Nov

3

Russian Facebookers, from DVG9

November 3, 2017 | Leave a Comment

"Russian Influence Reached 12 Million Through Facebook Alone":

"The internet search giant Google also confirmed earlier reports that the Internet Research Agency [a Kremlin-linked hasbara outfit] had purchased search and display ads from it. Google said the group had bought $4,700 in ads… How could poor Hillary, with only $1.2 billion and a virtual monopoly on the fervent support of the press lords—both American (such as Jeff Bezos of The Washington Post) and un-American (such as Carlos Slim of The New York Times)—hope to compete with Moscow's marketing might?"

In Facebook's earnings call this evening, Mark Zuckerberg emphasized at length how serious he is about investigating the Russians' use of Facebook to influence the US election, and how Facebook's increased security/preventive efforts will take priority over Facebook profits.Aside from the article quoted above (and linked to below), are there any major media news stories that have realistically analyzed and explained to the public the total $145,000 claimed to have been spent by Russia-linked buyers on Google, Facebook and other social media, compared to the over $1 billion spent by Hillary Clinton, plus equivalent amounts from the DNC and rich PACs supporting her?

$4,700 is what my auto parts company used to spend on Google EACH WEEK, and it did nothing to prevent the company from failing. I very much doubt the $4,500 spent on Google by the Russians (supposedly to foster racial tension by encouraging Blacks to attend protest events, as I recall, although possibly that was their Facebook spending) influenced even one vote.

Jeb Bush had a war chest of $100,000,000 early in the Republican primary contest and he could not influence the election.

Hillary Clinton and her supporters had a couple of billion dollars to spend and could not influence the election.

And if an easier comparison, how about the $145,000 the supposed Russian collusion with Trump spent compared to the $12 million the Hillary campaign and DNC spent to collude with the Russians in developing the anti-Trump dossier?

I realize reporters are usually not good at math, but don't they have any sense of the difference between $145,000 and $12 million? Or the difference between $145,000 and a couple of billion?

Feb

16

Advice to Someone Starting a Professional Career, from Russ Sears

February 16, 2017 | 1 Comment

My daughter is starting her first professional job as TV producer. What advice would you give some one just starting?

My daughter is starting her first professional job as TV producer. What advice would you give some one just starting?

Dan Grossman writes:

Work very hard and long hours the first six months. Then she can dial back to a normal level, but she will have established in everyone's mind that she is a hard worker.

Vince Fulco writes:

I would say, study your superiors ruthlessly and choose one as a mentor who is successful, well mannered, and genuinely cares for others. Working with a good one is a career accelerator. Working with a bad one especially your boss is an anchor which will affect you for years.

Also, get into a Toastmasters asap. I believe they have the most well structured program for both "Competent Communication" and "Competent Leadership", two of their formal tracks. It is an effective, cheap and low time way to boost your skills and resume. One of their meeting activities is impromptu speech giving of 1-3 minutes called Table Topics. It is a great exercise in thinking on your feet.

Stefan Jovanovich writes:

Learn the mike heads and technicians' jobs well enough to understand what bad producers do that drives them crazy and what good producers do that makes their lives if she learns to do the actual job well Enough that the crews and reporters want her, the career will take care of itself.

Jeff Rollert writes:

Having been in radio, "microphone sense" lacks in many. Learn how to use the different ones like lavaliere, unidirectional, correct cough guards etc. if your sound guy hates you, you are dead. Bad sound is worse than bad video to audience.

Toastmasters is also great. I'm a mentor in one here. Also, if she's serious take sone acting lessons so she learns how to direct and take direction.

Oh, and be very very lucky. Move markets, up the ladder asap. If she's good, she'll make a marine's travels seem modest.

Lastly, never ever date talent.

anonymous writes:

Hit 'em hard,

Hit 'em low,

And if they get up hit 'em again

anonymous writes:

I always liked this slogan: "Who must do the hard things? Those who can."

Business/career version: "How much are we going to have to pay the person who does the hard things? Whatever they charge."

anonymous writes:

1. Avoid any and all social interactions with coworkers - don't even be willing to go to lunch with them. Completely separate work and social life, and leave NO intersection. If it was your son rather than your daughter, I would extend this to include not even making eye contact with females at the workplace, and, inasmuch as is possible, avoid interactions with them. Remember what country and century you are in. It may all sound a little extreme but there is nothing to be gained by violating these rules.

2. The moment she has the slightest hint of any marketable skill, find a third-party agency to begin shopping her around to the next job. Most upward progress comes from the outside, and she should always have aces to play, ever be without an offer sitting on the table. Jobs in the 21st century are wasting assets, vanish and disappear to those not nimble.

anonymous writes:

While it's not always easy to do, if you can listen to the people who don't like you, it can be very valuable because they won't sugarcoat it and they will give you feedback nobody else will.

May

23

This is a meta analysis of twin studies. 14,558,903 twin pairs! This should settle degree of heritability (at least for those who believe in science).

Dec

17

Some Honorable CEO behavior, Quite Old-Fashioned, from Dan Grossman

December 17, 2014 | Leave a Comment

A CEO returns 44,445 shares of restricted stock (not options, actual shares worth $41 each) because he feels he should not receive such benefit unless shareholders receive an increase in their investment return.

Mar

12

Some Quick Common Sense About the SAT, from Dan Grossman

March 12, 2014 | 2 Comments

The SAT has been diligently and scientifically designed to predict performance in college. It predicts such performance better than HS grade point average.

The SAT has been diligently and scientifically designed to predict performance in college. It predicts such performance better than HS grade point average.

Think about that for a moment. A 3 hour test that predicts college performance better than 4 years of HS exams, papers, classroom performance, etc. Pretty impressive.

Further, when judging the value of the SAT for college admission, one has to ask, "compared to what?"

HS grades? As indicated, the SAT is better. And HS grades are impossible to compare across thousands of different high schools, and in addition are subject to significant manipulation by the high schools seeking to look good or have their students do well. That's why college admission offices use both the SAT and HS grades.

Teacher recommendations? They are notoriously even worse.

The recommendation of the Headmaster of Exeter as to which 40 or so of his graduating seniors should be admitted into Harvard? That's the way things used to work. Good luck to Vic Niederhoffer's getting admitted to Harvard under that system.

Stefan Jovanovich writes:

The SAT is a scam. It has been around for 50 years. It has never measured anything. And it continues to measure nothing. And the whole game is that everybody who does well on it, is so delighted by their good fortune that they don't want to attack it. And they are the people in charge. Because of course, the way you get to be in charge is by having high test scores. So it's this terrific kind of rolling scam that every so often, somebody sort of looks and says–well, you know, does it measure intelligence? No. Does it predict college grades? No. Does it tell you how much you learned in high school? No. Does it predict life happiness or life success in any measure? No. It's measuring nothing. It is a test of very basic math and very basic reading skill.

- Jon Katzman, Founder of the Princeton Review

The interview is worth reading in full.

But (of course, there would be a caveat from yours truly), Katzman wants to ignore the success that crammers have always had because he, like everyone else, does not want common public education to be what works - an intensive drill and practice of basic reading and math skills. These are subject that are, as Katzman himself says, "Nothing that a high school kid should be taking." Yet, they are the very skills that almost all children leave school now without having mastered.

Victor Niederhoffer writes:

And yet. I disagree with him on all parts. I believe the sat is a basic measure of IQ, highly correlating with it. And IQ is the best predictor of success in school and life. I'll have to look at the studies that confirm or infirm this.

Stefan Jovanovich adds:

Gentlemen: Mr. Katzman is admittedly hyperbolic, and he was, very skillfully, talking his book. Of course the test measures IQ, but IQ is itself a measure of one's ability to take these kinds of tests. That was and is his larger point. Schooling should be about test-taking and there should be as many different kinds of tests given as possible - those for dexterity, spacial awareness, physical assembly of a jumbled set of parts. The advantage that Eddy and all the other bright kids have is that their home schooling was competitive and testing yet built confidence and pushed away fear because there was always a new and different test to take and they quickly discovered that, in some things, they could be even better than their old man. My Dad was right - for all but the most fortunate school is simply the barrel in which the poor are told to put their children so they can learn how to keep each other from climbing out. That truth is what Mr. Katzman discovered about the Joes of this world and how much the SAT has become the barrel used for adult life; and, to his credit, it pisses him off just as much as it did my old man.

