to this phenomenon; I really believe that the study of these extremes can help us better understand the normal behavior of markets.

I'm fascinated by bubbles and crashes. They have a romantic feel, with all the theatrical elements reflected in a simple chart: enthusiasm, greed, madness, drama, fear, despair, and deception. My website has an entire section devoted to this phenomenon; I really believe that the study of these extremes can help us better understand the normal behavior of markets.

But enough theory! Japan small caps together with the GCC markets were the first bubbles to pop in 2006, and they haven't recovered since. The Mothers Index is probably one of the most manic-depressive of all markets I'm aware of. Since 2002 it has managed to climb from 500 to 2500 before falling back to 1500 in 2003, climbing back to 2500 in 2005, to finally loose 70% and counting. If you're looking for low correlations markets don't look further! But wait, I forgot to tell you that the bottom of 2002 was the terminal slot of a 90% freefall off its stratospheric 7500 peak in 1999!

Is this a sign of things to come in our part of the world? In spite of my general bullishness there are warning signs of sporadic irrationalities. How else can you name a struggling ex-dot com such as Artnet (Germany) that has an EBITDA of Euro 1 Mio and is valued at Euro 100 Mio?

But that's precisely the beauty of bubbles; they have this unmistakable flavor that brings out the best and worse of human beings. In the early stage you don't participate because you have decided that they are irrational. Then, after a rise of 50% you are still congratulating yourself, but you do have a little remorse for these opportunity costs. Then, after another +100% rise the elixir makes its way to your most greedy brain corners, and finally you decide to jump in (after finding the rational of course!). One of the most intriguing aspects of bubbles is that you make the highest returns precisely when nearing the peak.

Another fascinating aspect of bubbles is how they managed to fool everyone. Look at a chart of Deutsch Telecom since the late 1990s. What the Germans used to call the "Volksaktie" (the people's stock), looks more like a comedy than a romantic act. Actually, the chart does remind us of an inverted "V."

I wish I had kept all these useless analysts' reports on Deutsche Telekom (among others). They would have made for a great laugh today. But strangely they all disappear under some rug, no more trace in Bloomberg or anywhere. Maybe it's the invisible hand!

May

30

New Closing Record After Five or More Intraday Failures, from Steve Ellison

May 30, 2007 | Leave a Comment

Today is only the sixth day since the start of futures trading in 1982 that the S&P 500 index set a new record close after five or more intraday failures, i.e., days on which the index at some point during the day was higher than the previous record close, but closed lower than the previous record close. S&P futures returns the next day after the previous five instances were mixed.

Number of intraday failures next day before futures:

Date record change

2/7/1983 5 -1.6%

4/11/1983 6 0.3%

4/2/1991 5 -0.4%

8/22/1991 5 0.6%

1/10/1997 8 1.0%

5/30/2007 6

Seven years after the previous record close, today's record also ends the longest drought by far of new record closes since 1982. The index had a slightly longer dearth of record closes from January 1973 to July 1980.

May

30

Peru, from John Floyd

May 30, 2007 | Leave a Comment

It is notable that today the largest equity index decliner is not China but Peru, which at the moment is down 9.44%. The index is weighted heavily toward commodity shares, particularly industrial commodities.

It is notable that today the largest equity index decliner is not China but Peru, which at the moment is down 9.44%. The index is weighted heavily toward commodity shares, particularly industrial commodities.

A large part of today's move is generated by one particular stock, SMCV PE. Nonetheless, I think these sorts of developments should be watched as having potential implications for other similar and correlated markets. Specifically, does this say anything about what has been a seemingly endless demand for commodity-related assets, stocks, currencies, physicals, etc.? What implications might this have for particular countries, both pro and con, that both export and import these products, such as Australia, Chile, and South Africa, etc?

From Luca Coloso:

The Peruvian index has done +168% last year and today's fall included +41%. This is catching the attention of the locals who are speculating mindlessly. My wife is Peruvian and was telling me that one of her aunts, who has never invested in the stock market before, just last week was recommending strongly to her daughter to get a loan from the bank and invest in the market.

I don't think this needs further comment apart from the public's need to lose more than necessary, the system's upkeep, and the perils of a heavily "commoditized" market.

May

30

Shanghai Limited Engagement, from Dip Ka Ching

May 30, 2007 | Leave a Comment

Climb Shanghai mountain, from low to high!

Follow every night move; silk road to the sky.

Climb every mountain, black duck boiled in steam

Chase every decline, and cook up your dream!

A dream that will need

all the blood you can give,

Every day of your life

beyond overplus that you live.

Climb every mountain, crush every meme

Chase every wiggle along her inseam.

May

30

Last Suppers for a Lifetime, from Gavin Cowie

May 30, 2007 | 1 Comment

I was reading Da Vinci's notebooks recently, and was intrigued by his method for learning to paint. I thought it might be interesting to try to adapt his model to learning to trade. I'm not sure how useful my little Saturday afternoon research has been but it was fun. Listed below is the sequence Da Vinci recommended for young men to learn how to paint, followed by my own interpretation of the general learning outcomes, and then their trading applications.

I was reading Da Vinci's notebooks recently, and was intrigued by his method for learning to paint. I thought it might be interesting to try to adapt his model to learning to trade. I'm not sure how useful my little Saturday afternoon research has been but it was fun. Listed below is the sequence Da Vinci recommended for young men to learn how to paint, followed by my own interpretation of the general learning outcomes, and then their trading applications.

Leonardo Da Vinci's model for learning to paint, from his own notes:

1. Imitate a masters work — best to imitate an antique.

2. Draw objects from relief but not from memory.

3. Familiarity of the human form — seeing each muscle in every possible position.

4. Do stick drawings from nature and expand them at home.

5. "Thus I say to you, whom nature prompts to pursue this art, if you wish to have a sound knowledge of the forms of objects begin with the details of them, and do not go on to the second [step] till you have the first well fixed in memory and in practice."

6. Keep the company of people who share the outlook of being mirror like in their observations. If such people cannot be found then keep your speculations to yourself.

7. "I myself have proved it to be of no small use, when in bed in the dark, to recall in fancy the external details of forms previously studied, or other noteworthy things conceived by subtle speculation; and this is certainly an admirable exercise, and useful."

8. "Winter evenings ought to be employed by young students in looking over the things prepared during the summer; that is, all the drawings from the nude done in the summer should be brought together and a choice made of the best [studies of] limbs and body."

