Sep

14

Armed Rebellion

September 14, 2020 | Leave a Comment

Russ Herrold writes:

Our professor and others have had a point when they said the

> purpose of the 2nd Amendment was to support militias.* cough * ehh? If there was a point it would be anti-historical

The federal and state gov'ts did not need an enabling amendment to do something which they could (and did) already do as a matter of simple statutory law (anticipating 14th amdt

incorporation)) The purpose of the Amendments (thought unnecessary, by and large, by Madison) was to _fence off_ from first the Fed'l,and later through incorporation, the states, certain actions,explicitly, for which underlying power were not explicitly granted anyway Simple farmers did not really trust an approach of statutory construction, of 'expresio unius, exclusios alterius', in Latin-ifying the concept. The simple farmers said: When you mean something, sate it directly, rather than relying on lawyer's word games US v. Miller's Progressive mindset at the US Supreme Court was clearly 'bad law' from the onset, but 'stare decisis' is tough to overcome. It took Heller v. DC, and MacDonald v. Chicago to chip at that bad foundation

What they left out was the fact that owning a firearm was as much of a natural right as speech and property ownership. The purpose of the 2nd Amendment was to remind Congress that, since militias were voluntary, men would have to be self-trained. This may be some modernist attribution of purpose, but again, this is anti-historical.The idea of Americans as individually spontaneously rebellious in the name of liberty is historical blinking. Genuine rebellion in the U.S. has always been a matter of organized use of long guns and artillery barrels, not random murderous gestures with handguns.

Not sure that it was not tried, albeit ineffectively. The Whiskey Rebellion showed the futility of opposing set positions as an approach; the murder of veterans during the 'Thirty's Bonus March and encampment made it clear that set positions were a disaster. The weaker or 'civilian' side are left with 4GW Readily reloadible handguns are a relatively recent innovation, really only coming into their in the post-Black Power, cartridge based era (Yes, yes, I understand that the .45 Long Colt started life as a B. P. cartridge, and was really stabilized in the M. 1911 with modern protellants)

The blood in the streets that the Rothschilds saw are an indicator will only have come to the U.S. when Antifa or its opponents start using volley fire, ummm no, no 'volley fire' in the future. Rather: 4GW tactics,really starting in the run-out of of Lexington and Concord,and continuing development thereafter on an ongoing basis.

see: With Fire and Sword: The Battle of Bunker Hill and the Beginning of the American Revolution Nelson, James L., Thomas Dunne Books Combine that with the emergence and development of formal sniper doctrine … see the Finns almost mechanical approach, and and the more dispairite reply of the Soviets in WW II …showed that MOUT operations on an opponent who is able to 'melt away' into a surrounding population Followup reading as to what US Civil War II may well look.like:

. The Dirty War, Martin Dillon — the IRA vs the brits

. Fry The Brain: The Art of Urban Sniping and its Role in Modern Guerrilla Warfare (n/a Book 1), John West — from an analytic point of view of the sniper … from the TX Bell Tower shooter, a startling and 'eyes wide open're-examination of the LBJ assassination, and on to current Middle East theatre ** recommended **

. Red Sniper on the Eastern Front: The Memoirs of Joseph Pilyushin, by Joseph Pilyushin (biographical notes)

. Sniper on the Eastern Front: The Memoirs of Sepp Allerberger,Knights Cross, by Albrecht Wacker (and from the German side — mnore formal, less effective)

. Jack Hinson's One-Man War, A Civil War Sniper McKenney, Tom, Brand (US Civil war …. somewhat light-weight)

. Marine Sniper: 93 Confirmed Kills, by Charles Henderson (Carlos Hathcock, Viet Nam era)

Stefan Jovanovich writes:

I never quarrel with RPH but a few clarifications. The essay was about what the people at the time called "The War of the Rebellion" - what is now known as the Civil War, not the War of the Revolution. That remains the only time U. S. Government authority has been successfully challenged, even temporarily, by people taking up arms. Volley fire was the standard tactic of both Southern and Northern armies throughout the Civil War because the limitations of muskets remained what they always were. The awfulness of what happened to Pickett's men was caused by its use by the Union defenders who used the tactic first with cannon and then with canister and long guns at 300 yards. Even in ambush the Revolutionary Army regulars were taught to use concentrated fire which was the French doctrine that Washington knew firsthand from its having been used so effectively in the annihilation of Braddock's army.

The performance of the militia in the Revolutionary War was so notoriously bad that it was used as a tactic by the Americans, who would place the militia as the first line with the instructions that they could fire one volley and then skedaddle through the ranks of the regular army behind them. This worked to perfection at Guilford Courthouse where the Brits ran and charged on horseback into a murderous concentration of fire because they thought they had broken the Americans and did not need to pause and fire their own volley.

The Second Amendment was adopted at the end of 1791 as a sop to the wounded pride of the state militias that had proven once again to be useless.

https://ohiohistorycentral.org/w/Harmar%27s_Defeat

The U.S. would keep its regular army of volunteers AND the militias would be allowed to pretend that they were still the backbone of the American fighting spirit; and the obvious fact of life - people would keep and bear their own arms - would continue as before.

Jun

17

A Sad Thing, from Victor Niederhoffer

June 17, 2015 | 2 Comments

I thought it would never happen but it did. One person in this humble trading operation bought at a price, and the other person sold at the same price. Thus, we were guaranteed to lose, and the brokers were guaranteed to win. I suggested that if this were to be a template, we would be guaranteed to go bankrupt and the brokers would become infinitely wealthy. I would ask the brokers to send us a fish dinner to encourage us and reward us for this terrible thing, but I don't think they would get the drift of why it's so great for them.

I thought it would never happen but it did. One person in this humble trading operation bought at a price, and the other person sold at the same price. Thus, we were guaranteed to lose, and the brokers were guaranteed to win. I suggested that if this were to be a template, we would be guaranteed to go bankrupt and the brokers would become infinitely wealthy. I would ask the brokers to send us a fish dinner to encourage us and reward us for this terrible thing, but I don't think they would get the drift of why it's so great for them.

Russ Herrold writes:

Certainly, IBKR understands and matches quite intentionally 'crosses' in house at once, before ever exposing the net delta in position to an exchange. It is part of their disclosures

In designing my order management system I also set it so that it flags an exception event when short 'trading' positions, would cross against long term 'investments', and offers a simple journal entry to avoid the commissionable 'trip'.

Victor Niederhoffer writes:

To say nothing of their ability to take the other side of trades when their customers are stopped out for margin. According to one list member, they proudly acknowledge this in their conference calls. And one often sees huge bids below the market when the market is down big, and assumes that it is such an entity on the other side. In all fairness, however, I know from others that they give you a warning of 2 seconds or so and you can forestall being stopped out if you get the wire for your new margin to them within that 2 second window albeit, you might have as much as 2 minutes if you receive the margin call in the evening when the banks are closed.

anonymous writes:

Yes, they might consider handing out copies of "duel momentum" to all of their advisor customers, particularly the ones utilizing portfolio margining.

Stefan Martinek writes:

BTW, momentum made D. Harding (Winton, AUM ~30B; track record) one of the richest guys in the UK. (Harding on momentum) .The other point is that the "dual momentum" = absolute + relative momentum is used by traders since eternity, "discovered" by academics in 70s, and discovered again in 2014 by Mr. Antonacci.

May

19

When Will Bonds Start to Act Based on Inflation Expectations, from Russ Herrold

May 19, 2015 | Leave a Comment

A friend writes me and asks, "when will bonds start to act based on inflation expectations?" about this Bloomberg article "Euro-Area Bonds Climb as Coeure Says ECB to Frontload Purchases".

I don't know if it was a rhetorical question or not. The answer has to be bundled in with the seeming utter absence of labor market take-up occurring, and so fueling a general pricing competition for that (most vocal) factor of production.