Mar

10

Amazon Article in the New Yorker, from Dan Grossman

March 10, 2014 | Leave a Comment

The late Feb New Yorker has an interesting article on Amazon and books by George Packer. It's available for free online.

The late Feb New Yorker has an interesting article on Amazon and books by George Packer. It's available for free online.

One could teach an entire college course on this article. How it is built on quotes from disgruntled employees and everyone in publishing who has ever had anything bad to say about Amazon. More importantly, how the article in virtually every sentence is infused with a subtle anti-free-market, anti-creative-destruction, and pro-elitist bias against a disrupter whose business model is based on greater availability and choice, and providing convenience and low cost to the consumer.

And yet the exciting story of Bezos and Amazon shines through, notwithstanding the author. Bezos is one of the great businessmen of our time, ranking with Gates and Jobs. And as one editor admits in the article, in today's digital world, books might not even still exist. But instead of disappearing, they are thriving. Thanks to Amazon and all its boorish, low-class, non-literary-sensitive ways.

Ties in to Stefan's today mention of Ron Chernow, since the same is true of Chernow's best-selling biography of John D. Rockefeller, Titan. How, Chernow asks, could one person be such a fierce capitalist and also the world's greatest philanthropist? Chernow cannot begin to understand the business fairness and beneficial aspects of Rockefeller's creation of Standard Oil, but the story comes through to a reader without Chernow's prejudices.

The same with Packer's supposed expose of Bezos and Amazon.

Feb

10

Martoma Facing 45 Years, from Dan Grossman

February 10, 2014 | 2 Comments

I see that SAC portfolio manager Mathew Martoma, convicted of selling a pharmaceutical company's stock based on insider information received prior to an announcement, faces a sentence of up to 45 years in jail.

I see that SAC portfolio manager Mathew Martoma, convicted of selling a pharmaceutical company's stock based on insider information received prior to an announcement, faces a sentence of up to 45 years in jail.

While I wouldn't want to stake my freedom on an unsophisticated NY jury's understanding the legal subtleties of insider information (and its ability to resist the powerful US Attorney's office and their 95% conviction rate), I'm not questioning that Martoma may have broken the law and be deserving of some punishment.

But I do question the fairness and proportionality of up to 45 years — or even 10 years or 5 years — when we on this List every day see strong evidence of others trading on inside information prior to an announcement. Beyond Victor's flexions trading prior to government announcements, it is common (usual, one would say) prior to a company's takeover or other highly favorable event to see the stock moving up in the days prior to the announcement. In fact, when there is no prior movement and the announcement comes as a complete surprise, it is remarked upon how unusually well the secret was kept.

I dislike cheats, but this kind of non-violent, non-Madoff-like offense (whether there's an actual victim is questioned by some academic experts) could better be punished, for example, by a monetary fine and a year of community service devoted to helping disadvantaged businesses and families with their financial strategies.

BTW, I'm sure Martoma's legal expenses are already in the millions of dollars. And if the idea is to get him to testify against Steve Cohen, I'm sure some sort of deal was offered to him before his indictment or trial, and if didn't accept then, why should Martoma be pressured now after he apparently thought he was innocent enough to take his chances in a trial, and when his ratting on Cohen on the verge of a long-term prison sentence would be even less reliable?

Why is the prospect, or actual imposition, of this kind of overly severe prison sentence so easily accepted by media reports, legal commentators, and the public? Where is some sense of proportion and fairness?

Jan

13

The Value of a Person Who Is Always Wrong, from Dan Grossman

January 13, 2014 | Leave a Comment

On rare occasions one comes a person whose instinct in a specialized field (such as law, medicine or investments) is almost always right.

I saw this is law, where an older lawyer I knew would immediately point me to the right answer, even before the research had been done. I imagine this is also true of a doctor who at any early stage usually seems to have a feel for the right diagnosis (House?). Or an investor who can tell immediately that something sounds good, or bad.

But I also once knew a company general counsel whose instincts about legal questions was virtually always wrong. After privately making fun of the fellow for some time, it occurred to me this was equally valuable. All I had to do was ask his opinion and I could feel reasonably comfortable going the other way.

I see that Secretary Gates has much the same approach. In his new book he says (quite amazingly, so he must feel strongly about it) that Joe Biden has been wrong on virtually every military and national security issue for forty years. And when asked in a television interview broadcast today whether he went too far, Gates recounted the following anecdote:

"Mr. Gates said on one occasion, when driving back to the Pentagon, Adm. Michael Mullen, then chairman of the Joint Chiefs of Staff, noted that for once Mr. Gates and Mr. Biden had agreed on something in a meeting. Yeah, I said, that is why I am rethinking my position.”

Aug

23

Advice for a Young Person, from Dan Grossman

August 23, 2013 | Leave a Comment

I have been emailing my 8-year-old grandson a daily quotation or one-line advice (about sports, learning or life in general), which he seems to enjoy.

I have been emailing my 8-year-old grandson a daily quotation or one-line advice (about sports, learning or life in general), which he seems to enjoy.

But I am running out of quotations and pithy advice relevant to a young person. Does anyone have either a good source of these, or some particular favorite quotes or advice?

Many thanks,

Dan

Ralph Vince writes:

Here's some for you Dan. You may want to edit them for a younger mind, plus, you may not agree with all of them, but these are some that come to mind as I sit here and thing about it:

1. Don't try making sense out of it. You're in an insane asylum – things are not going to make sense, people will do things that don't make sense, that they cannot adequately explain. People don't know what makes them tick, only that they tick.

2. Happiness, of course…is all in your head. If you don't know that, if you haven't come to that realization, you will never be happy.

3. The Bull Market Syndrome. People, when they are met with success, take personal credit for it (bull markets breed geniuses), and when they are met with failure, blame luck.

4. Actually, luck is responsible for both! If you can only die by being struck by lightning, eventually, you will die by being struck by lightning! Conversely, if a man were to live forever, and bought a lottery ticket every week, eventually, he will win the lottery, with a probability that approaches certainty. Just stay the course, keep doing today what you must do today. As Woody Allen says, "Fifty percent of success is just showing up."

Luck Trumps Brains. To get luck, keep showing up each day with your shoes on.

5. Creativity trumps money every time.

6. Fortunately in life, you don't have to succeed at everything you do, only a few things. One success often justifies all prior attempts.

7. You can buy great a education – you can not buy brains.

8. The Oswald Principle: Usually, the best course of action in life, is to take no action (and usually, the best thing to say is nothing!). The guys in jail or there not because they didn't do anything. Usually, you should just sleep in! If nothing really bad happens today, as my friend Oswald said to me in eighth grade, it's been a good day!

9. You don't have the problems you think you do. Actually, the only real problems are health and criminal problems. Everything else is just a frivolous, meaningless nuisance.

10. Never say never. Everyone, however righteous they may claim to be, however upstanding they say they are, will, under the right circumstances commit the crime. A cold morning, wet, hungry, tired, angry….they'll do things they never dreamed they would!

11. Everything is going to be OK. It always is.

12. You never know what's going on in someone else's life. Before you do or say something nasty to them, realize this. Perhaps they have just gotten some awful news of some sort. You never know what is going on in someone else's life.

13. Don't pressure yourself. Just take care of today's things today, and relax…we got all the time in the world. The proper attitude in performance of anything, be it athletic, mental, etc., is a kind of relaxed, aware, confident attitude. You see it manifest in sport all the time (Ali, Ramirez…..or hitting a gold ball).

14. Don't complain and don't explain.

15. Don't react or engage emotionally with others. There is great power in stoicisim, in a cold, blank, stare back when others are trying to engage you in a fight.

16. Similarly, if it is someone you love or must live with, trying to engage you in an argument, practice avoidance. Just try not to be around them, to avoid them. Go out for a walk.

17. Live "in the tunnel," but think outside of it. In other words, deal with the mundane, immediate issues at hand, think as out-of-the-box as you can.

18. You can always "lift" more than you think you can.

19. Women will be as bad as they are allowed to be.

20. You should pray for your enemies — you need them. You need to have some enemies to keep life interesting.

21. Treat those you love as though they were going to die at midnight.

22. Your body is a record of how you have cumulatively cared for it.

23. The easiest way to learn things in life, is through observation. Sit back, watch all the ways everyone around you will figure out to how to screw up.