9. He is a poor disciple who does not excel his master.

10. "Some may distinctly assert that those persons are under a delusion who call that painter a good master who can do nothing well but a head or a figure. Certainly this is no great achievement.

11. "Nature has beneficently provided that throughout the world you may find something to imitate."

12. The mind of the painter must resemble a mirror.

13. "When, Oh draughtsmen, you desire to find relaxation in games you should always practice such things as may be of use in your profession"

14. "The sorest misfortune is when your views are in advance of your work."

General Learning Statements:

1. Copy the work of someone who has done great work before.

2. Copy the actions of a master.

3. Look at each part of the work and see every permutation and how it fits with the other parts.

4. Do basic models of the whole process, to practice.

5. If you wish to have a sound knowledge of the task or subject then study the details and memorize them and practice them.

6. Don’t become clouded by other peoples views and thinking processes.

7. "I myself have proved it to be of no small use, when in bed in the dark, to recall in fancy the external details of forms previously studied, or other noteworthy things conceived by subtle speculation; and this is certainly an admirable exercise, and useful.

8. When 'out of season' you should study past actions and commit them to memory and learn from them.

9. Look to excel past the people you learn from, but without arrogance.

10. Always learn and practice all elements of your skill.

11. Look in other areas of your life and world opportunities to learn and transfer observations to your study.

12. Only observe.

13. Make games that will help you learn better your skill.

14. "The sorest misfortune is when your views are in advance of your work."

Stock Market Learning:

1. Read the works of Soros, Jesse Livermore, William O'Neill, Warren Buffett and Nick Darvis.

2. Choose one and copy exactly what they do.

3. See each stage they go through to reach their conclusions and the actions they take and the inferrences they derive from the outcomes.

4. Pick stocks and plan out the course of action and all the permutations of what will happen in all price scenarios and put them into practice.

5. Memorise the details of the great coups and all the rules the masters have made in trading.

6. Keep all your trading a secret and don’t let others' views interfere with your own. Keep your mind totally on the facts at hand and the details of what you see.

7. Before going to sleep look at the coups of other traders and of your own. Talk with the masters you are studying and meet them in your mind for interviews.

8. When the markets are not open or the market isn't acting right for you then study past trades and memorise the actions you took and piece together the trade again looking for the lesson.

9. Be a better trader than your teachers and ask yourself how you can do better.

10. When you have practiced and 'perfected' position entry, move to exits, patterns, money management, probability theory, etc..

11. Look at situations and look at them as you would a trade. What would you do? Are there any interesting things to learn here that can be used in the markets?

12. See what's happening rather than guess.

13. Play games like the one played in Liar's Poker, where you invent scenarios and ask each other what you would do in that situation. E.g. nuclear explosion in Tokyo…

14. Be aware of views you are taking on a trade. Look at it always as if it’s the first time you have seen it and review an open trade every day as if you have just placed it.

Mike Ott adds:

When I read this post, the comedy a capella singing group Da Vinci's Notebook (and their most famous song) popped into my head.

May

30

Commercial and Equity Markets, from Tim Rudderow

May 30, 2007 | 1 Comment

I have made a few comments in the past suggesting the need to separate the commercial markets (commodities, fixed income, and FX) from equity markets when considering fixed systems. As an unrepentant fixed system guy, I would argue this is correct; there have not been many trends in commercial markets. Ten-year yield is about where it was in late 2003, as is the dollar. Commodities have moved up but when the carry is taken into account the move is modest. There is evidence of lack of movement in the volume levels of bond and FX options in particular.

This is, however, the ideal environment for Equity: stable rates and currency. As is the case with all diversifying asset classes, they are loved in research and hated in practice because they lose money when they are supposed to.

Steve Ellison writes:

There is a good reason why businesses try to minimize inventory using just-in-time processes. Holding inventory results in four types of costs, collectively known as inventory carrying costs:

- Cost of capital tied up in inventory

- Cost of storage space

- Risk of loss

- Risk of obsolescence or spoilage

In business, annual inventory-carrying cost rates are often estimated at 20% or more of the purchase price. For this reason, most business owners would consider buying and holding commodities a strategy for destroying business value, not enhancing it.

Over the weekend, I looked at the financial pages of the New York Times dated December 15, 1961. It was surprising how little the prices of some commodities have changed since then, even without considering inventory-carrying costs.

Annualized Price

12/14/1961 5/29/2007 Change

DJIA 730.94000 13521.3400 6.7%

S&P 500 71.98000 1518.1100 7.0%

Silver 1.03250 13.2230 5.8%

Gold 35.14500 657.2000 6.7%

Wheat 2.39375 4.9100 1.6%

Corn 1.41500 3.6475 2.1%

Coffee 0.42625 1.1035 2.1%

Copper 0.31000 3.3200 5.4%

Crude oil 2.74000 63.1800 7.2%

May

29

The USA is by far the top global destination for economic migrants and political refugees. The notion that we're hated is absurd and countably false. That foreign elites with hands on bureaucratic and media levers hate the USA, for easily understood reasons of envy and competitive fear, is equally obvious.

USA elites who wish to subsume American power into a global cauldron of "expert" rule, simply exaggerate the nonsense spewed by their overseas sympaticos.

David Wren-Hardin responds:

In some ways I agree with the critics, though not to a great degree. But if everyone in the world is against us, why did France just elect a president who ran on a platform of increased cooperation with America?

Shui Kage replies:

I am not aware of any French military cooperation with the US in Iraq. If the new French president has decided to do so, then I cannot understand why the French elected such an insane president.

Marion Dreyfus remarks:

The US is envied and lusted for. Big Bro is so powerful it dwarfs the modest claims of the littler countries. And France's new president is not "insane" because he professes more support for a country that has in the past done a great deal for the people of his modest state.

Chirac was a nasty bit of work, and we are deserving of a man whose raison d'etre is not hatred of the US for no particular reason other than to regain the Sun King reputation France lost so very long ago and has been striving to recapture foolishly and with an ugly complexion.