The other three factors of production ebb and flow as to demand, but usually have a less general, and more of a localized 'spot market' effect, and so do not trigger off inflation expectation reactions.

Nov

25

Fool’s Gold, from Russ Herrold

November 25, 2013 | Leave a Comment

I came across about this rather nice summary of backtesting in the context of investment/trading framing over the weekend.

I came across about this rather nice summary of backtesting in the context of investment/trading framing over the weekend.

Reasonable investors derisive of back-tests acknowledge that in theory back-tests can illuminate something true about the world but believe in practice back-tests can rarely be relied on to do so. The Vanguard study, by finding that past performance does not reliably predict future returns of asset classes, joins a chorus of studies by many independent researchers demonstrating the same. A skeptic might conclude back-tests are to induction what Richard Simmons' hair is to the category of things that can be burned for fuel.

The problem with that argument is too many successful investors are or were back-testers. Benjamin Graham, father of value investing and Warren Buffett's mentor, devised trading rules based on studies of what would have worked in the past–back-tests, in other words. Early in his career, Buffett applied Graham's back-tested rules to identify "cigar butts," statistically cheap stocks that had assets that could be sold for more than they could be bought for. Another successful Graham acolyte, Walter Schloss, achieved 20% gross annualized returns over several decades by "selecting securities by certain simple statistical methods…learned while working for Ben Graham."

Ray Dalio, founder of Bridgewater Associates and arguably the most successful macro investor alive, uses back-tested strategies to run Pure Alpha, an unusual fund that uses only fundamental quant models. Mathematician James Simon's Medallion Fund, a quantitative, fast-trading strategy, has earned 35% annualized returns after fees since 1989.

Jeff Rollert adds:

The difference between back testing and understanding drift is the difference between knowing history as taught and understanding evolution.

That is my inner Hobbes speaking today.

Oct

1

The Power of Brands, from Ed Stewart

October 1, 2013 | Leave a Comment

One thing I have been considering lately from an investor's perspective is the power of consumer brands.

One thing I have been considering lately from an investor's perspective is the power of consumer brands.

What is the value of a well known brand? My inquiry is motivated by a few different angles, but I think what has most stimulated the question is my study of a a "prestigious" company that has been growing by purchasing OTC medicine-type brands from the major consumer goods and drug companies.

At face value it seems like a great strategy. The shorter term economics look favorable. Yet, when I look in my families medicine cabinet, I notice my wife buys almost exclusively store brands when it comes to things like cold medicine, etc. It only takes choosing the low cost option one time to realize that the store brands (Costco, Walgreens, Roundy's etc) work just as well as the higher cost name brands.

Will the familiarity of an old brand have staying power that can allow for an above average roe over time, or are they wasting assets? How long can reputation last when the underlying reality is not particularly distinguished?

A family relation of mine owns a fashion design/women's retail business. One discovery this person made in the manufacturing process (working with contract manufacturers) is that the big names in mainstream "luxury" goods often have completely average quality or only slightly above average quality in terms of material and construction. The desirability factor is almost 100% psychological - what other people will think, a giffin good type effect. This might seem reasonable with regards to items people use to create their public persona or to establish a sense of status. But what about consumer staples? It seems like a much tougher sell. I know that when I go to Costco, I instinctively grab the store brand and am very rarely disappointed. When presented with two very similar, low risk options, even a 50 cent difference can feel significant at the moment when one must reach for an item off the shelf (or maybe I am particularly cheap?)

So the question is, how to evaluate brands in a competitive, relatively uniform (in terms of quality) market. When are they worth investing in over time (in terms of long-term roe?) I see two big things:

1. Need for reliability/high trust in product (condoms vs. hand soap)

2. Items that signify status (LV logo vs. generic)

To bring things to a specific context, I am presently evaluating if the company Prestige brand's (PBH) strategy of buying "known" but relatively mundane brands will have staying power over time (say next 15-20 years). The short term economics look good, but what about staying power in these competitive markets where stores have an incentive to sell their proprietary brands?

Any thoughts are welcome.

Russ Herrold writes:

Historically Sears also historically perfected the 'Good, Better, Best' model of offering several lines at varying price points.

Historically Sears also historically perfected the 'Good, Better, Best' model of offering several lines at varying price points.

That brand has huge value, at least out here in Flyover Country.

Jim Wildman adds:

Good, Better, Best has been adopted by John Deere as to their lawn equipment as well. 1xx series are cheapos, designed to compete at the low end with the Craftsmen and MTD's. 2xx are better, but still not what one thinks of with a Deere. For those you need the 3xx series, which are what I grew up with as a kid.

Easy to tell the difference once you know where to look as well (pressed metal vs cast pieces, bolted vs welded, etc, etc)

Aug

9

Software That Builds Software, from Russ Herrold

August 9, 2013 | Leave a Comment

This article in the New Yorker seems to be making a splash "The Software That Builds Software".

This article in the New Yorker seems to be making a splash "The Software That Builds Software".

Software that builds software is as old as the second day that the first piece of software was written. The second day, because coder (what we may now call a 'programmer' or a 'developer') realized that the computer target could do some of the work, deterministically, without typographical error, faster, and in some axes of metric, 'better' than a human can, and started to build tools.

And so tasks are delegated to the computers to perform

I am and have been active for years in a project which uses computers to building and test software, to ensure NEW software conforms to coding conventions for portability [1]. The testing computers are geographically disbursed, and it is unlikely I will ever physically see any of them that I do not own. Some do not not even have an independent physical existence, but rather exist 'virtually' inside other hardwareThey retrieve 'source code' from a distributed version control system. The article mentions 'git' and 'github', but we use another older variant. They are controlled by a textual and webbish control and status display interface [2] called a 'buildbot'

For this piece, to get some graphics, I just 'told' the control interface, via a text command, to start a job; I could have done it graphically, but I can touch-type much faster than I can move around a website with mouse-clicks:

lsb_bb> /msg lsb_bb force build app-checker-x86_64

and it acknowledged the request, and will assign it to a specific machine perform (there are several identically capable machines in that stable, and the software does 'load management' to assign it to an available 'worker' slave unit

11:35 =orc_orc> force build app-checker-x86_64 11:35 =lsb_bb> build forced [ETA 7m35s] 11:35 =lsb_bb> I'll give a shout when the build finishes

and as it build it updated the display [3], and keeps a viewable log of the process [4]

A few minutes later, the 'master' of the 'buildbot slave' tasked with the work 'told' me the work has been completed and that the test had succeeded:

11:42 =lsb_bb> Hey! build app-checker-x86_64 #91 is complete: Success [build successful] 11:42 =lsb_bb> Build details can be found here.

This is not at all uncommon or magical, although it can be difficult to get 'right' in the usual case. Think of Mickey Mouse in the 'Fantasia' film. Those mops can get uppity [5]

I am not all that clear, beyond the 'gee whiz' factor why the article cited considered this remarkable. It just seems 'normal' to me.

Feb

22

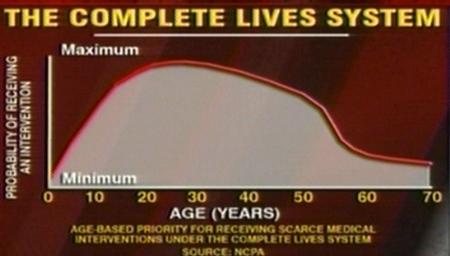

Found: A Libertarian MD Looks at the ‘Complete Lives System’, from Russ Herrold

February 22, 2013 | Leave a Comment

I came across these articles today, thinking about and researching what the health care system is going to look like, now that the Affordable Care Act is being rolled it.

I came across these articles today, thinking about and researching what the health care system is going to look like, now that the Affordable Care Act is being rolled it.

