Feb

28

All the News That’s Unfit, from Gregory van Kipnis

February 28, 2007 | 1 Comment

NYT, February 28, 2007 ECONOMIX A Recession That Arrived on Cats' Paws

By DAVID LEONHARDT The nation's manufacturing sector managed to slip into a recession with almost nobody seeming to notice. Well, until yesterday.

The misleading New York Times headline suggests recession is here. The bias is manifest. I guess liberals want a larger market correction?

George Zachar replies:

You're way too kind. They want a visible recession and a nasty asset price decline to use as rhetorical clubs through the 2008 election cycle. Their academic sock-puppets hit my email box this morning with gloating doomsterism. Expect at least a full week's news cycle of chronicmania.

Unless there's a photo of Anna Nicole necking with Elvis in a Des Moines Burger King…

Feb

28

Orphan Tsunamis, from Ken Smith

February 28, 2007 | 2 Comments

Tsunamis occur for which the orgin is unknown in that no source has been discovered. They are called orphans. This week a shock, like a tsunami, hit China and the shock wave extended around the globe. It could be called an orphan. Not accompanied an origin.

Tsunamis occur for which the orgin is unknown in that no source has been discovered. They are called orphans. This week a shock, like a tsunami, hit China and the shock wave extended around the globe. It could be called an orphan. Not accompanied an origin.

Orphans appear out of nowhere, are not predictable, and leave damage that takes time to repair. Lives are lost.

In Japan, officials recorded an orphan tsunami — unconnected with any felt earthquake — with waves up to ten feet high along six hundred miles of the Honshu coast at midnight, January 27, 1700.

So far I've not heard of lives lost this week, no accounts of stockholders jumping from high windows above streets teeming with anguished investors and traders.

Only accounts that were weak suffered losses. However, shock waves reverberate and second waves are common. Today is all we have for knowledge; what happens at the open tomorrow is unknown.

Jim Sogi adds:

Interesting how the wave traveled and continues to travel around the world, and how Japan follows US action later in the evening. The flu pandemic, which there will be at some point, will follow a similar path, and change many things, such as travel and free trade, more so than terrorism did.

Many lessons from DailySpec are coming in handy these past few days, on such topics as canes, leverage, liquidity, and survival. More heed might have been taken though to the bears' arguments the past few months, as they were not entirely wrong or foolish. Never underestimate the opposition. It is easy to be self-deluded as we, the market, were.

The biggest drop since 9/11, oddly, since there is nothing really wrong, as there was on 9/11. Just one of those panics that come with the regularity of the seasons, or the years, as the case has been. The news is good, the economy is good, the market is good, and even the price is good. Anyway, seems like a good time to get long, as it has been difficult to do so for months now.

Feb

28

Would You Like Chips With That? from Dan Grossman

February 28, 2007 | 4 Comments

I don't know why the recent remark from Prince Charles annoys me so much more than any other politically correct celebrity pronouncement. I guess it's just that this elitist wimp, who has never worked a day in his life, would casually call for the "banning" of the world's largest restaurant chain, a company that provides clean food (not to mention Professor Pennington's morning Egg McMuffin) at reasonable prices to literally billions of working people and their families worldwide. It is so mind-bogglingly inappropriate and unintelligent.

I don't know why the recent remark from Prince Charles annoys me so much more than any other politically correct celebrity pronouncement. I guess it's just that this elitist wimp, who has never worked a day in his life, would casually call for the "banning" of the world's largest restaurant chain, a company that provides clean food (not to mention Professor Pennington's morning Egg McMuffin) at reasonable prices to literally billions of working people and their families worldwide. It is so mind-bogglingly inappropriate and unintelligent.

Nigel Davies writes:

This, from YouTube, will make you feel better, we Brits have used it for years.

Feb

28

Penny Spreads in Options, from Tom Larsen

February 28, 2007 | 1 Comment

I started trading option spreads in SMH, which trade in pennies, and my initial opinion is that it is great for off-floor traders. In some equity options, I used to wait days on my limit because I didn't want to give up a whole nickel. Trading SMH, this is now unnecessary. Penny increments let me gradually give up two cents to get done. This is a huge savings.

I started trading option spreads in SMH, which trade in pennies, and my initial opinion is that it is great for off-floor traders. In some equity options, I used to wait days on my limit because I didn't want to give up a whole nickel. Trading SMH, this is now unnecessary. Penny increments let me gradually give up two cents to get done. This is a huge savings.

For example, trading a 20-lot spread, my commissions are $40, but if I have to give up a nickel on a spread, it costs me an extra $100. If I give up only two cents, I save $60! Obviously, I also save money when I trade out of the position. My commissions are already as cheap as I could hope for, so narrowing the spread is far more beneficial than any further commission reduction. I'm inclined to increase my trading size.

Feb

28

Maybe We Need a Stand-In Market “Mistress”? from Jeff Sasmor

February 28, 2007 | Leave a Comment

Stand-in mistress sought to take wife's abuse…

Monday, Feb 26, 2007 7:40AM CST

BEIJING (Reuters) - A Chinese businessman has advertised on the Internet for a stand-in mistress to be beaten up by his wife to vent her anger and to protect his real mistress, Chinese media reported on Monday.

"When the woman found out her husband had a mistress, she insisted on beating her up," the Beijing Youth Daily said, citing the advertisement posted on a popular online jobs forum on sina.com.

More than 10 people had applied for the job, the newspaper said. The "successful" candidate would be 35 and originally from northeastern China and would be paid 3,000 yuan ($400) per 10 minutes, it said.

Many Chinese businessmen keep mistresses in second homes, a trend banished after the Communists swept to power in 1949 but which has made a comeback with market reforms in recent decades.

Susan Turner remarks:

This has a Doug-and-Dinsdale sound to me. Why not just beat him up? No doubt this has already occurred to many people reading this…

Feb

28

The Chinese Carnage Revisited, from Bernd Dittmann

February 28, 2007 | Leave a Comment

Having continued with Jay Pasch's counting of the Chinese carnage of Tuesday (as published here on Feb 28th), and instead of using confidence intervals, I looked at extreme values. Based on daily returns from the 2nd of January 1987 utill today (4992 obs.), here are the left and right tails of the return distribution:

%return <-% obs normal dist >+% obs

0.5 1466 1865 1663

1 876 1337 1041

2 334 596 371

3 140 182 136

4 69 50 61

5 36 9 27

6 23 1 15

7 18 0 9

8 12 0 5

9 8 0 2

10 6 0 2

Feb

28

Counting the Carnage, from Jay Pasch

February 28, 2007 | 2 Comments

Measured yesterday's SPX closing price as a percentage decline of more than 4 standard deviations below the average one-day percentage change measured over the last 30 trading days. Examined the dates in history of like moves and the percentage-change T-days out. History shows a strong bounce averaging 4.3% by 2-days out, 9 of 10 winners and 1 no-change, t=3.2 at day-2.

Bernd Dittmann adds:

I continued Jay's counting, but instead of using confidence intervals, I looked at extreme values. Based on daily returns from Jan. 2, 1987 till today (4992 obs.), here are the left and right tails of the return distribution:

%return <-% obs normal >+% obs

0.5 1466 1865 1663

1 876 1337 1041

2 334 596 371

3 140 182 136

4 69 50 61

5 36 9 27

6 23 1 15

7 18 0 9

8 12 0 5

9 8 0 2

10 6 0 2

What is clearly striking is that declines of 3% or more have been observed more frequently than 3%+ percent increases. If one were to use a normal distribution to describe Hang Seng daily returns (which is rejected at any level of significance), one would clearly underestimate the frequency of extreme returns. Which distribution would thus fit Hang Seng returns, and also its asymmetry in extreme values?

Larry Williams remarks:

Traders should carefully note which stocks in the Dow were the least resistant to the selling pressures yesterday. An important subject, raised by Victor and Laurel a few weeks back.