Stefan Jovanovich adds:

I don't think that we Americans should spend much time being unhappy about the world press's not liking us. We are the only country that has the military capability to destroy every major city on the planet. That is hardly the kind of power that makes people want to say nice things about you. China has been bent on expanding its "sphere of influence" for quite a while. Notably, its East Asian neighbors are pushing back. Taiwan, South Korea and Japan are all undergoing major military expansions in their naval and air capabilities. On balance, the Chinese, even with their expansion, have less relative clout in the region than they did five years ago. Then, political reunification seemed a distinct possibility for Taiwan, given the presumption of China's military dominance. One does not need to like the Russians to concede that, from their point of view, enlarging NATO and establishing military bases in Central Asia could be seen as threats to their diminishing territories. But there is little the Russian Federation can do except bluster. The decline in the capabilities of the great conscript People's militaries of the Marxist world (first China, then Vietnam, then Russia) is the most important change in the past third of a century. Then, the U.S. had trouble invading the island of Grenada, and the Soviets could, simply by hinting at their strategic capabilities, force the IDF to let the Egyptians walk away from the east bank of the canal. Now, both the Chinese and the Russians have extreme difficulties in attracting even half-bright people into their militaries. They know that conscription does not work, but they have no ready alternative to it. They both have the money, but they are not willing to spend it. Both the Russians and the Chinese think their foreign currency reserves are more potent weapons than an all-volunteer military.

May

29

The Golden Man, from Nigel Davies

May 29, 2007 | Leave a Comment

The Soros piece about the Palindrome's predictions over six months got me thinking about the talents really required for short-term trading. This brought to mind a Philip K. Dick short story entitled The Golden Man.

The Soros piece about the Palindrome's predictions over six months got me thinking about the talents really required for short-term trading. This brought to mind a Philip K. Dick short story entitled The Golden Man.

The golden man of the story is really nothing more than an instinctive hunter-gatherer. But he has three unusual abilities that mean that he will not only be invulnerable but that the existing species of mankind will inevitably be wiped out and replaced by his kind. These are short term clairvoyance, speed, he is irresistible to women.

Now what better qualities could a day trader have? Within a few years he could accumulate huge wealth and ensure that his genetic tendrils dominate the world's gene pool for millennia.

Who needs economics?

May

29

Wishful Thinking, from Stefan Jovanovich

May 29, 2007 | Leave a Comment

"If those newspaper correspondents who take so much pains to vilify men who are engaged in fighting the battles would shoulder a musket and go into the field themselves I think they would do more to advance the cause, than in pitching in undiscriminately as they do." - W.R. Rowley, Head Quarters Army in the Field Near Pittsburg, Tenn. April 19th 1862.

"If those newspaper correspondents who take so much pains to vilify men who are engaged in fighting the battles would shoulder a musket and go into the field themselves I think they would do more to advance the cause, than in pitching in undiscriminately as they do." - W.R. Rowley, Head Quarters Army in the Field Near Pittsburg, Tenn. April 19th 1862.

It is truly wishful thinking to believe that newsies will ever "advance the cause". It is simply not in the nature of the beast. The news of war is almost invariably wrong because it comes from one of two sources: (1) those far away from the battle and (2) those who ran. Rowley himself knew this. In the same letter he writes,"(M)ost of our troops behaved well but some of the raw regiments broke and run and among them their officers. (Hence) (t)hese stories you hear emanate. (I)t is necessary that they should have some excuse for their cowardice and the best way to direct public attention from themselves is to direct it in some other course."

In less than a decade it will be the centenary of the Battle of the Somme. It is unlikely that the battle will be seen as anything other than dreadful, wasteful, and horribly sad. What is certain is that no one will celebrate the battle for being, like Shiloh, the beginning of the defeat of a brave but wrongful enemy. Both the Imperial German and British troops who did the fighting thought that the battle was the turning point of the war: that, for the first time since the end of the Battle of the Marne, the Germans had lost.

When the commemorative speeches are made in 2016 the verdict of the soldiers themselves will once again be irrelevant. Everyone except for the people who were there will know that the battle was a completely unmitigated disaster just as the news accounts and the histories written from them have always said. That will be, as it always is, the ultimate insult from the survivors. Those who did not fight will get to teach and preach the lessons of war.

May

29

The Alchemy of Finance, Really?! From Ronald Weber

May 29, 2007 | 5 Comments

I just read The Alchemy of Finance from George Soros (it's never too late!).

I just read The Alchemy of Finance from George Soros (it's never too late!).

As much as I was fascinated by Mr. Soros's description of market mechanisms and his reflexivity theory, I found his analysis flawed and mainstream when he begins to make long-term macro-economic predictions.

Now that's funny. One of history's most successful fund managers turned out to be wrong on most of his long-term predictions: the decline of the US economy, the rise of Japan as the next superpower, the Imperial cycle, etc.

So how can it be that someone who was wrong on so many predictions turned out to have generated such amazing returns for so long? Could it be that the achemy is nothing more than a great camouflage?

I see brilliant economists who are very accurate in their long-term predictions and present analysis, but somehow they can be lousy when it comes to managing money and "be right" within a tolerable time-horizon. On the other hand, I see brilliant fund managers who, I think, are lousy economists; maybe for the better, their success can't necessarily be attributed to what they believe is the true cause.

Mr. Soros's understanding of market characteristics (rational and irrational) and of markets participants is undeniable. And that, combined with a form of intuition, could be his main strength. Most important, he is very successful at "being right" within the next six months, which is all that matters for most investors! How it is packaged for the public and is a different matter.

Riz Din adds:

I formed a very similar opinion after reading Alchemy. I find it astounding how someone's long term convictions can be so off base while his trading produces super profits. After reading the insightful trading-diary portion of the book, I concluded that his strengths lie in his not trading based on his long-term views, but rather listening and reacting to the market on a day to day basis. His somewhat stubborn bearishness seemed absent in the day-to-day trading mode.

May

29

It should be noted that investment grade bond domestic bond issuance set a monthly record as of Friday, with borrowers selling $105.92 billion in securities (and the month isn't over, with three full days remaining.)

It should be noted that investment grade bond domestic bond issuance set a monthly record as of Friday, with borrowers selling $105.92 billion in securities (and the month isn't over, with three full days remaining.)

Among the commentary supporting the debt binge, equity strength is highlighted, as well as the perception that despite the aggressive pace of LBO/PE deals. The thinking is that it will be a quite some time until a high-profile deal melts down. Moody's agrees, apparently, with a report issued last week forecasting a decline in default frequency to a record low.

And the proceeds? S&P 500 components have spent more than $440 billion on share repurchases over the past 12 months, according to J. P. Morgan.