I formerly considered the 'health' part of my long term portfolio design a sector to emphasize, anticipating the bulge of the baby boomers turning into net health care 'over'-consumers, and in line with the long term move in the US economy to over-weight the health services sector, and the formality of that sector over the last fifty years to make sure a structured income stream is flowing into it without interruption

The article and the trail it leads to, point out that part of the healthcare delivery system is laying an 'allocation' formula, or 'curve' of who will get what level of care, over the span of their statistically projected lifetime (which 'manages' 'demand' for resources, rather than letting 'more free' market approaches prevail work) [1] [2]

I am not so sure that the sector was perhaps not 'too' successful, causing the emergence of a political will to put it under control of the central planners, and so ending that reason to over-weight it

1. "The "Complete Lives System"-why so little comment from the medical blogger world?"

Feb

4

And Never Never Go to Sea, from Stefan Jovanovich

February 4, 2013 | 1 Comment

It has been a while since the dailyspec discussed the potential for mayhem in the Straits of Hormuz. So far, the greatest threat to American interests has come from our own Navy. It has been nearly 4 years since the USS Hartford collided with the USS New Orleans. The "accident" injured 15 sailors; the repairs to both ships cost over $100M.

It has been a while since the dailyspec discussed the potential for mayhem in the Straits of Hormuz. So far, the greatest threat to American interests has come from our own Navy. It has been nearly 4 years since the USS Hartford collided with the USS New Orleans. The "accident" injured 15 sailors; the repairs to both ships cost over $100M.

The folks at StrategyPage just reported some of the details of the accident report:

1. There was no one supervising the sonar operator when the collision occurred

2. The sonar operator was not, in fact, looking at his screen at the time but talking to a fellow crew member

3. The ship's navigator was not plotting the ship's course but "doing something else, while listening to his iPod"

4. The officer in charge failed to raise the ship's periscope to scan the horizon before the ship breached the surface

In total there were 30 errors in procedure.

Chris Tucker writes:

Complacency and sloppy work are very difficult to control after they have taken hold of a work group. The proper place to kill them is in early training. People who are responsible for large numbers of other peoples lives and/or for highly valuable property need to be trained in active vigilance early in their careers. Unfortunately, safety is a boring topic to most — it lacks the intrigue of the higher mission, it lacks the luster of fancy technical gadgetry, and because it is something that has to be practiced with diligence day in and day out, at all times, it is difficult to keep at it.

But safety and its execution is absolutely essential to any complex operation. Organizations and systems that require precautions have to inculcate a culture of safety and then impress it into their people regularly. It can never be treated as a one off training item and then checked off as completed, it has to be pressed, again and again and drilled into the subconscious so that it comes automatically. Active surveillance, much like active listening, is a skill that requires practice to master.

I suspect that in the crossing of an active shipping lane like the Straits of Hormuz, that submarines use active sonar, but I have no idea how frequently they ping. Probably on the order of once every two or three seconds, much more than that and there is insufficient time to capture reflected signals without interfering with them. The point is that an operator, especially at a time that requires extra vigilance — like surfacing, needs to actively direct his attention to his equipment and scan for threats at least once every three seconds.

While this sounds easy enough, it requires a great deal of will and energy. Distractions constantly compete for attention and need to be reduced. Again, training is the only way to control this and create an environment that rewards attentive execution of duty and punishes the creation of distractions and sloppy behavior. I suspect that if the navy chose to drill procedures in vigilance and active surveillance as often as they train for emergencies or attack maneuvers, the frequency of these incidents would be dramatically reduced.

P.G writes:

Excellent stuff on complacency, but "culture of safety" might be too strong a goal for any place in the military. It's true that the Navy is the service where war most closely resembles peace. Most naval ships in WWII saw only a few hours of combat over the years' duration. Day-to-day operations were quite similar to peacetime ops, with the environment (including friendly ships) being the principal enemy. But the few hours of combat were the whole point, and it seems to me that safety must not be so deeply ingrained that it cannot be easily discarded when the necessity arises.

Paolo Pezzutti writes:

Western navies nowadays are dealing with decreasing budgets, changing operational scenarios and threats, issues in recruiting and retaining the professionals they need. All these factors are tightly linked. The level of ambition of naval forces is questioned in terms of requirements and capabilities needed. The threats is different from what it was at least two decades ago and attention is growing mainly for maritime security tasks. Hard to justify expensive investments to develop complex and futuristic weapon systems. For sure maintaining the fleet efficient and effective is tough at times when navies are struggling not to reduce numerically their fleets below critical thresholds. Recruiting highly skilled professionals and most of all retaining them is also critical. They need to find a motivating environment that meets their expectations. Innovation and technology are allowing the reduction of manning on board ships and submarines in order to achieve the compression of operating costs. This is also introducing risks because each member of the crew has more tasks than in the past to perform and no redundancy. On the job training and management of emergencies are issues to deal with. More focus over the past years is on modelling & simulation to train crews ashore although any sailor knows that these solutions cannot fully replace experience gained at sea. Some have questioned the extent of manning reduction that was envisioned as acceptable only a few years ago based on lessons learned developed on new constructions. The quality of training is key as days at sea spent each year tend to decrease. Incidents are the expression of this situation. Training concepts and processes have to change and adapt rapidly to this environment. As budget and personnel decrease, this is the challenge of this decade.

An interesting sidenote about, "Stick close close to your desks and never go to sea, And you all may be rulers of the Queen's Navee!":

The object of Gilbert's satire is not so much the person of publisher and politician W. H. Smith as the system that in essence de-professionalized command positions in the British armed forces, and promoted those with wealth and political connections rather than military ability. Thus, Gilbert was in effect attacking the long-standing aristocratic tradition of purchasing commissions. Instead of "serving a term" as a midshipman (which was the conventional route leading to officer status and ship's command), Sir Joseph has taken a strictly political route to the Admiralty.

Russ Herrold writes:

A former officer (here: identified as JG) from the US Navy who served in submarines inter-lineates replies to the article you linked to:

Sub commanders are under a lot of pressure to keep their sailors from leaving the navy (JG agrees). But the long periods submarine sailors spend away from their families creates pressure to get out and take a civilian job close to home. (JG agrees) The submarine sailors are very capable, and highly trained, people. Getting a better paying civilian job is not a problem. So sub captains try to keep the crews happy. That often leads (JG: Bull Shit!) to lax discipline. (JG continues: just lax discipline with this command)

Interestingly the article's remarks about generally available better substitutions employment were not addressed in the initial comments back to me; in following up privately, JG thinks the author is over-stating the substitution opportunities …

But then that makes for a more urgent article, then, doesn't it?

Chris Tucker adds:

My whole point is that these people are professionals and should be behaving like professionals. They are in positions of responsibility and need to act as such. There is a tremendous amount of self validation that comes with knowing that you know your business and that you act accordingly. People that understand this arrive at work with their heads held high and don't just talk the talk but actually walk the walk. They don't feel entitled to anything unless they've earned it themselves. This is the kind of behavior and path to self esteem that needs to be engendered. It is not about safety, per se, probably a bad choice of words on my part. It's about being a professional, about being an expert. And about wanting to be those things. It's about knowing what needs to be done and doing it properly, correctly and without fail.

Jan

21

Apple’s A Changin’, from David Lillienfeld

January 21, 2013 | 2 Comments

Any doubts about Apple under Tim Cook being different than the Apple under Steve Jobs are gone by now. Apple capex is up, there's a swing in production back to the US, and there have been at least one "significant" software disaster. Now come the reports of changes in the product cycles and product introduction schedules. Apple hasn't shied from cannibalizing its products in the past, so I don't this it will pause from doing so now. I'm wondering at what point does the smartphone market go generic? Conventional wisdom is that with the Chinese now buying smartphones, the market will only expand. Perhaps. But are the Chinese prepared to pay the premiums for smartphones as Westerners have? That's a problem not just for Apple. Then again, I've yet to walk into an Apple store that wasn't packed. Even during the recession.

