Nov

16

Stein’s Law

November 16, 2021 | Leave a Comment

p taking cold bath and doing stretching exercises

Rocky Humbert writes:

countless macro parallels - fiscal, monetary and social - to the 1960's. few of us remember that period, fewer of us were market participants during that period, and none of us kept our punched cards. rocky says good time to review Stein's Law.

Vic replies:

very nice to hear from rocky. a man of wisdom and poignancy and profits. p's law may augment.

i still have my punch cards and cassettes from the 60's. now i will look up steins law. from 25 years ago, whenever i heard from rocky who was named by a white shoe flexion many years ago, it was to point out how trend following was about to or had recently buried me.

stein's law appears to be that a big trend will stop because it can't go on forever. however, there is a law of consilience and beauty i will quote from p shortly and until the nikkei hits 30,000 there is no beauty.

thus i think that rocky's message to me form 25 years ago is resonant but different. i believe he warns me and my meager followers not to be overly bullish.

a quote from P's forthcoming book Time and Beauty. "the connection between beautiful images and ease of grasping and understanding serves as basis for the brain design known as cognition. this is why art occurred in cavemen."

It was robert rubin who gave rocky his name because he was part of the rocket scientists at that white shoe firm and even then the treasury secretary was flexionically in the clouds.

the boys on investicon have a system. buy to sell higher and sell to buy lower. one could wait a long time like 50 years for the latter to work. reminds me of the only time Lorie sold futures some time in 1986. he had a 200 point loss and bailed out on oct 19 1987. never sold short again.

the amazing thing was that the palindrome during the 12 years of our association was bearish on stocks 90% of the time. yet he made money. perhaps the two tennis cans and the back ache were the key.

Mar

6

Gold in Perspective, from Larry Williams

March 6, 2019 | 1 Comment

I see I can buy a 1924 mint condition GOLD double eagle for $1,300 on ebay.

I see I can buy a 1924 mint condition GOLD double eagle for $1,300 on ebay.

Had I invested that $20 in 1924 until now at 5% I would have $2,060…at 7% 12,373.

Rocky Humbert writes:

I rarely post these days, but I think Larry's post need a rebuttal.

On January 22, 1924, the constituents of the Dow Jones Industrial Average were: American Can, Anaconda Copper, Studebaker, American Car & Foundry, Baldwin Locomotive Works, US Rubber, American Locomotive, Central Leather, US Steel, American Smelting, GE, Utah Copper, American Sugar, Mack Trucks, Western Union, AT&T, Republic Iron, Westinghouse Electric, American Tobacco, Sears Roebuck.

There was no way to invest in the index in 1924, and commissions were fixed and were likely to be more than 2% of the investment value. So, the odds of investing in a company that went bankrupt over the ensuing 90 years was significantly more than 50%. Additionally, it was illegal to hold gold from about 1933 to 1974….

There is no doubt that violating Federal Law and holding gold would have underperformed a diversified portfolio of stocks. However, the appropriate comparison is what cash, net of income tax, would have returned over this period. And here again calculating that is trickier than one might expect, because hundreds of banks failed in the 1930's and there was no FDIC insurance. And the Treasury didn't begin auctioning Tbills until 1929!

My point is not that gold was a good investment. My point is that the actual realized after-tax return that you would have gotten with the alternatives is also entirely unclear — except with 20/20 hindsight!!! So the best comparison would be, what is today's purchasing power of a US $20 bill that you stuck in a drawer versus the purchasing power of that gold coin… and I suspect the answer is that the gold coin did better than the $20 bill.

There is only one free lunch and that is diversification.

What? I can't use hindsight?? You spoil sports.

My one assumption is I would have rolled into all the new DJIA 30 stocks as they were added and subracted

Dec

27

Holiday Markets, from Rocky Humbert

December 27, 2018 | Leave a Comment

It's definitional that you only know the "low" in hindsight. I can't remember ever seeing a "one day bounce" after a puke of this sort–rather, the first green close produces additional up moves — since there are a ton of people waiting for the first green close to pile on (or cover shorts). All of this is short term stuff–but it will very likely result in a 4 to 8 percent rally off the low. Then you'll hear all of the pundits talking about the "retest". Blah blah blah.

I never own enough when it's going up. And I always own too much when it's going down. But I have my discipline and I stick to it. Kind of like always picking Choice B on a multiple choice exam. Always better to be consistent than to be smart. And it's only lunch time–so today's green could easily still fizzle.

Dec

3

Ever Since the CFA Exams, from Victor Niederhoffer

December 3, 2017 | Leave a Comment

Ever since the CFA exams I have noticed a tendency for Wall Street research to deteriorate. A Gresham's Law appears to be operating. The articles like the white shoe one I mentioned are chock full of seemingly sapient stuff that are scientifically flawed amid reference to Shiller p/e data with their 10 year averaging and data when no earnings were reported etc. They refuse to take account of interest rates and use technical analysis and charts for suggestive but random conclusions. It is sad to see this deterioration as literacy increases as predicted by Nock.

Ever since the CFA exams I have noticed a tendency for Wall Street research to deteriorate. A Gresham's Law appears to be operating. The articles like the white shoe one I mentioned are chock full of seemingly sapient stuff that are scientifically flawed amid reference to Shiller p/e data with their 10 year averaging and data when no earnings were reported etc. They refuse to take account of interest rates and use technical analysis and charts for suggestive but random conclusions. It is sad to see this deterioration as literacy increases as predicted by Nock.

Alston Mabry writes:

I find that if I'm really serious about an individual ticker, one of the few places where I can get at least trailheads to research is the earnings conference call, not for the company's answers but more for the analyst's questions, assuming there are analysts on the call who are at least somewhat skeptical. Not that I dig into individual tickers that much anymore.

anonymous writes:

Vic's point of Gresham's Law happens everywhere, but especially in situations where there are credentials given that appear to have value. IMO the CFA society exists (as does the CMT) primarily to enhance the status of its anointed ones (for a price), and for the side benefit of providing income to the society heads.

Al is right: There is no original thinking and virtually no research. But there is a benefit to us thinking ones: If all of what passes for research is bot-written drivel, released over some time period, a case can be made for trends to exist based on the gradual release of the drivel. That would support the contention that what really drives certain markets is momentum and sentiment.

Never complain about the weaknesses of your opponents; exploit them.

Allen Gilespie adds:

In an effort to defend free thinking CFAs from the white shoe firms, I have attached and included a link to my most recent annual analysis on the Dow Jones Industrial Index built on Ben Graham's method's with an added modern twist and nod to Richard Russell in a world of QE. I have also include my white paper on Bitcoin, Banking, and Bernanke in a World of Monetary Chaos from 2013. Prior year reports available to those with a Bloomberg under DIA US equity. Given that the economy now includes industrial businesses and network/software type businesses like MSFT and V I think there is a delta between book value, average ratio and earnings methods due to network value theory and excessive monetary inflation. I am calling this new valuation framework my Gold, Bitcoin, Dow Theory whereby one bitcoin plus one gold coin = one Dow share. Obviously, figuring out the key ratios is key, but in short, the theory is that gold and tangible book on the Dow should trade on a ratio. There will then be the goodwill book value which gets measure by crytpo, so in combination they will equal the value of shares in fiat. In short, there is value but that value is dependent on the value of money, assets, earnings, and interest rates. We live in a world of fiat, hard, and crypto currencies. In short, I think QE is the same as John Law effort to demonitize gold but then cryptos broke out - you can inflate values but the market will find a way to make proper measurements. I have started making all price targets in dollars, gold and bitcoin equivalents - when money is mispriced it is hard to know the value of anything and all secular bear markets are the result of a breakdown in the monetary system (greenbacks - bi-metal system - gold standard - Bretton Woods - Quasi-Free float - Crypto) - bear just don't understand how they play (sometime values decline (deflation) (1929-1932), sometimes they inflate (1966-1982) so nominal prices hold but you loose purchasing power, and sometimes you hyperinflate your values go up but you gotta find a better currency (cyrpto).