Alston Mabry writes:

Having spent a while recently as a spectator at a PE buyout, from the acquirer's point of view, I can offer this observation from the cheap seats. The PE craze appears to be fueled, just like the hedge fund industry, by cheap leverage. The buyout firms are using leverage at 5% to buy cash flow of 10% and pocketing the difference. On a $5B deal, that's $250M/year. And if a few years later somebody comes along and offers you a price you can't refuse, like Riverdeep did for Houghton, then so much the better.

So where's the weak point? Or is it a free lunch? If there were to be a downturn that pushed too many of those cash streams negative, but still the interest payments on the leverage keep coming due, then could some buyout groups get hurt?

Stefan Jovanovich comments:

I doubt that where we sit qualifies as "seats". Even calling the location a knothole in the fence is probably an exaggeration for our odd-lot venue.

Over the last 12 months the return on common stock investments net of commissions before taxes was 19.65%. The pre-tax, post-expense return on our private investments during the same period was twice that - 38.52%. Alas, no one is eager to buy that private cash flow with or without leverage because the world of finance capital for small private businesses here in California no longer exists.

The roll-up boys are long gone and so is small business lending unless you include your Capital One credit card in that definition. The returns on small business equity here in the Golden State will continue to be outsized because there is no way for going concern values to be monetized. No one in their right mind wants to acquire legal employees unless they have already amortized that risk with a full-blown HR department.

If our situation is at all typical, then the flow of capital from small business owners into securities may have a great deal longer to run. We make a great deal of money from our private business, but we know that every new investment in it is truly sunk. We can only get a return from operations, not from selling.

Philip J. McDonnell writes:

In a way the return on private equity is higher than the publicly available equity. With the advent of Sarbanes-Oxley the costs to comply went up for public companies. It simply added costs to their operations with no compensating income gain for the companies or the investors. In addition to that there always was some kind of added cost borne by public companies. As usual the regulatory costs only ratchet upward never down.

With the example of a public company with a 10% return (PE=10) which is purchased for money that was borrowed at 5% giving a net 5% after interest cost return, the real situation may be better. In fact given the regulatory savings the newly private company may be able to yield 11% thus boosting the net return to 6% which is a 20% better ROI.

The benefits do not end there. There are no margin calls in private equity. Contrast that situation with a typical highly leveraged hedge fund. The hedge fund can borrow too. But if it is trading marketable securities there will be margin calls. Typically the portfolio will be marked to market daily and immediate liquidations will ensue if the value falls below minimum margin requirements.

For a private equity firm there is no daily quoted valuation. There is only the book value shown which is typically a high and inflated number set at the time of the buyout. The lender is actually looking to the cash flow more than any vague concept of market or portfolio value. Lenders want performing loans. To them performing means the borrower is repaying as agreed. It is capitalism as it was designed to work. When the government finds ways to regulate and to restrict credit the markets find ways around it. Ultimately the markets will rule.

May

29

What can we learn from shelled species about the markets? Shells protect creatures from predators, wind, sea currents and the sun. Sometimes they are conical, sometimes circular, and sometimes spiraled, with each shape being specialized to its particular purpose. Why do shelled creatures often live for so long … and in the markets, what makes some stocks live longer than others?

Reputation is key to business success, with companies spending fortunes to keep their reputations up, so that customers will pay more for their products. How does the market use the reputation effect to maintain its feeding webs, with particular reference to the last period effect, where there is no current incentive for a politician or market to fool its voters or votaries?

The Japanese and Israeli markets are both up sharply this morning, from when the U.S. markets closed at the end of last week. To what extent has there been correlation of these market's moves to the U.S. markets' move on the following day? My hypothesis is that the correlation was weak until last year, but has increased recently.

There has been a much greater tendency to reversal after big moves lately. Is this indicative of a change in regime or tempo, or is it bullish or bearish? The risk premium on stocks, according to a cursory study transmitted to me by the sapients at Gavekal, is at its historic average, but the risks nowadays from the economy are much lower than they have been before. To what extent is this bullish or bearish also?

It is an old saying that a nation's preferences in sports reflects its character. What can we say about the changing nature of sports in the U.S. that is indicative of future market moves? Is it truly hard to find kids in the ghetto playing basketball these days, and families visiting national parks together, because outdoor pursuits have been crowded out by computer games, etc.? If true, what are the implications of this for amusement park companies?

The ten year bond is a tenth or so away from a five percent yield? Is there a gravitational effect towards the round number, and will this have a detrimental psychological affect on stocks, with the yield differential still being at one and a half percentage points.

When will all the remaining trend followers get tripped into being long the dollar, and will the increased movement in the dollar's favor lead to another opportunity for the banks to make money from going against such a fixed position?

As a final thought, some old men are the greatest repositories of wisdom for the younger generation, like Ed Marks who was the greatest speculator I've ever met, or Larry Leeds, who has the best record of all for institutional funds. Others, (like the weekly financial columnist and the Nebraskan), have a message, that if followed would lead to lassitude and mediocrity.

May

29

Five Percent Yields, from Ken Smith

May 29, 2007 | Leave a Comment

Men and women born just after WWII are soon reaching retirement age. Interest income is important to retirees. They can't depend on volatile markets. They require something fixed, sure, a financial instrument that keeps food on the table, will pay the doctor, dentist, pharmacist, and funeral director.

Men and women born just after WWII are soon reaching retirement age. Interest income is important to retirees. They can't depend on volatile markets. They require something fixed, sure, a financial instrument that keeps food on the table, will pay the doctor, dentist, pharmacist, and funeral director.

There is more on the Fed's table than inflation and unemployment and corporate profits. Financial institutions and insurance companies for instance will be looking for yields that accommodate these needs.

Long bonds support fixed income; these yields must not fall if the future of retired voters are to be accommodated. A yield of 5%, in my experience, is insufficient to cover present inflation. How are retirees going to make out? The Fed is not independent from political and cultural forces. They will create a favorable situation for baby boomers. How does that affect stocks?

Stefan Jovanovich replies:

The first retirees in history were the merchants, schoolteachers, ministers, army and navy officers and imperial civil servants who lived into old age in the last third of the 19th century in the United Kingdom. They were the customers for the annuities that British insurance companies began selling in large numbers; they were also the audience for Gilbert and Sullivan.

The insurance companies looked to the bonds issued by the governments, railroads and utilities of the U.K. and the imperial territories, principally India. The recent anxieties about new home sales and re-sales and Congress's eagerness to "fix" the mortgage market suggest that the funding for the promises sold to American retirees is more likely to come from mortgages than bonds.