Any doubts about Apple under Tim Cook being different than the Apple under Steve Jobs are gone by now. Apple capex is up, there's a swing in production back to the US, and there have been at least one "significant" software disaster. Now come the reports of changes in the product cycles and product introduction schedules. Apple hasn't shied from cannibalizing its products in the past, so I don't this it will pause from doing so now. I'm wondering at what point does the smartphone market go generic? Conventional wisdom is that with the Chinese now buying smartphones, the market will only expand. Perhaps. But are the Chinese prepared to pay the premiums for smartphones as Westerners have? That's a problem not just for Apple. Then again, I've yet to walk into an Apple store that wasn't packed. Even during the recession.

"Rumor: Apple to debut 4.8" 'iPhone Math' device alongside next-gen iPhone in June"

Henry Gifford writes:

When I bought my phone the guy in the store (in New York City) told me the US Federal government subsidizes every mobile phone in the US to the tune of $600, limit once per person per two years, thus the two year contracts.

Subtract $600 from the price in China and the price is quite similar to the US price.

Russ Herrold replies:

Yeah, counter clerks will say almost anything. The truth is more commonplace. Some subsidies exist, nominally for low income folks but the people PAYING FOR that subsidy are … [hint: go read your cell phone bill closely] all the other telephone users. This is a good article about it.

Jan

2

The Difficulty, from Victor Niederhoffer

January 2, 2013 | Leave a Comment

The difficulty of getting back in once you have sold in stocks is underlined vis a vis the buy and hold strategy, as well as the fate of short selling, as well as timing— by the fast 50 point move in stocks today.

Gary Rogan writes:

It seems like generally speaking one should either trade, as in being in and out "often" or buy and hold. Buying and holding except for periodically being out or short seems to be what Victor is addressing, and I have always been suspicious of "market timing". All it takes is getting it wrong once, and you are in a hole that's expanding for a long time.

I'm still curious how Victor was so sure there would be a deal.

Anonymous writes:

What was the effective date of the STOCK Act to ban congressional insider trading, I wonder. As a staffer, one could have slapped the emini around harder the Khan brothers squash ball.

Victor Niederhoffer replies:

Let us hope that the profits from such activity were sufficient to assuage any such desires for a few days.

Russ Herrold writes:

The dance is a re-run and in prior seasons, the cliff is avoided. Sitcom writers can re-cycle plots endlessly.

Kim Zussman writes:

It's the binary conundrum of markets:

Buy the rumor / sell the news (or buy the news)

Buy and hold (or sell and sit)

You can't time the market (but some can)

Stocks beat bonds (except for the last decade)

Printing presses lead to disaster (which may not come in our lifetime)

The President of the Old Speculator's Club writes in:

I heard a Congressman speak recently and have to admit it was an enlightening experience. Traditionally, members display a certain amount of restraint when speaking of colleagues with whom they find grievous fault. In a refreshing departure from good manners, this gentleman took the gloves off and bluntly stated that a goodly number of his fellow representatives are less than bright. The word "clown" came up several times and "stupid" might have been slipped in.

Although he artfully avoided specifying individuals or party, I couldn't help but believe that he, like many in the "beltway", had come to the same conclusion: the arrival of the Tea Party contingent has been nothing short of a national disaster.

Unsurprisingly, the congressman's public and scathing view is shared by the current establishment elite. (It's dangerous to out there and speak your mind if what you say is out of step with the conventional wisdom.) His case is provided with added cover by a host of recently published and similarly themed books ("It's Even Worse Than It Looks", Mann, "Do Not Ask What Good We Do", Draper, "Beyond Outrage", Reich, and "The Party is Over", Lofgren).

However, the "fiscal cliff" isn't a maiden making her debut. We've had two relatively recent encounters with her; so her charms, though formidable, are familiar. Her appearances in '91 and '95 were just as awesome and, as expected, so compelling that one of the parties bit into the proffered apple. Unfortunately, the fruit, which is bitter and often fatal, is the produce of the tree of Folly. On this most recent visit, though, she is confronted by a group so naive and simple that her blandishments have gone unrequited.

In any event, it's apparent that the respect (whether real or faked) House members used to show each other, at least in public, has been thrown over for a newer, more aggressive, in-your-face approach. Long gone are the clever and informed debates which provided a rich mix of facts, history, and truth. It seems important to figure out why this has developed and if, in fact, a functioning government is still possible.

If one studies what the House has been in the past and what it has evolved into, it's impossible to overlook that this body has lost, or given up, much of it's power and authority. The growth of the executive branch (the Imperial Presidency) is one factor. Back in '96 the congress and the president worked long and hard to create the first welfare reform package. Contrary to forecast of terrible consequences, the new programs worked well.

Yet, in one day, an Executive Order by the current president re-established the old, failed programs. Another assumed power has been the declaration of war, and the most recent threat: unilaterally raising the ceiling on the debt.

While the Executive Order has been increasingly utilized to usurp powers constitutionally granted to the House (and Senate), the greatest loss of power has been though Congress' voluntary abandonment of authority to "regulatory agencies."

Figuring that some issues were just to tough, complex, or time consuming, the country has had foisted upon itself the EPA, FDA, TSA, USDA (with 20 sub-agencies within it), the Dept.of Commerce (with 17 sub-agencies), Dept. of Defense (with 32 sub-agencies) and the list goes on and on. Each agency is staffed by unelected individuals, many with their own agendas, who dictate new regulations that possess the force of law. It's understandable that so much work has to be delegated, but to give it to agencies that are unanswerable to the body that created them is inexcusable.

Then, of course, there is "party discipline." Sam Rayburn of Texas, Speaker of the House for many, many years, gave each incoming freshman representative of his party one piece of advice: "If you want to get along, go along." And they did. Those that didn't faced many difficulties: in committee assignments, in getting their legislation to the floor, in receiving party re-election funds, and they'd be high on the list of targets should redistricting become an issue.

Unfortunately, this approach worked, and worked well. As a result, many constituents found that the views they wished their representatives to promote in D.C., took a back seat to the views favored by the party leaders - many of them from different parts of the country with substantially different interests and goals. The "house of the people" became a house held hostage. Matters reached a new low in representative government when the other party adopted the same process.

Then 2080 rolled around and enough citizens, aggravated at the apparent unresponsiveness of their representatives, threw them out and ushered in the Tea Party. A delicate balance has been disturbed and the Dysfunctional Couple, used to newcomers adjusting to them, failed to realize that these clowns - these yahoos, actually believed in what they'd declared. Whether they win or lose, prevail or fail, their chances for another re-election are small. But for a brief period they have served as reminders that doing the people's business is serious business and that a promise made is a debt unpaid.

For a brief period this collection of vagabonds has added a dose of virility to a confederacy of eunuchs.

As to the President's actions in the recent negotiations, he did nothing, offered nothing…he arrogantly summoned everyone back to D.C. Most came back assuming he had a proposition - he didn't - even CNBC's John Harwood was a little taken aback at the presumptuous gesture. Some time back I suggested I was all for giving this guy everything he asked for - and then letting him perform as he has suggested he would. He has received almost everything; now it's time to lead. This from a guy who, in his short term in the Illinois senate, voted "present" on over half the bills that went through. He is structurally averse to taking a position - preferring, instead, to demonize his opponents.

So, first time at bat, he (and his faithful followers), are hand-wringing over what roadblocks the GOP will/might place before a debt ceiling deadline is reached. It's time he quit talking and started doing.

Apr

30

What PayPal is Good For, from Russ Herrold

April 30, 2012 | 1 Comment

Is there a reason to use PayPal rather than a direct credit card disclosure to a Credit Card accepting vendor? Yes. The CC accepting vendor may be wholly unknown to you, and could potentially be a front for 'harvesting' CC and all one's other information needed to forge your identity online.

Is there a reason to use PayPal rather than a direct credit card disclosure to a Credit Card accepting vendor? Yes. The CC accepting vendor may be wholly unknown to you, and could potentially be a front for 'harvesting' CC and all one's other information needed to forge your identity online.