24. There are two ways to learn something. The easy way and the hard way. With the easy way, someone tells you something and you learn it. The hard way is the way we usually learn things, and we usually don't learn it the first time through. So the easy way, you see, is the equivalent of a windfall. (note to teachers – you can cause the easy way in others if you can convey a different perspective on a problem, a manner wherein the person learning thinks, "Ah, I see it now."). The moral here is that there is no point lending money, time or advice to help people out if they aren't going to listen to you, if they are going to insist on remaining on their own vector, unchanged by your advice, wherein they are going to learn their lesson the hard way with or without your giving them time, money or advice. So don't give it unless they are going to incorporate it.

25. Do not succumb to the suffocating culture of comfort. If you are comfortable, you are in trouble, you just don;t see it heading towards you.

26. Remember – your best trades are ahead of you.

A commenter writes:

The time to abandon is when you have to step UP into the lifeboat (or raft). Any other time is premature.

Vincent Andres writes:

Hello,

A creative man is motivated by the desire to achieve, not by the desire to beat others.

All philosophical con games count on your using words as vague approximations.

A refusal to vote represents a definite expression of political opinion, a rejection of the candidates & the programs offered.

Credit is not…a magic piece of paper that reverses cause and effect, and transforms consumption into a source of production

if men want to oppose war, it is statism that they must oppose.

Man is not a lone wolf and he is not a social animal. he is a contractual animal.

and many more from A. Rand here.

The highest laws of the land (America) are not only the constitution and constitutional laws, but also contracts - H Arendt

The most radical revolutionary will become a conservative the day after the revolution. - H Arendt

Concentrated power is not rendered harmless by the good intentions of those who create it. - M Friedman

"Governments never learn. only people learn." - M Friedman

"Humility is the distinguishing virtue of the believer in freedom; arrogance, of the paternalist."

It takes a special sort of man to understand and enjoy liberty - and he is usually an outlaw in democratic societies.

The average man doesn't want to be free. he wants to be safe.

Sorry if not all quotes are appropriate for a 8 years old.

There are many specialized twitter accounts who deliver 1 or several quotes per day. There is one for Ayn Rand.

Anonymous writes:

Try to always practice good manners; be particularly polite, deferential and prepared at bars, gas stations, convenience stores and parking lots for these places are fraught with others over-valuing matters and ready to imprudently defend their claim.

There will be fights, unavoidable fights, they will find their way to you, you don't need to look for them.

Paolo Pezzutti writes:

It's not how to achieve your dreams. It's about how to live your life. -Randy Pausch

Throughout the centuries there were men who took first steps down new roads armed with nothing but their own vision. -Ayn Rand

Feb

18

Idiocracy, from Dan Grossman

February 18, 2013 | 3 Comments

Last night Elizabeth and I watched the 2006 Mike Judge movie Idiocracy, available on Amazon prime streaming.

Last night Elizabeth and I watched the 2006 Mike Judge movie Idiocracy, available on Amazon prime streaming.

It is not great cinema and only mildly funny, but it's the most subversive, un-PC movie I've ever seen. The story is based on reasonably accurate reverse eugenics (dysgenetic?) of the country becoming genetically stupider. More relevant today than when made because of all the current talk about Hispanics and even the Republican Stupid Party having to transform itself to appeal to Hispanics, the movie features a President Camacho.

Supposedly Fox wanted to bury the movie, only doing its contractual minimum in theatrical release, with no trailer promotion or screenings for critics, and open in minimal cities. But it has apparently acquired something of a cult following, with DVD revenues now nine times the theatrical.

Anyway, I was amazed how honest (if you have any fear IQ in the country is genetically declining). Although I guess the usual MSM critics, instead of having a fit over it, either didn't see it, or thought it was somehow a proponent or example of the stupidity that the movie was satirizing.

Jan

30

A Dailyspec Kind of Article, shared by Dan Grossman

January 30, 2013 | Leave a Comment

Orde Wingate, the eccentric British general who made his reputation in the 1930s-1940s by leading unconventional troops in Palestine, Abyssinia (Ethiopia), and Burma:

His pioneering efforts to add guerrilla tactics to the arsenals of conventional armies often met with disdain and disbelief from more conventionally minded officers. Wingate did not care. "Popularity," he believed, "is a sign of weakness." Considered by his peers to be either a "military genius or a mountebank" (opinions differed), he had been locked in an unceasing war against his superiors from his earliest days.

Even as a young cadet at the Royal Military Academy, Woolwich, he "had the power," recalled his best friend, "to create violent antagonisms against himself by his attitude towards authority." Later, as a junior officer, Wingate was known to begin meetings with generals by placing his alarm clock on the table. After it went off, he would leave, announcing, "Well gentlemen, you have talked for one hour and achieved absolutely nothing. I can't spend any more time with you!"

Wingate's first rebellion was against the stifling religious atmosphere in which he was raised. His father was a retired Indian Army colonel with a devotion to a fundamentalist Protestant sect called the Plymouth Brethren. He and his wife brought up their seven children, including "Ordey" (his family nickname), in what one of his brothers called a "temple of gloom," with prayer mandatory, frivolity forbidden, and "fears of eternal damnation" ever present.

By the time he arrived at Woolwich, to train as an artillery officer, he had left the Plymouth Brethren, but he never lost his religious outlook. For the rest of his life he would be deeply influenced by the Bible, on which he had been "suckled" and which a friend said "was his guide in all his ways." Another legacy of his childhood was that he developed a violent aversion to being regimented. At Woolwich he was in constant trouble, and he formed a low opinion of the "military apes" who tried to discipline him.

After graduation he learned Arabic, and in 1928 he joined the British-run Sudan Defense Force as an officer overseeing local enlisted men. Here he battled elusive gangs of slave traders and poachers within Sudan, learning the hit-and-run tactics he would employ throughout his career.

He also developed many of his unconventional habits, such as wearing scruffy clothing ("his socks were very smelly and all in holes," a subordinate later noticed), subjecting himself to great danger and discomfort, and receiving visitors in the nude. (He would become notorious for briefing reporters in his hotel room while "brushing his lower anatomy with his hairbrush.")

Read the full article here.

Jan

28

The Seminary Bookstore, from Victor Niederhoffer

January 28, 2013 | 5 Comments

One of the pleasures of visiting the declining city of Chicago (perhaps the next Detroit), is to visit the Seminary Bookstore in their new location, 5727 S. University Avenue, They have a great collection of quasi academic books, i.e. the kind that professors write for popular consumption, and the current text books can be bought a few blocks west at the University Bookstore.

One of the pleasures of visiting the declining city of Chicago (perhaps the next Detroit), is to visit the Seminary Bookstore in their new location, 5727 S. University Avenue, They have a great collection of quasi academic books, i.e. the kind that professors write for popular consumption, and the current text books can be bought a few blocks west at the University Bookstore.

Compared to the old store, it has much more room, much more light and glass windows, and plenty of places to sit and read. And unlike the old store, it's possible to find your way out without being buried by a ton of musty books if you don't get lost in the basement. I am one of those unfortunates who was not educated enough in my college days to have a good grounding in all the disciplines that make up the world of knowledge so I like to update myself periodically in areas that I am weak in or should know much more about, especially for market actualization or knowledge to share with my kids.

Perhaps the list of books I bought might be of interest to some scholars or would be market people. Microeconomics by Besanko and Braeutigan

Industrial Organization by Luis Cabral

Investments Bodie, Kane, Marcus (ninth edition)

Stochastic Modeling Barry Nelson

Scorecasting Moskowitz and Wertheim

The Evolution of Plants Wills and McElwain

Survival by Minelli and Mannuci

Thieves, Deceivers and Killers, Agosta

The Birth of the Modern World 1780-1914

The Lions of Tsavo, Patterson

Modeling Binary Data by David Collett (second edition)

Historical Perspectives on the American Economy, Whaples

Viruses, Plagues, and History, Olstone

Plastic (a toxic love story), Feinkel (for the collab for her new business)

The Power of Plagues, Sherman

Quantitative Ecological Theory, Rose

Think Python, O'Reilly (for my kids who want a job in the future).