This does not answer Ken's question, but it may dampen some of the enthusiasm for finding in Great Britain's recent history the analog for America's predicted imperial decline.

May

28

The world of movies and the culture of America have been different ever since Star Wars. I remember that I was 13 years old and finishing up the 7th grade, thinking about summer baseball and how I had been invited to play for an elite team of graduating seniors and seniors to be. I was looking forward to summer camp, and girls were definitely on my mind, the possibility of seeing Rachel, or Beth in a bikini.

The world of movies and the culture of America have been different ever since Star Wars. I remember that I was 13 years old and finishing up the 7th grade, thinking about summer baseball and how I had been invited to play for an elite team of graduating seniors and seniors to be. I was looking forward to summer camp, and girls were definitely on my mind, the possibility of seeing Rachel, or Beth in a bikini.

I remember Mr. Russell, who would become Coach Russell, and later my friend Mike who now works for me and home-schools my kids. Mike would pick me up two nights a week to go play basketball with the adults and high school kids at the local gym.

I remember one night our church youth group decided to go to the movies. That was when I saw Star Wars. Yeah, it was pretty cool! I had hair that nearly went down to my shoulders back then. Now, well let's just say that things have changed. But that boy inside of me is still there. And memories like this bring him back and I feel young again!

May

28

Some Archery Family Fun, from Scott Brooks

May 28, 2007 | Leave a Comment

I've written many times about hunting and how much fun we have as a family with hunting, fishing, hiking and spending time together in the outdoors. The hunt itself is only part of the fun. The preparation and practice are a blast.

My 8-year-old son, Hunter is really into shooting his bow. He's addicted to what Ted Nugent calls "the magical flight of the arrow". After practicing with him today we searched YouTube to show him some archery tips.

We came across Byron Ferguson's Incredible Archery Shots. There's a whole series of them on YouTube. They are all around a minute in length and definitely family friendly. Take a few minutes and watch a few of these videos and bring the kids in the room. Who knows? You too may become entranced with the mystical flight of the arrow.

May

28

There is an interesting one page article by April Frawley Birdwell that appeared in the Winter 2007 edition of the University of Florida Alumni Magazine, on theoretical ecologist, assistant professor Ben Bolker.

There is an interesting one page article by April Frawley Birdwell that appeared in the Winter 2007 edition of the University of Florida Alumni Magazine, on theoretical ecologist, assistant professor Ben Bolker.

From the alumni magazine article (not seen online), Dr. Bolker "uses math to develop models that answer the 'what if' questions in ecology".

"Bolker's field, theoretical ecology, sounds abstract, but he describes it more simply as ecological modeling. He takes data other researchers collect during experiments and devises the mathematical means to answer questions the results cannot answer alone, mostly about the population patterns of plants and animals. He also tires to answer ecological questions of the hypothetical sort derived from his own brain. This can help researchers know what type of data to collect, he says."

Bolker is preparing a book for publication which may appeal to the statistically and programming-inclined. Evidently the book is meant to provide a more technical background to information set forth in Hilborn and Mangel's Ecological Detective.

Bolker's forthcoming book can be found in draft form. He welcomes feedback (he does come across as a fine teacher and one willing to help his students "break down math barriers").

May

28

You Have to Advertise, from Larry Williams

May 28, 2007 | Leave a Comment

I have no problem with advertising. It is essentially freedom of speech, a right. How else do people find out about a product or service?

I have no problem with advertising. It is essentially freedom of speech, a right. How else do people find out about a product or service?

Coke does it, Microsoft does it, Nike does it, I've done it. The larger issue is, does the sales message fairly present the proposition? Ken Smith has led the charges on this point.

Considering the large cost of advertising it is natural to try to get your ad cost back so a legitimate promoter will be as enticed to get a response as a huckster.

It is one thing for a money manager to advertise vs. a letter writer or educator. They have different markets to attend to. Some prefer writing to trading. A few trade and write. Then there is the running of a money management firm (that takes a very sharp business person as there are numerous areas of expertise needed beyond trading).

The aggressive promoters always have a back end. They want to sell you a book for next to nothing. Then a campaign steps up to a very expensive service or personal mentoring. That's the one they are doing now.

Several of these guys have approached me telling me how they 'step' people up from a free seminar to eventually getting $20,000 from them.

That galls me, as I'm sure it does most people. I'd rather trade or promote myself, (brag like hell of course if that's what's required) but have full disclosure and no hidden agendas.

Perhaps this will alert some to the mentoring hustle going on in the world of trading now.

May

28

The Wealth-Effect, from Riz Din

May 28, 2007 | Leave a Comment

On the wealth-effect, I've been Googling for investigations on the effect as self-reinforcing feedback mechanism and I can't find anything of note. Most of the material I have come across refers to the wealth-effect as a two-step process (rising asset prices increase wealth that equals more spending).

However, as the Chair notes, a portion of this wealth-related spending will be on a variety of assets, whose prices then inflate to generate further wealth, and so the wealth-effect transforms from a two-stage process into a reinforcing cycle.

May

27

Interesting Variant of the Prisoner’s Dilemma, from Philip J. McDonnell

May 27, 2007 | Leave a Comment

The Traveler's Dilemma and Prisoner's Dilemma are two examples of cooperative-competitive games. They contain aspects of reward for cooperative behavior and rewards for competitive behavior. In the Traveler's Dilemma game picking a higher number is cooperative play. The player is maximizing the reward to the two-player community. Picking the low Nash Equilibrium is competitive play. The player is maximizing the minimum reward. Naturally as the reward for competitive play increases the number of actual players using competitive strategies increases as well.

The Traveler's Dilemma and Prisoner's Dilemma are two examples of cooperative-competitive games. They contain aspects of reward for cooperative behavior and rewards for competitive behavior. In the Traveler's Dilemma game picking a higher number is cooperative play. The player is maximizing the reward to the two-player community. Picking the low Nash Equilibrium is competitive play. The player is maximizing the minimum reward. Naturally as the reward for competitive play increases the number of actual players using competitive strategies increases as well.

There is a strong parallel to the market. If we all buy stocks with all of our money they will go up. The community of investors will all gain. But human nature being what it is we will always be at least somewhat fearful that someone else will sell first and we will be the last to get out. Thus based on a news event or even non-news some will choose the competitive choice to get out early. They seek to avoid the maximum risk of a putative future decline by getting out before the other guy. However the long-term drift strongly indicates that such anti-cooperative behavior is self-defeating and leads to opportunity loss.