The Dow Jones Industrial Average - Fintrust Investment Advisors

Bitcoin, Banking and Bernanke - Fintrust Investment Advisors

Rocky Humbert writes:

Spurious correlation. The first CFA exam was administered on June 15, 1963 to 278 men and 6 women. In 2017, the pass rate for CFA-I was 43% out of 189,000 candidates. The average starting salary for most CFA's is under $100k.

See page 55 of From Practice to Profession: A History of The Financial Analysts Federation and the Investment Profession

"CFA Says Pass Rate for Level 2 Climbs to 47%, Highest Since 2006"

Russ Sears writes:

While I agree with much of what Rocky states, what appears to be missing from the thread is that the motive for much "rresearsh" is often CYB (cover. your. behind) Designatona helps but the real cause and effect of such proliferation is litigation and regulation.

Gordon Haave writes:

I'm a CFA and I agree with Vic and Jeff. Almost anything written by a CFA is formulaic and uninteresting.

I get an email once a week from the CFA society linking to all the things on Seeking Alpha that were written by CFA's and they are almost universally worthless.

Rocky Humbert writes:

Wait a second. The hypothesis proffered by Vic was that "ever since the CFA exams I have noticed a tendency for wall street research to deteriorate. A greshams law appears to be operating."

We are in agreement that virtually all of the research is unhelpful or rubbish. But it is incorrect to to attribute this to the CFA exam or to suggest that this is anew phenomenon. At the very least, it is due to the fact that customers of wall street firms do not pay for the "product." And the price of the product has finally converged to the value. Do you remember Henry Blodgett? Mary Meeker? That was 20 years ago. This isn't news.

Additionally, back in the early 1990's and long before the front-running scandals, David Silfen formed an internal prop group to invest based on GS analyst research. The results were abysmal and the group was disbanded.

Russ Sears writes:

While I agree with much of what Rocky states What appears to be missing from the thread is that the motive for much "rresearsh" is often CYB (cover. your. behind) Designatona help but the real cause and effect of such proliferation is litigation and regulation.

Paul Marino writes:

I agree with you Russ, but in a world where you can pay to know if Fed Powell likes his morning egg hard boiled or over easy I'm a little over easy myself. Bernanke was an oatmeal man. This is Flexionic activity written by Gov's and the Operator's will take every advantage over the common man.

Allen Gillespie writes:

In an effort to defend free thinking CFAs from the white shoe firms, I have attached and included a link to my most recent annual analysis on the Dow Jones Industrial Index built on Ben Graham's method's with an added modern twist and nod to Richard Russell in a world of QE. I have also include my white paper on Bitcoin, Banking, and Bernanke from 2013. Prior year reports available to those with a Bloomberg under DIA equity. Given that the economy now includes industrial businesses and network/software type businesses like MSFT and V I think there is a delta between book value, average ratio and earnings methods due to network value theory and excessive monetary inflation. I am calling this new valuation framework my Gold, Bitcoin, Dow Theory whereby one bitcoin plus one gold coin = one Dow share. Obviously, figuring out the key ratios is key, but in short, the theory is that gold and tangible book on the Dow will normalize and the delta goes to crytpo, so in combination they will equal the value of shares in fiat. In short, there is value but that value is dependent on the value of money, assets, earnings, and interest rates. We live in a world of fiat, hard, and crypto currencies. In short, I think QE is the same as John Law effort to demonitize gold but then cryptos broke out - you can inflate values but the market will find a way to make proper measurements. I have started making all price targets in dollars, gold and bitcoin equivalents - when money is mispriced it is hard to know the value of anything and all secular bear markets are the result of a breakdown in the monetary system (greenbacks - bi-metal system - gold standard - Bretton Woods - Quasi-Free float - Crypto) - bear just don't understand how they play (sometime values decline (deflation) (1929-1932), sometimes they inflate (1966-1982) so nominal prices hold but you loose purchasing power, and sometimes you hyperinflate your values go up but you gotta find a better currency (cyrpto).

anonymous writes:

David Simon made a related point to all this with regard to journalism. (He worked for the Baltimore Sun before writing The Wire.) As seasoned journalists who knew their beat were replaced by cheaper fresh faces who can still write words, skepticism and quality deteriorated.

Nov

30

BTCorrelation, from Kim Zussman

November 30, 2017 | 2 Comments

WSJ featured a chart of BTC vs other bubbles. Usually there is a correlate–such as the desk top computer and tech stocks, gold and political uncertainty (sic), etc.

WSJ featured a chart of BTC vs other bubbles. Usually there is a correlate–such as the desk top computer and tech stocks, gold and political uncertainty (sic), etc.

The only things I can think of that correlate with BTC's trajectory are the frequency of NK nuke tests and due-process free salacious executions of key members of the deep state.

Others?

Andy Aitken writes:

A key characteristic of a bubble is that the people in it don't recognize that they are in it.

The bubble proclamations about bitcoin seem to come from those who have missed out (i.e., they're "too smart" to participate), as well as from those that stand to lose something. Despite Anatoly's misquoting of me, in response to Jamie Dimon calling bitcoin a fraud, I did not call Jamie Dimon a fraud. I wrote that bitcoin said that Dimon is a fraud. Bitcoin is still less than a $150B market cap, less than a third the size of one company (Cisco) at the height of the internet craze. Which turned out to have not been a "craze". The most chiliastic augurs of a connected humanity, portents of Teilhard de Chardin's noosphere reified, were too conservative. Just 15 years later, there are quite a few tech-oriented companies that have surpassed CSCO's peak valuation, and everyone is tied to the net 24/7 through pocket supercomputers.

In my view, the bubble that is barely acknowledged is the vast scope, size, and scale of the state (not just the government), and its rapacious intrusion into our private lives. This precarious bubble continues to inflate on the premise that there is no diminishing marginal utility of additional units of state power. The gap grows between the linear growth in expectations and the logarithmic returns. If this is a bubble, then bitcoin represents its antithesis.

Rocky Humbert writes:

Andy, Bubble schmubble. There are sardines for trading and sardines for eating. I submit that the most important trait for successful investors/speculators is knowing the difference. And not becoming an idealogue, philosopher or believer. I suggest that you read the Harvard paper that I posted two days ago a bit more carefully. As the paper reports and I've learned from experience, these moves go much further and last much longer than reasonable people expect. Especially for bitcoin (and real estate markets) since the supply/new issuance is very limited. And since you mentioned Cisco, I believe its high tick war around 85; 17 years later the stock is trading at 38. During its final blowoff phase, the stock appreciated by about 800% and the only trade was to be long. Until it wasn't. And then the only trade was to be short — for about two decades (with most of the move occuring during the first 24 months). Same thing with the Nikkei in 1990. Gold in 1979. Etc. And I feel comfortable predicting that the same thing will be true for BTC but from a final blowoff top of who-knows-where. Lastly, here's a rocky challege: Name one major currency whose value routinely moves around by 20% intra-day? (Other than a government engineered revaluation, of course.) Anyone? Anyone? Of course, it's Bitcoin.

Andy Aitken replies:

I've been emailed personally by several people on the List who asked what I guess they thought were questions I hadn't considered or couldn't answer.

I've responded with thorough emails with numerous academic and non-academic references, and never received a "thanks" or even an acknowledgement of my time spent. The fact is that I have pulled out many times my investment, and yet those with the strongest opinions have nothing at stake (at least in terms of money, the need to be right is very much in evidence), with no more relevance to the market price than a bucket shop price shouter. I have less certitude about the future price than they do. But what do I know?

I really don't care if people think I am ridiculous or stupid. I'll take my profits while they opinionate. Your benchmark of price stability (USD) has declined in purchasing power by 99.5% since the creation of the Fed just over 100 years ago. This was after a long period of purchasing power stability, or even of productivity-driven deflation. Ah, but those fluctuations in prices (e.g. 1907)! They drove a free people to put the management of their currency in the hands of technocrats. My grandfather retired as a bank vice president about 55 years ago, never having earned more than $10K a year. And yet he and his family lived an upper middle class life, with no mortgage on the brick house on a tree-lined street, cars bought with cash, and a child who went to an expensive private college.