Feb

28

Relative Size, by Kim Zussman

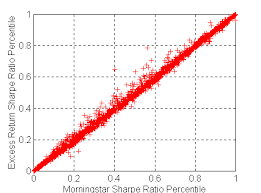

February 28, 2007 | Leave a Comment

The size of yesterday's decline in stocks was in the top several since the 1990's, however, since volatility and the size of moves in general were greater in the past, one way to put today in context is in comparison to recent market behavior.

The size of yesterday's decline in stocks was in the top several since the 1990's, however, since volatility and the size of moves in general were greater in the past, one way to put today in context is in comparison to recent market behavior.

This kind of analysis could pertain to trader herding: Long periods of small moves punish those betting on big moves while rewarding small patterns (and vice versa for volatile markets). In terms of environmental pressure, recent market behavior selects for followers, but such easy feeding may occasionally lure them to extinction.

SPY daily returns since 1993 were checked for cases where the close to close move was bigger than 2% (up or down). At each such instance, the prior 100 day mean and standard deviation were calculated and used to determine how many (recent) standard deviation units the big move (in absolute terms) was.

For big moves compared to the prior 100 days, todays decline of almost 4% in SPY was over eight standard deviations more than the mean move; ranked 1st of all such moves in relation to standard deviation.

Feb

27

Cowboy Up! from Steve Leslie

February 27, 2007 | 2 Comments

On a day like today, one is sure to see the deepest darkest side of the financial markets and the financial pundits. And the bulls and bears are going to choose sides, and start to fight things out in the short term.

On a day like today, one is sure to see the deepest darkest side of the financial markets and the financial pundits. And the bulls and bears are going to choose sides, and start to fight things out in the short term.

Being a veteran of more than 25 years of trading stocks and stock indices and living through the events of 1984, 1987, 1991, 1994, 1997, 1998, and 2001, my perspective is this:

One monkey does not close the show. A big decline like today does not lead to an end of the world or a China Syndrome.

It takes time for sanity to return to the markets on such a day as this. This means that the money will need to be sorted out and there will be continued volatility and big swings for the next several weeks.

Financial shows are in a war mode where they will begin to fight over viewership. Consider this akin to sweeps week at the networks. Financial advice will be ubiquitous. Remember, the more public the advice is and the more readily obtained it is the less valuable. The best bet is to not watch television, particularly the financial shows. Especially avoid the cable news shows. They are in the entertainment business not the moneymaking business.

Avoid all or none thinking. Eliminate Schadenfreude from your thinking. Avoid self-pity. As Bill Parcells says, "you are what you are."

Ignore the nattering nabobs of negativism. They are out there to rubber stamp their careers with one lucky call. Do not help them. Their opinions do not count anyway.

This is where all the practice, mental preparation, training, and professionalism become critical. General Patton would say, "This is where all the training pays off."

Be your own man. Make decisions based on your beliefs and your philosophy for better or for worse. If you had a good plan going into today, chances are it will be a good plan going forward.

Don't change tack. Any sailor will tell you to steer the vessel in the wave and head directly for it. As long as you have power, you have control.

Focus on what you have control of. Manage the trade; don't let it manage you.

Vincent Andres writes:

I ask myself, is it so important to identify the precise stimulus that triggered the market? There was probably one. One little shock, maybe, on one little fissure, which was enough. This is because it was applied at the right moment at the right place. But I'm afraid those remarks are of no predictive value. It is impossible to identify all possible little shocks and all possible little fissures. That's looking for a needle in a haystack.

But the market was in a state such that a little shock on a little fissure could propagate, coming from a microscopic, invisible level and emerging at the macroscopic visible level.

Why was the market in this state? Stress, pressure, tension. How to measure when the market is in such a state? I bet that some physicists have some ideas about this question.

Feb

27

Employment Notes, from George Zachar

February 27, 2007 | 1 Comment

According to ADP data, all of the last two years' US job growth has come from businesses with fewer than 500 employees.

A useful stock screen? A comment on relative regulatory burden? A factor in outsourcing/ offshoring/ trade?

From Stefan Jovanovich:

In California, the regulatory burden begins with five employees. Once you get to 25, your reporting, regulatory and liability burdens as an employer in this state are the same as General Electric's. Status outsourcing - reducing the number of direct employees and using outside contractors instead (which are invariably privately-owned corporations with only a few hundred employees at most) - is probably a bigger factor now than overseas outsourcing.

Most of the publicly-held companies that do business in California now have explicit policies to reduce their overall employee head counts in the state. I suspect that quality improvement from the use of digital technology is also a factor - as Jim Lackey pointed out yesterday about cars. If your business uses computers and digitally controlled machinery and your people are smart, you can now produce more and better with fewer bodies.

In the dot.com boom even the large-cap Bay Area tech companies were hiring anyone who could pretend towards geekhood. Now they are limiting themselves to people who have computer science degrees and have (gasp!) actual work experience. The military services are going through the same transformation (part of the evil Rumsfeld's legacy). They are reducing overall numbers even as they increase the number of boots they can actually put on the ground.

Feb

27

Searching R, from Vincent Andres

February 27, 2007 | Leave a Comment

Sasha Goodman's useful R-Seek page is quite recent (begun in February) and it works well. There were three R search engines announced this month… all mainly due to lack of specificity of the "R" keyword.

Also, since I subscribe to several R mailing lists, I have put online an R mailing lists survey page.

Feb

27

Fakeout Days, from Steve Ellison

February 27, 2007 | Leave a Comment

I define a fakeout as a session in which the S&P 500 futures move in one direction from the previous close to 9:30, and then move a greater number of points in the opposite direction from 9:30 to the close. I counted 21 fakeouts in the 57 trading days ending Jan 14, 2007. Of the 21, 15 consisted of an initial move down that reversed to a gain for the day.

I define a fakeout as a session in which the S&P 500 futures move in one direction from the previous close to 9:30, and then move a greater number of points in the opposite direction from 9:30 to the close. I counted 21 fakeouts in the 57 trading days ending Jan 14, 2007. Of the 21, 15 consisted of an initial move down that reversed to a gain for the day.

Since mid-January the market has been faking the daily direction much less, but the rarely seen fake up, close down appeared yesterday, Feb 26, 2007. Only the fourth fakeout day of the past 29 trading days, and two of the four were miniscule.

A team that is stronger than the opposition has little need to fake; it relies on superior execution. In the Woody Hayes era, everybody knew Ohio State's game plan would be "three yards and a cloud of dust," but few teams could stop the Buckeyes.

Feb

27

That’s How They Do It in Dixie, from Paolo Pezzutti

February 27, 2007 | 1 Comment

I have finally moved from Rome to Norfolk with my family. A big change! I have a NATO assignment for a three-year tour.

I have finally moved from Rome to Norfolk with my family. A big change! I have a NATO assignment for a three-year tour.

I am really excited although it is not easy to settle down. The culture, the food, even the simplest things are different. The fact that houses are made of wood is also quite interesting. Last night there was heavy rain in the area. I have just rented a home and was still asleep on a mattress as my furniture has not yet arrived from Italy. Suddenly, I noticed that water had infiltrated through the roof and had come down to the living room. Very nice start I have to say!

Electrical outlets are different, so I had to buy all new electronic devices. Heating is different. Even the washing machine works differently. And in Italy, dryers are not very common.

What really impressed me, however, as soon as I arrived last month was the housing market in general. There are so many houses for sale in the area that you are brought to think that something is wrong. I do not know the US market and this area in particular, but the volume of housing for sale is huge. From what I understood, however, prices are still high and sellers, I have tried to test them, are not so inclined to reduce the price.

The rental market is different. I could not find so many houses for rent. And prices are quite high. Eventually, I decided to rent the house for the next 3 years. Currency risks and the weak housing market led me to make a very conservative choice. But with this type of market it might also be possible to find good bargains. I need time to search, and patience.

Feb

27

An Invitation Received by the Specs, from Mark Hoguet

February 27, 2007 | Leave a Comment

Invitation to Roundtable Discussion on Neuroeconomics.