May

27

Swedish Online Traders, From Kim Zussman

May 27, 2007 | Leave a Comment

Swedish online traders trade more and lose more if they have higher percent total wealth in their trading accounts.

May

27

The Iraq War is for the Oil, From James Lackey

May 27, 2007 | Leave a Comment

I can assure you that American boys and girls join the military to fight. We told our parents it was for the education, money, or to see the world. Yet the fact remains we loved to blow stuff up and be soldiers. Nowhere, in any business or sport, are young men and women age 17-22 afforded such responsibility with powerful equipment or in such a strong leadership position with the chance of quick promotion than the military.

For a soldier, after about six years in the military you hit the decision maker. That is when the people in the civilian world start making much more money. For an officer, do you want a company command, take a corporate job, or start your own business? For the enlisted, do you want to be a platoon sergeant, work with and lead men for the next 15-20 years then retire and start your own business with the military retirement check?

It may come as quite a shock to some that there are millions of Americans that do not care about money. The Army has quite a retention system. The lifers, those that are in the Army for a career have a passion to retain those soldiers they feel are best, to promote their own love of a career.

I still remember the quote from Mel Humphrey. He was the meanest SOB to ever walk this earth. He thought it was his duty as an American to take young kids and teach them how to work. You had two choices, his way (the money) or join the military. He paid such high wages; I made enough working for him at 16 to work 4-6 months a year and race the rest of the year.

One of my first days at work we had a long drive to the job site. It was snowing and we were prepared to work 12 hours. In the pickup truck freezing my tail off he smoked like a chimney so I had to keep the window open. I peeled off my gloves as he said, "write this down now."

- How long does it take to drive to the job? Leave early to miss traffic and eat near the job site?

- How long does it take to use the bathroom? Fifteen-minute breaks are 13 minutes too long.

- How long does it take to each lunch? Eat while you work and it's a paid lunch.

- How long does it take to plan a job? Take twice as long and you'll save double the mistakes.

- How long does it take to clean up, pick up tools? Take the cost of lost tools and time to replace them into account when your cold tires and just want to go home.

- How long does it take to get home? Slow down, tickets and accidents on the way home kill.

- Out of a 12-hour day, driving-planning how much actual work gets done? How organized are you for the crew and how many actual man-hours of work are completed every day? Keep track.

Now what is your best guess to make (how much you want to make a month) what is your guess on how many hours you will be working.

You have a girl friend? Good because once you have it figured out how much work you do, the time and effort it takes. Realize you need to love your job and those you work with as much as any woman you marry. You'll see your work more than your wife.

All the while he told us crazy military stories. There was no money, a lot of BS and down time. Yet you had the opportunity to do things that were impossible to do in the civilian world. You want excitement? Join the military. You want money, "get back to work."

May

27

About Pessimism and Optimism, from Paolo Pezzutti

May 27, 2007 | Leave a Comment

Last week I attended a project management course called Prince2. It was very interesting, but also challenging. The written exam lasted about three hours. At the end I was exhausted. The questions were difficult and you had to manage your time very well.

Last week I attended a project management course called Prince2. It was very interesting, but also challenging. The written exam lasted about three hours. At the end I was exhausted. The questions were difficult and you had to manage your time very well.

English is not my mother tongue and may be this is also why I got so tired. The instructor asked me: "How was it?" I said, "Very difficult. I am not happy". The reply was, "You are never happy. You are a pessimist".

Perfectionism, is often confused with pessimism. In the end he was right from a certain perspective. You do not live well always looking to "the next step" in order to improve your results. Traders must be optimists because they must be confident in their system when they take risks. Optimism does not have to be confused with superficiality - "things will go fine anyway".

The optimist looks at the next market move confident that prices will go in his or her direction. A pessimist will never start trading because the improvement process will continue forever. A pessimist will work out the details and analyze risks thoroughly. A pessimist suffers during trades, projecting reversals and fakes to his positions. A balance should be found.

I think, however, that the approach should become as mechanical as possible to leave out emotions and attitude. A tested approach has to be followed with discipline. A trading methodology should be designed, tested, and applied in a scientific and mechanical way leaving the human factor out of the game. I am not sure how intuitive traders can do. The validity of their approach is not measurable, although their results in the long term are. And there are many successful intuitive traders out there.

From James Lackey:

Perhaps the reason "emotion and attitude" get a bad wrap is they're not measured and tested. In hindsight all bad trades were due to "emotion and attitude." What about the good trades? Are good trades always entered with the so-called proper no emotion and humbleness? Of course the proper way to exit a good trade is with reasonable humility.

Discipline is only good after the desired result. Discipline with bad results is insanity, doing the same thing over and over expecting a different result.

I have seen a few mechanical traders fail. After the fact they might blame their interference for their demise. After pointing out their system wasn't good enough in the first place, they argue that, no it was their lack of so-called discipline for not sticking with a winning system. Yah, right. If the system were winning big the emotional response would be to go out and celebrate or promote for even a greater monetary gain off a bigger stake.

May

27

Late on a Saturday Night McDonald’s, from Alan Millhone

May 27, 2007 | 1 Comment

I just now decided to have a late night Big Mac and pulled into our local McDonald's and noted they were closing. I hurriedly pulled to the drive through and placed my order. I got to the window to pay and was told the grill was shut down and I could get my # 1 with a Big Mac, but it would be made with a quarter pound of meat. I said that was fine. I got back home and found they had included a second burger at no extra charge.

I just now decided to have a late night Big Mac and pulled into our local McDonald's and noted they were closing. I hurriedly pulled to the drive through and placed my order. I got to the window to pay and was told the grill was shut down and I could get my # 1 with a Big Mac, but it would be made with a quarter pound of meat. I said that was fine. I got back home and found they had included a second burger at no extra charge.

I like McDonalds anyway, but that little extra tonight is good PR and keeps customers happy and thus helps McDonalds stock.

Many years ago one of the first McDonald's opened up on Hamilton Road in Columbus. My mother's sister and her husband lived in Columbus and took us to this brand new restaurant. I was probably 10 and can still remember the golden arches that I saw for the first time. At that time they had single burgers with ketchup and a pickle for around 29 cents. They came wrapped in paper. Hard to beat that occasional Big Mac, hot fires, and a cold Coke, as American as apple pie.