What sort of price stability is this? I hold gold and trade it, and even expect a rally in it, but I think we all know that the CBs would kill any "bubble" in gold, though such a "bubble" might be very much justified. If the state and its extension, the CME, kill bitcoin as Anatoly hopes, then another cryptocurrency (or something like it) will replace it.

There are already several that could replace it. It is a mistake to equate bitcoin with cryptocurrency.

There is the beginning of something here that all lovers of freedom should welcome, even if its name is not bitcoin.

Jason Pilfer writes:

Victor had a quote about Dimon I recall that sums up many of these bitcoin bubble threads.

"Sounds like one of the non-falsifiable predictions from the adventurous traveler or so many of his ilk that don't have the constraint of having to make a profit with trading.vic"

I admire Andy's instructive tenacity and hope to see more. There remains quite a chasm to bridge. I've argued in the past that cryptos are an ongoing disruption rather than simply a new currency coming into an old framework. Many of the predictions would be more relevant if bitcoin were simply a global fiat currency.

The chartism and top/bottom calling entirely misses the reason why cryptos came into being, are incredibly popular and accelerating in adoption and appeal.

The bubble discussion is weary and likely tied to the ongoing global FOMO effect, yesterday I ran across this Fortune link from two years ago about how to short the megabubble when bitcoin was 1/10th today's price

Not much has changed.

The higher level discussion about CME impact is insightful and appreciated.

Oct

10

Superb Interactive Asset Allocation Tool/Visualizer, from Rocky Humbert

October 10, 2017 | Leave a Comment

I stumbled upon this tool on the RA website. It's by far the best one I've seen (for free). It allows you to see historical risk/reward for different asset classes over different time periods, efficient horizons, expected future returns, various blends, mixes, blah blah blah. It really is superb.

Sep

28

Tbills Outperform Stocks Over the Long Run. Man Bites Dog. Provocative Academic Paper, from anonymous

September 28, 2017 | 3 Comments

The NY Times and Bloomberg wrote about this new paper (August 2017) that purports to show that Tbills outperform almost all stocks over the long run–and that a tiny number of stocks account for all of the returns. I just read it. I recommend that you read it too–since it is counter intuitive.

I see several unrealistic/unspecified methodologies in this paper including (1) equal weight holdings from IPO to delisting of every stock; (2) no clear explanation for how the capital from mergers, acquisitions and spinoffs are handled; (3) where the new investor capital comes from to buy fresh IPO's and where the cash goes when a company is acquired for cash. I also didn't study his statistics carefully. Since most every company goes through a life cycle, it's intuitive that most will disappear or be acquired/acquire, so I need a better explanation for the investor's portfolio management/cash to really understand the practical. What other problems or unique insights do you see in this paper? Something just feels wrong here.

Do Stocks Outperform Treasury Bills?

Hendrik Bessembinder, Arizona State University. Revised August 2017.

Abstract:

Most common stocks do not. Slightly more than four out of every seven common stocks that have appeared in the CRSP database since 1926 have lifetime buy-and-hold returns, inclusive of reinvested dividends, less than those on one-month Treasuries. When stated in terms of lifetime dollar wealth creation, the entire gain in the U.S. stock market since 1926 is attributable to the best-performing four percent of listed companies. These results highlight the important role of positive skewness in the cross-sectional distribution of stock returns. The skewness of multiperiod returns arises both from positive skewness in monthly returns and because the compounding of random returns induces skewness. The results help to explain why active strategies, which tend to be poorly diversified, most often underperform market averages.

Victor Niederhoffer writes:

This ridiculous paper from anti stock which I haven't read and goes counter to the carefully worked and accurate work of the triumphal trio duly reported in all their yearbooks is an absurdity. Of course most stocks will underperform. That's the nature of cross sectional returns. The distribution has quite a few good winners. It's probably true of a normal distribution also. Certainly for the kind reported in the NYSE year book. Certainly for the stocks in any variant of the pareto distributions. How far will they go to undermine the value of equities. It's so absurd I can't begin to say how it would apply to most any real life distribution in any field like IQ's.

Stefan Jovanovich writes:

Index investing works because it allows people to avoid the risks of trading; and most of us are lousy traders.

Enterprise ownership beats public investment in terms of ROI (not "Radio on Internet"); but the public markets offer the only way for entrepreneurs to cash out. We still own one of our start-ups; its annual payout as ROI has been greater than 40% annually for the last 38 years. But, we cannot not "cash out" by selling it to someone else. The actual market for private businesses that makes hundreds of thousands, not millions, does not exist. We have been able to "retire" - i.e. extend the life of the business beyond the time we directly manage it - by doing a private variation on an ESOP; our former employee now runs it as a part owner.

As for the tug of war between "capital" and labor, we have been lucky enough to escape Marxism almost entirely. The cash flow from the business is distributed using the New England whaling ship model of "shares". Keith, the captain and part owner, sails out into the unknown every month and we get our cut on what the barrels that he lands in New Bedford. What we all share - Keith, Eddy and her Mom, your pontificating correspondent, and everyone else in the crew - is a 19th century American sense of equality. We are all equal members of the enterprise in dignity and responsibility and everyone understands that what people "make" is a function of talent and timing, not innate worth.

P.S. Every business failure in my life has been a situation where the people in charge (including me) thought that talk about the business as "family" and a mission statement on the web site would do the trick. It didn't; it can't.

Rocky Humbert writes:

I read his paper again and was able to tease one critically important fact out of it.

Page 15 and table 2A/Panel C: 70.5 % of the stocks that are in the largest decile by market cap outperformed the Tbill with a 1 decade horizon. And 81.3% of those stocks had a positive return. It's only for the smallest market cap groups that a substantial percentage substantially underperformed Tbills. Look at that table carefully and you can look at your own portfolio and it all makes sense.

In essence — if you own the biggest companies, you have beaten the Tbill (as we know from experience), but if you own the smallest market cap stocks, you have not. This makes intuitive sense since there are only two kinds of small cap stocks — those that start small and end up big. And those who were once big and are on their way to 0. It's a rare and bizarre company that starts small and always stays small!

The press reports and paper abstract are written in a bearish sensationalistic manner. For whatever reason, he chose not to include the key point mentioned above in his abstract. Now that I found this fact, I feel like everything else is noise — except for reinforcing one lesson that I've discovered anectodally: individual price momentum on the way down matters. If you have a stock that was once a $100 billion market cap and is unfortunately now a $10 Billion market cap, you should take your tax loss and reinvest whatever is left in another stock. And not wait for it to go to zero…and definitely not keep averaging down. In contrast, if you bought a $50 Billion market cap stock and it's now a $100 Billion market cap stock, don't sell it because it went up a lot. The skew and history suggest that it will continue to do well. (Until it doesn't).

Sep

6

Do You Read Chinese? Do You Hold Bitcoin? from Rocky Humbert

September 6, 2017 | 1 Comment

It's clear that the People's Bank of China (PBOC) just cracked down on the initial offerings of cybercurrencies (as did the SEC). But it's possible that they just made all virtual currencies illegal. If someone can read Chinese, they can provide much better insights than Google Translate…

It's clear that the People's Bank of China (PBOC) just cracked down on the initial offerings of cybercurrencies (as did the SEC). But it's possible that they just made all virtual currencies illegal. If someone can read Chinese, they can provide much better insights than Google Translate…

Google translate says: The tokens or "virtual currency" used in coinage financing are not issued by the monetary authorities, do not have legal and monetary properties such as indemnity and coercion, do not have legal status equivalent to money, and can not and should not be circulated as a currency in the market use.

anonymous writes:

In China, what are said to be not allowed are always allowed for somebody, or are done by many regardless; and what are said to be allowed are always not allowed for somebody, or may not be done by many regardless.

Sep

4

My Question, from David Lillienfeld

September 4, 2017 | Leave a Comment

/https%3A%2F%2Fblueprint-api-production.s3.amazonaws.com%2Fuploads%2Fcard%2Fimage%2F574706%2F9ae45d95-fc22-47dd-b5f7-0426894a2201.jpg) Forget the unemployment numbers.