I am writing to draw your attention to a roundtable discussion on neuroeconomics being held at the Philoctetes Center at 247 East 82nd Street on Saturday, March 17th at 2:30pm. The Philoctetes Center holds some of the most interesting conversations in New York City. Admission is free and open to the public. Daniel Kahneman, winner of the 2002 Nobel Prize in Economics, will be participating in the discussion.

It's a good idea to arrive 20 minutes early.

Feb

27

Execution, from James Sogi

February 27, 2007 | 1 Comment

It's spring in Hawaii. The free-range chickens in the yard are having little chicks. They are really cute. The clutches vary from three to 10 chicks. They all follow their mother hens around and peck at little worms. They struggle to keep up with mom, across the grass, up the rocks. Sometimes when the mother is spooked, she reverses direction really fast. Some of the chicks are not paying attention, or are not as fast, and are left behind. The Hawaiian Hawk, or Io, is cruising right above in the trees and swoops down and grabs a chick. Out of ten chicks, maybe two or three survive to maturity. Execution is swift.

It's spring in Hawaii. The free-range chickens in the yard are having little chicks. They are really cute. The clutches vary from three to 10 chicks. They all follow their mother hens around and peck at little worms. They struggle to keep up with mom, across the grass, up the rocks. Sometimes when the mother is spooked, she reverses direction really fast. Some of the chicks are not paying attention, or are not as fast, and are left behind. The Hawaiian Hawk, or Io, is cruising right above in the trees and swoops down and grabs a chick. Out of ten chicks, maybe two or three survive to maturity. Execution is swift.

That reminds me that when he market changes direction, not everyone is paying attention, or can't move as fast, and some few are left straggling in the wrong direction. A good spec is on the alert and can swoop down for a meal. That brings up the subject of execution. It can account for several percentage points of return, no matter what the system. There is always the tradeoff in fills, between size and accuracy. One can't have both. That brings up alpha. How much alpha is execution? A part of any system is its executability and accounts for a chunk of alpha. Many systems look great, but will they execute? A poor system can turn out great with great execution.

Feb

26

Advice for an Aspiring Trader, from David Wren-Hardin

February 26, 2007 | Leave a Comment

What do hedge funds look for in a proprietary trader?

What do hedge funds look for in a proprietary trader?

Independent, entrepreneurial team-players. Aggressiveness, with the ability to integrate information quickly. Essentially, the ability to make quick decisions on incomplete information.

The longer the track-record the better. Consistent profitability with low volatility of profits, where "low" will depend on the fund. Some will look askance at "too low" volatility, figuring there isn't enough risk, or that you're afraid to put it on. Be able to explain the scalability of your trading, and how you can increase or decrease volatility, i.e., risk. Maybe you had to play it safe because of margin constraints, broker constraints, etc. They'll want to know how quickly and how much you can scale up whatever it is you want to do.

As to education, the traditional degrees, Finance, MBA, etc., are easier only because you don't have to explain yourself. People know what you know. An ex-scientist or ex-engineer will constantly be asked why he switched careers and the applicability of his background to trading. A different degree helps you stand out, but it also moves you from being a safe, and easily defensible choice, to a risk.

Your cover letters should be short and to the point. No one is going to sit and read a long essay from someone he's never met. Generally, funds are looking for junior people from groups they know at banks they know.

Everyone is hiring, to a certain extent. They may not be publicizing it. Almost any fund will listen to someone they find intriguing. There are recruiters all over the place, playing up their hot contacts and jobs.

Feb

26

Sales and Sports, from J. P. Highland

February 26, 2007 | 2 Comments

I'm only 34 but I have been involved in sales for 16 years, when I started selling ads in a magazine. At some point I managed a sales force of fifty and I found the most successful salespeople to be hard working single mothers who needed to work hard to raise their kids. The best salespeople I know come from the lower classes, driven by the desire to have a better life. I can't recall a single good salesman coming from the upper levels of society.

I'm only 34 but I have been involved in sales for 16 years, when I started selling ads in a magazine. At some point I managed a sales force of fifty and I found the most successful salespeople to be hard working single mothers who needed to work hard to raise their kids. The best salespeople I know come from the lower classes, driven by the desire to have a better life. I can't recall a single good salesman coming from the upper levels of society.

Mark Goulston adds:

People who play in competitive team sports are sought-after for sales positions because of their ability to "take the hit," face, and deal with a reality in their face that produces an unambiguous score.

James Sogi extends:

The benefit of sports to a child, which leads to success in life, is the ability to face, accept, and overcome loss. A sporting loss is not life-threatening or career-ending, and the sportsman learns to overcome adversity in a controlled setting. Furthermore, he learns the rewards of effort, ultimate effort, training, discipline and competition. He learns, perhaps the hard way, that he cannot succeed without extra effort, hard work. These are over and above the benefits of health and fun and camaraderie from sports. These are lifelong lessons.

The benefit of sports to a child, which leads to success in life, is the ability to face, accept, and overcome loss. A sporting loss is not life-threatening or career-ending, and the sportsman learns to overcome adversity in a controlled setting. Furthermore, he learns the rewards of effort, ultimate effort, training, discipline and competition. He learns, perhaps the hard way, that he cannot succeed without extra effort, hard work. These are over and above the benefits of health and fun and camaraderie from sports. These are lifelong lessons.

David Lamb writes:

Many Wall Street firms hire ex-athletes, who are sought-after due to their competitive nature, their ability to take a "hit", and their desire to excel.

Steve Ellison replies:

It is not a Wall Street firm, but tech giant EMC that has built an outstanding sales force by seeking out athletes. I know a manager there who was a college hockey player. He says that he would give preference in hiring to anybody who was a student-athlete because it takes excellent time management and organization to be able to compete at the collegiate level while completing a college education.

Russ Sears adds:

Quote of the day from the sports page describing the Duke lacrosse team's motto for this season: "Succisa Virescit," Latin for "Cut it down, and it will grow back stronger."

To compete, in sports, in sales, in business, even in life and perhaps eternity, it is not enough to learn to "take a hit." Even the losers who barely survive will learn to take a hit.

To thrive you must learn to embrace the pain, to accept that success has a price. This will take you beyond the masses. The runt playing football or basketball for the love of the game will learn this.

To be a champion, you must find your niche; find that pain that makes you stronger. You must learn what exists inside you that, when it is cut down, makes you grow back stronger. You must learn to reinvent yourself until your dreams run parallel to your ability. You must learn to evolve.

Many great successes do make great salesmen. They don't make great salesmen, however, by just selling anything. They must sell something they believe in, on their own terms, not somebody else's.

Feb

26

New York Times Endorses Hillary? from George Zachar

February 26, 2007 | Leave a Comment

How else to explain this unprecedented swipe at a money-machine for the Democrats?

How else to explain this unprecedented swipe at a money-machine for the Democrats?

The Media Equation — Someone Give Geffen a Day Job, by David Carr.

There is a danger that if the coming election becomes David Geffen's full-time hobby, his precision ruthlessness will distort the public process.

The NY Times, with its long history of covering for dictators and ridiculing freedom, pouts about "ruthlessness" threatening to "distort the public process."

Damn. My irony meter just shorted out.

Feb

26

Peak Oil, from Stefan Jovanovich

February 26, 2007 | 2 Comments

Here is a link to Vaclav Smil's recent piece on Peak Oil.

Ken Smith writes:

In fact, when the price at the pump hit $3.00 a gallon last summer, it was America's number one gripe.

Filled tank yesterday, price of gas was just short of $3 a gallon for premium. Bought 12 oz of coffee at Starbucks for $1.80 plus tax, just short of $2. There is no shortage of coffee beans. Shortage or supply has nothing to do with price of coffee. Demand for coffee in relation to price is economically irrational since a cup of coffee is mostly water.

What is the cost of water per cup? A cup of coffee and a gallon of gas, what the hell are people bitching about when they buy gas? They should be bitching that coffee cost so much. Gasoline is a bargain. Coffee is expensive.