True story: there appeared an online vendor that Google's Shopping feature 'found' that purported to have in stock and for immediate shipment an unreleased product from 'pointing device' manufacturer Wacom. I was dealing with their engineering product team, and at the time in question, they checked for me and confirmed that no authorized shipments had occurred to any authorized sales agent.

The order form for an entity with no physical office and no phone number was most comprehensive in gathering personal details for the CC authorization and shipment, of course. This was in the back of my mind, and I concluded not to proceed to provide such information to the 'seller'.

By using PayPal, one adds a intermediary to avoid disclosing CC details — number, expiry and CVV — to a potential gateway agent to identity theft, and also gets a guarantor to the transaction (PayPal) who actually has existence and does not hide contact information from its patrons.

–

Jan

22

Hats, from Victor Niederhoffer

January 22, 2012 | Leave a Comment

I am researching and reviewing my contact with hats over a not uneventful life. I am considering their value, their uses, their symbolic significance, the great people I know who have worn them, the hat corporation of America I bought as my first trade, the hat that Tom Wiswell always wore to prevent sunburn and cover up baldness, the hat that Shane wore that made him an icon, the hat that the accountant in Monte Walsh wore that Hat Hendersson just couldn't resist noting was just right for a pistol shot, the hat that I wear now to show my respect for those previous, the man I called Hats H. because he always had a million different conflicts of interest while working for us. The importance of a hat outdoors in the West to shield from rain, sun, and the elements. Et al. What value do you see in hats these days? What anecdotes? They seem to have gone out of style because of the automobile. You don't need protection from the elements any more. Also they're hard to store. How do they relate to markets?

I am researching and reviewing my contact with hats over a not uneventful life. I am considering their value, their uses, their symbolic significance, the great people I know who have worn them, the hat corporation of America I bought as my first trade, the hat that Tom Wiswell always wore to prevent sunburn and cover up baldness, the hat that Shane wore that made him an icon, the hat that the accountant in Monte Walsh wore that Hat Hendersson just couldn't resist noting was just right for a pistol shot, the hat that I wear now to show my respect for those previous, the man I called Hats H. because he always had a million different conflicts of interest while working for us. The importance of a hat outdoors in the West to shield from rain, sun, and the elements. Et al. What value do you see in hats these days? What anecdotes? They seem to have gone out of style because of the automobile. You don't need protection from the elements any more. Also they're hard to store. How do they relate to markets?

Alan Millhone writes:

Dear Chair,

I remember well the hat Tom wore. The ball cap I wear has a board on it (see picture). The Market trader might wear such a hat to remind them to look ahead and make the right moves (trades).

.

.

.

.

Sam Marx writes:

On the subject of "Hats". I am reminded of the aversion that John F. Kennedy had to hats and the picture that has stayed in my mind, since 1961, is of his carrying and not wearing his hat at his inauguration. I believe it was his attitude that caused the downswing in hat wearing in the U.S.

Tim Hesselsweet writes:

Seems like a good example of ever-changing cycles. The hat has been making a comeback for the last several years. Kate Middleton has become a popular figure and she frequently wears hats. Upscale department stores like Saks now carry a large selection of hats as well.

Seems like a good example of ever-changing cycles. The hat has been making a comeback for the last several years. Kate Middleton has become a popular figure and she frequently wears hats. Upscale department stores like Saks now carry a large selection of hats as well.

Alston Mabry responds:

Yes, but…mens hats are a different dynamic:

Look at this photo of mens hats at a Liberty Rally in Columbus Circle, 1918, and mens Hats at the Horse Races 1920s style, and 1950s Men with hats.

Scott Brooks writes:

When I graduated high school, the guy who measured my head for my mortar board said, "Young man, I've been doing this for 35 years and you have the biggest head I've ever measured".

As a result of my freakishly large cranium, hats rarely fit me. I wear one from time to time, but only out of necessity, and occasionally for functionality.

As a result of my freakishly large cranium, hats rarely fit me. I wear one from time to time, but only out of necessity, and occasionally for functionality.

Necessity is when I need to keep my bald head from burning in the sun or freezing in the winter or dry in the rain. Never under estimate the insulating and protective qualities of hair.

Functionally is because I need a hat when I hunt to keep the sun out of my eyes when I'm scanning for game, peering through my scope to place the cross-hairs on the shoulder of my intended quarry, or placing the aiming pins of my bow in the middle of said quarries chest cavity.

I avoid hats otherwise as I can rarely get one big enough to fit. If I wear one too long, it gives me a headache. Therefore, when it comes to trading, if you see me placing a trade while wearing hat, fade my position as I'm likely making a losing trade because my mind is clouded by the hat that is squeezing my brain all to tightly.

Pete Earle writes:

I wear a hat, and have for seven or eight years. When I began to wear one, I expected to be lightly razzed by friends; that not only didn't deter me, but never occurred. Instead I've received unexpected compliments, and over the last few years other have seen a higher frequency of hat wearers in Manhattan, Washington D.C., and even when I'm down in Auburn and Atlanta.

Christopher Tucker writes:

The grandfather of my best friend from college was one of the kindest and most sensible men I have ever met. He was a traveling sales rep for the John B. Stetson company. The man always had the best (the absolute BEST) hats.

GAP Capital comments:

Born and raised in Chicago, so "hats" remind me of only one person…Dorothy Tillman!!!

Anton Johnson writes:

"By some accounts, Christopher Michael Langan is the smartest man in America……….he has a fifty-two-inch chest, twenty-two-inch biceps, a cranial circumference of twenty-five and a half inches–a colossal head, more than three standard deviations above the norm"

Esquire article on "The Smartest Man"

Alan Millhone sends another photo:

Here is Tommie Wiswell with his trademark hat tilted back. Might also been used to keep

overhead light from his eyes while he focused on the many boards.

.

.

.

.

.

.

.

.

.

.

.

.

.

Russ Herrold writes:

I am traveling, and so cannot conveniently post, but I placed orders this week for a new Stetson, a couple of Fedora designs, and some other … I forget …and have in my car, for the conference I am at this weekend, easily 5 or so, which I use both for their protection of my head from the cold, and also so I can 'do some branding' work in the community the conference represents (I also have other 'branding' in my clothing, and appearance), such that people I deal with, who don't know me by sight, can recognize me anyway.

I am traveling, and so cannot conveniently post, but I placed orders this week for a new Stetson, a couple of Fedora designs, and some other … I forget …and have in my car, for the conference I am at this weekend, easily 5 or so, which I use both for their protection of my head from the cold, and also so I can 'do some branding' work in the community the conference represents (I also have other 'branding' in my clothing, and appearance), such that people I deal with, who don't know me by sight, can recognize me anyway.

Marion Dreyfus adds:

I think I am fairly well known as a hat person, and have been since I wore unusual chapeaux /to synagogue and school when 12 or 13.

Aside from style and stating an individualistic aspect, I think a hat harks back to a gentler, more mindful age, perhaps 100 years ago. It also keeps the head, inside of which are all these excellent ideas and scenes for a better tomorrow and a niftier evening today, comfy-cozy. Hats also show, oddly enough, respect. Hatless men in the 1970s were declaring their freedom from the mindfulness of suit and hat, and perhaps we are the poorer for having abandoned hats.

They also keep milliners in funds, and milliners I went to grad school with in the early 90s were aghast at the drop in hat-wearing citizens, alleviated only by temporary crazes or fads that fade as swiftly as they arise.

As a biker, for me, even mild days produce a breeze when one is on that leather seat, and a hat prevents sunstroke and sun in one's eyes as well as too much wind over one's head.

In the Orthodox world, wearing a hat connotes one is married, so it may be foolish of me to wear hats, because i communicate a status I do not currently entertain. But i do like the fashion and focus statement being made by wearing a lid, many of which, actually, i create myself.