Forget the unemployment numbers.

The question I've got is how much of a bump to the GDP is generated by the rebuilding of Houston and the rest of Texas hit by the recent inundation?

anonymous writes:

This will help: "The Parable of the Broken Window"

George Devaux writes:

I am not sure about the truth of the parable.

Consider that for years people transferred wealth to insurance companies. The insurance companies put liabilities on their balance sheets, and used the cash to generate net wealth.

With the event, the insurance companies transfer cash to the people (and reduce the liabilities on the insurance companies) to restore the destructed wealth. The insurance companies retain the net wealth.

In the longer term, people having seen the destruction build differently. The people are also more prone to secure insurance. The insurance companies use their collective wisdom to innovate solutions or at least improvements that reduce future destruction.

In summary, destruction forces improvements.

Russ Sears writes:

Banks and insurance companies cause the multiplier effect. the higher the leverage, the higher the multiplier effect is. Holding more reserves and surplus slows the speed of money. Hence rather than just GDP, it should have an "inflationary" effect as the speed of money increases. Prices also increase because of demand and supply shocks. We've already seen the effect on gasoline.

Rocky Humbert writes:

This is actually a complex analysis with many feedback loops. It is possible, but not necessarily true that short-term US GDP will increase due to the hurricane rebuild. Nor is it necessarily true that this will be inflationary, however, certain prices (such as local lumber and wallboard) will likely increase. I believe that the primary determinant on short-term and longer-term US GDP is what activities and investments and jobs will be sacrificed/diverted to the hurricane rebuild; what income will be temporarily or permanently lost; and what the relative multiplier effects are between these alternative uses of capital and labor and the hurricane rebuild. Furthermore, if the economy were in a recession with a high unemployment rate, the effect on GDP would probably be greater than the effect in a modestly expanding economy with a low unemployment rate.

For illustration, if my house was destroyed by a hurricane, and even if I have flood insurance, I will surely still have uncovered losses. I will therefore likely immediately reduce other spending, such as a trip to Disney World and eating out at restaurants and buying new clothes. I might also delay the purchase of a new car and other big ticket items because I will need to buy replacement furniture. More generally, local businesses will likely be disrupted — and productive local service employees will be laid off for days/weeks/months — resulting in less economic activity in the region — offset by an increased need for carpenters, plumbers, and tradesmen.

There is a debate among economists about the real multiplier effect from infrastructure spending. But even that debate assumes that the infrastructure will be upgraded and improved — not simply hauled away and replaced. But the multiplier effect is beyond the question on the table. The bottom line is: it's complicated…..

Aug

10

Trump’s ‘Fire and Fury’ Comments, from Charles Pennington

August 10, 2017 | Leave a Comment

I've been trying to figure out what a President is *supposed* to say when a foreign power threatens:

"WSJ: Trump's 'Fire and Fury' Comments: Statement by William J. Perry"

Andy Aiken comments:

"We do not make empty threats, because empty threats weaken our credibility, and weaken the strength of threats that we do intend to carry out. As Theodore Roosevelt said, "speak softly but carry a big stick."

So is Perry speaking of Trump when he writes this, or Obama, GWB, and Clinton? The Nork nuke deal hatched by WJC, Jimmy Carter, and Madeleine Albright was the framework for the Iran nuclear deal. Both were deeply flawed miscalculations, modern versions of "peace in our time". What came of Obama's "red line" in Syria? His pronouncement was counterproductive blabber. Perry himself was probably behind that empty threat.

Rocky Humbert writes:

Well he was certainly not speaking of Reagan — who directly and openly challenged the existing Soviet military doctrines (pre-gorbachev):

From "Reagan and The Cold War":

What struck Reagan about Communism was its weakness. Communists ruled by fear and intimidation. He believed that policies of peaceful coexistence or of passively containing the Soviet Union would be disastrous. The Communists would over time use the Western fear of war, especially nuclear war, to undermine the confidence of free peoples. They practiced "salami slice" tactics of intimidation and bluff to gain marginal advantages that would eventually accumulate to a victory in the Cold War or allow the Communists to win a final showdown. Reagan sought to turn the tables on Moscow and its allies by advocating an all-out fight against the growing encroachment of Communism in this nation and throughout the world.

By all-out fight, Reagan did not mean military action, although if that was required of the United States in particular circumstances—e.g., Korea, Vietnam—the United States should have fought to win. The key front in the Cold War, in Reagan's assessment, was actually the Soviet economy. Marxism was a materialist philosophy, and its chief claim to practical allegiance around the world was its supposed ability to produce economic plenty (and thereby, social justice). In fact, Reagan believed that democracy and capitalism had decisive, natural advantages over totalitarian systems and centrally-planned economies. Reagan sought to confront the Soviet Union simultaneously with various forms of economic pressure: nearly-open ended American military spending; threats to the security of the Soviet empire (especially in Eastern Europe and Afghanistan) through direct and indirect American support to resistance movements; losses of foreign currency that the Soviets had expected from sales of oil and natural gas; and a cutoff of Western aid and technology.

Reagan argued that the Cold War would end only when there was a fundamental change in the Soviet system, and not just in Soviet policies. The strategy of economic warfare was designed to force such a change, by bringing to the fore a new generation of Soviet leaders who would finally recognize the bankruptcy of communist ideology and move toward a true political rapprochement with the West. The United States, in turn, would promote democracy throughout the world as a magnet and an example to all the peoples oppressed by dictatorships of whatever stripe.

Jun

28

The Death of Malls, from Ken Drees

June 28, 2017 | 4 Comments

![]() My father (RIP) joked back in the 1980s that when our local northeast Ohio mall died that it would make a great prison. At the time we laughed because we never thought the mall would ever lose its appeal–I mean it had an Orange Julius store in it–what could be better than that? Well that mall did die and it still is just one huge boarded up bereft eyesore. The mall up the road 3 miles in the next town just lost its Sears anchor –recent December announcement. And this mall will be the next to die. Another 5 miles up the road in a better neighborhood is a mall that had to restrict unchaperoned teens on weekends due to a mass teen flash mob that went wilding–terrorizing the people actually shopping. It will be the next to go–people do not want to be harassed in a captive space when they go out to shop. The trend seems to be more of these outside based shopping plazas where you walk outside and stroll from store to store and enjoy open air and green space, etc. The "everything under one roof" concept seems to be going away.

My father (RIP) joked back in the 1980s that when our local northeast Ohio mall died that it would make a great prison. At the time we laughed because we never thought the mall would ever lose its appeal–I mean it had an Orange Julius store in it–what could be better than that? Well that mall did die and it still is just one huge boarded up bereft eyesore. The mall up the road 3 miles in the next town just lost its Sears anchor –recent December announcement. And this mall will be the next to die. Another 5 miles up the road in a better neighborhood is a mall that had to restrict unchaperoned teens on weekends due to a mass teen flash mob that went wilding–terrorizing the people actually shopping. It will be the next to go–people do not want to be harassed in a captive space when they go out to shop. The trend seems to be more of these outside based shopping plazas where you walk outside and stroll from store to store and enjoy open air and green space, etc. The "everything under one roof" concept seems to be going away.

What will eventually develop out of these dinosaur chunks of dead mall space in prime locations in less that prime towns? These towns lost middle america–maybe prisons, or halfway houses, or a la Trump–new job training centers, or low rent housing for displaced illegal aliens, or detention centers for questionable illegals, or new factory centers for returning blue collar jobs. I do not know the answer.

anonymous writes:

The dead mall long standing empty property and another one about 20 miles away were bought by Amazon to be turned into warehousing distribution centers . Both will be high tech built for drone delivery. Not many flesh and blood workers to be getting jobs in these places. However, the building trades will be quite busy and there will be contractor dislocations and shortages of cement and rebar, etc to be anticipated.