Beautiful Evidence by Edward Tufte

All of Nonparametric Statistics by Larry Wasserman

Number Shape and Symmetry by Diane Hermann and Paul Sally

Nonparametri Statistics with Applications to Science and Engineering, Paul Kvam and Brani Vidakovic

Discrete Multivariate Analysis by Yvonne Bishop et al

Modeling with dta by Ben Klemens

Python Essential Reference by David Beaszley

The Origin of Wealth by Eric Beinhocker

America, Empire of Liberty by David Reynolds

The Entrepreneur (classic texts by Joseph Schumpeter) Marcus Becker

A History of Everyday Things: the birth of consumption in France, Daniel Roche

Civilization by Niall Ferguson (the west and the rest)

The Americans (the Colonial Experience) by Daniel Boorstin

Triumph of the City (how our greatest invention makes us richer, smarter, greener, healthier and happier) by Edward Glaeser

The Big Red Book by Coleman Barks (bought by Susan)

The Founders and Finance, Thomas McCraw

A Nation of Deadbeats (an uncommon history of America's financial disasters) by Scott Reynolds Nelson. (this one I have to read immediately)

Rome by Robert Hughes

The American Game: capitalism, decolonization, world domination and baseball by John Kelley ( 173 5 by 8 pages only)

Exploring the city (inquiries toward an urban anthropology ) by Ulf Hannerz

Brokerage and Closure (an intro to social capital), Ronald Burt

All the Fun's in How You Say a Thing (an explanation of meter and versification) by Timothy Steele

The American Songbook by Carl Sandburg (for Aubrey)

The Measure of Civilization (how social development decides the fate of nations) by Ian Morris

Freaks of Fortune ( the emerging world of capitalism and risk in America by Jonathan Levy

The Invention of Enterprise (entrepreneurship, from ancient mesopotamia to Modern times) by David Landes et al

I feel like Louis L'amour who gave lists of books he likes to read in The Wandering Man without telling what he got out of them, but I do not have enough erudition to tell based on skimming them how valuable or interesting they are. Any suggestions or augmentations on that front would be appreciated and perhaps helpful to others.

Kim Zussman writes:

University of Chicago is now ranked #4 by US News — the highest ever. This is a big jump from the era of the low tax predecessor to the former con law professor, and will hopefully have a favorable impact on South side murder rates.

Dan Grossman writes:

Unintended Consequences by Edward Conard is the best book I have seen on the subprime crisis and current government tax and economic policy.

Jan

23

Do Stocks Yet Reflect Obama’s Second Term Plans? from Dan Grossman

January 23, 2013 | 1 Comment

As Adam Smith remarked, a country can bear a lot of ruin (ie, a lot of damage from government policies). And I had been assuming O's second term would be largely ineffective due to his lame duck status, the Republican House, and the country's and even the media's becoming bored by and turning against O the way it eventually did with Jimmy Carter.

As Adam Smith remarked, a country can bear a lot of ruin (ie, a lot of damage from government policies). And I had been assuming O's second term would be largely ineffective due to his lame duck status, the Republican House, and the country's and even the media's becoming bored by and turning against O the way it eventually did with Jimmy Carter.

But now we have (i) O's hard-line, no-compromise inaugural address, (ii) clear indication O's policies will be implemented by executive order rather than attempts to pass laws through Congress (eg, earlier announced non-enforcement of laws dealing with illegal immigrants; last week's gun control measures; budget and debt ceiling measures; today's announcement the long-standing ban will be lifted on women in combat), (iii) the Republicans' total wimpiness and ineffectiveness in countering or standing up to O, and (iv) the public and the media seemingly loving it all and just wanting more (as one tiny example, the very popular Phil Mickelson having to apologize for a fairly mild statement about his work incentive under a 60% combined Fed and Calif service rate).

I know the stock market is very smart, far smarter than any individual theorist like me. But I have to ask, is the market discounting all that will be coming from the administration during the next four years? O's second term is only two days old and look what we have so far. Four years of it can perhaps be a lot more ruin than Adam Smith could imagine in smaller, less sweeping governmental days.

Dec

17

The British Navy, from Dan Grossman

December 17, 2012 | 1 Comment

Today I heard a striking point about the British Navy, a frequent subject on this site.

Today I heard a striking point about the British Navy, a frequent subject on this site.

At the start of WWII the British Navy was the largest in the world, but its effect on WWII was inconsequential. (I know Stefan will probably give various counter-examples but still, this statement is certainly accurate in relative terms compared to, say, the RAF, the American Navy, etc.)

The reason was the British Navy was out of date in forward thinking. It still thought battleships were the key, although they were fairly useless, and it had not really taken into account the effect of airpower — the key role of aircraft carriers and also the effect of enemy aircraft on British naval operations. Maybe also hadn't sufficiently taken submarines into account.

A lesson to all of us about military and other institutions, and life in general.

David Lilienfeld writes:

The Royal Navy had two impacts on the war:

First, it made the Mediterranean a British lake. There was never any contesting that control throughout the war. Second, it prevented Sea Lion. Whether Hitler would have prevailed in such an invasion is great fodder for holiday discussions with cognac by a blazing fire in the fireplace.

As for battleships, they still had a role–shore bombardment–but it was hardly the dominant role it had had pre-war. It's interesting that the Japanese looked at the air raid on Pearl Harbor as a partial success even as they didn't touch the US carriers or the critical US Navy's (and Army Air Forces's) supplies of fuel.

Dec

4

What a Fake Negotiation, from Dan Grossman

December 4, 2012 | 1 Comment

I'd been wondering, even if Obama and the Republican House did reach an agreement to avoid the fiscal cliff, how it would be possible to negotiate all the crucial terms before the Christmas recess.

I'd been wondering, even if Obama and the Republican House did reach an agreement to avoid the fiscal cliff, how it would be possible to negotiate all the crucial terms before the Christmas recess.

From yesterday's proposals, I now understand. They are not trying to negotiate what you and I would view as an agreement with substantive terms. Instead what they are trying to negotiate is just the numbers. For example:

1) $800 billion of tax revenue increases, from "millionaires and billionaires" or at least from "the wealthy"; and

2) $1.2 trillion of spending "cuts", of which (i) $400 billion would be from Medicare and Medicaid (but of course no benefits would be cut, so would have to come from "administrative savings"; and (ii) the remainder to come from "wind-down" of the Iraq and Afghanistan wars.

They would then congratulate themselves, and maybe each other, on the wonderful compromise they have reached to save the American people from going over the cliff. And the stock market would go up initially and then straight down as it did after Obama's election. And any substance would be put over to the first half of 2013, when there is far less media and public attention, to try to work out how these numbers are to be achieved (to the extent they are to be achieved at all).

Far better to go over the cliff. At least then the American people would have a half-way honest view of where we stand.

Nov

2

Koufax Facts, from Dan Grossman

November 2, 2012 | 1 Comment

I once saw Koufax pitch.

I once saw Koufax pitch.

In his honor, here are some tidbits:

He was signed by the Dodgers for a $14,000 bonus and $6,000 annual salary.

His career was, of course, before free agency. When he and Drysdale were at top of their careers and held out together (refused to report to Spring training for six weeks), he eventually settled for a $125,000 salary.

Inside baseball language in those days was not very PC (perhaps still isn't). In 1965, when big decision for first game of World Series was whether to start Koufax or Drydale, manager Walter Alston came into clubhouse and announced, "I'm going with the Jew."

Notwithstanding modest earnings, lack of endorsements and very limited TV career, he retired to Maine and seemed to live a distinguished, very private post-baseball life.

He married, and eventually divorced, a highly attractive daughter of actor Richard Widmark.

I was saddened to see that, through the advice of his childhood friend Mets-owner Fred Wilpon, Koufax lost a considerable amount investing with Bernie Madoff.

Jul

12

Romney on his Jet Ski, from Dan Grossman

July 12, 2012 | 4 Comments

Apparently the vacation picture of Romney and wife on their jet ski is considered a campaign gaffe in a league with Kerry on his windsurfer (pic ), and almost in a league with Dukakis in his funny helmet driving that Abrams tank (pic ).