Finally, one can maintain a superior air of mystery in a hat, which is impossible to the same degree in a hatless state.

Alan Millhone adds:

What really amazes me on hats are the clods at football games I attend who don't remove their head cover when the National Anthem is played.

Ken Drees muses:

The baseball cap trend: rappers wearing the caps askew, wearing caps with logos of designers and companies, wearing caps for status/advertising, caps as gang signal, wearing caps in restaurants/indoors, wearing hoodies in lieu of caps, caps as fashion, caps on backwards, caps with brim curved just so, it all has to do with being cool. Lebron James wears Yankee cap to Indians games–it's all about me, fool.

The baseball cap trend: rappers wearing the caps askew, wearing caps with logos of designers and companies, wearing caps for status/advertising, caps as gang signal, wearing caps in restaurants/indoors, wearing hoodies in lieu of caps, caps as fashion, caps on backwards, caps with brim curved just so, it all has to do with being cool. Lebron James wears Yankee cap to Indians games–it's all about me, fool.

Gary Phillips writes:

"Wearing a cap backwards is a baseball fan tradition that started with Yankee fans. It wasn't because they liked Yogi Berra, either. The Yankees and Red Sox have a century-old rivalry. A group of young guy Yankee fans, around 1980, took the train up to Boston to catch a couple of games. Boston fans are loud and boo other teams. The young Yankee fans were seated in front of loud Bostonians. The New Yorkers didn't want to start an altercation, but made statement. Those guys turned their Yankee caps around backwards to show the Bostons that they were Yanks fans and proud of it."

Anton Johnson writes:

On baseball's rally cap superstition:

"A rally cap is a baseball cap worn while inside-out and backwards or in another unconventional manner by players or fans, in order to will a team into a come-from-behind rally late in the game. The rally cap is primarily a baseball superstition."

And hockey's Hat-trick.

Victor Niederhoffer writes:

It would be nice if this worked in the market. But then the adversary could always tell if you were weak or strong, especialy if signals could be reflected from the hat. I was surprised to see that in all the uses for hats I have collected, including flopping the rump of your horse, and fanning a fire, and collecting water from a stream or the rain, I did not see many variants of using it as a signal to get a cab or alert a Native American that a interloper was near, or to collect bets, or to conceal a salt shaker. This latter is particularly effective in the west because to ask a man to remove his hat is akin to a date with boot hill.

Gary Phillips adds:

Surely not a hat, barely a cap, let us not forget the kippah or yarmulke. The Talmud says that the purpose of wearing a kippah is to remind us God is the Higher Authority over us. He alone is Lord of Lords and King of Kings. When we pray and worship with our heads covered, we are saying that we are in total and complete submission to the will of God Almighty now and forever.

Surely not a hat, barely a cap, let us not forget the kippah or yarmulke. The Talmud says that the purpose of wearing a kippah is to remind us God is the Higher Authority over us. He alone is Lord of Lords and King of Kings. When we pray and worship with our heads covered, we are saying that we are in total and complete submission to the will of God Almighty now and forever.

I was recently in the hunt for 2 of the crocheted variety for my 2 and 4 year olds to wear to school. My elder son demanded that the kippah be white with a blue Magen David. The synagogue gift shop was unable to fill our order, so I turned to a higher authority - E-bay. As J. Peterman would say, it is 6" in diameter — one size fits all. Handmade in Israel with a *very small* fine stitch. The yarmulkes are from Israel and are made by people who have made Aliyah; low income and handicap people, generating income to make a living.

I grew up and observant Jew until I had my first taste of bacon and blondes, and I never looked back. However, I now find myself lighting the candles, saying the hamotzi, and making Kiddish on Friday nights… Nice.

Jim Sogi writes:

A hat is essential in Hawaii to keep off the sun, rain and wind, to keep glare out of your eyes, and at night on the mountain for warmth when it gets cold. There are different hats for different situations. A baseball cap is good all around since it keeps the sun off your face, stores easily, can be worn in a car and is cheap and stays on in a brisk wind. A good brim hat is good to keep the sun and rain off the back and shoulders as well. A nylon hat is light and can be washed. A waterproof rain hat is good for extended rain, and a light nylon brim is good for hot sun. A small brim bucket with a strap is worn in the water while surfing to keep intense sun at bay for hours in the water, and to stay on in the surf. A knit or fleece watch cap is good for boating at night or sleeping in the cold. A helmet is good for sports to protect the skull from boards, rocks, trees and impact. The Original Buff is an adaptable piece that can be worn as a hat, scarf, or facemask. A balaclava is good for winter conditions and can be used as a hat, or face mask in windy conditions. I must have 20 or more hats.

A hat is essential in Hawaii to keep off the sun, rain and wind, to keep glare out of your eyes, and at night on the mountain for warmth when it gets cold. There are different hats for different situations. A baseball cap is good all around since it keeps the sun off your face, stores easily, can be worn in a car and is cheap and stays on in a brisk wind. A good brim hat is good to keep the sun and rain off the back and shoulders as well. A nylon hat is light and can be washed. A waterproof rain hat is good for extended rain, and a light nylon brim is good for hot sun. A small brim bucket with a strap is worn in the water while surfing to keep intense sun at bay for hours in the water, and to stay on in the surf. A knit or fleece watch cap is good for boating at night or sleeping in the cold. A helmet is good for sports to protect the skull from boards, rocks, trees and impact. The Original Buff is an adaptable piece that can be worn as a hat, scarf, or facemask. A balaclava is good for winter conditions and can be used as a hat, or face mask in windy conditions. I must have 20 or more hats.

As with all equipment, each type of hat is specialized for specific conditions, and there is not one that is good for all conditions. As with markets, its good to have specialized systems and rules for the differing conditions or cycles and no one rule is good in all conditions but must be tailored to match the expected conditions.

Rudy Hauser writes:

I do not wear a hat indoors with the exception of trains and planes or if there is no good place to put the hat. If there is a draft from air conditioning it helps to keep me from getting a headache. But more important is that unless I just want to hold my hat in my hands there is no good place to put it. I prefer to read, not hold a hat. I once made the mistake of putting a Panama hat in the overhead rack in a plane. The motion of the plane bounced it around enough to ruin it. That gives me little choice but to wear it. If I have a hat without a brim, such as my winter hat, I can a do take it off aside from trains which are not that warm.

Bill Rafter adds:

Glare, particularly from lensed overhead lights or high-hat floodlights can cause headaches and eyestrain. That can easily be counteracted by wearing a baseball cap or other large-brimmed hat indoors. I have kept one at my desk for decades.

Glare, particularly from lensed overhead lights or high-hat floodlights can cause headaches and eyestrain. That can easily be counteracted by wearing a baseball cap or other large-brimmed hat indoors. I have kept one at my desk for decades.

For years I noticed that whenever I saw a certain actor & director, he was always wearing a hat, even indoors. Then I saw him entering a food emporium at a ski area and he removed his hat. I immediately understood why he always wore one — his particular baldness aged him at least 10 years. So his vanity choice was either a wig or a hat, and he chose the hat.

Hats indoors also provide a level of anonymity for those who do not want to be recognized in an airplane or robbing a bank.

My first "real" hat was a Homburg, which was required for one of my college jobs: pallbearer.

Sep

17

Briefly Speaking, from Victor Niederhoffer

September 17, 2011 | 3 Comments

Have you ever noticed how those who have done you the most wrong, or those who loathe you the most, when they come onto hard times will often come back to you asking for assistance. This often happens to me with former colleagues. I can't always differentiate between whether the colleagues are in such bad straights that they will go to their most unlikely and ill wanted savior, or whether they wish to take their worst enemy down with them once more before they finally go under. I believe it is a variant of rats deserting a sinking ship. The British Navy and I believe all navies have a standard order from their captain "every man for himself " when the ship is sinking. And there is doubtless maritime law about when it is legal to put the captain in chains, (albeit this is somewhat a different situation). I believe the idea has many market implications, especially when markets have gone to the nadir like last week, but more important is how to protect your life in such situations I think.