Kevin Bryant writes:

The professor (Vaclav Smil) may be an expert in many things oil related but I'm not sure he understands the definition of peak oil, at least as Hubbert expressed it. Hubbert himself is sometimes blamed for the confusion until he clarified his methodology in 1982.

The professor (Vaclav Smil) may be an expert in many things oil related but I'm not sure he understands the definition of peak oil, at least as Hubbert expressed it. Hubbert himself is sometimes blamed for the confusion until he clarified his methodology in 1982.

Hubbert's theory proceeds from a graphic representation of yearly production divided by cumulative production (an expression of production rate) on a y-axis and cumulative production on the x-axis. On this graph, "peak oil" is that point at which half of total reserves have been produced. Estimates of total reserves are of course up for debate; however, Hubbert's graph can be used quite neatly to extrapolate this value.

After the early production years, data points on the graph form an uncannily straight line. The theory or the main point of the graph is not to predict annual production or even when annual production will decline, rather, it highlights that the ability to find oil is principally determined by the fraction of oil yet to be discovered. One of the best analogies I've come across is the one about fishing in a pond: the more fish you catch, the harder it becomes to catch the next fish. Unfortunately oil has no offspring making the comparison less dramatic than it could be.

Corollaries from Hubbert's main theory then suggest that once peak is reached, production begins to fall precipitously and/or the marginal cost of production increases geometrically. Actual production experience for single wells seems to corroborate the significance of the halfway point. There may be a lot of oil left in the ground but getting it out in ever increasing amounts becomes an increasingly vexing and costly challenge - the Canterell reserves and the tar sands of Canada are prominent examples of these dynamics in action.

For a more detailed discussion of "Hubbert's Peak," Ken Deffeyes (dismissively referred to in the professor's article), also a geologist, has written two books on the subject: Hubbert's Peak: the impending world oil shortage and beyond oil, and The View From Hubbert's Peak.

Stefan Jovanovich adds:

Hubbert will, of course, ultimately be right; there is only a finite amount of petroleum and other usable hydrocarbons in the earth's crust. What Vaclav Smil ("the professor") and others in the oil & gas business have been trying to point out is that most of the planet has not had anything close to the intensive exploration that the United States' lower 48 had gone through when Hubbert first shared his magic curve with the world. They also find Hubbert's "discovery" of a perfect bell curve evidence of how little he understood the "erl" business.

Global Reserve estimates are like CBO projections of future deficits - very big numbers that have only political meaning. "Proven reserves" - the amount of oil and gas that a company knows is there under the ground because they have verified that it - never go out more than 2 decades of current production. The reason is very simple: "proving" that the stuff is there (as opposed to simply pumping it out of the ground) is the major variable cost. This is why the pond analogy is all wet (rim shot, please!). The size of the pond is a function of the amount of capital and ingenuity people are willing to put into the discovery of new reserves, and the present value of any discoveries they make.

Hubbert's Peak as a theory is analogous to a professor from the business school measuring Wal-Mart's inventory against its revenue history sales and "discovering" (sic) that the Walton brothers were running out of peanut brittle. The Walton brothers were (and measured against historic sales) always will be running out of peanut brittle. Hubbert's "methodology" is an accounting truism about any business that has an inventory; it's called the inventory to sales ratio.

I once asked Buster Turner about Hubbert. Buster had an advanced degree in petroleum geology from the University of Oklahoma, and his best fishing buddy was the State geologist who was a full professor at I.U. He was not a man who scorned academic learning. Quite the contrary. But he thought Hubbert was a perfect example of academic arrogance, what he called "the damned professoriate." Hubbert, he said, didn't even understand how much the tax code had favored finding and pumping oil and gas out of the ground in the domestic United States instead of exploiting overseas reserves. As Buster put it, "Congress had been sending everyone in the oil & gas business a telegram for 50 years that said 'Drain America First."' And so they did.

Kevin Bryant adds:

You put your finger on the key issue it seems to me, moving from the theoretical to the practical. Enlarging the pond requires capital. Investing capital requires appropriate risk/return. There's a reason there haven't been any super giant oil fields discovered in the last thirty years. All the low hanging fruit has been picked. Further discoveries will require significantly more investment relative to output.

You put your finger on the key issue it seems to me, moving from the theoretical to the practical. Enlarging the pond requires capital. Investing capital requires appropriate risk/return. There's a reason there haven't been any super giant oil fields discovered in the last thirty years. All the low hanging fruit has been picked. Further discoveries will require significantly more investment relative to output.

Again, Canterell and the tar sands are evidence, in my opinion, that further discoveries will be found only after significant time (I understand several years will be required to bring the "new" Canterell discovery to production if further tests bear out its potential) and expense. Otherwise, neither project would be as seriously pursued given their less than ideal economics.

Whether or not oil depletion is decades away or centuries away, the costs of exploration and production are likely to increase dramatically, which points to higher oil prices over the next decade.

Feb

26

Buying a New Car, from Ken Smith

February 26, 2007 | 4 Comments

Yesterday I sat with a Honda salesman, agreed to price for an Accord, pulled out my checkbook to pay in full. The salesman shoved papers at me to fill out. These asked personal questions that in my view had nothing to do with the sale.

Yesterday I sat with a Honda salesman, agreed to price for an Accord, pulled out my checkbook to pay in full. The salesman shoved papers at me to fill out. These asked personal questions that in my view had nothing to do with the sale.

You got a car. I got cash. That's all there is to it as far as I'm concerned. No. Must to complete the papers and sit with the finance officer.

What kind of business is that? Should be like buying a sack of onions, go to the cashier and pay, walk out with onions. I walked out. Still looking for a car dealer to take my offer.

James Lackey writes:

Yes, back to the good old days when we waited three days for a check to clear, then marched ourselves down to DMV to register the car before we drove it.

Yes, back to the good old days when we waited three days for a check to clear, then marched ourselves down to DMV to register the car before we drove it.

Oh, and how could that pesky finance man try to sell us something after securing a loan for 4% under the Fed Funds rate? Do not take the Japanese rate of 0.9% — best deal Honda offers is 3.9% for 60 months.

Never pay a 2% premium on a Honda for a full factory 100,000-mile warranty. Let's all just complain that our four-year-old car with 70,000 miles on it broke down and cars are much too complex to work on nowadays. Worse, we can just trade in and buy new cars every 2.5 years once they reach 36,000 miles.

New Honda tech that is wonderful unless it breaks:

1. A Drive-by-Wire throttle system helps to smooth the power delivery. And the Maintenance Minder system monitors how you drive and reminds you when it's time for service. VTEC adjusts valve timing and lift to increase low-end torque as well as high-rpm power. In the 2.4-liter engine, i-VTEC adds Variable Timing Control, boosting power and economy.

2. The Accord automatic transmissions use Honda's Grade Logic Control system. This system differs from other computer controlled shift programming because it can detect vehicle driving situations and then set appropriate shift points for the car. This avoids gear-hunting on uphills and descents, and downshifts for added engine braking.

3. Vehicle Stability Assist with Traction Control is a sophisticated safety device that aids the driver in retaining control of the vehicle if wheel slippage is detected. When the driver is cornering or must make a sudden maneuver, the system can sense over steer and under steer and can brake individual wheels and/or reduce power to restore the driver's intended course.

4. Power sliding doors — my favorite on the minivans!

And this is the simplest of mass-produced cars. You should read the Lexus tech specs. Unreal. Awesome. New cars and the deals are amazing. If anything, they are "too good" to the consumer — as far as stocks and profits go.

George Zachar adds:

Lack's hosanna prompted me to ping the CPI database to see how these advances showed through to the reported price data. Thanks to hedonic adjustment and price compression, the government's CPI series for "new vehicles" shows prices are unchanged since September 1994. For geeks, the series is CUUR0000SETA01.

Roger Arnold adds:

My 1999 Nissan Maxima GLE with all the options had a sticker of $32,000. The new loaded Maxima has a lower sticker. In real terms, without hedonic adjustments, that's 30% lower. With hedonics I don't know what it would be, but as James pointed out, it has to be a lot.