Apparently the vacation picture of Romney and wife on their jet ski is considered a campaign gaffe in a league with Kerry on his windsurfer (pic ), and almost in a league with Dukakis in his funny helmet driving that Abrams tank (pic ).

I certainly don't see it that way. Far from elitest, or Frenchy, like Kerry windsurfing, I would think jet skis much more blue collar (like snowmobiles and ATV vehicles), noisily tearing around the lake to the annoyance of elitists in the sailboats or sitting on their terraces drinking gin-and-tonics.

Perhaps it was the added fillip that blond and buff Ann Romney was driving the jet ski, doubly annoying the collectivists.

Or as the Chair would say, just the media with their now constant agenda of favoring Obama at all costs.

Jul

1

Chief Justice Roberts, from Dan Grossman

July 1, 2012 | Leave a Comment

I respectfully disagree with Rocky and Stefan (happily without fear of counter-argument, since each has said it is his last post on the ACA decision and thus will not be able to respond).

If it was Roberts' attempt to throw a false gift to the liberals by upholding the ACA, while at the same time establishing the principle that the individual mandate violates the Commerce Clause, he did a pretty incompetent job of it.

Because his tax justification of the ACA has provided a new road map to Congress, broader than the Commerce Clause, under which roadmap virtually any infringement of our liberties can be upheld.

If the President and Congress wish to require each of us to purchase an electric car, simply pass a law that each person must purchase an electric car or pay a tax of $5,000.

If the President and Congress wish to require each of us to eat certain low fat or locavore foods, simple pass a law that each person must purchase such foods or pay a tax of $2,000.

I will forego the broccoli example and countless others, but they are obvious.

In the words of Richard Epstein, a favorite law professor of a number on this list, Roberts was "too clever by half":

"On the crucial issue of the individual mandate and the taxing power, Roberts sounds like a lawyer who is too clever by half. The point here is ironic, for without question, the Chief Justice came to his decision by self-consciously marching to the beat of two drummers: judge and statesman… The entire edifice that underlies the ACA on this critical mandate rests on a constitutional house of cards. If the legislation fails under the Commerce Clause, there is no reason to resurrect it by engaging in extravagant machinations with the words "tax" and "penalty." No umpire would accept such a shaky result. No statesman should either."

And in his half-baked approach, he squandered a once-in-a-generation opportunity to strike a blow for the Constitution, limited government, and individual liberty.

May

11

I'm wondering why Jamie Dimon is so popular with the media.

I'm wondering why Jamie Dimon is so popular with the media.

He's always treated with kid gloves.

Even today's $2 billion was referred to as a "rare black eye".

Is he married to a black woman? Or gay?

Or have some other fact in his background that leads to his being treated as such a good guy?

I'm so out of things I have no idea what's going on here.

Victor Niederhoffer writes:

The more one thinks about it, the more that one believes that Dimon and Buffett have the same hallmarks that make them beloved by the intellectuals and the media. What those hallmarks are, I can't put my finger on exactly. Perhaps it's a zacharian, "your own man says that you must be low".

Anonymous writes:

It's what I call the no-bullshit bullshit factor. Americans like leaders who say, "The buck stops here. And I screwed up." Buffett took a 300+ million dollar whack on some energy bonds that collapsed. And he stood up and took the blame. And no one blinked. He does that regularly. I think the press likes to hear people stand up and say, "I screwed up. I was wrong. I take responsibility. This was bad and stupid." There are countless examples of this in politics, sports, commerce, etc. They don't like people like Audrey McClendon who say things like "I apologize." But who never stand up and say, "The buck stops here and I was wrong."

Victor Niederhoffer adds:

One doesn't admit "I was wrong" when there are likely to be lawsuits as this wouldn't seem very good to a jury when defending yourself against damages. There must be an exemption from civil and regulatory liability for such activities in support of the greater good here that enables one to take blame for such "egregious" behavior and at the same time get it past your lawyers.

Laurel Kenner writes:

The Administration needs a whipping boy, and Lloyd was tired of the job. Anyway, Dimon likes harpooning whales in a highly public, loss-producing way. Remember what happened when he announced to the world that he would be liquidating Salomon's book. Call him Ahab.

Victor Niederhoffer writes:

Perhaps he serves as a depository and station stop in the revolving door for former flexionic officials when they need money in various forms. Also, as a symbol of the trillions of bail out moneys that were taken away from the forgotten man, and given to the banks to invest in such useful activities as synthetic credit derivatives at the CIO's office (note the symbolic name sort of like showing the tv showing bush war activity while beggars starve on tv during a movie to show you're a fellow traveler), he must be shown to be Holier than the Pope to symbolize the verisimiliture, the halcyon nature of the transfer of the trillions and the reason for the lack of jobs.

Rocky Humbert writes:

Folks, we can debate the politics, but don't miss the macroeconomics here. If they had done this by making a few hundred billion in new loans, people (but perhaps not the shareholders) would applaud (at first).But if they do the same trade by buying the CDX index, it confuses people. But it's really the same thing. Therefore, I think it's a multi-dimensional cognitive dissonance. Between the people who want the banks to loan. And the people who don't want them to use derivatives. And the people who hate Jamie Dimon. And the people who love Jamie Dimon. And the fact that as a multiple of price/tangible book value, their stock is among the most expensive money center bank. Lastly, the 10Q says that if the yield curve steepens by 100 basis points, their 12 month pretax earnings go up by $549 million. And, their credit losses made a new cycle low.

Jan

30

Revisionist History, from Rocky Humbert

January 30, 2012 | 1 Comment

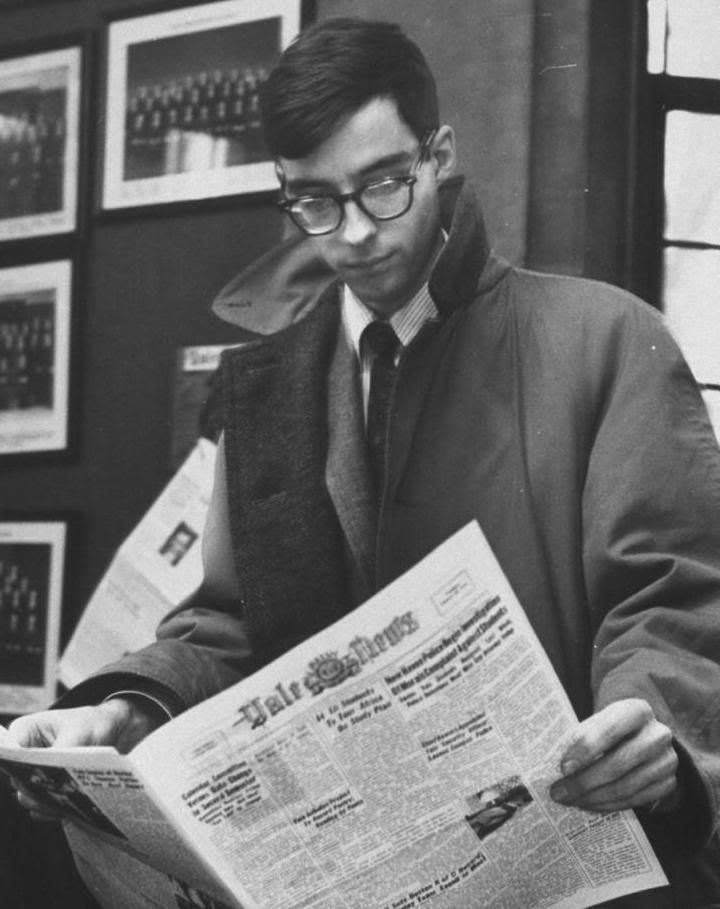

When I was a Yale undergrad, I took a class called "Lessons of Japan." The course was a mixture of economics, policy and sociology, and the goal was to explain why Japan was so successful; how US industry should model itself after the Japanese; how the Commerce Department should be like MITI; and how the interconnected corporate holdings of Japanese companies ("Zaibatsu") were a key to lasting profitability and success. (There was also a mention of morning calisthenics for assembly line workers.)

When I was a Yale undergrad, I took a class called "Lessons of Japan." The course was a mixture of economics, policy and sociology, and the goal was to explain why Japan was so successful; how US industry should model itself after the Japanese; how the Commerce Department should be like MITI; and how the interconnected corporate holdings of Japanese companies ("Zaibatsu") were a key to lasting profitability and success. (There was also a mention of morning calisthenics for assembly line workers.)