Rocky Humbert writes:

It is arguable that this country has way too much retail space. It is arguable that Class A malls will survive, but Class C malls (that still look like the 1950's) will fail. It is arguable that population movements will render some malls unprofitable. It is arguable that the valuations of REITS are too high relative to their growth prospects and trend in interest rates. But the "Anchor Tenant" is a legacy of a bygone era….

Lastly, I will speculate that people who live in large urban centers (especially New York City) have little understanding of the social phenomenon of malls– and how they are the climate-controlled "main street" in many places.

May

15

Henrik Cronqvist, Stephan Siegel, and Frank Yu:

Value versus Growth Investing: Why Do Different Investors Have Different Styles? [39 page PDF ]

Abstract:

We find that several factors explain an individual investor's style, i.e., the value versus growth orientation of the investor's stock portfolio. First, we find that an investor's style has a biological basis and is partially ingrained in an investor from birth. Second, we show that an investor's hedging demands as well as behavioral biases explain investment style. Finally, an investor's style is explained by life course theory in that experiences, both earlier and later in life, are related to investment style. Investors with adverse macroeconomic experiences (e.g., growing up during the Great Depression or entering the labor market during an economic recession) or who grow up in a lower socioeconomic status rearing environment have a stronger value orientation several decades later. Our research contributes a new perspective to the long-standing value and growth debate in finance.

Victor Niederhoffer writes:

This is why we count and do prospective studies versus retrospective ones, and why we eschew paying attention to work form Yale professors who average earnings over 10 years , many of which were not reported until 6months after the earnings were or were not reported, with retrospectively selected stocks.

Rocky Humbert writes:

Vic, by your own admission and work, if the stock market declines massively this year, it increases the probability of a greater-than-average return in the future. And by extension, if the stock market rises massively this year, it increases the probability of a lower-than-average return in the future. Why don't you extend this logic (which is both fundamental and technical) to relative valuation (i.e. growth v value) ; perhaps because your data set is lacking one of the largest multi-year examples (1997-1999) in history?

Also please explain how dismissing Shiller (or anyone else's argument) strengthens your argument– which I interpret as being a blanket belief that "fast growing company stocks outperform inexpensive slow-growing stocks." I can provide you with many strong academic studies that have documented this phenomenon in the past; as well as good studies that demonstrate momentum, small cap and other factors have historically outperformed. I would also like to better understand how you define a prospective study — since I find your use of the term confusing in this context.

As others have noted, this list has increasingly veered from its mission and why I joined; because the direction and rigor comes from the top, this exchange provides an excellent opportunity to reorient — unless you'd rather demur and focus on longevity.

Since when is this kind of thing true for future returns in a random walk?

Russ Sears writes:

The stock market declines massively this year, it increases the probability of a greater-than-average return in the future. And by extension, if the stock market rises massively this year, it increases the probability of a lower-than-average return in the future. There is a subtlety in this statement that I think should be pointed out, it is time. A quick hard drop increases the chance of a quick high return next year. However it is not symmetric with time. A large risk may lower expected return over a much longer period of time. Knowledge and therefore increases in wealth stays with us longer than destruction.

Victor Niederhoffer writes:

Since when is this kind of thing true for future returns in a random walk?

May

9

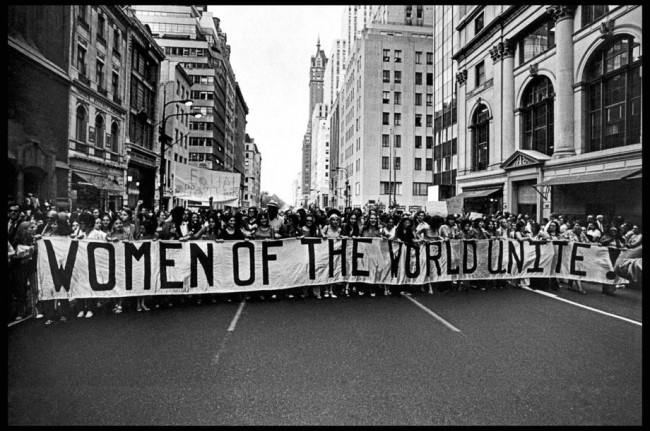

I believe "African Studies", "Feminist Studies", "Women's Studies", "Social Justice", "HR Specialist", and so many more add no real value to the world.

I believe "African Studies", "Feminist Studies", "Women's Studies", "Social Justice", "HR Specialist", and so many more add no real value to the world.

Gordon Haave writes:

I disagree, those majors also open up the opportunity for community activist type jobs.

Thurston Trowell writes:

So people should get finance degrees and MBAs and go on to become analysts and managers of mutual funds and hedge funds, at least 88% of whom lag the markets each year? In your view, exactly how are these wealth sapping leaches on society diverting peoples' hard earned retirement savings into their own bank accounts and grand villas in Connecticut adding more "real value to the world" than the African Studies major?

Scott Brooks reacts:

As usual, you jump to conclusions and ascribe things to what I wrote that I never said or wrote. It makes me think that you're part of the media who spins what people say to fit their desired narrative in order to demean those that dare disagree with their "exulted enligntened world view". Heck, it's almost like you're trying to smear and label me as some unworthy disgusting deplorable person.

But, that might only be the case if you were one of those media people. But let's look at what you said and deconstruct your faulty logic about the evils of financial people and what value to they bring to the world?

Let's keep this simple: How many people do these financial employ? How much revenue do they create from their efforts of adding value to the lives of other people (whether you see it as value or not…..people voluntarily see it as value since they keep giving these financial people money…..at least I know my clients do).

Personally, I employ 8 full time and 2 part time people, all of whom make very good money. I'd say that's pretty good. There are ~ 50 financial advisors flying to STL in a few weeks (on their dime) to spend 2 days with me so I can train them to better serve their clients, grow their businesses. Further, I will be training them on how to grow their staffing (creating jobs) as their businesses grow. I'd say that puts me and my services in demand. I'm the guy who donates money to the people who think they are doing good deeds in their communities. I'm the guy who pays the taxes that are forcibly taken from me to "support" (read: create dependence on the government) those poor souls (read: people who will vote for the polilticians who take my money and give it to the poor souls). I'd say that makes me pretty valuable.

As a matter of fact, I'd go so far as to say that the "do-gooders" of the world and they people they serve are completely dependent on the value I create so that I can donate to their services (or allow their "revered government" to take from me and give to them. Those with a degree in African Studies can do…….what? Hope to get a job teaching African Studies at some university to students who can do…..what? Hope to get a job at some university teaching African Studies to students who can do…..what? And so on, and so on, and so on, etc. etc. etc. And feel free to replace "African Studies" with "Feminist studies" or any other such worthless degree. If we eliminated African/Feminist/ studies (and other BS degrees) from universities….what would happen? I submit that the world would immediately become a better place. Of course, you may not like it because it would be a world filled with more financial people and businessmen and media types. Heck, we might even see the rise of the worst possible mashup of those things…….a media businessman who specializes in writing financial articles.

Rocky Humbert responds:

Shame on you. It saddens me that you, as a devoutly religious man, views the world in such mundane economic terms, rather than philosophical or existential terms. I suspect that hostile prose distorts your true beliefs. One's college major and one's college means little. Whether it's in physic or math or basket weaving. It's a piece of paper. And only to academics and archaically minded professionals does it have any meaning at all. How one conducts one's life means everything. Defining one's worth to the world is for only oneself and one's creator to measure.

Russ Sears writes:

Having a degree gives others insight into what the graduate values.

I will agree that the usefulness of what you learn can only be determined by the person using that knowledge.

Few art majors would have the ability or desire even if they had the skills to commit the time to engineering a bridge for example, but the engineering team may need an art major to enhance a bridge's aesthetics.