My 1999 Nissan Maxima GLE with all the options had a sticker of $32,000. The new loaded Maxima has a lower sticker. In real terms, without hedonic adjustments, that's 30% lower. With hedonics I don't know what it would be, but as James pointed out, it has to be a lot.

Nissan said they would give me $10,000 for my 1999 with 94,000 miles and get me into a comparable new car for an extra $20,000. Is that a good deal? My 1999 is perfectly fine and in near-new condition.

Feb

26

The Battle for Baghdad, from Stefan Jovanovich

February 26, 2007 | 2 Comments

The strategy of the people blowing up chlorine tankers is based on the combined hopes of foreign intervention and American surrender. As James Dunnigan puts it, "Most of the terrorist bombings these days are the work of Iraqi Sunni Arab organizations, who still believe that if you make the Iraqi Shia Arabs mad enough, they will get so nasty that neighboring Sunni Arab nations will feel compelled to invade." The bombers' other hope is that the nightly pornography of splatter on ABC, NBC, CBS, and CNN will prove that the war is "unwinnable."

The strategy of the people blowing up chlorine tankers is based on the combined hopes of foreign intervention and American surrender. As James Dunnigan puts it, "Most of the terrorist bombings these days are the work of Iraqi Sunni Arab organizations, who still believe that if you make the Iraqi Shia Arabs mad enough, they will get so nasty that neighboring Sunni Arab nations will feel compelled to invade." The bombers' other hope is that the nightly pornography of splatter on ABC, NBC, CBS, and CNN will prove that the war is "unwinnable."

Even the most optimistic believers in the Crusade for Sharia have their doubts that the Saudi Army can be persuaded to leave their barracks and start driving towards An Nukhayb. On the other hand, the prospects for unilateral American surrender seem fairly bright - at least in the eyes of the seasoned, if not to say pickled, political press in the U.S. and Europe. The American Congressional leadership has already accepts the judgment of military experts like John Murtha, John Kerry and Chuck Hagel ("we all served in Viet-Nam and we are still pissed about it"), and nearly everyone agrees that it is all Donald Rumsfeld's fault.

Of course, it is not. Like Winfield Scott, Rumsfeld will not get the credit he deserves when victory comes, but he is the author of the first strategic success in a foreign American war since Korea. For investors the parallel is worth noting. Market observers then continued to worry about the "record" (sic) highs in the Dow just as they are worrying now.

No one knows the future, but the one bet few people are making is that 2008 will equal 1954.

Feb

26

Space Farming, from J T Holley

February 26, 2007 | Leave a Comment

If you are looking for another movie that promotes individuals following dreams intently, second chances, father-son relationships, anti government with their frivolous laws, individuals making choices, and unconditional love, then go see Warner Independent's Astronaut Farmer.

If you are looking for another movie that promotes individuals following dreams intently, second chances, father-son relationships, anti government with their frivolous laws, individuals making choices, and unconditional love, then go see Warner Independent's Astronaut Farmer.

Billy Bob is excellent for the part and the only other human I think that could fill the shoes of the role Charlie Farmer. Bruce Willis plays an antagonist in the film. Anyone looking for a film that involves the brighter side of existentialism other than the Woody Allen take will also enjoy this.

Of course, those on the Spec List that seek and need great examples on non-altruistic heroes will get their fill with ole' Charlie Farmer! Couple of lines that I love were as follows:

(When pulling his son out of of school for a month) "You are here to teach him History; I'm going to show him how to make History"

(After burying his Father-in-law he sees a man on the ranch looking over things, and finding out he was an appraiser for the bank going through on foreclosure) "How many head of cattle you got here Farmer?" He replies, "Enough." "How many acres?" He replies, "Do you know how hard it is to find a dead body on 362 acres?"

There is plenty of Countin' dealing with "rocket fuel" and tons of lessons on risk and reward. One of the main themes is "you have to take big risks to get big rewards." Capitalism is portrayed in a favorable light as well utilizing NASCAR!

Great film. The boys and girls of Hollywood really let the government know how they felt with this one.

It is PG, and I took my 4, 6, and 8 year olds with me. Those more conservative than my family might want to go at it alone or with the spouse.

Feb

26

Death of the Phillips Curve Foretold, from George Zachar

February 26, 2007 | 2 Comments

Today's Wall Street Journal front-pager on how the Fed now purports to think about tradeoffs between inflation and unemployment is a must read for folks who play in debt, seeking to divine how the children on Constitution Avenue want us to think.

Today's Wall Street Journal front-pager on how the Fed now purports to think about tradeoffs between inflation and unemployment is a must read for folks who play in debt, seeking to divine how the children on Constitution Avenue want us to think.

Executive summary: The Phillips Curve is dead. Employment is no longer the Fed's jumping off point for rate-setting decision-making. It's been replaced by (bear with me) the Fed's perception of the public's perception of the Fed's credibility in ensuring core inflation reverts to about a 2% zone.

I am still mulling the implications of this, but suffice to say this mushy standard marks a new "high" in the migration of monetary theory, from the now archaic phrase "gold standard."

Feb

24

If You Think This Market Is Boring…, from Kim Zussman

February 24, 2007 | Leave a Comment

…and taxes too low, just wait:

Compared SP500 monthly returns since 1950 under Democratic and Republican presidents (from inaugurations in January). Turns out under Dems stocks do a little better, but not significantly:

Two-sample T for Dem ret vs Rep ret

N Mean St Dev SE Mean

Dem ret 685 0.0073 0.0408 0.0016 T=0.51

Rep ret 410 0.0060 0.0429 0.0021

Notice the standard deviation is a little lower for the party of redistribution, so maybe their appeal is less volatility?

Test for Equal Variances: Dem ret, Rep ret

95% Bonferroni confidence intervals for standard deviations

N Lower St Dev Upper

Dem ret 685 0.038 0.041 0.043

Rep ret 410 0.040 0.043 0.047

F-Test (normal distribution) Test statistic = 0.90, p-value = 0.252

Depending on your definition of what "is" is (as well as significance of DNA on children's clothing), Dems do have slightly lower market volatility (N.S.) as well as possibly better skills subduing the mistress.

Feb

24

How Not to Run a Trading Operation, from Victor Niederhoffer

February 24, 2007 | 2 Comments

Umberto Eco is the master of how not to run a typical library, one that makes it impossible to take out books, or photocopy anything, or use facilities, or fill out a card, or use the stacks. He studies such libraries to get a feel for what's going on in the world of information.

Umberto Eco is the master of how not to run a typical library, one that makes it impossible to take out books, or photocopy anything, or use facilities, or fill out a card, or use the stacks. He studies such libraries to get a feel for what's going on in the world of information.

I wondered if it might be good to consider how to run a trading operation the wrong way in the same vein. Here are some rules.

- Be sure that there is much frivolity and high five-ing whenever there is a good trade.

- Do mix in much personal business with the trading, as this will get you excitable and ready to pull the trigger.

- Have all bills from the service and other agencies come directly to the office and the trader so that they will wish to trade better to cover the bill.

- Be sure to have a voluptuous other in the room at all times so that he or she can be impressed at all times with the big stuff you're involved in.

- Pay much attention to what's on the tube, especially rumors of terrorist action and who's buying and selling as if you're able to react in a nanosecond you could make the bid asked.

- Be sure to go for small profits as you can't go broke that way, and perhaps you will be able to cover the transactions costs, when your expectation if you do make the profit is a small part of the grind.

- Have much badinage about the money won at Vegas or lotteries, as this is a good substitute for trading.

- Always have a pure mathematician at hand so you can solve theoretical problems from the stochastic calculus and really keep track of the latest papers from quantitative finance which are so relevant to trades today.

- Be sure not to have any prospective files on hand but use the retrospective ones so as not to interfere with what you actually could have done.

- Only look at data series that go back at least 1000 observations and include the 20s and 70s because p/e were so much lower then and interest rates really didn't affect stocks.