It looks like Yale has updated its curriculum! From an interview with Steve Roach, former Morgan Stanley economist/permabear and now lecturer at Yale:

ROACH: … one of the great courses I'm teaching at Yale is called "The Lessons of Japan." You spend five weeks studying what happened in Japan and developing metrics to calibrate the excesses pre-bubble, the mistakes made post-bubble, and then we look at that template relative to other countries in the developed and developing world and there's a lot of striking similarities. Especially insofar as the U.S. and Europe let these bubbles and policy blunders distort the real side of their economy. It would be one thing if these were just financial or market-driven excesses. But they're not.

Read the full interview here. (By the way, I got an A in my class. It was a gut course.)

Dan Grossman writes:

One of the great mysteries to me in recent years is why Japan is not doing better, its economy not growing faster.

I used to do quite a bit of work in Japan, and I was always impressed by the intelligence, hard work and cooperative dedication of Japanese businesspeople. Yes, maybe they screwed up somewhat from a government economic standpoint, but why should that be so important compared to all skills and expertise of major Japanese companies, and their position close to China where they can both take advantage of cheap Chinese manufacturing and serve as the gateway for many business interactions between China and the Western world.

Nor am I impressed by the conventional explanation that a part of the problem is Japan's failure to allow immigration, that its static population will doom it to know low growth and an aging population. I don't see that massive legal and illegal Hispanic immigration is so economically so advantageous for the US. And there are great advantages to Japan in maintaining its homogeneity and its happy, fairly classless interactions between all levels in Japanese society.

Actually I have heard from Japanese friends and visitors that life in Japan these days is quite good. The population is prosperous and happy, with far fewer problems than in the US and Western Europe.

I guess my puzzlement is why Japan has not been a better investment, why its stock market has not been performing better.

Jan

9

In Dec 2010, Daily Spec announced a contest for best investment ideas for 2011 at this link . Several volunteered to judge the contest. And this seems necessary as there were many intricacies in judging. As a start to declare the winner, would those who feel they are in the running for the winner's prize, please alert me to their recommendations, the results, and why they feel they may be near the top. Thank you. Vic

In Dec 2010, Daily Spec announced a contest for best investment ideas for 2011 at this link . Several volunteered to judge the contest. And this seems necessary as there were many intricacies in judging. As a start to declare the winner, would those who feel they are in the running for the winner's prize, please alert me to their recommendations, the results, and why they feel they may be near the top. Thank you. Vic

Dan Grossman writes:

Vic, below is my contest-entry email, with the results indicated in italics. It should perhaps count in my entry's favor that my percentage gains were achieved without the use of derivatives or other form of leverage, and that they were very specific stock predictions, easy for anyone to implement and make money from.

As indicated, if I am lucky enough to win, I will donate my prize to a free market or libertarian nonprofit organization.

—

Trying to comply with and adapt the complex contest rules (which most others don't seem to be following in any event) to my areas of stock market interest:

1. The S&P will be down in the 1st qtr, and at some point in the qtr will fall at least 5%. S&P wasn't down for the quarter but second part of prediction was accurate in that S&P fell 6.4% from Feb 18 to Mar 16.

2. For takeover investors: GENZ will (finally) make a deal to be acquired in the 1st qtr for a value of at least $80; and AMRN after completion of its ANCHOR trial will make a deal to be acquired for a price of at least [corrected in followup email to $16]. GENZ (50.93 at contest date) was acquired early in the year for a then-current value of $74, but including a contingent right which could still bring total value to $80. AMRN (8.20 at contest date) was not acquired, but soon traded above 16 for some two months.

3. For conservative investors: Low multiple small caps HELE and DFG will be up a combined average of 20% by the end of the year. HELE and DFG had a combined price at contest date of 58.58, and a combined price at year-end of 75.00, for a combined average gain of 28%.

For my single stock pick, I am something of a johnny-one-note: MNTA will be up lots during the year — if I have to pick a specific amount, I'd say at least 70%. (My prior legal predictions on this stock have proved correct but the stock price has not appropriately reflected same.) MNTA was 14.97 at contest date and 17.39 at year-end, for a gain of 16.17%.

Finally, if I win the contest (which I think is fairly likely), I will donate the prize to a free market or libertarian charity. I don't see why Victor should have to subsidize this distinguished group that could all well afford an contest entrance fee to more equitably finance the prize.

Best to all for the New Year,

Dan

Yanki Onen writes:

Dear Vic,

Once again I would like to thank all of the contributors to the daily spec word press for sharing their insight and wisdom. It is a never ending journey. Below were my ideas but to be quite frank I don't know if they were eligible for the contest. But if they were results should be alright

1) Going long csco and long put lost $2,18

2) Sell contango buy backwardation trade for cotton buy selling spreads

made a lot of money but I don't know how to quantify that cause it is trading call 3) Leveraged ETFs suckers play. This strategy was right in the money and made quite a sum.

Our lively hood depends on what we make of the beloved mistress, if you get a long she is quite charming. Thanks for the challenge. Also would like to use this opportunity to wish you all a great prosperous new year.

Phil McDonnell writes:

My trade on the Silver ETF SLV was closed out when the ETF hit its target price of 40 as stated in the original instruction (at the bottom). On April 11, 2011 the trade was exited with the following post to the list in reply to a suggestion from Big Al:

Yes, they are short puts. Yes, you are right. In my original contest entry I said close out the 'entire position' if and when slv hits 40. So I think I need to go with that. I don't think we were allowed to change our original entries beyond fixed original. instructions.

So taking the SLV at this morning's open when silver broke 40 it went out for .12. The net on the calendar spread was 2.50 less .12 is 2.38 credit. On a cash investment of .50 this is a return of 376%. After a dismal January the Phoenix rises from the ashes.

Originally I wrote:

If 40 is not reached then exit on 2/31/2011 at the close.

Correction it should have been: 12/30/2011 instead of the nonsensical

2/31/2011.

And here is my corrected submission:

When investing one should consider a diversified portfolio. But in a contest the best strategy is just to go for it. After all you have to be number one.

With that thought in mind I am going to bet it all on Silver using derivatives on the ETF SLV.

SLV closed at 30.18 on Friday.

Buy Jan 2013 40 call for 3.45. Sell Jan 2012 40 call at 1.80. Sell Jul 25 put at 1.15.

Net debit is .50.

Exit strategy: close out entire position if SLV ETF reaches a price of 40 or better. If 40 is not reached then exit on 12/30/2011 at the close.

Brendan Dornan writes:

Victor,

Thank you very much for putting on the contest. The reason I started to write a blog is to document some picks, and hopefully build a reputation after a decade of being in isolation behind the screens. The contest enabled this goal. Thank you for the opportunity.

The contest entry updates earlier this year did not include my entries, probably because the access to quotes for the instruments added an extra degree of difficulty, so allow me:

1. Credit Default Swaps on:

· +99.44% : French Gov CDS

· +70.80% : German Gov CDS

· +99.88% : Italian Gov CDS :

2. Short the Euro + Far OTM put options near parity · +% : 1.3224 - 1.30469, not great: learned spot FX poor for tail event trades. 3. Long Put X-Warrants or CDS on any Hong Kong or Chinese Property Developer · +103.20% (20.64% X 5 for warrant use) Shanghai Property Index,

(2759.58-2190.11):

3a. or Credit Default Swaps Chinese 5 year Government Debt · +118.26%: China Gov CDS

Extra Credit: · + 214.25% : Short Copper:

o 4.4455-3.4695 NYMEX Copper HG

o ($111,375 - $86,725) = $24,650.00

· Short Iron Ore, Cement, similar declines (SWAPs would have done well) · + 52% : Short Japanese Industrials via CDS o Hugh Hendry's fund is up and can be a proxy · +32.96% peak, but plunged -60.80% below open : Cleveland Biosciences (CBLI) o Although unsuccessful, CBLI spiked higher amid the Japanese Nuclear Meltdown, serving its purpose as a hedge

Stanley Rowen writes:

And the winners are…? I fortunately did not participate in last year's contest (my guesses turned out to be non-winners. But, I am indeed curious if there will be a major article posted to Daily Speculations dot Com with the winners? I'm looking forward to it.