Have you ever noticed how those who have done you the most wrong, or those who loathe you the most, when they come onto hard times will often come back to you asking for assistance. This often happens to me with former colleagues. I can't always differentiate between whether the colleagues are in such bad straights that they will go to their most unlikely and ill wanted savior, or whether they wish to take their worst enemy down with them once more before they finally go under. I believe it is a variant of rats deserting a sinking ship. The British Navy and I believe all navies have a standard order from their captain "every man for himself " when the ship is sinking. And there is doubtless maritime law about when it is legal to put the captain in chains, (albeit this is somewhat a different situation). I believe the idea has many market implications, especially when markets have gone to the nadir like last week, but more important is how to protect your life in such situations I think.

One finds that there are only 25 suicides a year at Niagara Falls these days, and The Golden Gate has much more, but one can't speculate as to whether the sight causes the suicides or whether people with suicide on their mind tend to go there to do the deed. As for market moves, they must cause many more such catastrophes but again whether the person seeks out the opportunity or the opportunity causes the action, or both, it would be hard to unravel and a quantitative study of the types of moves that induce same would be helpful for saving lives and profits.

Russ Herrold writes:

I've had this happen a few times. I think the reason is that the former colleague or friend is sufficiently 'intimate' with the weak spot that their former friend had, and so can 'get past your guard' more easily.

Factor in some perverse pathological character trait, and they may even feel justifies in taking advantage of someone they feel has 'done them wrong' in the past. Indeed, it may be that there was an intent to deceive (conscious, or latent) from the onset of them approaching you, 'the mark'.

The best approach is to probably to buy the lunch, but to keep one's checkbook firmly locked up.

Polonius: (to his son)

Neither a borrower nor a lender be, For loan oft loses both itself and friend, And borrowing dulls the edge of husbandry.

Hamlet Act 1, scene 3, 75.77

and later

Polonius:

This above all: to thine own self be true, And it must follow, as the night the day, Thou canst not then be false to any man. Farewell, my blessing season this in thee!

Laertes: Most humbly do I take my leave, my lord.

Hamlet Act 1, scene 3, 78.82

The thought expressed by Vic is that there should be some heightened sense of gratitude if one is dealing with a moral person and 'offering the hand up' and a hand-out. But Twain echoed the Bard on this topic as well:

If you pick up a starving dog and make him prosperous, he will not bite you. This is the principal difference between a dog and a man.

- Pudd'nhead Wilson

Steve Ellison writes:

When my children were 5 and 3, we hiked across the Golden Gate Bridge. There had recently been a freak accident in which a small child had somehow fallen through the small gap between the bottom of the railing and the sidewalk to her death. There were plans to replace the railing with one that went all the way down to the sidewalk, but the work had not been done yet, so I was keeping a close eye to make sure the children did not go too close to the railing. While my attention was diverted in this direction, I was almost caught off guard when the 3-year-old climbed on top of the one-foot high barrier between the sidewalk and the speeding traffic.

When my children were 5 and 3, we hiked across the Golden Gate Bridge. There had recently been a freak accident in which a small child had somehow fallen through the small gap between the bottom of the railing and the sidewalk to her death. There were plans to replace the railing with one that went all the way down to the sidewalk, but the work had not been done yet, so I was keeping a close eye to make sure the children did not go too close to the railing. While my attention was diverted in this direction, I was almost caught off guard when the 3-year-old climbed on top of the one-foot high barrier between the sidewalk and the speeding traffic.

T.K Marks writes:

I, too, have walked across that bridge on numerous occasions. I'd walk over to Sausalito and take the ferry back. A spectacular stroll. One is still struck mid-span by the ease at which a despondent person could reach their goal. The curiously low railings prompt one to macabre thoughts. Who was the civil engineer involved with this project, Derek Humphry?

Stefan Jovanovich answers:

The answer is Charles A. Ellis. Joseph B. Strauss did everything he could to claim credit for it (Strauss was to architects and engineers what Douglas MacArthur was to the Army and Navy - even when he was wrong, he was right - just ask him). Ellis reworked Strauss' initial proposal for a cantilevered suspension bridge - which would have been the mating of the Forth bridge with a ropewalk - and produced the design one sees today. Ellis did almost all the actual work - the calculations required for the computation of stresses, the specifications, contracts and proposal forms - singlehandedly, working non-stop for 2 years. After Ellis completed the work but before the final designs were submitted to the Bridge District's Board for its review and final approval, Strauss fired Ellis. There was no mention of Ellis in any report by Strauss, including the final report upon the bridge's completion in 1938. Ellis was the equal of Louis Sullivan, and like Sullivan he spent half his working life in total obscurity, unable to get any further commissions. Moisseiff gets credit for the development of deflection theory; but, as events proved (see "original bridge" section of Tacoma Narrows bridge), Ellis was the person who fully understood the necessary relationship between span length and flexibility. He is literally the father of the modern suspension bridge and the engineering theory behind it.

The answer is Charles A. Ellis. Joseph B. Strauss did everything he could to claim credit for it (Strauss was to architects and engineers what Douglas MacArthur was to the Army and Navy - even when he was wrong, he was right - just ask him). Ellis reworked Strauss' initial proposal for a cantilevered suspension bridge - which would have been the mating of the Forth bridge with a ropewalk - and produced the design one sees today. Ellis did almost all the actual work - the calculations required for the computation of stresses, the specifications, contracts and proposal forms - singlehandedly, working non-stop for 2 years. After Ellis completed the work but before the final designs were submitted to the Bridge District's Board for its review and final approval, Strauss fired Ellis. There was no mention of Ellis in any report by Strauss, including the final report upon the bridge's completion in 1938. Ellis was the equal of Louis Sullivan, and like Sullivan he spent half his working life in total obscurity, unable to get any further commissions. Moisseiff gets credit for the development of deflection theory; but, as events proved (see "original bridge" section of Tacoma Narrows bridge), Ellis was the person who fully understood the necessary relationship between span length and flexibility. He is literally the father of the modern suspension bridge and the engineering theory behind it.

Bill Rafter comments:

There was a psychology professor that published a study showing that the vast majority of Golden Gate jumpers took the leap on the side facing the city (facing East) rather than the ocean (West) side. The article then attempted to theorize why this might be the case, and he concluded that it was an attempt by the jumper to say goodbye one last time. Nice thought, but it totally ignores the reality that it would be damned hard to jump on the ocean side as that pedestrian walkway is almost always closed.

It must be particularly interesting to be on the bridge when one of the big carriers goes under, as they have to time it with low tide to clear.

Sep

7

No Email Say Docs, from Dan Grossman

September 7, 2011 | Leave a Comment

In a survey of doctors on a website I follow, 80% of responding doctors answered no way would they allow their patients to email them.

In a survey of doctors on a website I follow, 80% of responding doctors answered no way would they allow their patients to email them.

This was the response I posted:

To the 80% of responding docs who say "No way": If you wonder why many patients develop major hostility to doctors' office procedures and to doctors themselves, and why the public is happy to stay silently on the sidelines while the government and insurance companies take over control of doctors' working lives, could it be that doctors (who for 100 years had control of their practices and refused to make them patient-friendly and efficient) have failed to enter into the 21st century? And regard it as perfectly acceptable to impose inefficiency, frustration and wasted time on patients by not letting them communicate with the doctor but requiring them to make an office appointment (probably 3 or 4 hours with travel to and fro, long office waits, etc) for every question or matter?

I see nothing wrong with a doc charging for email or telephone time. Those patients wishing to use email or telephone should be willing to pay the time charge, regardless of whether such charge is covered by insurance. But if our profession continues to lord it over patients by refusing to allow them what every other profession and all of modern life does, doctors will deserve what they get in the way of government and insurance oversight and regulation.