- Keep track of what's working on the last 3 trades as if something is hot, why you might as well assume that no one else knows about it and you can follow it with impunity.

- Do make sure that all meals are taken off the trading floor so you can have a break of at least 2 hours for food and drink and have a fresh start as to where things are and what the rhythms are.

- Have very crowded facilities so that one can always be in discomfort and never have patience to put a trade on.

- Make sure your brokers call you up at all times to tell you that the reason that the market just went up or down a few percent was that the white shoe firm was buying.

- Keep in touch with many lieutenants of the big traders as it's good to know what the big boys want you to know about why the market is so good or bad. Ditto for what the big mutual fund players just sold or bought.

- Forget about all markets except the thing you're trading as every trade and individual market must float on its own bottom.

- Be sure to find out what the masses of traders are doing on such things as nobletraders.com. They once had big profits and they're very eager to share their wisdom with you on the chance that you might do better than them.

- Much argumentation with your colleagues is good as that's the way the unusual ideas can percolate and harmony might elicit zone type ideas.

- Be sure that trading sheets are hard to get to so that you can really recheck what happened from memory or based on what your counterparts or brokers have memorialized.

Please augment with others of an Umbertoan nature.

Feb

24

The Market Mistress and Her Peak Flow Meter, by Jeff Sasmor

February 24, 2007 | Leave a Comment

On January 22 I took my older daughter to the allergist for a checkup; she's been having allergy shots for about a year. Prior to seeing the doctor (a cursory exam where he mostly talked about his real-estate taxes, essentially the same conversation as last year. I didn't have the heart to tell him I have it even worse than he does) a nurse did a test using a device that I'd never seen before called a Peak Flow meter. It's used to test the airways of asthmatics. My daughter isn't an asthmatic but they test everyone.

On January 22 I took my older daughter to the allergist for a checkup; she's been having allergy shots for about a year. Prior to seeing the doctor (a cursory exam where he mostly talked about his real-estate taxes, essentially the same conversation as last year. I didn't have the heart to tell him I have it even worse than he does) a nurse did a test using a device that I'd never seen before called a Peak Flow meter. It's used to test the airways of asthmatics. My daughter isn't an asthmatic but they test everyone.

A Peak Flow meter is a small tube that you blow into after taking a deep breath. My daughter registered about 350 somethings. Curious, I decided to try it as well. I took a huge breath, thinking that there would be some resistance and blew hard - and to no one's surprise, with a result of about 550 somethings, I am quite the blowhard. Interesting, there's almost no resistance at all. The nurse told me that the idea is to measure the volume of air that comes out, not how hard you can blow.

So naturally on a slow day like today (Friday) when I watch the Brownian motion of numbers and screen-wigglies up and down, my mind began to wander and I thought about the Peak Flow test and how we've been having a situation where lately there's no resistance at all to blowing through one peak after another. Almost like blowing into the Peak Flow meter.

Spec Listers often talk about the market mistress (if you Google "market mistress," the only direct hits seem to be the Daily Spec blog), and I for one have an anthropomorphic view of the market organism as well. However my personal visualization is of a character, a group mind, that's definitely manic depressive, often paranoid, and certainly schizophrenic. Not a nice thing to say about a lady. Or a fellow, for that matter.

Maybe today he or she was catching its breath? Maybe she can only take a deep breath and blow a 550 a certain number of times; then she has to take a day off? I was glad that he did. Maybe she was taking the day off to think about what to do next. How to confound those who are trying to foretell, the bulls who are looking for a nice neat 10.00% pullback to some recognizable moving average, or Fibonacci retracement so that they can load up again on stocks, or the bears who predict that mortgage derivatives have already bankrupted a bunch of hedge funds and banks last week due to Thiotimoline contamination, and we should all buy gold.

I have no idea. Maybe that's the best approach as I can't be wrong that way. Nobody knows what will happen Monday at 9:30 EST. I could guess. But I'd probably be wrong. There's a signpost up ahead. It's a 4-way stop. Four cars (interesting that the character for the '4' key is a '$') waiting to see who will go first. Each one edges out a little bit to see what the other guy will do. If they figure it out, it's orderly. If they don't, it's a crash.

Now I have to take off my thinking cap and get ready to watch Bill Maher insult President Bush on HBO.

Feb

23

Some Book Recommendations, from Pamela Van Giessen

February 23, 2007 | Leave a Comment

The Science of Success: How Market-Based Management Built the World's Largest Private Company, by Charles Koch should be read by anyone who works in any kind of organization. I am terribly biased but I have never before seen someone take the free market view and apply it to actual business management. When I read the manuscript for this compelling book my first thought was 'Wow. Now I get how the economic principles that Heyne so wonderfully explained works in real business on a day to day, ground level.' Koch may be the most under appreciated yet brilliant businessman in the world. He's also a succinct writer that should appeal to ADD readers. When I am queen of the world, I will run it Charles Koch's way.

Radicals for Capitalism: A Freewheeling History of the Modern American Libertarian Movement, by Brian Doherty was reviewed last week in the WSJ. It is not succinct (clocking in at over 700 pages), and I'm not done reading it yet but it's proving a fascinating read that is the first libertarian history of which I am aware. The index is a who's who of so many of specs' favorite thinkers and writers.

A big thank you to Chair for his recommendation of His Excellency George Washington, by Joseph Ellis which tops my list of best reads for 2006. Extraordinary and I didn't want it to end. The lessons I learned will, hopefully, stay with me forever.

Finally, I am also finding The Island at the Center of the World, by Russell Shorto utterly fascinating. NYC owes the Dutch almost everything. . . which takes us back to Charles Koch who is, coincidentally, of Dutch ancestry.

Feb

23

Innovation, from Janice Dorn

February 23, 2007 | Leave a Comment

From Peter F. Drucker, The Essential Drucker:

"There are innovators who are 'kissed by the Muses,' and whose innovations are the result of a 'flash of genius' rather than of hard, organized, purposeful work. But such innovations cannot be replicated. They cannot be taught and they cannot be learned….

"But also, contrary to popular belief in the romance of invention and innovation, 'flashes of genius' are uncommonly rare. What is worse, I know of not one such 'flash of genius' that turned into an innovation. They all remained brilliant ideas.

"The purposeful work of innovation resulting from analysis, system, and hard work is all that can be discussed and presented as the practice of innovation…. And the extraordinary performer in innovation, as in every other area, will be effective only if grounded in the discipline and master of it.

"Purposeful, systematic innovation begins with the analysis of … the seven sources of opportunity: … [which are] the organization's own unexpected successes and failures … incongruities … process needs … changes in market structures … changes in demographics … changes in meaning and perception … [and] new knowledge. All sources of innovative opportunity should be systematically analyzed and studied. It is not enough to be alerted to them….

"An innovation, to be effective, has to be simple and it has to be focused. It should do only one thing; otherwise it confuses. If it is not simple, it won't work. … All effective innovations are breathtakingly simple. Indeed, the greatest praise an innovation can receive is for people to say, 'This is obvious. Why didn't I think of it?'"

Dan Grossman writes:

In considering innovation/invention, I would add the US probably has a more flexible society for welcoming change, and a more varied capital market for financing innovation, which is probably why innovation seems to do better here.

Feb

22

Liquidity, from Bill Rafter

February 22, 2007 | 1 Comment

The current popular explanation for the market's persistent strength is "worldwide excess liquidity" (a la Sam Zell's singing Christmas card).

Under this view,

1) Where is all the excess liquidity coming from?

2) And why is there more liquidity being created now than in normal other good economic times?

Dan Grossman writes:

Maybe the world is awash in liquidity and maybe it isn't. But the central banks of the number 1 and number 2 economies are restrictive and have been that way for some time:

www.mathinvestdecisions.com/us_japan_monetary_bases.gif

Jim Sogi writes:

I am sure everyone has noticed that the market refuses to go down. Every time the bid pauses, after a small airdrop, buyers come back to bid it back in force. The liquidity is a tectonic event, like the movement of plates. Once put into motion by years of pump priming in the US, in Japan, in China, it is hard to hold back.