Victor Niederhoffer comments:

These entries from the contest for 2011 investments. These are the ones so far in the running. Would any like to add their selections to this list for judging.

Nov

3

The Greece People, by Daniel Grossman

November 3, 2011 | 6 Comments

Some years ago I was a tourist in Turkey and I hired the captain of a small sailboat to take me out for the day. The captain could only speak a little English but enough for me to learn he was a retired Sergeant from the Turkish Army.

Some years ago I was a tourist in Turkey and I hired the captain of a small sailboat to take me out for the day. The captain could only speak a little English but enough for me to learn he was a retired Sergeant from the Turkish Army.

When I said to him the Turkish Army had a reputation as very fierce fighters, he explained that was necessary because Turkey was surrounded by bad countries — the Syrians, the Iraqis and, shaking his head, the worst of all, "the Greece people".

As I scan financial news reports from Europe over recent weeks, the Sergeant's words echo back to me: "The Greece people, very bad."

[No offense to SpecListers or others who may be of Greek descent. I just liked his serious and striking English phrasing: The Greece people, very bad.]

Paolo Pezzutti comments:

I think an extremely weakened Greece could destabilize the area. You heard also that "the government of Greek Prime Minister George Papandreou has sacked the top commanders of the Greek Armed Forces in one afternoon.

The move came within 24 hours of Papandreou's announcement that he intends to hold a referendum on the European Union's bailout package, which is widely seen in Greece as a ploy to forestall early elections." Very unusual move in a NATO country.

Sep

25

The True Lesson of Solyndra, from Dan Grossman

September 25, 2011 | Leave a Comment

The Government's $535 million loan guarantee to solar company Solyndra on a hurry-up schedule to comport with highly publicized visits by Biden and Obama, followed by Solyndra's bankruptcy and taxpayer loss of the entire amount guaranteed, has prompted considerable criticism in the media and Congress.

The Government's $535 million loan guarantee to solar company Solyndra on a hurry-up schedule to comport with highly publicized visits by Biden and Obama, followed by Solyndra's bankruptcy and taxpayer loss of the entire amount guaranteed, has prompted considerable criticism in the media and Congress.

The Solyndra case was able to garner such public outrage because political contributions by the company's backers were so clearly on the record, the Government's due diligence was obviously put secondary to the Administration's self-promotion schedule, and Solyndra's quick bankruptcy revealed the Government's incompetence in choosing which "green jobs" company to support with taxpayer dollars. But the true lesson of this sad case is that the Government's SBA (Small Business Administration) and Green Jobs programs are virtually always incompetent and politically motivated.

It is extremely difficult for private venture capitalists to analyze and decide which early-stage companies are likely to succeed. And private venture capitalists possess great expertise, and have the extreme incentive and personal discipline that the money they are risking is their own and that of their investors. The Government on the other hand has practically no expertise in such complex and subtle analysis, and lacks personal discipline in that the money being risked belongs to no one in particular. Or worse, wasting the money is considered a positive because it is part of a "stimulus program", or is necessary to "help small business which, as we all know, generates most of the jobs." Further, lacking true expertise and personal financial discipline, the Government will inevitably be influenced by political considerations.

The upshot is that virtually every Government SBA and Green Jobs guarantee or grant will be some version of a scam, either from the standpoint of incompetence or outright fraud, resulting in loss to the taxpayers of the great majority of the tens of billions of dollars allocated to these programs by the President and Congress. But in most cases it will take several years for the recipient company's difficulties to become clear, and by then no one will notice.

Equally detrimental (although much more difficult to notice or understand), subsidies to these economically undeserving companies distort the market and are significantly damaging to other businesses who are more competent and seek to play by the normal rules of capitalism. This happens is various direct and indirect ways. A subsidized company like Solyndra drives up the price of expert labor and specialized raw materials, to the detriment of non-subsidized competitors. Subsidized Solyndra will also tend to charge prices that do not cover its true costs, again hurting honest competitors.

And more subtly, the enterprise prices and ownership of businesses themselves will be distorted.Without the Obama Administration subsidy, Solyndra would have been in trouble in early 2009.The owners would probably have been forced to try to sell out at a distress price. If the company had any value at all, it could have been purchased by more competent management at perhaps ten cents on the dollar, and that management may have had a good chance to make an economic success of Solyndra, to the far greater benefit of its employees, suppliers and customers.

I can testify this is not just theoretical. For many years I have been in the business of trying to acquire and run small companies in a variety of industries. I cannot tell you how many times, when I analyzed and made what I considered a fair market bid to purchase a company, I was told that my bid was too low, that the broker for the seller was arranging for another buyer to obtain an SBA loan to purchase the company at a higher price. Such a buyer, who typically would not have the personal net worth to buy the company, was in effect getting a free option: Either he would be successful with the company and pay off the SBA loan. Or he would be unsuccessful and be relieved of the loan through bankruptcy. And in the meantime he could draw a salary and expenses from the company and live quite well.

Sep

19

Why Buffett’s Tax Proposal is Self-Serving, from Dan Grossman

September 19, 2011 | 3 Comments

Perhaps the Chair has not yet been apprised of (or, more likely, refuses to lower himself to comment on) Obama's new proposal to tax "millionaires" at a new and higher income tax rate, which Obama apparently plans to campaign on by terming it "the Buffett Rule" (cf "the Volcker Rule), based on the Sage's recent op ed piece to the effect that he should pay a higher tax rate to bring him up to the rate paid by his secretary.

Perhaps the Chair has not yet been apprised of (or, more likely, refuses to lower himself to comment on) Obama's new proposal to tax "millionaires" at a new and higher income tax rate, which Obama apparently plans to campaign on by terming it "the Buffett Rule" (cf "the Volcker Rule), based on the Sage's recent op ed piece to the effect that he should pay a higher tax rate to bring him up to the rate paid by his secretary.

In the course of attempting to explain to Elizabeth and other sensible but tax-unsophisticated family members why Buffet's op ed piece is fraudulent and self-serving, I have found the following the clearest and most effective explanation:

Buffett has a net worth of $70 billion. I have read that based on the fairly modest net capital gains he realizes each year (all he needs to live extremely well on) he pays income tax of about $7 million a year. Thus his yearly income tax represents about 1/10,000 (0.0001%) of his net worth.

The average young, single working stiff makes, say, $60,000 a year, and if he's lucky has a net worth of perhaps $20,000. He might pay almost $20,000 a year in income tax, which would mean his yearly income tax represents almost 100% of his net worth.

And let's take an older middle-class family with a hard-working husband and wife making a combined $250,000 a year, who have saved and purchased a house and have some other investments. If they have been highly successful in their house and other investments, they might have a net worth of perhaps a $1 million. If they pay approaching $100,000 in income taxes, this would mean that their yearly income tax represents almost 10% of their net worth.

To reprise each year's income tax payments at current rates:

Young working stiff, 100% of net worth.

Hardworking H& W with successful investments (well within Obama's "the wealthy"), 10% of net worth.

Buffett, 0.0001% of net worth.

So Buffett's unselfish proposal is: That the middle-class family paying 10% of their net worth each year pay significantly more. That perhaps even the young working stiff pay slightly more. And that Buffett himself pay a little more but since his relative income is so low, still close to 0.0001% of his net worth.

Yes, let Obama run his campaign by lauding Buffett for his unselfishness, and for Buffett's explaining tax fairness to the public in such clear and folksy way.

Phil McDonnell adds:

I agree with Dan that the Sage's comments on this are completely disingenuous. He will never get hit by the tax he proposes. He only makes a salary of $524k/yr because that is what he chooses to take. Rich people have a great deal of control over how they get their income. They can hide it in corporations that do not pay dividends. They can choose not to take capital gains in years with high taxes on such. Alternatively one can take capital losses as offsets. They can choose to pay themselves a dividend.

In Buffet's case the vast majority of his money will never be converted to capital gains because it will be donated to the Gates foundation to provide a nice future income for his kids and their kids. It will never see estate taxes either. The idea that the problem is all about the tax rate is a deceitful canard.