Apr

20

Dell, from Rocky Humbert

April 20, 2017 | Leave a Comment

Take a look at the late, great Dell computer. I started shorting it in the late 1990s using a statistical/valuation methodology that was predicated on volatility and the near certainty of a substantial correction. I was correct in that I eventually made money, but the mark-to-markets (and "risk adjusted return") were dismal. I don't use that strategy anymore…

Take a look at the late, great Dell computer. I started shorting it in the late 1990s using a statistical/valuation methodology that was predicated on volatility and the near certainty of a substantial correction. I was correct in that I eventually made money, but the mark-to-markets (and "risk adjusted return") were dismal. I don't use that strategy anymore…

Remember also that nearly every company (GE being one of the exceptions but for the grace of the Fed) eventually disappears either through acquisition, merger, or bankruptcy. So if you only look once every decade or two, and leave a GTC order to buy everything down 50%, you are very likely to get filled. But you are also likely to own a portfolio of losers.

Apr

9

≈50 Tomahawk Missiles into Syria, from Rocky Humbert

April 9, 2017 | 3 Comments

Some historical context is necessary. Let us remember that much of the current Syria situation can be attributed to Obama's "red line" and his naive agreement to have the Russians remove all chemical weapons. Does anyone remember that? Let us also remember that the flood of Syrian refugees is a direct result of the former too. Wouldn't it be nice if everyone could just "get along" and sing Kumbaya? Perhaps in our next life. But not in this one.

The missile strike is a calculated political signal; not a military one. It's how one sets the table for negotiations — not so much in Syria, which is now a lost cause — but much more importantly in North Korea and other places. And on that subject, Gordon and the others will surely change their views if and when Kim tests a Nuclear-tipped ICBM capable of hitting of San Francisco….

Stefan Jovanovich writes:

Kim and I may be hopelessly biased; we think the United States' only sensible policy in the Middle East is to insure the survival and prosperity of Israel. To do that, the U.S. and the Israelis have to choose which side of the ongoing civil war among Muslims is the better bet.

It is not a difficult choice; the Sunni majority countries are the only ones that are not absolutely focused on the destruction of the Great and Little Satans.

What the missile strike - by its size and focus - has done is show the Sunni countries (many of whom just happened to be visiting the White House recently) that President Trump is not someone who believes in military gestures. He is actually willing to break things permanently. That air base is gone.

The fact that the missiles were in the air as the President sat down to dinner with the one country in the world - other than the U.S. - that can destroy North Korea's nuclear threat is, of course, a mere coincidence.

anonymous writes:

Just like everyone else, you're entitled to your opinion, but please excuse us for questioning another unilateral action in the Middle East that does little to serve US interests. If anything, I would expect it to accelerate nuclear programs in both North Korea AND Iran.

You should be asking yourself who gains from this action, and why Little Marco and McCain are ecstatic about the news. I understand that anything that helps Israel is probably fine in your book, but I find it curious that noone seems to be questioning why a rational actor like Assad would be gassing people on the verge of a peace process.

A civil war has been going on in the WH between the populist platform that Trump ran on, and the globalist policies of the existing state apparatus via the proxy of Kushner. Based on these recent events in Syria, Bannon being stripped from the NSC, and the latest news that he and others may be out completely, things are not headed in the right direction for anyone who actually voted for change last election.

And so it goes…

anonymous responds:

Your conclusions about how North Korea and Iran will view this are interesting — but are diametrically opposite to how I and many others may view this.

One must ask the question, why would Assad use chemical weapons right now? This is very odd timing, don't you think?

The only plausible explanation was as a test of Trump. And Trump's response was a calculated signal to the world.

You can argue what the signal meant. And you can reasonably argue that it's a bad message.

But for me, it meant several (good) things:

1) International standards (Geneva Convention) matter and we are not going to rely entirely on the "international community" or the UN or useless financial sanctions.

2) Violating deals and treaties have real consequences. This is a signal to Iran regarding their Nuclear accord with Obama.

3) We are not afraid to use force and we will not be intimidated by the playground bully.

Ultimately, you have to decide whether there is good and evil in the world and if there is, who are the "good guys" and who are the "bad guys" in the world. I will readily admit (and here I am being an idealogue) that I am one of the good guys. And I want the good guys to prevail in the least bloody way. And that means carrying a big stick.

Mar

30

One Sees Obstacles to Reforms, from Victor Niederhoffer

March 30, 2017 | 2 Comments

One sees that everything is topsy turvy with the service reform that repubs are now pointing to. Apparently the agrarian reformers have put a framework in place where a new plan must be revenue neutral or else it has to subject to whatever non-reconciliation is. To the layman that means it's a lot easier to get a revenue neutral plan in. Washington loves that because gov spending won't be decreased. But the fly in the ointment is that any proposal to reduce service rates will generate enormous increased revenues through growth and compliance and proper business activities rather than those designed to reduce payments to the service. Supposedly the "non partisan" budget office made the congress agree that there can't be dynamic scoring. So the Lafferian correlation between reductions in service rates and growth can't be taken into consideration. Thus, the whole thing has an improper foundation, a twisted acorn that must grow into a twisted oak. I've found that all things built on improper foundations eventually crumble.

Rocky Humbert writes:

Since taking office, I count that to-date, Trump has eliminated over 90 government regulations; some of which are very significant and positive from an economic growth perspective (if one is inclined to view the cost/benefit ratio of such regulations as high).

Rocky wonders whether Vic has any hot water in his Connecticut manse. Why? Because he always seems to have a bucket of cold water at the ready.

Ralph Vince adds:

And further to Rocky's point comma it is estimated that these regulations costing economy about to trillion dollars a year. That's one eighth of our economy. Cut that in half reduce half of these regulations and you see an immediate 6% bump in GDP. In my case I have spent over 150 hours in the last month simply wrestling with the regulations caused by Dodd-Frank. Those who oppose the president on the political scale to sew an ideological grounds but in the nuts and bolts world of trying to get anything done and America the regulations are stultifying.

That 6% bump in GDP is before any kind of multiplier is put on it. Can again go back and look at any of the great social programs have been started and worked successfully in America from Social Security to Medicare to Medicaid they all coincide with double-digit GDP growth, something I personally and looking for between now and January of 2019. Taking a machete to the Jungle of regulations anyone trying to start or run a business or even so much as take out a mortgage has to contend with, as the numbers illustrate goes a long way towards getting his towards that double-digit growth, and possibly then some type of healthcare plan in America. People have been flying to this putting the cart before the horse.

Kim Zussman shares the article:

"How to Engineer a Trump Boom"

Cut taxes, deregulate, build roads, bridges and airports—and don't start a 1930-style trade war.

By ROBERT J. BARRO

Stefan Jovanovich writes:

Mr. Barro is looking through the large end of the historical telescope. Trade wars only occur when countries are already having shooting wars; they begin and end when one country loses all its money. The 20th century's "trade war" began in 1914 and only ended in 1945.

What "explains" the 1920s is that the one country in the world that had any money - the United States - decided that it could afford to accept other countries' central banks' valuations of their domestic currencies. What explains the 1930s is that Herbert Hoover and Franklin Roosevelt both agreed that the way to solve the collapse of the Wall Street credit bubble was for the U.S. to join the rest of the civilized world and undertake its own default on its domestic currency.

When economists now say that countries can inflate their way out of their debts, they are referring to the magic of the defaults of nearly all the international loans issued after the Great War. No one got paid back because the valuations accepted for the initial loans (mostly from the U.S.) were as fictional as the current Venezuelan exchange rate; and the Americans decided that having the U.S. Treasury own all its citizens' money was the ideal way to revive American credit exchanges.

Academically trained economists insist on treating political economy as a science, yet they believe, without evidence, that international trade was "free" after World War I. They see a world without quotas, currency controls and imperial preferences after 1918 as a kind of mystic vision that is true regardless of any actual facts. They believe this version of history with even more fervor than LDS believe in the story of Joseph Smith and the golden plates. The Mormons, God Bless Them, consider their gospel a matter of faith; Professor Barro and his colleagues must pretend that it is all somehow Reed Smoot's fault.

Feb

21

Forecasting Factor & Smart Beta Returns (Hint: History is Worse Than Useless), from Rocky Humbert

February 21, 2017 | Leave a Comment

Rob Arnott et al has released a new paper on Smart Beta, a topic that has gotten some air time here. His observations have analogs to other investing styles too.