Ross Miller adds:

Despite Ray Kroc's best efforts, McDonald's quality varies widely from store to store (I am reluctant to use the word "restaurant"). I once considered the better stores to be reasonable places to eat, but my tastes have changed (I hope for the better) over time.

My current favorites in pre-fab food are four regional chains that have settled into the Albany, NY area on an experimental basis. Here are some quickie reviews in descending order of quality:

Carrabba's: Ersatz Soprano eatery. Surprisingly good and an okay "date" restaurant that pegs one with a net worth of under $25 million — so some dates may object. I am a regular so the help knows that I will have them executed in the parking lot if I have to wait for anything.

Nothing but Noodles: A good date restaurant, seemingly from Arizona, for the sexually ambiguous. The name is a misnomer. I'm a regular there too but turnover is so high no one has noticed. Southwestern style noodle dishes are amazing by local standards. Free Wi-Fi, but happily few use it. Don't look too long at the other dinners or a Zoloft/Merlot chaser may be necessary.

Five Guys: Great authentic DC area hamburgers and even better French fries. Not a date restaurant unless your net worth is over $1 billion. Free peanuts are a bonus to attract the hedgie crowd. Now open at National Airport, though eating is the last thing on my mind when I'm staying there so I have no idea how the food is at that outlet.

Moe's: Upstate New York's weak attempt at Una Mas, a great Bay Area burrito place. Makes me miss California a whole lot. I am a regular there and they yell "Happy Monday" whenever I walk in. I am probably their version of Stevie, which is really sad.

May

27

At first you might think it's a joke, but apparently they're deadly serious. The latest proposals by the UK's education secretary are that private schools may be forced to 'loan' teachers in order to maintain their 'charitable status'.

At first you might think it's a joke, but apparently they're deadly serious. The latest proposals by the UK's education secretary are that private schools may be forced to 'loan' teachers in order to maintain their 'charitable status'.

Evidently it counts for nothing that they already take the burden off the education system and parents who send their kids there without taking up their 'entitlement' to free education.

May

26

Some Things To Consider, from Victor Niederhoffer

May 26, 2007 | 3 Comments

Amidst the bearish and bullish voices of present, there are three subjects that I believe are important which have received little consideration:

1. The tremendous hedged long/short (both direct and indirect) pool of funds still trying to capture an alpha of a few percent, that has not bought into the 10% a year rise in stocks. There is also considerable capital with the foreigners who either hate Bush, or are just uninterested in the US.

2. The moves to cut taxes all over the world, as countries try to compete with China where they have no capital gains tax, and an income tax of 15% (there is even talk of abolishing this).

3. The incredible increase of wealth in such things as real estate and equity holdings, as well as firm values, mutual fund values (and a dozen other such 'values' that are indirect signals of the US's great wealth), collectibles, investment in intangibles such as patents, education, or brand names, and improvements in homes. Also, spending in the stock market due to the Wealth Effect has increased to an inordinate extent, and there has been great rises in almost every other stock market around the world, offering great untapped reservoirs of liquidity. I believe that the much denigrated and unstudied Wealth Effect is a greater source of spending on stocks, and a driver of stock values, than the normallly used Income Effect explanations, that economists and officials of the doomsday persuasion like to pay attention to and study.

May

25

Scott Brooks on Memorial Day

May 25, 2007 | Leave a Comment

My favorite holiday of the year is Memorial Day. This is the day when I remember the freedom that I have and how it was won. It is the day when I give deep and sincere thanks to those who fought .. .not for my freedom (I would never ask anyone to do that), but for their freedom, and for the freedom of their children.

My favorite holiday of the year is Memorial Day. This is the day when I remember the freedom that I have and how it was won. It is the day when I give deep and sincere thanks to those who fought .. .not for my freedom (I would never ask anyone to do that), but for their freedom, and for the freedom of their children.

I remember that the freedom I have and enjoy is a by-product of other people's willingness to fight for what they believed in. Over the course of this weekend, we'll hear a lot about the sacrifices of these men and women, but I don't think about what they did as a sacrifice — I believe that what they did was simply a matter of choosing their highest values.

I doubt most sane people want to die, but there are those that choose to "walk into the valley of the shadow of death" so that they may have that which they value most; freedom and liberty.

I was thinking about baseball today also. I remember fondly my carefree years of youth, playing baseball and wishing I could some day play in the big leagues, and I remember having players that I idolized. One in particular comes to mind, who was introduced to me by my father, and whose career had ended two years before I was born. He was Stan "The Man" Musial. What a player! What a career! What a person!

I was also thinking about all those who are about to enter what used to be an elite club; the 500 homerun club. I began to wonder if Stan Musial feels he had sacrificed something as important as the 500 homerun club to serve his country? His actions and life lay bear that myth. I can't read "Stan's mind, but he strikes me as one who is contented with his place in history. I'll always think of him as "The Man", who gave up a full season in his prime to serve his higher values.

I don't want to forget my A.L. friends either. There is a player of great renown who likely would have made the 600 homer club if he had not choosen to serve his higher value: Ted Williams hit 521 homeruns but also served our country's military for several prime years. Here's what wikipedia has to say Ted:

Williams served as a United States Marine Corps pilot during World War II and the Korean War. During World War II he served as a flight instructor at Naval Air Station Pensacola teaching young pilots to fly the F4U Corsair. He finished the war in Hawaii and was released from active duty in January of 1946; however he did remain in the reserves.

In 1952, at the age of 34, he was recalled to active duty for service in the Korean War. After getting checked out on the new F9F Panther at Marine Corps Air Station Cherry Point, North Carolina, he was assigned to VMF-311, Marine Aircraft Group 33 (MAG-33) in Korea.

Many men and women have given their lives and limbs to fight for their highest values, and I highlight these two only as reference points.

I think that the real spirit of Memorial Day is best summarized in the words of one of our Founding Fathers:

Is life so dear, or peace so sweet, as to be purchased at the price of chains and slavery? Forbid it, Almighty God! I know not what course others may take; but as for me, give me liberty or give me death! — Patrick Henry

My friends, remember this day and what it really means … and everything it took to get where we are today! Remember the words of Patrick Henry as you relax, comfortable and safe, and maybe take in a ball game.