May

30

The College is a Waste of Time Meme, from Jeff Sasmor

May 30, 2011 | 7 Comments

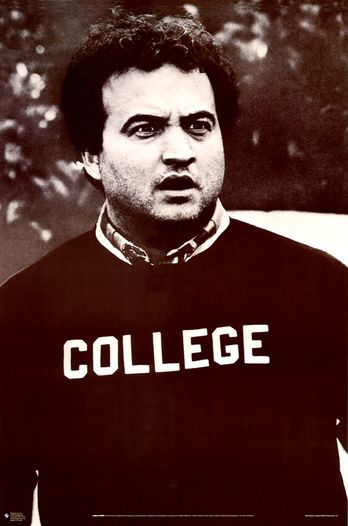

One has to wonder why this whole "college is a waste of time" meme has suddenly become so prevalent. Is it because so many people have trouble with college loans? Too many writers who have nothing more to say about O's birth certificate?

One has to wonder why this whole "college is a waste of time" meme has suddenly become so prevalent. Is it because so many people have trouble with college loans? Too many writers who have nothing more to say about O's birth certificate?

Thinking one can predict the future based on what one does in the present is a persistent human foible. For sure a lot of kids go to college who don't need to. But is this truly something new? Would anyone sensible make a decision based on what they read about this subject? Unfortunately some probably will.

It remains to be seen how employers of the future will react to resumes that state "I am really smart but I didn't go to college because I read online that it was BS; but I really am smart."

One of my kids is 1/2 way through college and the other is just entering this fall– and I don't spend any time at all thinking it's a waste of time or money; it's been a path to prosperity in my family where none of the previous generation had any education past high-school (if indeed they finished that at all).

On the other hand my wife and I went to CUNY at a time where the cost was $35/semester. That's not a typo.

But I still wonder what's behind the impetus to discredit higher education?

Ken Drees writes:

I get the vibe that the intent is more of a cost justification issue. You don't send a kid to college who gets middle of the road grades and majors in marketing anymore. The job market out of college is poor and will continue to be poor. College now will set you back serious money as a percentage of household income and there will be serious debt burdens on the student and parents upon graduation. You can't put the college payments on the credit card or the home equity loan anymore.

I believe that a college bound child needs serious career planning up front, which is tough to do since kids sometimes do not know what they want to do prior to going off to the higher education arena. Like the union bubble which is feeling the backlash from the debt riddled state pockets empty reality, colleges need to step back, cut back, stop the pay raises–else enrollment is going to crater and the pie shrinks.

Victor Niederhoffer comments:

A college education will always serve as a signaling device to employers and partners and parents that one is capable of being admitted under highly competitive circumstances and then has the fortitude to stick with the program, and finish the requirements, and the moral fiber not to have been kicked out. The signaling will always be of value and the rate of return from college should stay relatively constant.

A college education will always serve as a signaling device to employers and partners and parents that one is capable of being admitted under highly competitive circumstances and then has the fortitude to stick with the program, and finish the requirements, and the moral fiber not to have been kicked out. The signaling will always be of value and the rate of return from college should stay relatively constant.

Russ Sears comments:

Very similar qualifications could be said about homeownerships, commitment to paying a mortgage and good citizenship of being a good neighbor. When a persons limit to leverage has no bearing to what they could reasonably expect… many with nothing to loss will gamble with somebody else's money. This of course creates a bubble in some areas where there will be large oversupply of X degrees. For instance everybody will think in 2022, "what were they thinking taking forensic science and $100 grand of loans?"

The problem is when you use the argument that is it "should" be worth it to argue that everybody has a "right" to upgrade there lives. Further when you grant this "right" to any 18 year old capable of getting a high school degree you are bound to get many that should not have been given this privilege without working a few years and tasting responsibility. I still believe orginially there was a segment of responsible people that were granted sub-prime loans. These people however, proved to be the exception to the rule when everybody was given this right.The difference may be that those youth that are the sharpest will see the "bubble" within these areas and avoid them.

Could we be looking at the class of 2011? on a resume and subconsciously think what a deadbeat?

James Goldcamp writes:

I agree with chair's analysis of the signaling value of education, but one also wonders at what cost. I would find it hard to believe the return on invested capital has not gone down with both greater real costs and general degree (volume) inflation over time. It occurs to me that a rigorous self study program with standardized tests against which one could be compared might provide some lesser but nonetheless valuable signaling vehicle at 1/20th the cost of the current college education. Interestingly, one hire we had years ago was more known for his perfect SAT than his multiple Ivy degrees.

I agree with chair's analysis of the signaling value of education, but one also wonders at what cost. I would find it hard to believe the return on invested capital has not gone down with both greater real costs and general degree (volume) inflation over time. It occurs to me that a rigorous self study program with standardized tests against which one could be compared might provide some lesser but nonetheless valuable signaling vehicle at 1/20th the cost of the current college education. Interestingly, one hire we had years ago was more known for his perfect SAT than his multiple Ivy degrees.

Thomas Miller writes:

This anti college education and anti home ownership "debate", seem to reflect a negative attitude that is growing in this country. The theme seems to be "dont even bother to go to college or strive to own your own home. it's not "worth it." just give up and settle for less." Of course college education or home ownership is not for everyone, but those that propagate these defeatist platitudes, (especially the ones that do it on internet blogs read by a large audience), are doing a great disservice to young people. "just settle for less" is not the attitude that made this country great. A generation ago, many that chose not to pursue college could get a decent job with benefits and be fairly sure of being able to retire from that job. There are very few of those jobs available now. The gap between those with a college degree and those without will continue to widen.

Russ Sears comments:

I believe those that are "anti" college are saying take more risks start a business instead.

I believe those that are "anti" college are saying take more risks start a business instead.

And for those that it will not turn out for the better, it's not good government to guarantee the loan. More responsible decisions will be made if they have to compete for access to loans like anyone else.

Ralph Vince replies:

I cannot speak for others, but I am not advocating a "give up," or defeatist attitude here. I speak with those who have children of college age frequently, as well those who ARE of college age frequently too. One of these day, I'm going to stop speaking to people who don;t take my advice (most people are incapable of taking advice, we simply have to learn things the hard way, and usually more than once)

I hear an awful lot of talk from all of these people that a college education is necessary to enter the American job market, as though it were a ticket to the dance, a means to an end as it were.

(I should point out in full disclosure I do not have a college education. I am self taught. When I decided I should learn math, I started with algebra, geometry, trig, analytic geometry, calculus, topology…..eventually stochastic differential equations, which is used (with near exclusivity) to model prices with (a nice target for a math track for someone interested in the markets, but I find these methods model prices with a degree of reality akin to Oz modeling Kansas). When I wanted to learn literature, I started with Homer, then Virgil….through to the 1950s. Of course one cannot study everything and anything, you have to make selective, intelligent decisions (which is where talking with others comes in) and someone must WANT to dispal their ignorance (and this is the key attribute, the acknowledgement of our ignorance and a desire to overcome that — whether formally educated or not).

The last time anyone ever asked me about my educational background was probably when Reagan was running against Carter.

So when I look at what people are learning, and WHY they are learning it, I DO come away in MOST cases with a "Why bother with that?" attitude.

So once we acknowledge that there are two reasons for edication:

1. To dispel our ignorance, and ultimately, to study material we are passionate about, should have such good fortune, and

2. To make ourselves, personally, a marketable product (i.e. posses a marketable "trade," be it electrician, brain surgeon, or truck driving certificate)

people can make better decisions. Unless they are fortunate enough to be a trust fund kid, they need #2. A mere college degree does NOT provide that — this is a wives tale that floats about America wherein a lot of money is being wasted in its pursuit.

#1 is a luxury — one must have the good fortune of finding what fires their jets at a young age, aside from pornography, and find a way to pursue it. If they have the resources and time, college is the way to go. If not, anyone with a spark and a modicum of resourcefulness will find a way to pursue it.

I've spoken of this before. The number of persons from the 2000 census to the 2010 census is up 20%, the number of households, nowhere near that amount. Clearly, in the not-so-distant future, either much housing must be created or much work must be done to convert the "cul-de-sac development" McMansions into 2 and three household homes. What young person is a yeoman plumber out there, or plasterer? Not many, certainly not many over the past 10 years — but it is the fastest track to acquiring #2, above, for most.