Feb

13

Article of the Day, from Alston Mabry

February 13, 2017 | Leave a Comment

Here is a nice piece for skeptics:

"Who Will Debunk The Debunkers?" By Daniel Engber

In 2012, network scientist and data theorist Samuel Arbesman published a disturbing thesis: What we think of as established knowledge decays over time. According to his book "The Half-Life of Facts," certain kinds of propositions that may seem bulletproof today will be forgotten by next Tuesday; one's reality can end up out of date. Take, for example, the story of Popeye and his spinach.

Popeye loved his leafy greens and used them to obtain his super strength, Arbesman's book explained, because the cartoon's creators knew that spinach has a lot of iron. Indeed, the character would be a major evangelist for spinach in the 1930s, and it's said he helped increase the green's consumption in the U.S. by one-third. But this "fact" about the iron content of spinach was already on the verge of being obsolete, Arbesman said: In 1937, scientists realized that the original measurement of the iron in 100 grams of spinach — 35 milligrams — was off by a factor of 10. That's because a German chemist named Erich von Wolff had misplaced a decimal point in his notebook back in 1870, and the goof persisted in the literature for more than half a century.

By the time nutritionists caught up with this mistake, the damage had been done. The spinach-iron myth stuck around in spite of new and better knowledge, wrote Arbesman, because "it's a lot easier to spread the first thing you find, or the fact that sounds correct, than to delve deeply into the literature in search of the correct fact."

Arbesman was not the first to tell the cautionary tale of the missing decimal point. The same parable of sloppy science, and its dire implications, appeared in a book called "Follies and Fallacies in Medicine," a classic work of evidence-based skepticism first published in 1989.1 It also appeared in a volume of "Magnificent Mistakes in Mathematics," a guide to "The Practice of Statistics in the Life Sciences" and an article in an academic journal called "The Consequence of Errors." And that's just to name a few.

All these tellings and retellings miss one important fact: The story of the spinach myth is itself apocryphal….

Rocky Humbert writes:

Could this be a case of the myth of the myth, i.e. the metamyth.

Mr. Isomorphisms writes:

Myths are interesting as social and (il)logical phenomena, but a good rule of thumb is that anything written by a network scientist is not worth your time. It's my opinion– that Ditto Santa Fe Institute, complexity science, cognitive science. (It's been remarked that any science which needs to call itself "____ science" is protesting too much–but this is wrong because it would exclude food science, life science, brain science, and natural science.)

Feb

7

The Unemployables, from J.T Holley

February 7, 2017 | 1 Comment

Let's not forget that some people only work for 5-6 months and stop after they make 8000 grand so that they can get the earned income credit. They then take the remaining 6 months off. It's a crazy loophole that exists.

Says the man on disability.

It sure feels like 10-15% of folks are just flat out unemployable.

anonymous writes:

The gist of your last remark shows up in anecdotes and studies of the current labor market. The quality/skill set/attitude/demeanor of job applicants is a frequent cause for lamentation.

The latest NFIB (small biz) report says 89% of firms hiring/trying to hire see few or zero qualified applicants. And 15% of all businesses say finding qualified workers is their single biggest problem. Both numbers are high relative to history.

Rocky Humbert writes:

There are many different ways to slice and dice these complex issues. It can be argued that the root cause is the labor force is now unqualified. It can also be argued that employers are reaping what they've sown by investing less into the workforce.

Where you stand depends on where you sit.

Personally, I think this is a secular evolution with plenty of blame to go around. The key variable is that the median job tenure has been declining for years. No longer is a job at IBM or GM or GE a career that spans a lifetime. This phenomenon can be sourced to Jack Welch at GE. It spread throughout the corporate landscape (including to the Bob Rubin/Steve Friedman era at Goldman Sachs).

Some economists will say that this is a healthy sign of a dynamic labor force. Some economists will say that it's a consequence of the absence of defined benefit plans and union power. Some will say its the Gig Economy. It was part and parcel of the loss of job security and the solid American middle class.

But it is also clear that if an employer expects a short employment duration, he is less inclined to invest in his workforce (i.e. training/education) etc.

Marion Dreyfus writes:

That uptick of .1% is a reflection of hope–people who stopped hunting a job now feel hopeful enough to set foot to pavement. I stopped for months, and notice I started looking again this past month. Many are like me.

Nov

28

First Brexit, then Trump, now France: the Trend Continues, from Rocky Humbert

November 28, 2016 | Leave a Comment

Readers of the Dailyspec who follow the trend should note the French presidential primary result:

Readers of the Dailyspec who follow the trend should note the French presidential primary result:

From the WSJ:

Francois Fillion, a former prime minister who compares himself to Ronald Reagan and Margaret Thatcher, resoundingly defeated Bordeaux Mayor Alain Juppe in the runoff [election] primary Sunday, garnering 66.5% of votes.

Just two weeks ago, polls had shown Juppe, a centrist with bipartisan appeal with a comfortable lead.

Fool me once. Shame on you. Fool me twice. Shame on me. Fool me three times, shame on the pollsters and media.

Scott Brooks writes:

The pendulum is swinging hard away from the leftists.

Soon the non-leftists will screw things up and it will swing the other way.

The left (including the MSM) are like cockroaches…..not even the nuclear bomb of Trump can wipe them out.

Ralph Vince writes:

I think we're witnessing something bigger than a pendulum swinging — I think we're watching a major, glacial, cultural shift going on now, around the planet large than politics, where the last vestiges of the last century are being slowly self-lulled into extinction, and many other things going on.

I think the "ZIRP minus minus" world, the survival of the ending of easing, and other "perfect storm" factors are colliding to make for an explosive rise in asset values sans a corresponding rise in rates, that may persist for decades.

The greatest free-market transference of wealth in human history is already upon is for those willing to assume risk, to be followed by legions of those who must assume ever-greater risk. Never has there been such powerful feedback and driving mechanisms that have fallen into place.

And as I've said here, I think most people are on the wrong side of this, which further buttresses the case. As I mentioned yesterday, the "Snowflake" generation (who I regard as the new "greatest generation") are modern-day Spartans of productivity, trained in it from birth. I have infiltrated their camps, I have gone in and worked with them for months at a time, wanting to learn this-or-that (and getting paid to o it) telling myself that when I leave, I leave knowing what they know (oh, yes indeed this coerced humility from me!) and I walked out the doors with heir brains in mason jars, amazed at their work ethic, embarrassed by my own in comparison. Every preceding generation had "no such thing as dumb questions," but theirs.

What an engine, what a perfect storm, what a cultural cusp we are upon.

Oct

31

Rational Decision-Making Under Uncertainty, from Patrick Boyle

October 31, 2016 | 1 Comment

This is a paper by Victor Haghani of LTCM fame on bet sizing observing and analysing how people place bets on a coin flip that is biased to come up heads 60% of the time.

This is a paper by Victor Haghani of LTCM fame on bet sizing observing and analysing how people place bets on a coin flip that is biased to come up heads 60% of the time.

Ralph Vince writes:

It's a very interesting paper, and to many might be surprising. A couple of comments:

1. It assumes someone's criterion in wagering on this is to maximize what someone makes. This is certainly not the case in capital markets, where (the rather nebulous) risk-adjusted return is king, specfically: "Optimal F: Calculating the Expected Growth-Optimal Fraction for Discretely-Distributed Outcomes"

2. Even what the authors and Thorp himself claim are the amounts to wager so as to maximize expected gain, their answer is not quite aggressive enough! The amounts the refer to are asymptotic, as the number of trials ever-increases. The author himself points to a horizon of 300 plays in half an hour, and the actual optimal wager (which would, int hat time period, yield a greater return than the authors or Thorp point to) is slightly more aggressive, and can be determined from the above paper.

Not trying to toot my own horn (it needs no tooting, and besides, my horn will do a lot, but tooting it won't do) but the paper is inaccurate on these two points.

Jim Sogi writes:

Thank you for the interesting article. The other night at our band practice, the bass player's wife, who works at a public school, asked me if I was taking my money out of the market. She had heard a number of people were worried about the election and a market drop if either candidate was elected. I told her the market would probably go up, though it might jump around a bit. I thought that was interesting. Its an example of the public doing the wrong thing, for the wrong reasons. It reflects peoples fear about uncertainty about the election. It helps explain some of the market action recently.