Charles Pennington writes:

Chiming in, that is a pet peeve of mine. What other profession won't take email? Lawyers, dentists, accountants, etc. all communicate by email, of course. Doctors make it even worse by making you communicate with them only via a voice-mail maze that begins with "If you are a physician, press 1; otherwise, your call is very important to us so please remain on the line…"

Russ Herrold comments:

I'm with the doc's here.

When the tears are flowing, everyone says they are willing to pay, but without getting into the business of FIRST AND AT THE ONSET, having a Retainer Agreement, unilateral right to draw it down upon presentation of statement, Mandatory Arbitration clause, deposit for fees in the Trust Account, all one does is lay a background for a fee dispute complaint or malpractice counterclaim to a suit to collect those fees. It's not gonna happen as a general practice. The doc is caught between the rocks of patient desire for immediacy and convenience; the professional obligation 'not to miss' something that in hindsight seemed obvious; and the fact that insurer reimbursement for web and email oriented 'treatment' lag.

Having had poor service (breaches of patient confidentiality, outright prevarication by nursing staff, and failures of delivery of test results repeatedly and after specific instruction) in the care of a wound, all since May of this year, from the standpoint of the patient, I want there to be a formal paper trail (not email; not call center notes in some database, forgotten and closed; not some other ephemeral media) … a well drafted letter explaining the issue, a file CC, and a cc to the supervising agency (hospital system privacy officer, nursing board, 'authorized provider' certification entity), and an equally formal response (or in its absence, proper escalation on my part).

Unreasonable, I know, but progress is made on the backs of unreasonable people.

The same goes for lawyering. If a client cannot keep and will not pay for an office visit, or meeting at other venue of their choice, to permit the open-ended probing that proper representation requires, they won't be MY client very much longer, as I cannot properly represent them.

Alex Forshaw writes:

The fact stands that interacting with doctors is a pain in the ass from the second you enter the door. They do not face nearly enough competition. There is no bigger beneficiary of protectionism in the entire country. The lack of competition has meant they face no evolutionary pressure. I hate "socialized medicine" as much as anyone but US doctors are as much culprits in their own demise as the tort bar and all of doctors' other favorite bogeymen.

George Zachar adds:

In my conversations with doctors, I've been told the potential legal and regulatory liabilities risked by patient email contact are vague and large, leading them to simply shun the practice.

Phil McDonnell writes:

Regular email is not a secure medium. Privacy regs hamper a Doc's ability to use email. Most will call you on the phone and/or write a letter with results. That is why expensive software with encryption is required that often the smaller practices cannot afford.

Gordan Haave responds:

Sure that's what they say. But it's BS. How is the fax or telephone somehow more secure than email?

If the issue is confidentiality, why is it that Lawyers will email you but not Doctors?

There is one other group that won't send emails: The IRS.

I am in the middle of a personal and business audit, and you can't email the IRS. It's very inefficient.

To me this is just further proof that Dr's collectively are not the saints they claim to be, but rather just a cartel that uses wildly inefficient systems to extract rent's from consumers.

Dan Grossman writes:

I am surprised that a few otherwise highly astute Speclisters so easily accept doctors' excuses for refusing to permit email. As a service to the medical profession and to our country (and in time for inclusion in the President's speech tonight as a new regulation under the Patient Protection and Affordable Care Act), I have drafted and present below a few simple groundrules that a doctor can require a patient to accept as a prerequisite for emailing him.

"A Patient wishing to email Doctor must indicate his acceptance of the following:

1. Complex or detailed matters require an office visit. This email is for minor procedural, scheduling and prescription renewal matters.

2. Doctor will attempt to look at reasonable numbers of emails as time permits but because of his busy schedule cannot commit to read or deal with every email. Any information Patient wishes to convey with certainty must be conveyed by other means.

3. Emails are not secure and should not include sensitive personal information. They will not necessarily be presevered or included in Patient's medical file or record.

4. Patient agrees to pay $20.00 for each ten minutes or part thereof Doctor spends reading or dealing with emails from Patient, regardless of whether the amount is reimbursable to Patient by his insurer. Medicare and Medicaid Patients unfortunately are not eligible to use this email since such programs do not permit email charges. (Doctor regrets this and asks that you please take up such inefficiency with the Government rather than with him.)"

With regard to 3, doctors or their office assistants can instead spend 15 minutes setting up free encryption, as others on the List have already pointed out.

Cheers,

Dan

Sep

15

A Thought Experiment, from Jim Sogi

September 15, 2010 | 1 Comment

Assume that only daytraders are left trading. Assume they all enter in direction of recent moves sometime after open. One would believe that they try to maximize profits by trailing or waiting til near close to close position, then on close close position and pull orders. What would market result be? I am guessing something like today's price action might result. It is difficult to verify this, but perhaps the assumption is not too far off or just a case of fitting the theory to the facts after the fact?

Assume that only daytraders are left trading. Assume they all enter in direction of recent moves sometime after open. One would believe that they try to maximize profits by trailing or waiting til near close to close position, then on close close position and pull orders. What would market result be? I am guessing something like today's price action might result. It is difficult to verify this, but perhaps the assumption is not too far off or just a case of fitting the theory to the facts after the fact?

Jeff Sasmor asks:

Are you talking about human daytraders or robot daytraders?

I doubt human daytraders have much effect on anything these days. Isn't it so that something like 3/4 of volume is robots trading about 100 stocks?

Jim Sogi replies:

The "robot" trader needs to be defined. There are human system programed execution bots, and perhaps a few "intelligent" trading systems which do not have pre-programed systems, but rather gather current info, process that, make a quick rule, test it, and trade on it, but I strongly doubt it. There might be market making algorithms which might be classified as bots, but I doubt they are making directional bets all day long looking for legs. IB has some entry algo's such as VWAP and I think a few more algos for order execution. Seems on the 5-6 flash crash some skirts were lifted with a glimpse into some order spamming systems which would have to be automated at that speed. You and Russ might be best to say what is out there and what is possible and I sure would appreciate what might be possible.

Russ Herrold comments:

Yes, real time adaptive and intuitive systems are to some degree possible and exist– consider robotic market maker assistant algorithms, that are permitted to 'fly themselves' with no-one with sentient hands on a 'dead man's' switch, assuming so long as the market stays within known parameters [some of these gone haywire (or simply unimaginatively constrained) clearly could have been 'goaded' into playing on May 6]

Yes, real time adaptive and intuitive systems are to some degree possible and exist– consider robotic market maker assistant algorithms, that are permitted to 'fly themselves' with no-one with sentient hands on a 'dead man's' switch, assuming so long as the market stays within known parameters [some of these gone haywire (or simply unimaginatively constrained) clearly could have been 'goaded' into playing on May 6]

I took the open question to be tested to be a restatement of the buy (or sell) at close, and to sell (or buy) at open, [perhaps biased by an anticipated mean reversion 'bias' to decide which way to lean, as a first extension].

As I recall we've had posts on this in the past here, and I was just going to run a couple of simple scenarios through some back testing and do some 'binning' or anticipated 'regime changes' based on the a look-back of 'scheduled news' calendar.

The market making algorithms that could be classified as Bots have performed well, all day long; other times, they fall off the tracks wildly as well. Thus the need for that 'dead man's switch'. The question becomes, can one train a few 'turtles' to spot regime changes that a bot cannot, at a low enough cost to pay them to 'play the video came' in shifts and cover a trading day.

Concerning what you said about how "IB has some entry algo's such as VWAP and I think a few more algos for order execution. Seems on the 5-6 flash crash some skirts were lifted with a glimpse into some order spamming systems which would have to be automated at that speed"…

The data response feedback loop rates have long since gone beyond the limits of a remote link and having an electron crawl back and forth. Local computers in a data center are competing with one another, and the trick at this point may simply to predict how the battle will progress, grab hold, and hang on for a ride!