I am sure everyone has noticed that the market refuses to go down. Every time the bid pauses, after a small airdrop, buyers come back to bid it back in force. The liquidity is a tectonic event, like the movement of plates. Once put into motion by years of pump priming in the US, in Japan, in China, it is hard to hold back.

While the monetary authority is restrictive in its pronouncements, it is not necessarily so in practice, with low rates below short-term rates, which would cause liquidity to flow to equities under the Fed model. Typically, as with any political movement or group situation, once a consensus is created it is hard to change the direction and the momentum tends to overshoot the changing circumstances. It is a typical group dynamic caused by the difficulty of getting people to agree. And as with the gambler's being more certain once the bet is made, decisions become etched in stone and are hard to change. When currencies move, they tend to overshoot their mark. When risk is deemed to be low, the consensus continues even beyond the time and circumstances justify. Remember 1995? It seemed the market was really high then. But it shot up like crazy over the next five years.

Old metrics of liquidity such as M3 don't work. George and Phil mentioned the role of derivatives. Is there a way to measure the derivative market? What are the indicators? Currencies measure the relative strength of flows of capital, goods, and fiscal and monetary balances between nations, and are important measure to consider in a multivariate way similar to gold and commodities that reflect and predict equities.

Japan's new equity highs and yen lows reflect a political and economic dynamic of a growing economy with its monetary gear in reverse. Very odd. Both the US and Japan benefit from weak currencies against the Euroland, and despite the jawboning and posturing, the currencies stay low. The fiscal power is exercised by the Executive but the power, in theory, is in Congress. This is separate from the monetary power of the central banks. The two are related, but are not formally coordinated. The size of the currency markets surpasses equity and debt and is subject to intervention in scope beyond both.

As the floating fiat currencies mature, the competition between nations may become more intense. While liquidity is good, now, there is not much of a squeeze. Reading some of the old books, there were some tense moments when bars of gold had to be shipped from England to New York to keep things afloat. Benjamin Franklin argued for printing money to stimulate commerce. All nations have incentive to inflate their currencies to keep growth from falling back into recession. What happens when the confidence, rather than gold, that keeps the currencies afloat turns dark?

It's a very difficult issue to understand. Thanks all for your help.

Bud Conrad writes:

Nice charts. I appreciated your sharing them. I agree with your base point, and want to see if I understand the importance of this analysis.

A little more explanation would help me apply the observations. The red curve fit looks like it is at a higher rate for the Japanese. Can you give me your fit percentage annual growth for each? The size is hard to read on my small screen.

Do you have an explanation of the big drop in Japanese monetary base? I think there were shifts in the policy of the BOJ in May 2006, around going off the Zero Interest rate policy but I can't recall the actions taken. Would they fit though the Japanese end point were higher or lower than the US? Is the monetary base an important measure now that there is so much credit created outside the banking system that is not regulated, and for which there is no reserve requirement, and now people prefer paper money to credit cards?

From Bill Rafter:

U. S. Monetary Base is the combination of currency in circulation and deposits in Federal Reserve Banks. It is released bi-weekly in seasonally adjusted form by the St. Louis Fed. It is also released weekly in non-seasonally adjusted form. I can seasonally adjust the weekly data myself, but then I would be the only one with that data. Since much of market action is sentiment-based, it's best to see what everyone else is watching, so I use the default.

http://research.stlouisfed.org/fred2/series/BASE

The Base must grow at the rate of the population growth and economic growth or risk causing deflation. Thus in the long run the Base growth will be exponential with some positive and negative feedback influences. The best way to fit it would be with a parabola. That's what the red line represents. The software that I use (our own*) does that easily and produces the formula giving the growth rate. Off list, I will send you a text file with the base and parabolic fit numbers. What is absolutely amazing is that the fit is so perfect from inception. To me this means that there is a "natural" target for the Base. Whether the Fed admits to a target or not is inconsequential. One exists. Once you have acknowledged that, then it is a small step to say that growth in excess of the target is accommodative, and less than it is restrictive. The two spikes (Y2K and 9-11) prove that the Fed has control.

The Japanese Monetary Base numbers are available monthly. They consist of currency and deposits and are available raw and ARIMA adjusted. I used the latter in my chart. The Bank of Japan did have an inflation epiphany last May, when the numbers showed a huge contraction. Some have attributed the sell-off in our equities markets at that time to the BOJ action. Yes, the growth rate in the Japanese Base is considerably greater than that of the US. Please don't flame me for saying so, but I attribute that to (a) inexperience and (b) BOJ having less independence from the government than our own Fed does.

www.boj.or.jp/en/type/stat/dlong/fin_stat/boj/cdab0150.csv

Credit is created outside the central bank infrastructure, but sooner or later, that money hits the banking system where it is recorded in the Base.

Note to members: I would be happy to produce additional information based on monetary numbers from other countries. Send me links. Europe would be particularly useful. Australia and Russia are probably just warts on the elephant's butt. China is a question mark. I assume that even the rural areas are somewhat dollar-influenced. I don't know how China's banking system works, but assume it is run by benign neglect. Therefore, a lot of what goes on there shows up in the U.S. numbers.

* To all: I have previously offered the software free to list users. That offer still holds. Just send me an email if you want a serial number.

Feb

22

A Visit to Traders Expo, from Henrik Andersson

February 22, 2007 | Leave a Comment

Traders Expo was held this past weekend in NYC. The exhibit was filled with vendors and traders. Seminar topics ranged from 'Basic Momentum Principles' to 'High Probability Pivot Systems for Swing Traders' to 'Candlestick Essentials and Beyond: Catching the Next Move.' In general, there was a strong bias towards finding the next trend and locating breakouts. Much emphasis is on risk management, as if your strategy doesn't matter as long as you have a good risk management system in place. Stop-loss is of course the central theme in all these techniques.

Traders Expo was held this past weekend in NYC. The exhibit was filled with vendors and traders. Seminar topics ranged from 'Basic Momentum Principles' to 'High Probability Pivot Systems for Swing Traders' to 'Candlestick Essentials and Beyond: Catching the Next Move.' In general, there was a strong bias towards finding the next trend and locating breakouts. Much emphasis is on risk management, as if your strategy doesn't matter as long as you have a good risk management system in place. Stop-loss is of course the central theme in all these techniques.

One vendor received much attention, VectorVest. They challenged the audience to pick any starting date over the last 10 years and their system would beat any given benchmark over the period up till today. You can apparently buy this system, which must be classified as the Holy Grail of investing, for the price of $9.95! Should one laugh or cry?

Maybe the savior for the scientific minded investor is the sentiment at Traders Expo, since it seems like ballyhoo investing still very much is the mainstream.

Feb

22

Market Psychology, from Rodger Bastien

February 22, 2007 | Leave a Comment

The psychology of the market is what has always drawn me to it and I find it very interesting how this thing we call "the market" has so many diverse faces. Most interesting to me right now is how intuitively it is a market of which you should be leery.

The psychology of the market is what has always drawn me to it and I find it very interesting how this thing we call "the market" has so many diverse faces. Most interesting to me right now is how intuitively it is a market of which you should be leery.

But although you can cite so many sentimental measures that point to topping action, the sentiment I feel is anything but that of a toppy market. This from the little guys in Middle America who are so reliable.

Feb

22

An Open Invitation from Victor Niederhoffer

February 22, 2007 | 1 Comment

Our Feb. 1 Junto (Latin for "meeting") celebrating the 102nd birthday of Ayn Rand was a great success. More than 160 people turned out to hear about Rand from many who knew her, including our special guest, Patricia Neal, who starred in the movie version of The Fountainhead.

Our next Junto event is on Thursday, March 1. It features Steven J. Milloy on Using Capitalism Against Capitalism. He'll talk about how leftist activists harness the power, resources, and influence of publicly-owned corporations to advance their social and political agendas. Milloy is the publisher of JunkScience.com and is a manager of the Free Enterprise Action Fund. Our meeting is at the General Society Library , 20 West 44th St. in Manhattan. Our gathering begins at 7 pm with discussions about what's on anyone's mind. We bring the speaker on at about 8 pm. Admission is free. Daily Specs readers are invited to come, bring their friends, and say hello to me.