Rocky Humbert writes:

Mr. Sogi's anecdote and conclusion is a textbook example of Confirmation Bias — which is the tendency to search for, interpret, favor and recall information in a way that confirms one's preexisting beliefs or hypotheses.

To wit: On what basis does Mr. Sogi conclude that the bass player's wife represents the "public" — as distinct from Mr. Sogi himself being the "public" ??!!

How the stock market will perform over the next 30 or 60 days has very little to do with the study of a coin that is heavily loaded to land on heads. At best, the stock market's performance over the next 30 days is only slightly better than 50:50.

Alston Mabry writes:

Just had to do a quick sim of their betting game.

Oct

31

Israel, from Victor Niederhoffer

October 31, 2016 | Leave a Comment

One likes to use Israel open to close for prediction of US markets the next day over the weekend. This must be counted out. Strange to see it down 7% year to date versus our S&P up 4% year to date.

One likes to use Israel open to close for prediction of US markets the next day over the weekend. This must be counted out. Strange to see it down 7% year to date versus our S&P up 4% year to date.

Anatoly Veltman writes:

A few considerations:

1. A short term indicator - intraday trend Sunday morning as predictor of the intraday trend Sunday evening - may well be valid. One better know make-up of participation "over there". Are foreign "actively trading funds" significant participants?

The above notwithstanding, and to address the second observed anomaly

2. Longer term trends may be cyclical, and they may also be lagging. Being "surprised" with 11% discrepancy is not everything (yet). What was the delta in FX for the same period? (I'm assuming their index is in shekels). Maybe shekel also depreciated 11%, and under-performance is actually 22%…Interest rate differentials and trends are another variable. Finally, U.S. aid and geopolitical threats loom huge over any Israel forecast.

I wonder if anyone can weigh in on "Dem vs. Rep" impact on Israel's future.

Rocky Humbert writes:

Please. Two stocks, Teva Pharma and Perrigo Pharma account for 20% of the TA-100 index. Both stocks have declined massively over the past 12 months and can account for the index underperformance.

As anyone who is sentient should know, the bio, pharma, and generic drug stocks have performed horribly over the past twelve months — beginning with Valiant and Shkreli and Hilliary's tweet — and more recently on bad R&D and earnings news and speculation about the end of price-hike-led earnings growth. When I was buying the drug stocks during the last Hillary-scare, the pe multiples were 9x to 12x. The multiples today are 15x to 23x — even after the declines.

Someone should tell the "public" …

TA-100 Index: The TA-100 Index, typically referred to as the Tel Aviv 100, is a stock market index of the 100 most highly capitalised companies listed on the Tel Aviv Stock Exchange…

David Lillienfeld writes:

It seems likely to me that the generic manufacturers are going to come under a lot of pricing pressure moving forward. The ethicals? I'm not so sure. Yes, there's looking to be a potential product failure on Regeneron's cholesterol drug, likely partly because of price, but almost half of all drug development today is for orphan drugs—and I haven't seen much in the way of push back from the market with regard to them. Lots of kvetching, no changes in purchases.

One of the "wake-up calls" for the industry has been what happened with Gilead's Hep C franchise. (When Gilead bought Parmassett, from whom it got this franchise, everyone thought they grossly overpaid—not unlike Pfizer and Wyeth for Lipitor. It was the deal of the century thus far—for Gilead.) It made a lot of money—short term. There was lots of grousing about the high cost, never mind that it was curative in ways that existing treatments were not, i.e., it was cost-effective even if insurers didn't appreciate the fact immediately. What few understood was that most of that revenue—and profits—resulted from a backlog of patients, now emptied, through which Gilead had to recover its costs and pays the piper for past failed efforts. Did it overcharge beyond that? Depends whom you ask.

There were other viral diseases (Gilead's specialty) it was supposed to have turned its attentions to, as well as (finally) some performance from its oncology unit. About 6-7 weeks ago, though, I noticed that construction on the Gilead campus had slowed. Not stopped, though. I tried speaking with people that I know there, make that knew there, and heard that a couple of retired and have fallen off the grid. One was pretty disgusted and turned up at Genentech—and was unwilling to talk except to say that he was still detoxing.

Look at pharma companies like BioMarin and Ultragenyx and you might find companies with lots of pricing power. Also lots of waiting-to-be acquired power. Will they be hauled in front of a Congressional committee? Perhaps, but I doubt it. That's the nature of an orphan drug—and I don't see that changing anytime soon. The costs of development (fixed costs) are almost as high as for those intended for more common conditions. Yes, there are fewer patients, but they may also be harder to find (= expense). And there are the drug failures. Go ask Bristol-Myers Squibb about the impact of those—BMS is in the process of hacking off a good portion of its R&D department after a major failed trial/program.

Two thoughts: First, stay away from cancer immunotherapy. Yes, someone will win big there—maybe. No one has any clue as to whom/if. In 5 years, probably a different story, but at the moment, not ready for prime-time. (If you like to gamble, go to Vegas or Macau.) Think of this area as the equal of NASH. Maybe Intercept will be a big winner. I'm not so sure. One thing is clear—there's an increasing amount of roadkill on that highway.

So yes, Rocky, the generic manufacturers are challenged—and given the size of the generics marketplace and some of the price hikes that have taken place, I don't see that ending any time soon.

But the pharma space still offers opportunities, just not with the larger companies.

Oct

10

New Word: TRUMPTURE, from Leo Jia

October 10, 2016 | Leave a Comment

"The Coming Anti-National Revolution" by Robert J. Shiller:

"The Coming Anti-National Revolution" by Robert J. Shiller:

For the past several centuries, the world has experienced a sequence of intellectual revolutions against oppression of one sort or another. These revolutions operate in the minds of humans and are spread – eventually to most of the world – not by war (which tends to involve multiple causes), but by language and communications technology. Ultimately, the ideas they advance – unlike the causes of war – become noncontroversial.

I think the next such revolution, likely sometime in the twenty-first century, will challenge the economic implications of the nation-state. It will focus on the injustice that follows from the fact that, entirely by chance, some are born in poor countries and others in rich countries. As more people work for multinational firms and meet and get to know more people from other countries, our sense of justice is being affected.

Indeed a likely big wave in the comin' decades. Any further thoughts?

Rocky Humbert writes:

Shiller may have gotten this 100% backwards. If my perception of the global and popular mood is correct, then the pendulum may be about to start moving in the opposite direction. The Brexit/Trump meme is the instant when the acceleration of the globalist/intellectual elite/HYP is changing sign. (Stefan can elaborate–but I am unaware of any of these so-called revolutions being wholesale wealth transfers…without bullets flying.)

As a footnote, I am surprised that anyone claims to be surprised by the most recent lewd Trump video–it is entirely consistent with the persona that he projects. In my 30 years on Wall Street, I've heard and seen much much worse. Similarly, the Wiki document dump on Hillary's speeches confirmed the perceptions that her detractors have.

Lastly, someone posted an article about the wisdom of crowds and confidence. And that confident observers (as a group) make the best predictions. I have gone on record and remain confident that Trump will be the next president. I do not share Mark Cuban's belief that this will result in a stock market "crash" — but on the edges, none of this is particularly bullish. The most interesting question for me is whether when Trump wins and if the markets get turbulent, will the Fed blink in December? Given the number of HYP's there, and their collective beliefs…

Back to Shiller. The UN will be the first globalist institution to suffer Trumpture. (Trumpture is the rupture of a bubble by Trump. If the NY Post and Drudge pick this up, I will be most pleased.)

HYP=harvard/yale/princeton. For full disclosure, I'm a Yalie.

Jul

12

Italian Banks, from Stef Estebiza

July 12, 2016 | Leave a Comment

Merkel does not see a banking crisis in Italy. She is waiting for Italy to intervene and save the banks with BAIL-IN and only after be able to save Deutsche bank with bail out. It would serve an avalanche for Deutsche bank …