I will end by saying this: thank you to every man and women in this country who has served in our military. To my friends who have served (and there are many of you), I want to extend a warm and sincere thank you to you personally. If I could, I would shake your hand and give you a hug, I am truly grateful.

May

25

Remarkably, each of the four days this week the S&P Index has traded above its previous all time high close of 1527.9, but then failed to set a new closing record.

Remarkably, each of the four days this week the S&P Index has traded above its previous all time high close of 1527.9, but then failed to set a new closing record.

| Day | High | Low | Close |

| Mon | 1534 | 1526.6 | 1527.9 |

| Tues | 1533 | 1525 | 1525 |

| Wed | 1535.7 | 1524.3 | 1525.5 |

| Thur | 1532.5 | 1507.8 | 1511.6 |

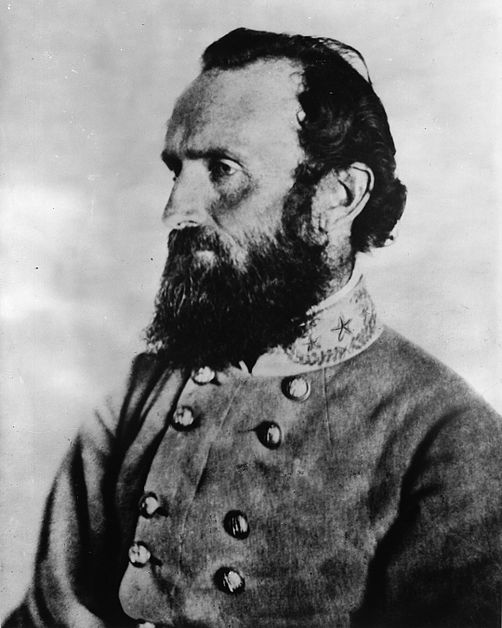

Note the artful way that the market was able to be down on the week by a hair, as of Wednesday, setting up the longs to increase their positions, only to decline 25 fast points the following day. It would take a Rommel or a Stonewall Jackson to duplicate such cunning.

Thursday had the highest single day range since March 21st; it was up seven by 10 a.m., but then down 18 by 3.40 p.m. (NY time). This is about two and a half times the average range of last year, and shows the usual ability of the market to do the unusual.

Finally, there have been four serious down afternoons, and these are presumably related to the fake Drs. feelings about China … let us hope he visits there for a second time soon, as the first time he was only there for a day (with Paulsen, just 1 year ago).

From John Floyd:

I think other contributing factors to the market's retreat are also tied to the cycling of rate expectations, economic data, and "carry trades." The beginning of yesterday's sell-off started not soon after the stronger U.S. economic data and coincided with a sell-off in interest rates and carry.

In addition to the Dr.'s comments, who does seem to be losing some of his "mojo," the directive of the latest comments were towards China and the market has disregarded the comments and moved to new highs since them. The overnight price action in carry and Japanese inflation data continuing to border on deflation should make today interesting.

Also of note, combined with other indicators, is that gold last Memorial Day was at roughly the same level and subsequently fell sharply.

From James Sogi:

Why three times? It's like the old knock, knock joke. Who's there? Always three times of course. Three is the minimum number to create a pattern. "Knock, knock. Who's there? Orange you glad I didn't say banana?" The three tops were also the three-mountaintop candlestick pattern. Seems like the market likes threes. "On your mark, get set, go!" Seems like something deeper, but what? But it's something to ponder over a three-day weekend.

Speaking of weekends, here's a favorite barbecue: Yakitori.

It's great for sitting on the deck because you can eat holding the little stick and still have a free hand for the beverage and you can gesticulate with the little stick to make your points more emphatic. Serve rice of course, or better yet Musubi. Here's how to make Musibi.

From Dylan Distasio:

If you're in the NYC area, check out Yakitori Totto on the West side for awesome organic yakitori and a great sake selection. They actually have an East side location also. My wife and I have eaten at both fairly often, and the food is delicious. They cook most of it over the long slim charcoal grill on skewers, and you can order any piece of a chicken you can imagine (and then some). It's fun to just order an assortment of small skewers and drink some sake. There's a great atmosphere also. I've never been to Japan but it seems pretty authentic. We're often one of the few Caucasians in there; the rest are usually all Japanese-speaking, including the entire staff. I'd highly recommend it.

John Floyd adds:

Actually if you want sake and good food the other place to try is Sakagura on East 43rd street, in the basement of an office building. There are several hundred of types of sake to choose from, anywhere from a few dollars to a hundred dollars for a masu (traditional wooden box cup).

May

25

“Computational Ecology,” noticed by Sam Humbert

May 25, 2007 | Leave a Comment

"It turns out that circuit theory shares a surprising number of properties with ecological theory describing animal movements and connectivity," said Brad McRae, NCEAS project leader. "We can now represent landscapes as conductive surfaces — with features like forests and highways having different resistance to movement — and analyze connectivity across them using powerful circuit algorithms. Unlike standard conservation planning tools, these algorithms simultaneously incorporate all possible pathways when predicting how corridors, barriers, and other features affect movement and gene flow over large areas."

May

25

One of the big financial businesses of the 19th century was to buy cheap Latin American sovereign debt, and then enforce payment by use of gunships. Apparently, the system is back, and its opponents too.

One of the big financial businesses of the 19th century was to buy cheap Latin American sovereign debt, and then enforce payment by use of gunships. Apparently, the system is back, and its opponents too.

The Paris Club of official creditors decided to prevent aggressive investors buying poor countries' debt at a low price and then suing to recover large sums of money. There is growing irritation among international development agencies and NGOs over the actions of "vulture funds", which buy up discounted debt, often of developing countries, and then sue the government for more money than they paid. The emergence of litigation by vulture funds is forcing some poor countries to use spare money to settle debt claims, angering the other creditors who have written off the debt.

A British high court judge ruled in February that Zambia must pay the investment firm Donegal International a much larger sum than the $4million it had paid for the country's debt. The International Monetary Fund, World Bank, and Western creditors wrote off a large part of Zambia's debt in 2006.

I remember reading that among many others, Turkey and Venezuela's debt was recovered by these methods. Theodor Herzl offered to settle Turkey's debts for a charter of South Syria, then a Turkish province.

May

25

Fed Governor Fred Mishkin laid out part of the intellectual framework for the Fed’s economic uber view.

Fed Governor Fred Mishkin laid out part of the intellectual framework for the Fed’s economic uber view.