Feb

22

Changing Interactions, by Victor Niederhoffer

February 22, 2007 | Leave a Comment

My firm, Manchester Trading, got its start some 40 years ago, based on the idea that interactions between multivariate time series were important. Since then we have proven this fact many times over. As in ecology, 'there is always a food web between the various species in an ecosystem', but our problem is that the web is always changing. There is always an intimate relationship between concurrent correlations of changes of commodity pricing, but the predictive properties are always changing.

In the bad old days of the early 80s it was very common for days like yesterday to occur. A tremendous increase in gold in conjunction with rises in all the grains, and a decline in bonds. Those days it was always good for a major decline in stocks that day or the next. Yesterdays move in gold, up 21.5, in conjunction with a 2% increase in the Goldman futures index and fantastic up moves to multi day highs in all the grains and metals, brought back those ugly memories.

In the bad old days of the early 80s it was very common for days like yesterday to occur. A tremendous increase in gold in conjunction with rises in all the grains, and a decline in bonds. Those days it was always good for a major decline in stocks that day or the next. Yesterdays move in gold, up 21.5, in conjunction with a 2% increase in the Goldman futures index and fantastic up moves to multi day highs in all the grains and metals, brought back those ugly memories.

To put things in the simplest perspective, taking a page out of the book of yesteryear, and from localized contingent regression predictions, I found that gold on the day has been up two standard deviations or more on 58 occasions since 1996. The impact on stocks five days later is down half a percent, with no significant effect on bonds, gold, or any other commodity. But still, ugly memories …

Feb

22

Drifting up Stairways to Heaven, from Kim Zussman

February 22, 2007 | Leave a Comment

There's a Mistress who's sure all that glitters is gold

And she's climbing a stairway to heaven

And when she gets there she knows if your shorts are all closed

In a day it will go up even more so

Woe oh oh oh oh oh

And she's climbing a stairway to heaven

There's a chart on the wall but she wants to be sure

'Cause you know sometimes moves have two meanings

There's a page in the book by a bull always sings

Sometimes all of bear's hopes are misgivings

Woe oh oh oh oh oh

And she's drifting up stairways to heaven

There's a feeling I get when I look toward Wall Street

And my spirit is crying for leaving

In my dreams I have seen smell of smoke in tea leaves

And the voices of dead from two thousand

Woe oh oh oh oh oh

And she's buying a fairway at the seventh

And it's whispered that soon, if we all heed the tune

The bull piper will lead us to reason

And a new day will dawn for those who stand long [actual]

And the patterns will patter will all be reversals

And it makes me wonder (am I getting younger?)

If there are shortputs in your hedgerows

It's just a spring clean for the May Queen

Yes there are two paths you can go by

but in the long run

There's still time to realize the dependency on them

Feb

21

More On Cognitive Dissonance and Markets, from John DePalma

February 21, 2007 | Leave a Comment

Late last month, New York Times writer John Tierney posted a good description of cognitive dissonance. To what Tierney wrote, I'll add another cognitive dissonance experiment that has obvious market parallels.

Late last month, New York Times writer John Tierney posted a good description of cognitive dissonance. To what Tierney wrote, I'll add another cognitive dissonance experiment that has obvious market parallels.

From Robert Cialdini's "Influence: The Psychology of Persuasion" comes:

"A study by a pair of Canadian psychologists uncovered something fascinating about people at the racetrack: Just after placing a bet, they are much more confident of their horse's chances of winning than they are immediately before laying down that bet. Of course, nothing about the horse's chances actually shifts; it's the same horse, on the same track, in the same field; but in the minds of those bettors, its prospects improve significantly once that ticket is purchased … Thirty seconds before putting down their money, they had been tentative and uncertain; thirty seconds after the deed, they were significantly more optimistic and self-assured. The act of making a final decision - in this case, of buying a ticket, had been the critical factor. Once a stand had been taken, the need for consistency pressured these people to bring what they felt and believed into line with what they had already done …".

Feb

21

Venezuela, from Duncan Coker

February 21, 2007 | Leave a Comment

Now on a visit to Venezuela, I thought I would share some highlights on what's happening here from a ground view. Though I am mainly at resort type areas away from the city, the spirit or how things are done here or not done can still seen.

Now on a visit to Venezuela, I thought I would share some highlights on what's happening here from a ground view. Though I am mainly at resort type areas away from the city, the spirit or how things are done here or not done can still seen.

The black market for dollars in very active, changing daily and at a 30-40% premium to the stated bank rate. It is actually very difficult to change the local currency, Bolivares (B) to dollars, other than through the black market. The spread on the exchange is about 10%. So going the other way and changing $200 for a week's expense in B's garners a nice profit for the locals. Unfortunately the black market is used mostly by the wealthy and connected here as a vehicle to siphon funds. It work like this: the government will exchange B's for dollars at the fictional rate of 2150 B/$ for certain business. They have to justify a "need" to buy imported goods and then can get the very favorable and fictional bank rate. These exchange rights are given to government cronies for big infrastructure projects, of which there are many.

The dollars are then sold back on the black markets at 3300B/$, and they just used domestic suppliers. I imagine this is funded by oil profits that bring in dollars to the treasury, but amount to a heavy indirect tax on the country. Gasoline, however, is government controlled and incredibly cheap, about 40 cents a gallon. There are shortages for other goods caused by price controls, mostly on food distributors who have no incentive to supply at capped prices. It varies from week to week. Sometimes chicken, sometimes meats, dairy, or other. There is very little regulation or laws on ownership for property or vehicles. One of the locals tells me, regarding cars, "If you have the key, you own it." Chevys and Jeeps are very popular here and made in the country. Land titles are slightly more organized but involve much greasing of the wheels.

On a more uplifting note, I saw some incredible bird life while on the island of Los Roques, where pelicans in particular are abundant. When they are feeding they have a signaling element for the local fisherman. Like the seagulls in the Northeast showing the way to the bluefish, the pelicans feeding on bait fish are usually followed by tarpon and red snapper. The feeding skills of these predatorily birds are incredible.

Related to this is my pursuit of bonefish and tarpon. With a fly fishing rod, I'm always honing proficiency. While casting I have been thinking about the steps that lead to the best casts. It is a series of counterintuitive things. You start with creating line speed by swinging loops in the line with the rod. You try to maintain a tight loop, to keep the line loaded. In other words you prefer a v-like line to a u-like line up in the air and taught at all times.

But the most important step is then abruptly and dramatically to stop the movement of the rod. The line continues in the desired direction towards the fish you have your eye on. But the stopping is the key and the difficult part. You have to move the rod tip away from the fish in order to get the line to the target. The closest example I can think of is the action of cracking a whip.

I have been thinking about what stopping techniques are used in trading. If the stopping is the entry of a trade, then I view it as getting in with confidence and size, not limping in afterward. Chasing the trade afterwards is like dropping the rod tip, losing line speed. Another part is to allowing the line to reach its target. It is better to set wide perimeters for profits, not to take quick ones.

Basically, let the line reach its target. The best casts are unforced, combining patience and timing. Sometimes you have to force yourself to relax even in the face of a fast-approaching school of bonefish that will be quickly past you. Relax, but be quick; generate speed, but then stop. It is a combination of counterintuitive actions, much like trading.

Feb

21

Ranges, from James Sogi

February 21, 2007 | Leave a Comment

The market has days when it consolidates, then breaks out of the range to a new level, like the discussion of bird nests. Counting the last three months by hand shows a count of the number of days to build a bird's nest. 7+5+5+5+3+6+6=37 /7 ~ 5.

The market has days when it consolidates, then breaks out of the range to a new level, like the discussion of bird nests. Counting the last three months by hand shows a count of the number of days to build a bird's nest. 7+5+5+5+3+6+6=37 /7 ~ 5.